The Real Estate Risk-Reward Spectrum & Investment Strategies

Interested in real estate investing? Find out your real estate risk/reward spectrum appetite and apply the right investment strategy.

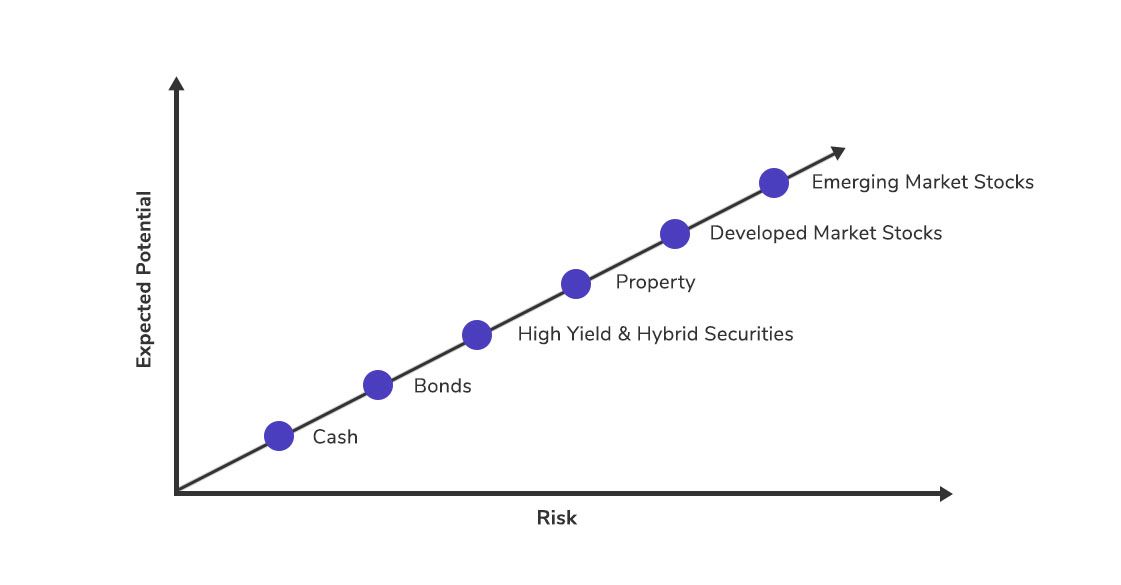

All investments carry risks. Returns can be seen as the reward investors deserve for the risk they have assumed. For investors to take on higher risks, they would need to be adequately compensated for the additional risks that they bear. As an asset class, real estate investments have traditionally been ranked somewhere in between fixed income and equities, as depicted schematically* in the diagram below:

Asset class risk spectrum

*This schematic chart should not be taken as investment advice. While the relationship between return and risk is positive, it may not necessarily be linear as the chart suggests.

This short article introduces:

(i) a simple framework that captures the risk-reward spectrum for real estate investments;

(ii) the terminology for investment strategies that correspond to different points on the spectrum; and

(iii) characterises the nature of these investments within the framework.

