Market Selection in Real Estate - RealVantage’s Approach

Choosing the right market is crucial for a successful property investment. In this article, we will breakdown how to do your own market selection as well as how we do it.

Table of Contents

- Establishing Investment Objectives

- Defining The Investable Universe

- Which Countries?

- How does RealVantage Conduct Property Investment Market Research

- Our 3 Primary Market Selection Criteria and Target Countries

a. Strength of Regulatory Framework

b. Market Depth

c. Transparency

d. Our Target Countries - How has the Pandemic Affect Global Property Investment

- Going Granular In Selecting Markets

- Finally…Our Favoured Markets

- In Conclusion

Often, we hear about how successful property investment is all about location, location, location. While to say that it is just “all about location” might be overly one dimensional, we certainly concur that it is one of the most critical success factors. An important question to ask would therefore be “Where should I invest in?”.

In this article, we draw upon past experiences investing on behalf of institutional investors to (1) offer a glimpse of how they approach the topic of market selection, (2) share how RealVantage selects key markets for its investments and (3) round up with a broad level discussion of the markets we favour.

Throughout the article, we see clear takeaways from the institutional investors’ perspective that would be helpful at the individual investor level for market selection and elaborate on these insights.

Establishing Investment Objectives

The motivations and objectives of investors can greatly affect the selection of markets. Cliché as it sounds, to arrive at the right answers, one has to first ask the right questions. As a simple example, for investors pursuing stable yield-driven core investments, they are more likely to find rich opportunities in a deep and developed market like Tokyo as compared to an emerging market like Ho Chi Minh City. The converse is true for another investor chasing higher returns and development opportunities.

