How Does Internal Rate of Return (IRR) Impact Real Estate Investors' Decision-Making Process?

Does the higher IRR deal always suggest that it is a better deal? Is IRR the only measure that you should look out for? This article seeks to demystify the concept of IRR, its pros and cons and how you should use it to elevate your understanding of real estate deals.

Table of Contents

- What is IRR?

a. NPV Formula

b. IRR Formula - Advantages of IRR

- IRR Limitations

- How to Make Effective Use of IRR for Real Estate Investments

- In Conclusion

Imagine that you are presented with 2 real estate deals, one with an IRR of 8% and the other with an IRR of 18%. Does the higher IRR deal always suggest that it is a better deal? Is IRR the only measure that you should look out for? This article seeks to demystify the concept of IRR, its pros and cons and how you should use it to elevate your understanding of real estate deals.

What is IRR?

IRR is a calculated value for the expected rate of growth of an investment per year. The calculation is similar to net present value (NPV), but the NPV value is set as zero in an IRR calculation.

In real estate, IRR is one of the many investment metrics used by real estate investors to assess the profitability of a potential investment. It considers the time value of money (TVM) and is usually expressed in annual percentage.

So, what is TVM? TVM, also known as Present Discounted Value, is a concept suggesting that given a choice, investors would prefer to receive money earlier rather than later, all else being equal. Put another way, a dollar today is worth more than a dollar one year down the road. Investors would rather avoid uncertainties due to inflation and repayment risks, and be able to use the money received earlier to reinvest or generate more wealth down the road.

In order to fully understand IRR, it is therefore crucial to grasp the concept of Net Present Value (NPV) first as both of these concepts are intertwined.

NPV Formula

OK, so what is NPV?

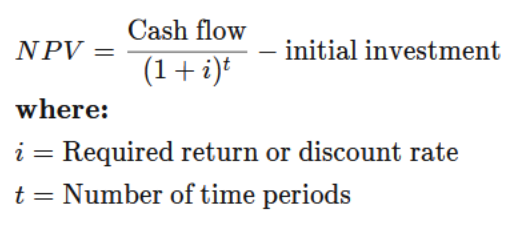

First of all, NPV is expressed as a positive or negative figure which takes into account all future cash flows and discount those cash flows using a required rate of return (i.e. determined by the investor; different investors have different required rate of returns) and minus off the initial investment to derive the final figure (please refer to Figure 1 for NPV formula).

The key idea for NPV is to determine whether it is worthwhile to invest in a project / investment opportunity by considering the present value of future cash flows (profits) and the initial cost outlay e.g. purchase cost and renovation cost. If the NPV is positive, the project / investment opportunity is likely to be accepted or rejected if the NPV is negative. In an actual real estate deal context, no sponsor would bring deals with negative NPV to the table.

Sign Up at RealVantageIRR Formula

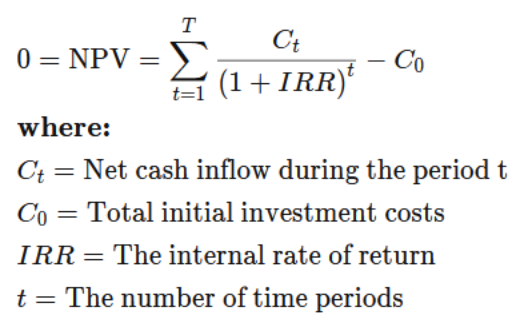

After we have grasped the concept of NPV, it is time for us to delve back into IRR. IRR builds on the concept of NPV but the key difference lies in the discount rate to equate the present value of future cash flows to the initial cost outlay (please refer to Figure 2 for IRR formula).

Put another way, the IRR is the rate of return that has to be used in order for the NPV to be zero. In order to obtain the IRR figure, one could easily retrieve via the usage of a financial calculator or simply from the IRR function in Excel. Using the derived IRR figure, an investor could then use it to make decisions on the attractiveness of the investment among other factors.

Read also: Understanding IRR, Cash Yield, and Equity Multiple

Advantages of IRR

There are several advantages that IRR could provide for real estate investors:

Specifically to IRR,

1) Using NPV, an investor is able to compare absolute profitability easily. But the selection gets more complicated when the investment periods vary across different projects. For example, it is not straightforward to pick between a project with higher NPV but longer investment period compared to another project with lower NPV but shorter investment period. As such, IRR is more superior than NPV in this aspect as it takes into account projects with differing investment periods, normalizes it and provides investors with a standardised basis of comparison.