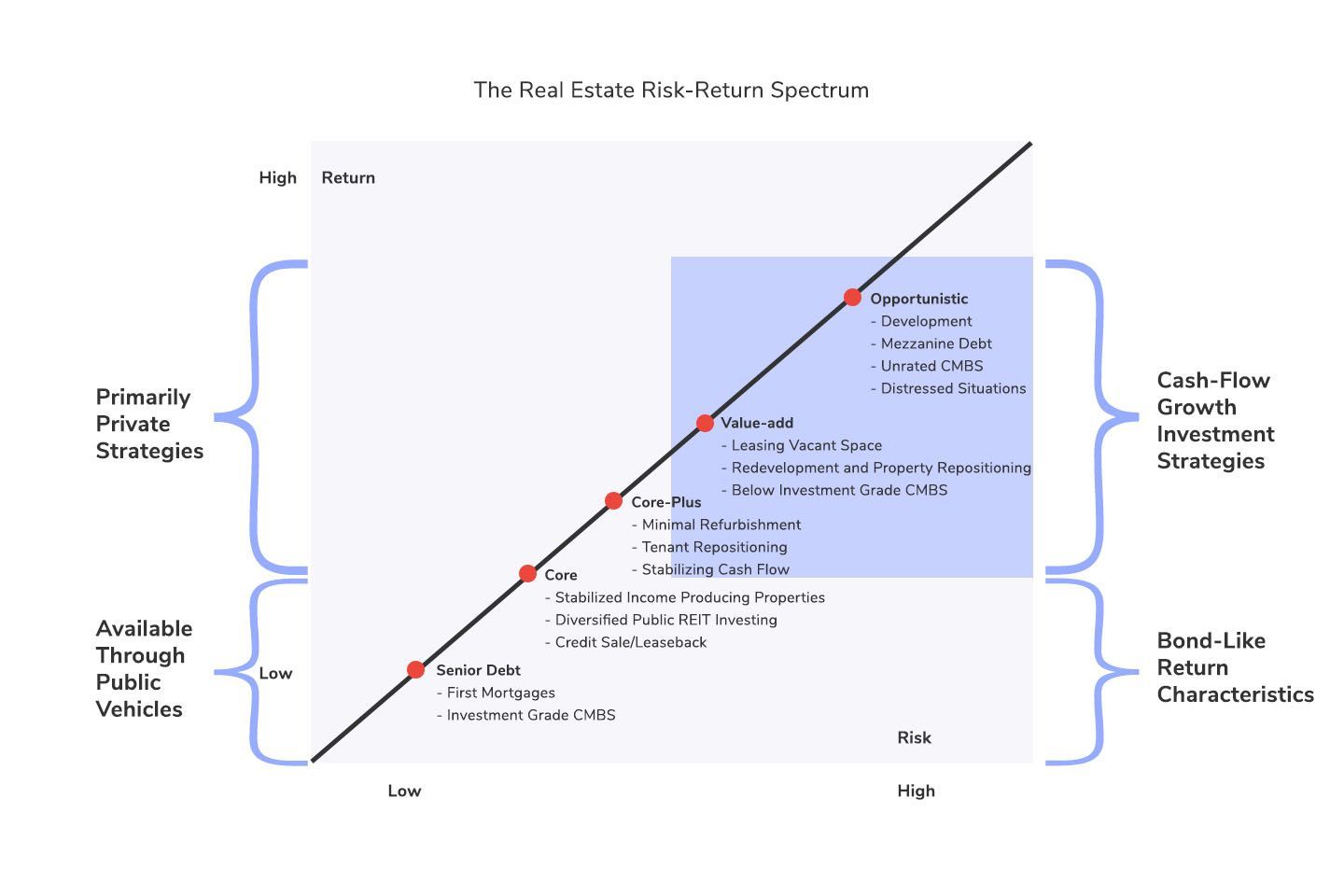

Real estate risk spectrum

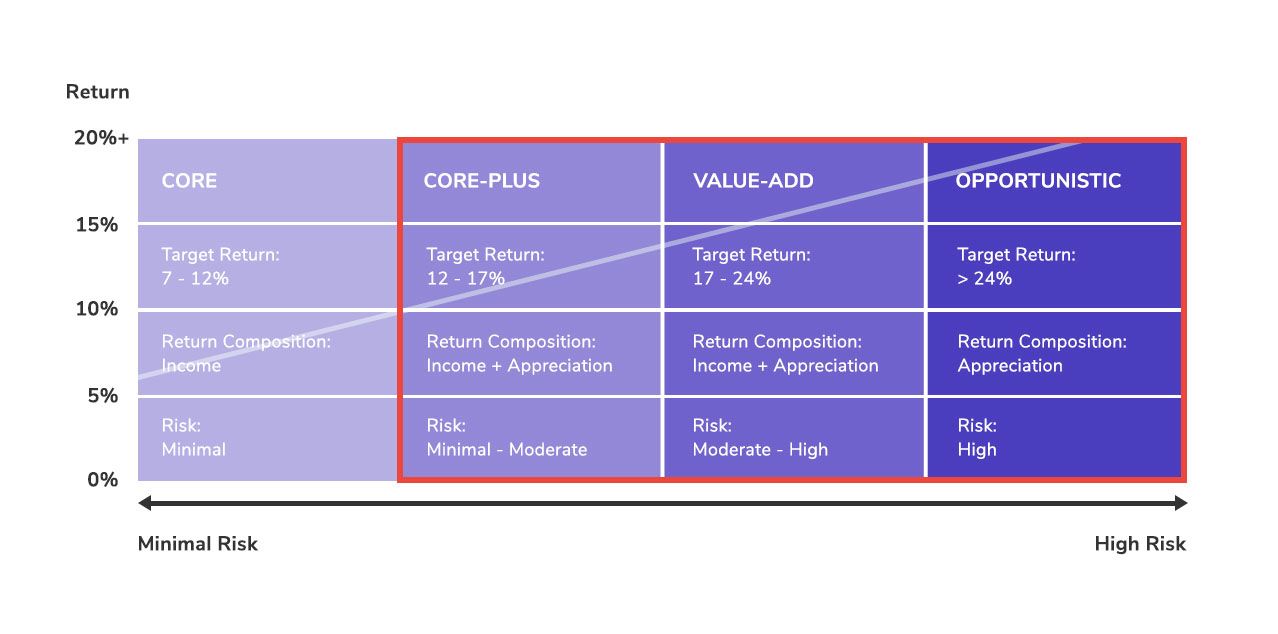

The real estate investment industry had established a set of common terminologies for classifying investment strategies and their typical risk-return profile. Broadly, these strategies fall into four categories: Core; Core-Plus; Value-add; and Opportunistic. Note that while there exists a general consensus on the broad classification, it is not uncommon for the boundaries between the categories to be blurred.

Core

This strategy corresponds to the low-return-low-risk end of the spectrum and typically exhibits the following characteristics:

- Relatively low degree of leverage

- Properties that are fully (or mostly) leased with stable cash flow

- The property is in good shape, with little need for major renovations

- Located in a demand-heavy and transparent market with strong underlying fundamentals

- Usually follow a “Buy And Hold” business plan

This investment strategy sits well with relatively conservative investors who prioritise wealth preservation and inflation hedging as their primary investment objectives.

Such investments tend to hold up very well during economic downturns, as the assets are leased to creditworthy tenants and the property is typically located in a market with a strong and diverse enough set of demand drivers to fare relatively well during a downturn. Core investments typically project internal rates of return (IRRs) in the low-teens, or even lower.

Core-Plus

These projects also focus on relatively-stable assets in strong, established markets and submarkets, but also entail increased opportunity in the form of some property renovation and optimisations to rent roll. Typically, at least one attribute of the underlying asset is riskier than you would expect from a