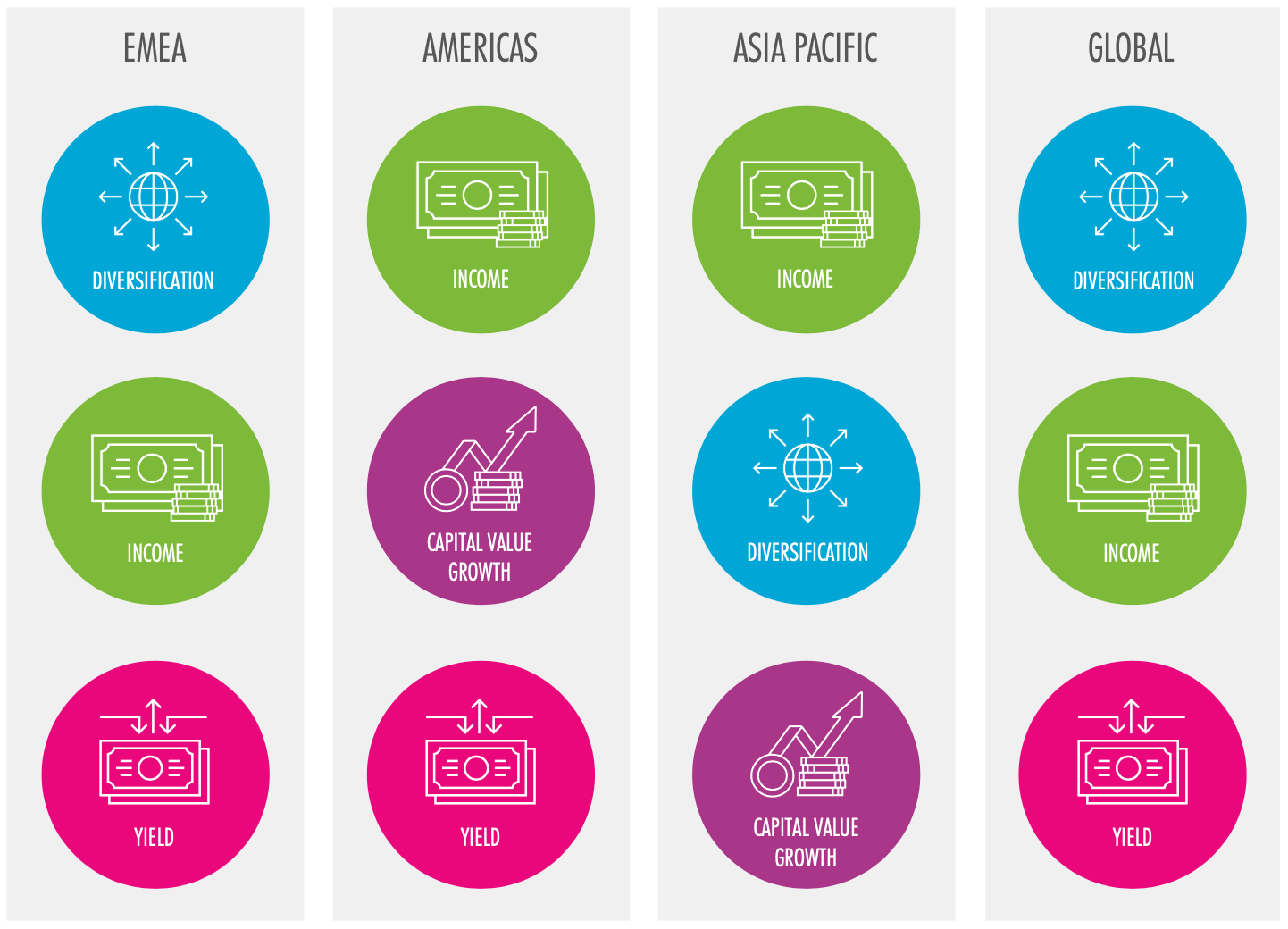

In the case of institutional investors, their motivations for pursuing direct real estate investment are crystal clear. In addition to just superior risk-adjusted returns afforded by the asset class, a recent global investor survey (Exhibit 1) revealed diversification benefits, stable income and yield as the top reasons they are investing into real estate.

It is therefore unsurprising that most, if not all institutional investors invest across multiple markets and sectors to avoid concentration risk. The allocation of capital towards various strategies – 59% for core, income-driven strategy versus 41% for value-add and opportunistic strategies – reflects the priority given to income and yield generation.

Exhibit 1: Motivation For Real Estate Investment

Despite the importance of establishing clear investment objectives as a first step, our interactions with individual investors reveal that this line of thought is not as well entrenched as it should be. The appeal of individual markets vary depending on whether an investor is prioritising passive income, wealth preservation, alpha returns on market or diversification.

For example, if building a resilient investment portfolio is identified as an important consideration, a Singaporean investor who has substantial local equities holdings, draws the bulk of income from local employment and already owns domestic real estate would find additional Singapore real estate exposure yielding limited diversification benefits. On this last note, Exhibit 2 shows that:

