Positioning for Advantage

Watch our webinar where we share about Institutional Real Estate investment strategies and how we should position ourselves in these challenging times.

Against the backdrop of massive liquidity injection by governments worldwide, investors need to rethink their investment approach and be ready to capitalise on opportunities when they arise.

Watch our webinar where we will share about Institutional Real Estate investment strategies and how we should position ourselves in these challenging times.

| Time Stamp | Topic Reference |

|---|---|

| 00:00 | Introduction |

| 02:30 | Platform & Team Introduction |

| 04:55 | RE Strategies & Risks |

| 05:04 | The World of Real Estate Investing |

| 06:10 | Overview of Real Estate Strategies |

| 07:46 | Types of Real Estate Investing Risk |

| 10:05 | Strategy Risks |

| 10:27 | Institutional Real Estate Fund Strategies |

| 10:52 | Core Strategy |

| 12:55 | Value-add Strategy |

| 14:24 | Opportunistic Strategy |

| 15:35 | Core Strategy - Case Study (Commercial Office Building) |

| 17:46 | Core Strategy - Case Study (Service Station) |

| 19:04 | Value-add Strategy - Case Study (Portfolio of Malaysia Malls) |

| 20:35 | Value-add Strategy - Case Study (Heritage Office Asset) |

| 22:03 | Opportunistic Strategy - Case Study (Prime Office Asset) |

| 23:35 | Opportunistic Strategy - Case Study (Townhouse Development Project) |

| 25:00 | Real Estate Investment Allocation by Strategies |

| 27:17 | RV's In-House Changes in Response to COVID-19 |

| 28:53 | Our Views |

| 34:07 | Historial Return by Strategies |

| 37:29 | Investment Strategy |

| 41:26 | Q&A |

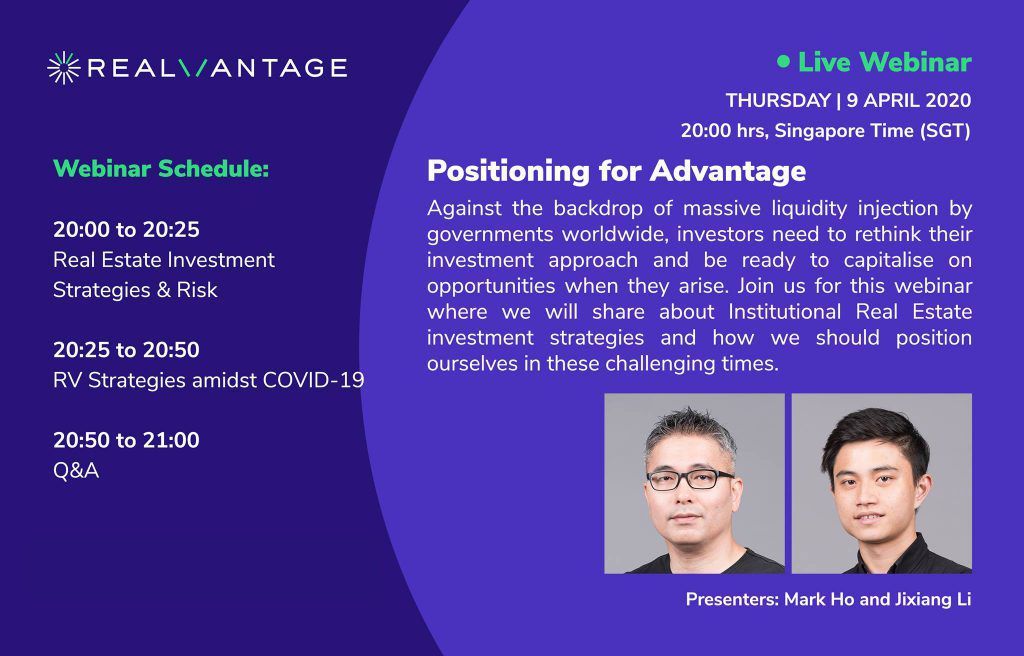

About The Speakers:

Mark Ho | Managing Director Investment & Asset Management

Mark has over 16 years of experience spanning cross-border investment, research and strategy, he has advised on and executed transactions in excess of USD 800 million across multiple asset classes and investment strategies. He was involved in the investment, research and strategy while under Pacific Star Group, capital market transactions and investment research in JLL, and real estate private equity in Deutsche Bank.