Similar to NPV,

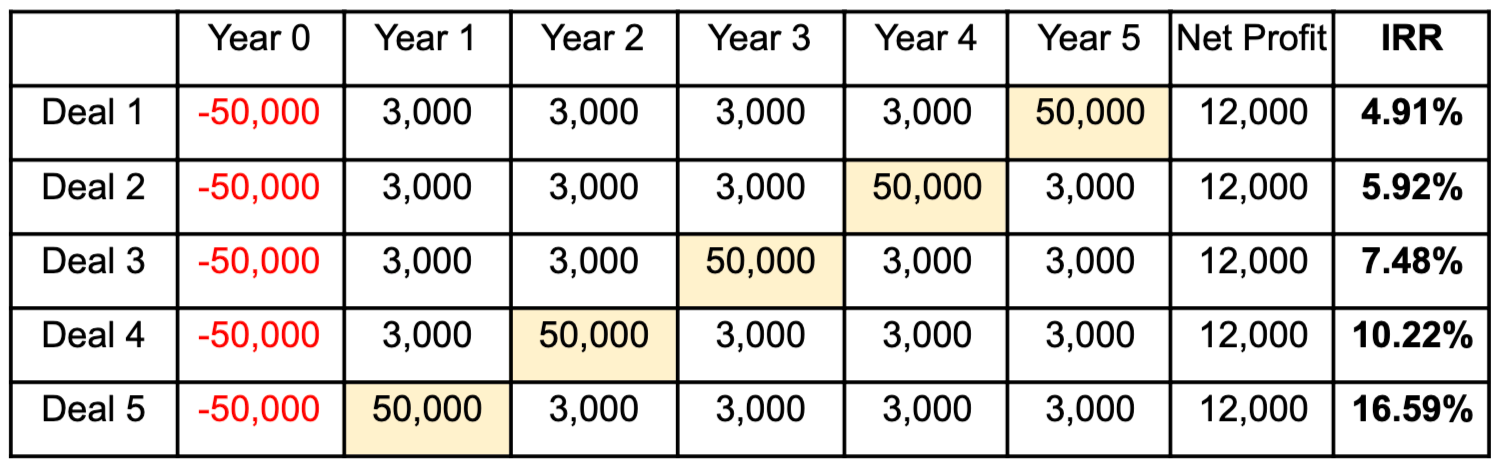

2) It encapsulates the concept of TVM to provide investors with a single figure to evaluate the attractiveness of an investment. Although the net profit for all the 5 deals in Figure 3 are the same, the IRR differs significantly due to the timing of cash flows. Receiving a larger bulk of cash flows earlier is certainly favoured highly as compared to receiving it at a later period.

As shown in Figure 3, the decision to receive $50,000 in either year 1 (or Deal 5) or year 5 (or Deal 1) results in a staggering IRR difference of 11.68 percentage points! As such, apart from net profit, IRR could provide an additional layer of benefit for real estate investors as it considers the essence of TVM.

Figure 3: The Impact of TVM on IRR

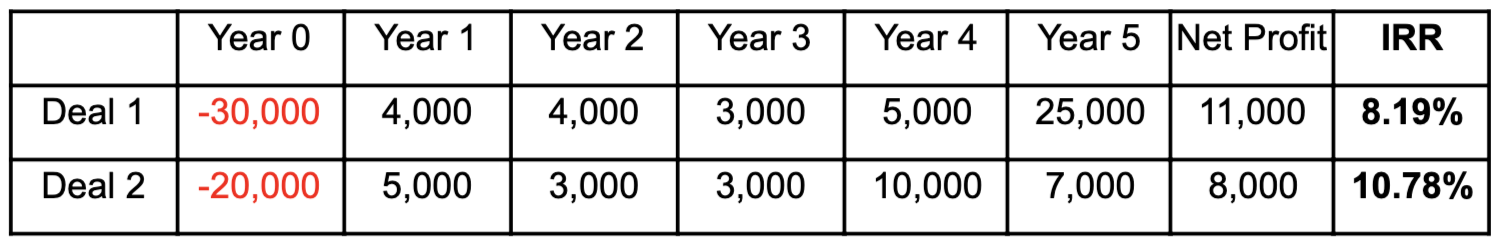

3) It standardises the basis of comparison for different real estate deals with varying cash flows profile but with the same investment period. As shown from Figure 4, IRR is able to provide real estate investors a standardised basis of evaluation when 2 deals with differing cash flows profiles are presented.

Even though deal 1 brings about a higher net profit for investors, it does not seem attractive on a standardised basis when IRR is taken into account. Hence, with IRR, it could provide real estate investors with a quick and easy way to compare numerous deals with varying cash flows profile.