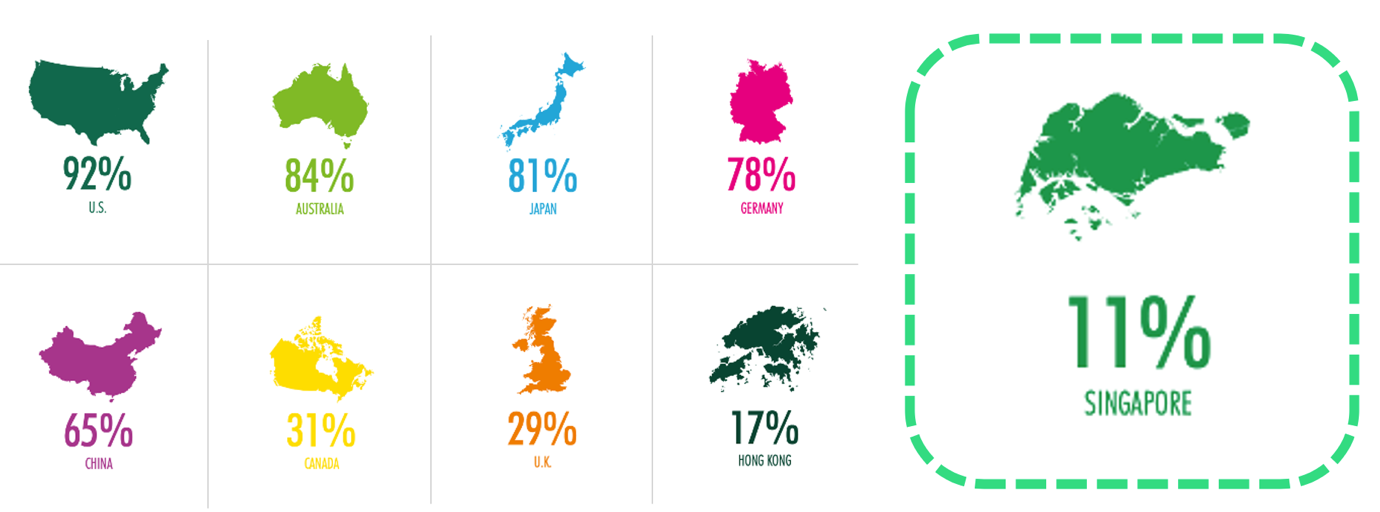

i) Institutional investors from countries with smaller markets generally do not view their respective domestic markets as being the most attractive. This reflects how these investors prioritise diversification over familiarity and ease of operations within their own markets.

ii) Conversely, institutional investors domiciled in deep markets overwhelmingly view their own markets as the most attractive. The depth of their domestic markets afford them sufficient berth for diversification while operating within familiar territory.

Exhibit 2: % of Institutional Investors Choosing Their Home Markets As The Most Attractive Market

Defining The Investable Universe

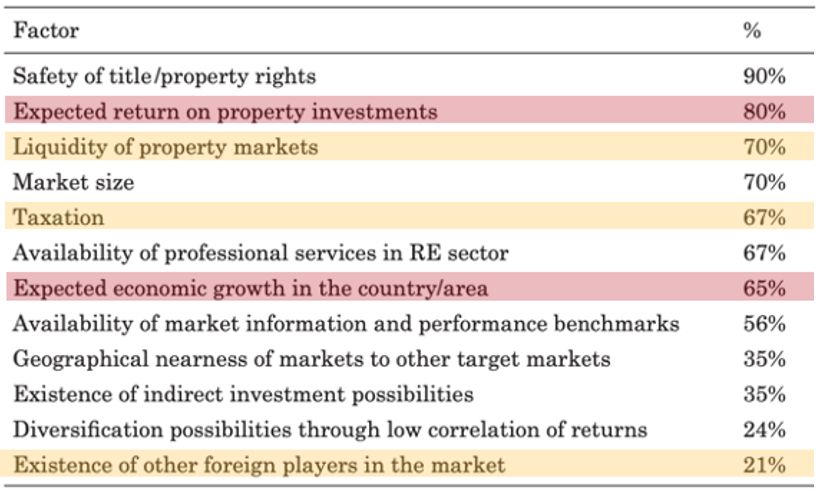

With clarity on the objectives driving real estate investment, investors can now take on the market selection question in a systematic way. Institutional investors approach this by first defining their investable universe. There are certain “threshold levels” that help them determine if a market is investable or not. Exhibit 3 shows a table extracted from a study published in the International Journal of Strategic Property Management that reveals factors, ranked in terms of importance, when selecting markets. Security of property rights and title, expected returns, liquidity and market size are amongst the top considerations. Markets that do not meet a certain minimum threshold will be dropped. Little wonder that there is rarely institutional investor action in markets with weak regulatory frameworks and limited depth.

Read also: What is an Accredited Investor?

Exhibit 3: Threshold Factors In Institutional Investors’ Market Selection Process

It is worthwhile to note that the definition of an investable universe is not entirely static. Some factors in Exhibit 3 (highlighted in red) are relatively dynamic while other factors (highlighted in orange) are not as fluid but could still change over the medium term.

Which Countries?

Before getting down to actual selection of specific real estate markets, institutional investors often employ a data-driven asset allocation optimisation process across all asset classes they invest in – equities, fixed income, alternatives like hedge funds, private equity, commodities and direct real estate. Depending on specific motivations and house views of the individual institutional investors, the optimisation is often run on a constrained model and the end-results are further fine-tuned to arrive at the final asset class allocations. After a target allocation to real estate has been determined, another round of portfolio optimisation is applied to just the real estate allocation.