Jixiang Li | Associate - Investment & Asset Management

Jixiang was from Partners Group, a global real estate fund manager, as their financial analyst for Product Management in Private Real Estate.

Transcript:

0:08

Keith

Okay, hi guys, trust everyone is doing well and safe and listening to us from the comfort of your homes. My name is Keith.

I'm the co-founder of RealVantage and we're very pleased to have you.

In an earlier webinar we conducted a fortnight ago we summarised the potential impact of the coronavirus and shared our perspective on real estate investment during these challenging times.

We also highlighted that adopting a core investment strategy will be our preferred moat.

So providing the context of our investment strategy here by giving you an overview of the various investment strategies that real estate fund managers around the world use. We also share how global institutional investors such as GIC, The Blackstone Group, how they look at the risk and return dynamics of the deal. Next, we'll dive deeper into the rationale of our core strategy.

So joining me today are my colleagues, Mark and Jixiang - dialling in from their homes. Jixiang was with our partner’s group - a global real estate fund Manager. Next Mark - Mark has been active in investments and research throughout his career. And he was formerly with Deutsche Bank and Pacific Star.

Okay, before we start, everyone is in a sombre moment. But I just start by sharing some light-hearted cartoons.

So these cartoons, by the gentleman called Kevin Carl, political cartoonist. He is a regular contributor to The New York Times - so here has some of his newest works.

So like everyone else would like to take a potshot at Trump, right? Here's one of him trying to encourage everybody to start a business during Easter, so you can see that he's dressed like an Easter Bunny.

Next one is about Trump. Coming up with a fantastic one called the tremendous plan - how to deal with the virus. He tells everybody to stay calm, don't panic. And finally, what is his plan?. He explains who to blame, basically. So he blames Hillary Obama, fake news and so forth. All right.

Okay, let's stop.

And there are some users new to our platform. So I thought it's good that we give a quick brief of our platform. So RealVantage is an online platform that provides investors with institutional real estate deals. So what we do is we source, evaluate and analyse these things.

And once we find that the deal is very comfortable and has already been cleared by the Investment Committee. We'll put it out for funding. Well, once the deal is fully funded, we act as a real estate fund manager.

We acquire the deal and have managed assets over the investment period and at the end of the investment period to seek the best possible exit for you. So for those who have invested in overseas real estate, you can appreciate the pain points in management and the risks involved. So in RealVantage, we aim to solve these issues for you. Through fractional ownership, you get to diversify your risk to smaller ticket sizes, our investment starts as small as 25,000.

You get exposure to different markets and different sectors as well. So once invested, yes, let's have a professional managed during the investment period. So you can just sleep tight at night. And finally, the key point is we also pride ourselves in providing better quality deals, I mean access to us that you don't normally get right. We share more with you in the next few slides.

Next, we feel the concept of them as good as the team behind it. So let me do a quick introduction of the RV team. So collectively, we have an average of a hundred years of combined experience in real estate fund management, private equity and technology. On the real estate front, to get together with advisors, we have transacted over 10 billion in real estate across Asia, Pacific, Australia and also across all sectors from residential to commercial, right. Many of us will come from organisations such as GIC, Barclays and Deutsche Bank.

Okay. Let's jump into the topic for today. We will start with an overview of the research strategies led by my colleague Jixiang, followed by my colleague Mark will dive into why we decided to pick the core strategy. And finally, we have a Q&A segment. Okay, let me hand you over to Jixiang.

4:54

Jixiang

Thanks Keith for the introduction. So now I will bring you guys to the various strategies and risks. To summarise the various real estate investment options out there in today's market. For most individual investors, real estate investing is limited to public listed REITs or buying directly into residential properties like condominiums and renting it out for rental income. Many of you do not realise that in a world of real estate investing, there are a lot more options out there. So here are some of them. Right for example asset repositioning, development projects, and lease-up opportunities.

However, they're mostly confined to the playbooks of institutional investors, such as sovereign wealth funds. GIC is up there as you can see, pension funds, insurance companies, family offices, and ultra-high net worth individuals. These investments usually come at higher risk and will require greater investment management expertise to navigate the higher risks involved.

