An Overview of Institutional Investors

Gain a better understanding of institutional investors through this article by examining the various sub-types of institutional investors, the impact that they have on the market, and the advantages that they possess compared to retail investors.

In the world of finance, investors are typically categorised into two different groups: institutional investors who invest through entities, typically on behalf of others; and retail investors who invest as individuals, for their own interest. The investment strategies deployed by these two types of investors are different, primarily due to their differing accesses to the financial markets and information.

Let us now take a closer look at the various sub-types of institutional investors, the impact that they have on the market, and the advantages that they possess compared to retail investors.

What is an institutional investor?

An institutional investor is a legal entity or organisation that pools funds from numerous investors, such as retail investors or other legal entities, to invest in different financial assets, such as stocks, bonds, real estate, or other investment vehicles.

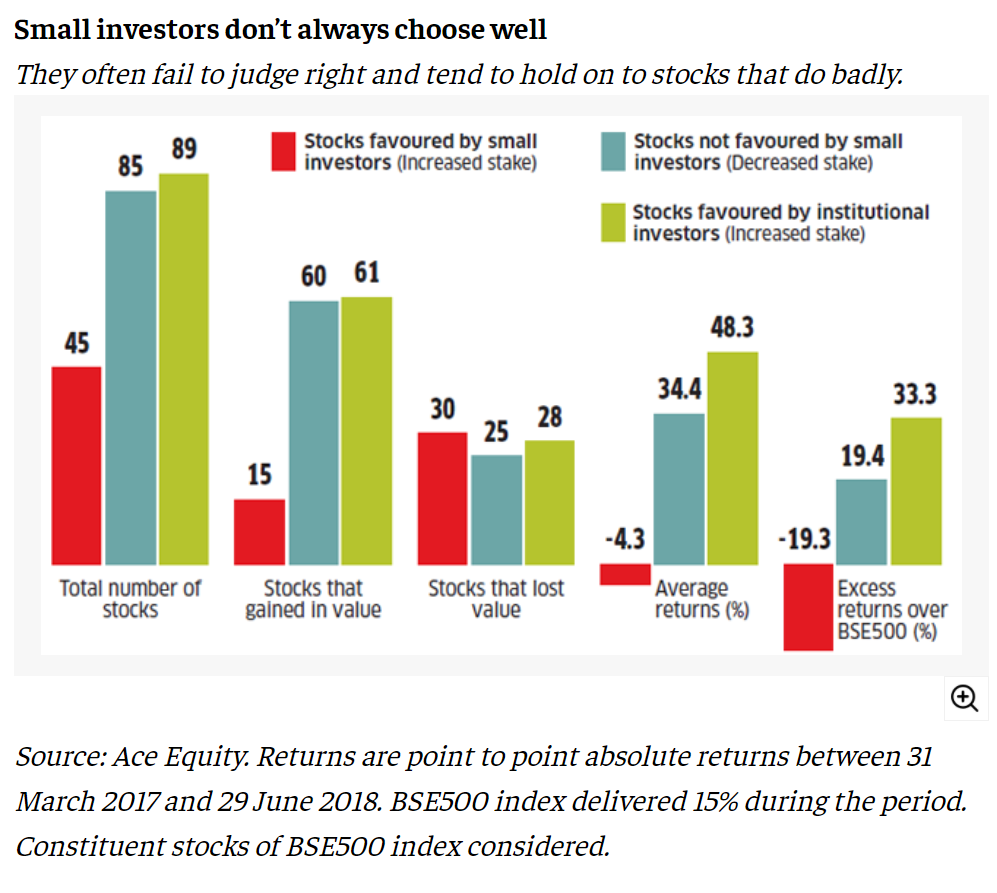

Institutional investors are considered sophisticated investors who possess extensive investment knowledge and experience. They are capable of in-depth analysis and are able to develop sophisticated financial models. Typically, institutional investors would have in place robust due diligence processes, so they are less likely to make poor investment decisions compared to retail investors.

Institutional investors generally invest money on behalf of their members or clients, but may also invest their own money. They also have access to private investment options that are not typically open to retail investors, such as institutional real estate, private equity, or private stock placements.

Retail investors, on the other hand, tend to be non-professional investors who trade in securities and funds, usually through intermediaries, such as brokerage firms or investment accounts managers provided by banks. Since these retail investors are investing on behalf of themselves, rather than an institution, the investment amount tends to be much lower, compared to institutional investors. Retail investors also tend to be less skilled and more susceptible to emotional biases, compared to institutional investors.

Institutional investors typically follow clear objectives set out in the investment thesis, and have compliance and risk management teams to manage the overall risk of the investment portfolio.