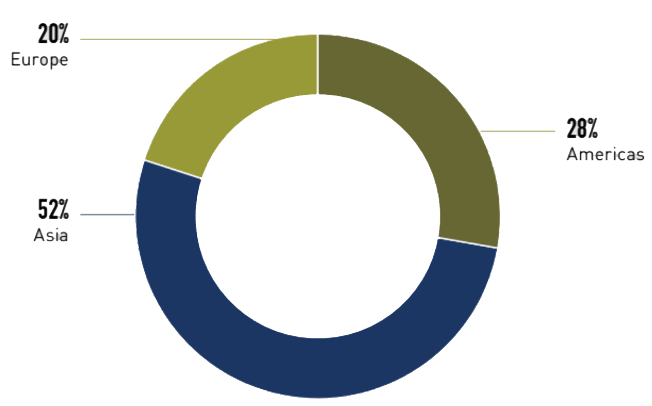

Exhibit 4: Real Estate Investment Allocation By Regions

To illustrate, Exhibit 4 shows the high level real estate investment allocation across regions for GIC, Singapore’s sovereign wealth fund. Roughly half of its real estate investment capital targets Asia while the balance goes towards Americas and Europe. Within each region, there are more granular and detailed allocations to specific countries and cities.

For individual investors with significantly less investment capital compared to institutional investors, it may not be feasible to run optimisation exercises the way institutional investors do. Nevertheless, the merits of maintaining a sensibly diversified and (somewhat) calibrated allocation strategy remain.

Visit RealVantage

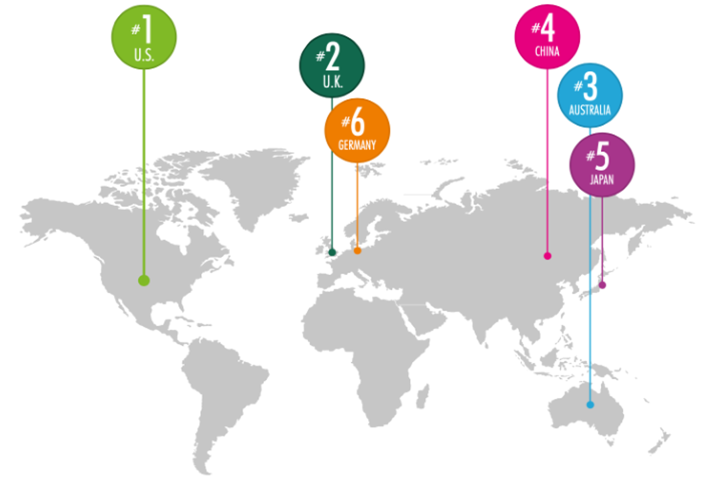

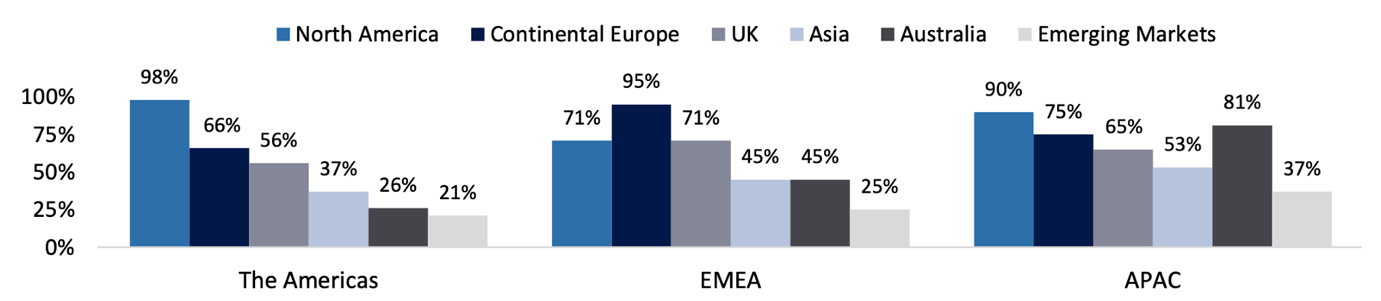

Rounding up the discussion on institutional investors’ market selection approach, Exhibit 5 reveals their top destination countries when it comes to investing outside of their home countries – US, followed by UK and Australia. Exhibit 6 provides further insights – institutional investors domiciled in Asia Pacific favour North America and Australia. Emerging countries are least favoured while UK features significantly (above 50%) for institutional investors across all regions.