Now, all these options can be broadly categorised into three strategies. So here you can see they are namely called the new and opportunistic. They can be more depending on how detailed this risk curve is being divided. For this discussion we will focus on these main three strategies. Now, starting from the lower end of the spectrum, we have the core strategies, which are the least risky investments that deliver about 7 to 9% per annum. It's also worth noting that there is an extension of core strategy called core plus, which are properties that have the ability to increase cash flows to light property improvements, management, inefficient efficiencies, or by increasing the quality of tenants.

The returns for core plus strategies typically in the low teens. So moving on this risk we have the value strategies that have moderate risk, and they generate around 10 to 15% for investors. At the other end of the spectrum, opportunistic opportunities. So these are the riskiest in nature and investors will typically look for returns of at least 18% to compensate for the higher risk. The value-add and opportunistic strategies are where most individual investors do not have access due to the greater investment skills needed to manage the higher risk and larger capital requirements. So in the subsequent slides, we'll dive deeper into what each strategy entails, and provide a couple of case studies by Keith after we go through the characteristics.

Now before that, we would like to explain the risks involved in real estate investing and how it applies to the three strategies we just discussed. Although this is not an exhaustive list but should provide a pretty good picture on the general risk, the investors will be exposed to a real reason or other reason it's important to understand and appreciate real estate risk is that many investors are very excited when you hear about high returns often unless the magnitude of recent rough and unprepared when something goes wrong.

So we can classify this risk into three baskets, economic, real estate specific, and then regulatory and environmental. So for economic risk, there is the market interest rate and currency risk, which applies to not only real estate investments, but all investments out there; being equity, bonds or commodities. So as opposed to being the global economic downturn that we are experiencing right now, which has caused turbulence in the markets, interest rates and currencies to fluctuate massively.

In a second basket, real estate specific risks are genuine to the real estate asset class, such as technical, tenant or development risk. So unlike the other risks, real estate specific risks are usually within the control of investment managers, and can be directly mitigated through various measures such as rigorous underwriting and robust business plans.

Next, we have regulatory and environmental, which result from government policy changes. So some of these policy changes could be increases in land tax, water charges, or like capital gains tax, which will have real impacts on the property's cash flow. So environmental risk includes hazard risk, which pertains to the soil building material, or paints that are used in the property. So these might have hazardous effects on the immediate environment. And these problems could potentially reduce the future value of the property or incur costs to remedy.

Now, let's look at how these risks interrelate to the respective strategies. Evidently, core strategies are the least risky overall. Therefore, they offer the lowest range of returns and as for value-added and opportunistic strategies, investors would command higher returns to commiserate for the higher risk involved. Let's look at how these strategies play out in the institutional space.

Every year, numerous new funds are raised in the private markets across the world catering to the various investment strategies. Here are some of the biggest names in industry - they have raised flagship funds, one after another, expanding their portfolio with assets that fit their primary investment strategy. All right.

Now we will discuss each investment strategy in greater detail. Before we start, I just want to be clear that these characteristics are generic in nature. So they could vary depending on the exact details of the investments we are looking at. So, with that in mind, let's get started.

First, we'll be looking at a core strategy. This is the typical view matrix investments. Now, the sources of returns would mostly come from operating cash flow and little from capital appreciation. What this means is that most returns will be realised from rental income, which investors receive on a monthly or quarterly basis. The remaining returns come from the capital value appreciation of the property, which will typically only be realised upon selling the asset.

One of the pros of core investments is that the cash flows are stable and secure, as the in-place lease is usually very long from say five to 10 years or even more. And credit of the tenant is typically very strong, the tenants could be like Amazon or Walmart. Another advantage is that only a touch of asset management is required. As the property is usually quite new and well maintained. The downside here would be the expected returns in the lower range. Because these assets usually are situated in prime locations where prices are relatively higher, leaving less room for capital appreciation.

Adding to that is the longer investment whole period that comes with core investments. Due to the fact that most returns come from operating cash flow, investors will need to hold on to these investments longer in order to realise meaningful returns. Examples of such assets are like prime CBD office buildings, retail centres and selected industrial warehouses.