core investment; the property may be in a suburb or secondary market, or the property may not be fully-leased, which presents both risk and opportunity. Returns for investments that adopt both Core and Core-Plus strategies tend to be primarily driven by rental yield, rather than capital value appreciation.

Value-Add

Value-add real estate projects incur a higher level of risk alongside the greater potential for driving operating revenue growth and capital value appreciation. The potential for rental growth could stem from various sources , such as sub-optimal management or inefficient operations at the property, opportunities for moderate renovations to attract higher-paying tenants, significantly higher prevailing rents in the immediate area, or a combination of these factors.

“Repositioning” is often synonymous with the value-add real estate investing strategy; this refers to making selective improvements to an existing property before marketing it in a new way to a new profile of potential tenants. Such strategies often offer appealing potential returns for investors if they believe in the investment thesis and the investment manager’s ability to execute the business plans.

Opportunistic

The nature of projects can vary widely at this end of the risk-return spectrum. Projects are usually associated with little to no in-place rent roll, require significant rehabilitation or even entail ground-up development. It is common for Opportunistic and Value-Add strategies to have the returns back-end loaded, nearer to the end of the target investment period, which can amount to significant risk. While Opportunistic investments entail a relatively high degree of risk, they typically project an IRR of 24% or more – sometimes much higher.

For more Insights:

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.