Exhibit 5: Most Attractive Markets Outside Of Home Country

Exhibit 6: Geographic Focus, By Location Of Institutional Investor

Read also: Important Considerations when Buying Overseas Properties

How does RealVantage Conduct Property Investment Market Research

Given our background investing on behalf of institutional investors, our approach on many levels are aligned to their practices. However, as an online co-investment platform, there are also some differences that will have implications on how we select markets.

1. We are not constrained by any specific organisational requirements

Some examples:

- Unlike Pension Funds and Insurances, we do not have any ALM (asset liability management) considerations.

- Although we function in ways that are similar to institutional fund managers, we are not constrained by pre-defined investment mandates that might restrict us to only being able to invest in core deals.

- Our platform is independent from any real estate players. Other than providing opportunities with the best risk-adjusted returns, we are not obligated to channel capital into projects undertaken by any real estate players in particular.

2. The segment below institutional investors that RealVantage serves spans a very wide spectrum with investment objectives that vary just as widely

As a platform serving their needs, RV selects markets that are able to offer a wide range of strategies to cater to this demand.

3. We adopt a SEA-centric perspective

We are sensitive that we need to minimise region-specific idiosyncratic risks. As an example of region-specific risks, some of us may recall the Asian Financial Crisis that rocked the region back during 1997. While this region was in the hurt locker, the US and European markets were largely unscathed.

4. RealVantage employs a highly data-driven approach and artificial intelligence in our operations.

Such an approach allows us to monitor a large number of markets in a timely manner, much more efficiently than if we relied on pure labour. It also allows markets to be evaluated, at least at the onset, without any bias or emotions. While we draw benefits from using technology, we need to be careful that the data inputs that go into our system are reliable, comparable, timely and of a certain quality. Not all markets offer data of that quality.

Read also: Application of Technology in Real Estate Investments

Our 3 Primary Market Selection Criteria and Target Countries

Strength of Regulatory Framework

Safety of title/property rights ranked top in Exhibit 3. We have broadened this to consider the overall strength of a market’s regulatory framework. Having been active in investment markets that span both developed as well as emerging countries, we have acquired an acute appreciation of the risks accompanying markets with weak regulatory frameworks.

In certain jurisdictions, while there may be laws and regulations, their implementation may not be consistent across sub-markets and over time. These regulatory discrepancies in certain markets can result in riskier investments and are not advisable. As a case in point, Vietnam’s law allowed foreign property ownership as far back as 2015. But depending on the location, some who have bought into apartments have not been able to obtain their property titles till date. When entering deals, we can employ the best lawyers to draw up the tightest legal documents, but whether the courts interpret them according to the original intention or not is a separate matter.

It is important to look into the strength of the regulatory framework in the prospective markets before an investment is made. This includes the existing regulations in place for investors and the stability of these regulations as indicators for whether or not an investment is safe.

Market Depth

Depth of a market takes into account (1) how rich the opportunities are in a particular market, and (2) how liquid the market is. The learning curve entering foreign markets – both big and small – is hardly trivial. For that reason, it makes better sense to prioritise markets of meaningful size and depth rather than shallow markets. This allows investors to determine the supply and demand within the market as a measure of its viability for investment. The depth of markets is also a good proxy for liquidity. An investor trying to realise paper gains needs to be able to sell when he or she needs to exit. This factor is particularly important for RealVantage because there are specific timelines for our investments.