Next up, we have a value-add strategy and here we can see that, from the sources of return, approximately 50% will come from operating cash flow and the other 50 from capital appreciation. This means that a higher proportion of returns are back-ended and only realised when their properties are sold. The pros of this strategy include the benefit of upside potential from selling the property and higher value. But these are dependent on the successful execution of asset improvements. The strategy was to allow investors to cash out earlier than compared to core investments.

The cons here would be that this value-add strategy is highly Asset Management intensive. As one can imagine, with all the work involved in repositioning, or to lease out the property and also the success of value-add will also depend on the market cycle. Though this is not necessarily a bad thing, timing the market is nearly impossible. As I'm sure we can all appreciate.

Black Swan events like the COVID-19 situation now can have a huge impact on the market and greatly affect risky investments like value-added ones. Some examples of these value-add investments are like secondary properties with depressed levels of income or value that have fallen in contrast with the broader market.

Finally, we have an opportunistic strategy, where most of the returns are usually 80% or more are back ended, and lesser and 20% are from operating cash flows. This provides less certainty to investors as the return of capital and profits are realised in the later stage of the investment.

The pros of this strategy include larger upside potential and the relatively brief period when compared to the earlier two strategies. And downsides here include that most of these returns are back ended. As mentioned earlier, similar to the value-add strategy, the success of opportunistic investments would greatly rely on being on the good side of the market cycle. Opportunity investments are usually more exciting and promise greater returns. But it's important to bear in mind the riskiness, being equipped with the right skill set is pivotal to the success of this strategy. So now let Keith take you through a couple of case studies to better illustrate the various strategies that we are talking about.

15:34

Keith

Okay, thanks, Jixiang. This is Keith again, just to recap. Essentially, it is about the risk and return dynamics right. Core deals means lower risks which actually means lower returns right up the investment spectrum, which is opportunistic, which are higher risk and higher returns. So these are some examples of deals according to the three different categories of risk. Some of them are deals that RealVantage (RV) has funded. Some others are the ones that I have done personally. Now, let me take you through. The first one is a core strategy here.

This is an office building located in the heart of Geelong in Victoria.

The property itself is leased to a government department. The lease itself runs for 10 years, the government department anchors 94% of the property. The property was built in 2009, which is relatively new.

So given these characteristics, this deal is considered core, right. Why? Why do we call it core because it's high-level income security, a triple-A-rated government tenancy, and it's on a very long-term basis as well. However, on the flip side, the rents have limited upside as they are fixed.

So now, given the nature of the long lease, the capital value of the asset might be kept as rents upside is limited. However, the capital value of the asset is also very well protected. Because the income stream is secured. So there's also a limited downside, right? So what's driving the returns for this asset, the returns for this investment, is essentially derived from the secure cash flow.

So as you can see right here, the returns are projected at 9.2%. So this essentially is the returns coming out from the rental, right. Typically, for core deals, real estate fund managers would not give a big capital value appreciation, simply because the rents are locked in.

Next one to highlight is a deal that we funded. It's also a core deal. This is a service station - a petrol station in Singapore. So located in Perth is a fresh 15-year lease to Exxon Mobil, Exxon Mobil as you know, it's one of the strongest petrol better companies in the world. The lease itself is termed as a triple net lease, which means the tenant is responsible for all outgoings maintenance as well as capital expenditure.

So really there are no other costs that the landlord needs to worry about, right? All the property costs, maintenance, running costs and so forth are all paid by the tenant. The lease itself is a fixed 3% increase every year. So, given this nature of the lease, right, the upside of the rent is also capped in that sense. So similarly, it plays a very core characteristic right. The returns are largely derived from the rental that the tenant pays, which is about 8% per annum. All right, next moving up the risk curve is a value-add property.

So this is a value-add deal that I was personally involved in. It's a portfolio of five shopping malls in Malaysia. The assets were well located in key cities in Malaysia. However, their assets are very old and tired. They're easily more than 30 years old. Occupancy was so low, averaging across the five shopping malls - they were coming in about 70%. And the rent itself, we're trading below the market rates.

So we went in and acquired the assets at below market value. And we spent a substantial amount to spruce up the assets. What we mean by sprucing up - this means that we changed the layout of the shopping malls. We created new floor areas, and we added new facilities like a cineplex.