Figure 4: IRR Standardises Deals with Varying Cash Flows

Read also: Market Selection in Real Estate - RealVantage’s Approach

Sign Up at RealVantageIRR Limitations

On the flip side, IRR does have limitations that investors should take note of:

Specifically to IRR,

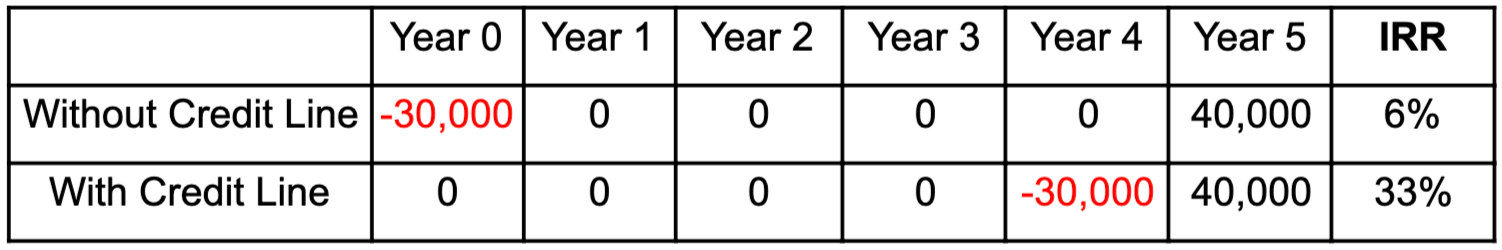

1) IRR could be financially engineered at the expense of investors. The usage of a subscription line (also known as a credit line) is one such example that sponsors could financially engineer a higher IRR for their personal benefits. Subscription line is essentially a credit facility extended by banks to provide sponsors with quick access to funds as long as they are able to find investors to commit their capital (i.e. having the ease to draw on the committed capital whenever the sponsors require funds).

With the ease of obtaining a subscription line, the sponsors would not need to go through the cumbersome process of seeking funds from investors during the initial phase when they acquire new deals. As shown from Figure 5, the sponsors could make use of the subscription line to fund a project during the initial phase and subsequently tap on the investors’ fund at year 4 to financially engineer a higher IRR.

Despite seeking the same amount of funds from investors, the timing when the funds are being utilised could lead to a stark IRR difference of 27 percentage points! Some sponsors might adopt such manipulative behaviour as a higher IRR would generate higher fees for them or allow them to raise capital easily.

Read also: Important Considerations when Buying Overseas Properties

Figure 5: How IRR Could Be Financially Engineered

2) An implicit assumption when using IRR is that future cash flows can be reinvested at the same rate as the IRR. This assumption is not practical as IRR is sometimes very high and opportunities that yield such a return may not be available when cash flow is distributed back to investors.

3) The IRR measure does not account for the size of projects when comparing competing deals. A smaller project might appear more attractive because of a higher IRR, but ignores the fact that another competing larger project can generate significantly higher cash flows and perhaps larger profits.

Similar to NPV and most other measures of returns,

1) As is the case for most other measures of returns, IRR does not account for the level of risk. Without considering those risk factors, it would not provide a comprehensive evaluation for investors. For example, varying real estate deal types such as core, value-add and opportunistic offer different IRR with various degrees of risks involved (e.g. IRR for Core= 7-9%, Value-add = 12-15%, Opportunistic = >20%). As such, a higher IRR does not simply imply that it is a good investment as the sponsor could be taking on much higher risk which may not be suited for certain investors if they rely solely on IRR for their decision-making process.

2) It does not take into account the changes that occur during the investment period or the quality of the underlying assumptions. As IRR is a projected figure, unexpected events such as losing an anchor tenant, property damages as a result of natural disasters and black swan events such as COVID-19 are not taken into account when projecting the figure. Those unexpected events could have a significant impact on the projected IRR which would render the initial investment evaluation process futile.

How to Make Effective Use of IRR for Real Estate Investments

Similar to other investment metrics, IRR should not be used alone for investment evaluation especially for real estate deals. In order to make effective use of IRR, it could be combined with other metrics such as equity multiple (EM) and cash on cash returns.

For instance, EM which is derived by dividing the total cash distributions received throughout the years from the total equity invested could be combined with IRR to provide investors with a clearer picture on their investments. Since EM does not consider TVM, combining it with IRR would provide investors with a better idea of how effectively funds are being utilised by the sponsor in the long run.

In addition, cash on cash returns (or annual net cash flow divided by investment’s down payment) which only takes into account the yield received per annum, could be analysed alongside with IRR to provide both short-term and long-term outlook on the potential returns that the real estate deal could provide.

Read also: The Real Estate Risk/Reward Spectrum & Investment Strategies

In Conclusion

IRR is an imperative investment metric that could provide investors with a glimpse of how their invested funds could play out in the long run by considering an important investment concept – TVM. However, in order to fully utilise the merits of IRR, it should be combined with other real estate investment metrics in order to provide investors with a more comprehensive evaluation for their decision-making process.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.