Transparency

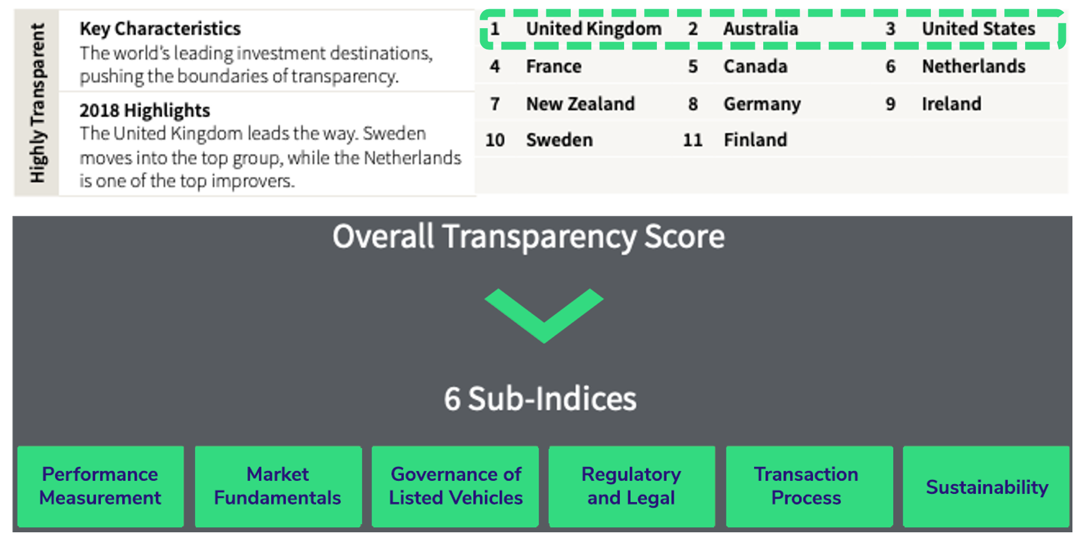

Real estate investment is a very localised business where information asymmetry can be significant. Hence, we prefer markets where as foreign investors, we are as close to level playing field with the local players as possible. Transparency is an important factor that levels the playing field. In addition, transparent markets allow us to obtain data inputs of sufficiently good quality for our artificial intelligence operations. One measure of transparency is through The Global Real Estate Transparency Index, which highlights the transparency levels of real estate markets worldwide. This provides more crucial data for market selection.

Our Target Countries

For the purpose of generating attractive risk-adjusted returns for investors, we have identified three markets – US, UK and Australia – as our target markets, comfortably checking off the boxes in our market selection criteria. As we are still seeing attractive opportunities in these markets, there is little compelling reason for us to migrate up the risk spectrum at this point in time.

On this last note, Exhibit 7 shows results from JLL’s (a top tier real estate professional services MNC) latest edition of the Global Transparency Index – a widely recognised index that is watched by international cross-border investors. This index is broken down into 6 sub-indices covering important areas – Regulatory and legal framework, market fundamentals, transaction process etc. – and comprehensively tracks 186 individual elements covering 100 countries. The rankings change with each edition of this bi-annual index, but the US, UK and Australia have consistently maintained pole position.

Sign Up at RealVantageExhibit 7: JLL Global Transparency Index 2018

How has the Pandemic Affect Global Property Investment

The pandemic has upended investment markets across major asset classes in recent months. Its unprecedented nature has generated uncertainties of such a scale that is difficult for anyone to have any good amount of confidence in forecasting. Any GDP forecasts now come heavily caveated. Even for specific markets – Hong Kong residential sector for example – forecasts from seasoned analysts are all over the shop. JP Morgan thinks prices will drop 10% this year. S&P says 10-20% fall. But Morgan Stanley is forecasting a 5% rise while Citi is going with 5-10% rise from April 2020 onwards.

RealVantage tracks these market views closely. But at the same time, we take a pragmatic approach when it comes to market selection. We hold the view that while market dislocations will be widespread across many countries, we should be targeting markets where these disruptions are likely to be relatively short-lived. To that end, we favour markets and countries where the governments take a more aggressive fiscal stance to support their economies.