We also did quite a bit of facade upgrades and planned imagery upgrades as well. So there's a lot of assets management work involved in these sorts of assets. So after the assets were upgraded, we managed to secure strong rents, and it jumped up by 25%. And the occupancy was boosted up to 95%. So this was an investment that was that lasted for 4 years and we managed to secure 80% IRR return.

The next deal is, is one that we have funded as well. It's what we call a refurb and the sub-strategy. The asset is located in the heart of Adelaide CBD, and it's one of them's prime locations. However, the asset was underperforming and was only 30% occupied. So we went in and acquired the asset at 40% below market value. The strategy was to refurbish the ground floor, inject more F&B operators. We also had plans to refurbish the main lobby and the comedy floor piece as well.

We felt that this was a good value at play because of a few factors, this is in a very prime location - number one and number two - is that the attractive price. We got it at40% below the market value. So that gives us a lot of buffers to fix up the asset. And this deal is till live and we expect to divest in about three years' time. Similarly, for this deal, we expect to generate a return of 12% which is in line with the risk involved.

The next deal is an opportunistic deal, which I was also involved in. It was the acquisition of the empty grid A office building in China. The Nanjing IFC was located in the heart of Nanjing, one of the most prime parts of the city. The asset itself is a sizable one, and it totals a hundred thousand square meters and it comprises 51 stories. This asset was quite the distressed situation.

The seller was in negotiation with another buyer. However, the buyer pulled out. During the negotiation, the GFC hit. So we went in and we mentioned a secure good 30% discount relation, but we must appreciate the risks involved in this project. In this project, it's an empty building, 1.1 million square feet building was totally empty. So, we went in, and we managed to fix it up, spruce it up a little more and release it up. We did a lot of active leasing and within a year after we acquired we filled up to a stabilised occupancy of 90%.

So, this was considered very opportunistic due to the risk involved. We acquired a brand new asset, but it was empty. It was a very sizable asset. So the leasing up risk was very high.

Okay, the next opportunistic deal to highlight is one that we involve in funding. It's essentially a ground-up development deal. It's a townhouse development project in Sydney. It is considered opportunistic because it's a developed project. So all the risks that we have we have spoken about comes in with market risks, construction risk and so on and so forth. For this deal, we are confident in managing risk due to the following factors. Number one, market risk is considered small as we're only dealing with external causes and the market was starting to recover. Next, construction risk was also mitigated as such construction costs were really locked in by the developer.

Next thing, we thought the competition was so limited as bought into a tightly held market that catered only to the locals. This deal is still live with now 1.5 years to go, but we are quietly confident that we will write out the current crisis. Let me just hand it over to Mark now. He will speak about RV strategies during this crisis.

24:59

Mark

Okay, I would like to start my section by sharing a very interesting chart. This chart displays the strategy preferences of institutional investors. And this was done through surveys usually carried out towards the end of the year. So, for example, investment style preference for 2010 was probably somewhere sometime towards the end of 2009.

And just to make a few observations, we can clearly see that the investment picture is highly static for institutional investors. They actively adjust the strategies through the economic and property cycles. And it should also be very clear that when it comes to real estate investment, sophisticated institutional investors deploy a very broad array of strategies. Now, it's also very interesting to note that the preference for strategies do follow a pattern generally speaking.

Now, in terms of economic duress, you can see this corresponds to the circle in the chart now, during the last recession, that investors tend to gravitate towards a call and more defensive strategy away from some of the higher risk strategies. And there's nothing surprising about this because during this stage of the cycle cap rates can be widened during this period and would, therefore, create attractive entry opportunities.

Now, for those who might not be familiar, cap rates is a term we use that refers to the yield of the property, usually the net operating income divided by the price of the asset. So as the cycle matures over the cap rates compress investors who then migrate up the risk spectrum and seek better returns. So, as indicated by the arrow over the years from 2012, most of the investors will then gravitate towards the higher risk strategies. Now just as sophisticated and institutional investors actively adjust their strategies through the cycles, so should all of us.

But before I dive into the views and strategies portion, I would just like to quickly share with you some steps we have taken to a better position ourselves as a firm to capitalise on opportunities - while we safeguard the interests of our investors. And one of the first things that we did was obviously to get a handle on a situation.