Read also: An Analysis of COVID-19's Impact on Office Real Estate Demand

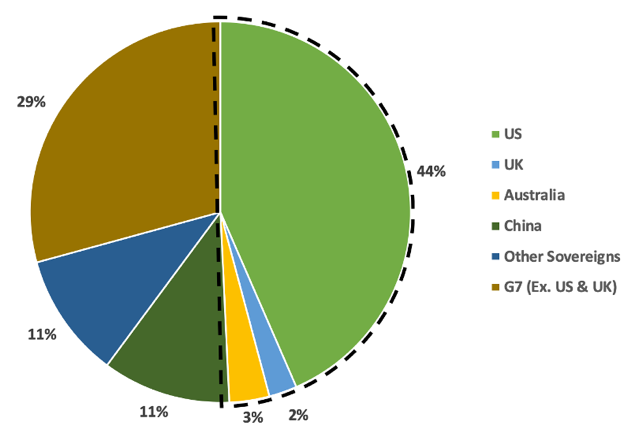

Exhibit 8 shows the various countries’ direct fiscal stimulus response as a proportion of the global response. While the US and Australia account for 15% and 1.7% of the global economy respectively, their fiscal responses at 44% and 3% of the global share have been outsized. The UK's response is proportional to their share of the global economic pie. Together, our 3 target markets account for about half of the world’s stimulus response.

Exhibit 8: Contributions To Global Direct Fiscal Stimulus In Response To COVID-19

Read also: Implications of COVID-19 Aftermath on Real Estate Sectors

Sign Up at RealVantageGoing Granular In Selecting Markets

Unlike the case for city-states, stopping at the country level is not good enough for selecting markets, given the size of our target countries. For things to be meaningful, we need to dive down to at least the city level, if not district. For RealVantage, this is an A.I.-aided, multi-layer filtering process (Exhibit 9).

Exhibit 9: RealVantage’s Market Selection Process

Having identified the target countries, the next step involved sieving out regions/states/cities that are congruent with our investment strategies. We have articulated our investment preferences and strategies, taking the ongoing pandemic into account, in earlier articles (RealVantage’s COVID-19 viewpoints and strategies) and webinars (Navigating through choppy waters and Positioning for advantage).

We are not done just yet after this stage. At risk of sounding like a broken recorder, real estate investment is a highly localised business. More than just buy low and sell high, execution is key for successful real estate investment. Of the cities identified for attractive risk-adjusted returns, RealVantage had to further filter down to the cities where our industry relationships and access to opportunities are the strongest.

Finally…Our Favoured Markets

Exhibit 10 tabulates 5 of our preferred cities from each of our target countries. To be fair, each selection deserves a robust and big discussion of its own. A research paper would be more apt than an article to fully do the individual selections any service. But a few common threads guide these selections in general.

Exhibit 10: RealVantage’s Favoured Markets

Broadly, the city selections are premised upon:

1. Beneficiaries of multiple secular tailwinds and robust economic fundamentals: Mid-sized markets the likes of Austin, Dallas and Melbourne are among the highest in projected population growth and net migration. Birmingham, London, Brisbane are prime examples of cities well placed to benefit from mega infrastructure projects.

2. Cities with sustained appeal for businesses and expected to maintain competitiveness through the pandemic and ensuing economic downturn: Cities like Sydney, Edinburgh, London possess potent combination of qualities – easy access to huge talent pool, top grade infrastructure, critical business ecosystem – that cannot be easily replicated elsewhere.

3. Cities fortified by crisis-proof elements: Adelaide is home to the bulk of Australia’s defense industry while a fair portion of businesses in Washington DC are plugged into the government’s eco-system.

Read also: Manchester as an Investment Destination | Overview of St Andrews (Scotland, UK) as an Investment Destination | Atlanta, a Thriving Metro with a Profusion of Opportunities

In Conclusion

As should be apparent by now, the seemingly simple question of “which markets to invest in” is anything but trivial. For individual investors, the process that institutional investors take would seem like an “overkill” of sorts. But if there are any takeaways, there are very good reasons why they draw the distinction between investing into developed markets and emerging markets.

While many emerging markets have compelling fundamentals going in their favour, investors need to appreciate the risks of going into those markets. Diversification is the number one reason for investing into real estate for institutional investors. Individual investors would do well to take a leaf from their rationale but it would not be surprising if many find the whole cross-border investment business daunting.

If the market selection process is not onerous enough, individual investors still need to grapple with issues ranging from tax, legal, investment structuring, asset and property management, research, financing and capital structuring etc. in order to enjoy the sweet rewards of real estate investment.

For that reason, RealVantage exists to extend the benefits of direct real estate investing minus the hassle to investors.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.