We comprehensively mapped out and assessed the risk arising from the virus situation, identifying what's known and what we do not know yet. And we have recalibrated our investment views and strategies in light of this crisis, which I will share more in a while. And going into the crisis, we were tracking up easily 30 deals. And the first thing that we did was to flush out all the deals that no longer sit well within our strategy.

And secondly, we are actively retooling the ones remaining, meaning to say that , we are tightening all our underwriting assumptions, running deeper due diligence, revisiting the leverage assumptions, and, importantly, carrying out pretty rigorous stress testing the numbers, especially for the years we're into. And we also reached out to our contacts and our best in class partners we work with within the industry, to let them know what we are looking out for in order to bring a deal into the pipeline that works best for investors.

Now, before I start on the views, I just want to say that we have in a very recent article shared some of our perspectives and more details, which can be accessed from our website under the section called ‘Real Insights’. And I will invite you guys to check it out if you have time and share your views with us. So obviously, this economic impact is very significant, but more than just that. It pays to appreciate that the impact will be extremely uneven across regions, countries and sectors. Just looking at early data coming from China, China was first ground zero and the first to emerge from lockdown.

As they came out of a lockdown Chinese economy is now operating roughly at about 20% below their normal levels. And we think the outlook is even less than for Western economies, especially for late actors that will take longer to subdue the virus outbreak. And by the time some of them emerge from the virus-driven ice age they may very well reset to levels of 70%, or even less compared to where they were before entering the pandemic. And some even face the risk of permanent damage to parts of their economies after prolonged hypothermic conditions.

Now, in the near term transaction volumes are definitely significant as both the buyers and sellers take time to reassess the situation. And well from experience this is also the time when you know the market views differ widely that parties with better research and acumen can find the best value.

Now, we have also observed that a flight to quality has already begun within the credit markets and for sure this will filter through to the real estate segment. But it's worthy to note that unlike the early stage of the GFC period, credit markets are still functioning right and credit remains available. But lenders have turned highly discerning over who and what they will lend to. Deals still being funded for institutional investors during this period as we speak.

But distress has also started for some of the riskiest sectors such as hospitality. For example, no liquidity crunch is forcing Singapore listed Eagle hospitality trust to resort to raising cash by liquidating some of the assets. So, discounted assets already coming through right, some already lending or deal tables. Now in formulating our strategies, we just cannot emphasise enough the importance of distinguishing between what factors are structural in nature and what are cyclical.

Similarly, like which are temporary and which are permanent. Some structural trends going to this global crisis will continue to dictate the trends coming out of it. In our opinion, things like ageing demographics and rising healthcare need to remain, pretty much unstoppable growth paths. And in other areas like for example, F&B might be under extreme duress right now. But we firmly believe that these will be bound strongly from once the crisis has subsided. And yet, some changes could be more permanent.

An example could be sudden supply chains could experience some resets. Now, having experienced major supply chain disruptions, certain firms are now considering moving away from a globalised supply chain towards more localisation and regionalisation just to manage the security.

And on this note, I will say we stressed that we have to be very careful with distressed prices. Distressed prices that reflect temporary cyclical conditions to us are fine and in fact represent opportunities. But for sectors that are permanently impaired, even hugely discounted prices could very well meet something else.

Now, we are already observing right now that cap rates are widening from what was a record low period previously. And you know, as real estate investors, we take a slightly longer-term investment horizon. And we would expect beyond the near term that given the ultra low-interest-rate environment that we are staring down, and the unprecedented liquidity sloshing around that kept rates will eventually compress to even newer lows and remain lower for many more years to come. And while the focus now is pretty much entirely on the virus situation itself and the immediate repercussions on the economy.

We envision many more potential aftershocks to come with implications on the real estate when the virus episode is over. You know, just some examples would be geopolitical factors, social unrest or political repercussions. So, as unprecedented as these times are, the bigger picture may not be all that unfamiliar.

Notwithstanding differences in the nature and transmission mechanism, there is much value in drawing upon past experiences. So, as Mark Twain said, history doesn't repeat itself, but it often rhymes. Now, before getting into the details of our investment strategy, let us review the relative performances of the various strategies through the last recession.

So, this chart I'm about to show you plots the performance of funds, adopting various strategies, as measured by the median IRR along the left vertical axis against the vintage view of the funds along the horizontal axis. So, for example, this orange chart shows the performance of funds of various vintages that follows our core investment strategy.

But it's also worthwhile to note that these are average returns. So within each vintage year, there will still be core funds that outperform and others that come up short. This would be the performance for value-added strategy and the red line is for opportunistic and we superimpose the fund performances against global growth - year on year growth chart.

Now, property prices typically lack economic growth by about half a year right. But in the absence of a global property Price Index, we will use the global growth data as a proxy and do note that funds typically have a fund life of about five to seven years.

So one of the world's most obvious observations that we can make here is that - also unsurprisingly, the returns on value-added and opportunistic strategies display significantly more volatility compared to a core strategy. And as I mentioned earlier, within each strategy, for example, the opportunistic strategy, the returns while they are represented by a single line - you can be sure that the performance of the constituent funds would vary very widely.

Now, I want to draw your attention to how core strategy performed during the times of extreme economic duress, and we reckon this is where we are now. And as you can see that a core strategy pretty much outperforms a value-add and opportunistic strategy during his time. And even as we entered the early stage of recovery, you can see that the value-added opportunistic funds have clocked a higher return compared to core strategies.

But in our opinion, the risk premium of about a ballpark, you can charge 3% or 4% that does not even compensate investors sufficiently for the additional risk that they are taking when they move up the spectrum. So on a risk-adjusted returns basis, we think through the boom-bust cycle, that our investors remain better off staying defensive with our core strategy as their primary strategy.

Now, just want to wrap it up with more actionable strategies to share. Very importantly, we think that investors will do very well to adopt an investment horizon of at least four to five years. And by now, it should be very clear that we advocate adopting a very defensive core strategy as the primary approach

Now we will target prime locations while staying very cautious on fringe locations. As you can already tell the flight to quality is a recurring theme in times like this. So as we witness the credit markets. In countries with long lead structures - the likes of Australia, Europe and US, assets with existing long long leases, especially to strong tenants top our target list. Such leases provide investors with a highly visible income stream to bridge them over this period of extreme uncertainties. And on the other side of the recession, we believe the flush of global liquidity would send cap rates ever lower, giving investors or prime locations that added capital appreciation boost.

So if one thought that cap rates in London and Sydney were low going into the virus situation, I would say be ready for even lower cap rates in the aftermath of COVID-19. And beyond the defensive core strategy, I would advocate taking a more thematic approach. Now we think that the rising tide will float all boats. Our situation is a thing of the past. While beta oriented investing worked pretty well previously, the coronavirus episode is likely to leave certain legacies that require a more thematic approach to investing in going forward. On this note, we would advocate things like aligning ourselves with very long term structural drivers.

As I mentioned earlier, we like themes like ageing demographics, rising healthcare needs. We think this will continue unabated, and we favour real estate catering to this kind of growing demand. Now, another example would be data infrastructure continues to play a catch-up game, the trend towards remote communication is likely to become more deeply entrenched because of recent distancing measures. With 5G technologies at our doorsteps, you know, the increase in demand for bandwidth and data storage can only grow.

Now I've also mentioned about resetting logistics and supply chains. So, we will look for acceleration towards more localisation and regionalisation. And on this note, we think last-mile logistics will remain very much in demand.

We would also focus more on essentials and be very cautious on discretionary. What this means is, for example, for retail - essentials will always be used essentials. Grocery anchored retail catering to non-discretionary needs have long been a mainstay of the portfolios for conservative investors. And if anything at all, this pandemic has amplified the defensive quality of these assets, not just retail even for the residential sector. We will move from owner occupation to rent because we believe that economic repercussions from the virus situation are expected to linger much longer even after the virus has gone.

And lost last but not least, with the number of market dislocations that have already started, and with more yet to come. We simply cannot resist the temptation of going through the distress pile just to see what we can find. It is not our go-to strategy. But you know, given our connections in the real estate space, it would be a waste not to keep our eyes open for such opportunities.

And on this note, I would like to end and we start the Q&A session. Thank you.

Transcribed by https://otter.ai

For more webinars:

| Demystifying Real Estate Co-investing |

| Market Selection: Securing the Right Start |

| Deal Sourcing with AI |

| Navigating Through Choppy Waters with RealVantage |

For more real estate insights:

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.