Read also: What is Cap Rate?

Can an individual be an institutional investor?

The answer is “no”. An institutional investor is a company or entity that invests capital on behalf of individuals. Institutional investors invest in a range of different asset classes, while individual or retail investors typically invest in publicly traded stocks for their own gains. Accredited investors, on the other hand, may be an entity or an individual, but they will need to fulfil specific financial criteria.

Read also: Guide to Investments in Singapore

How do institutional investors make money?

Since institutional investors are investing on behalf of others, returns from investments do not go directly to them. These investors earn asset management fees charged for managing investments, or by taking a share of profits should the investments exceed a predetermined performance target This performance fee is termed as “promote” in the financial industry.

Read also: What is Real Estate Sponsor Promote

Are family offices institutional investors?

Family offices function similarly to institutional investors, investing and managing the assets for the family that they represent. However, unlike institutional investors, they typically only cater to a single client (that is, the family they serve) and do not manage investments from other individuals.

Types of institutional investors

There are several different types of institutional investors in the market. Each of them specialises in specific asset classes and follows their own investment strategies.

1) Hedge funds

Hedge funds are one of the most well-known types of institutional investors in the financial world. Some of the world’s biggest hedge funds include Bridgewater Associate, AQR Capital Management, and Blackrock. As the term suggests, a hedge fund’s fundamental objective is to ‘hedge’ against losses in the overall stock market. This is often done by taking both long and short positions on various securities.

Hedge funds typically have strict requirements for their investors and are usually not open for subscription to retail investors. To invest with a hedge fund, you must be an Accredited Investor.

One distinctive characteristic of hedge fund investments is illiquidity. This means that hedge fund investors have their capital locked up in the investment for a certain period of time without the freedom of cashing out and exiting it. In addition, hedge funds typically use a concentrated investment strategy, where funds are directed to a few assets in larger proportions, making it more susceptible to larger gains and losses. Hence, hedge funds are considered a riskier investment.

Read also: Illiquidity Premium in Real Estate Investments

2) Mutual funds

A mutual fund is another common investment vehicle. The underlying investments of a mutual fund may include stocks, bonds, funds, or other securities. Most mutual funds invest in liquid securities that are traded in the stock market. Vanguard, JP Morgan, and Fidelity Investments are some of the world’s most famous mutual fund managers.

Mutual funds are well-diversified funds that invest across different industries, sectors, and geographical markets. They are designed to. Most mutual funds do not have entry requirements for investors and are open for subscription to individual or retail investors with a small minimum investment outlay. One attractive feature of mutual funds is their low barrie

Read also: What is Sources and Uses of Funds?

3) Private equity and venture capital

Private equity (“PE”) institutions are pooled investment funds that provide capital to private organisations that are not publicly listed. The duration of the investment is usually long, typically over five years, making the investment illiquid. PE institutions typically only target high-net-worth individuals as their investor base, due to the high minimum investment outlay, and they are able to provide investment access to private companies that are under the radar.

Venture capital (VC) is a form of private equity financing, which typically provides funding for startups, early-stage companies, and emerging companies with high growth potential. The typical objective of a VC is to invest early with the objective of increasing the valuation of their invested startups through a series of funding rounds, with the ultimate aim of an initial public offering (IPO). Some well-known VCs include Sequoia Capital, Softbank, and Andreessen Horowitz, which have invested in successful startups, such as Facebook, Airbnb, and Über, just to name a few. Both PE and VC investments are deemed high-risk.

4) Insurance company

An insurance company collects premiums from its policyholders regularly from the insurance products they sell, which are generally divided into life and non-life insurance policies. A part of the premiums collected is typically deployed into long-term investments to generate returns and cover claim payouts. Some of the financial instruments these firms invest in include inflation-hedged bonds, government bonds, or long-duration bonds.

Some of the world’s largest insurance companies include Axa S.A. Insurance, Prudential PLC, and Allianz SE.

Read also: Knowing Your Capital Stack

5) Endowment funds

Endowment funds are generally established by universities, hospitals, charitable foundations, or other non-profit organisations to manage their money, which typically come from donations and are not needed immediately. The income generated from investment activities is usually mandated to be used to finance the beneficiaries’ activities, such as to provide scholarships or fund charitable events.

6) Pension funds

Pension funds are funds established using monetary contributions from pension plans. The accumulated capital is typically allocated to income-generating and stable investments, as the primary purpose of pension funds is to provide steady financial income for pensioners upon retirement.

Pension funds have low-risk appetites and typically invest only in well-diversified funds, low-risk government bonds, large-cap stocks, and stable real estate assets. Some well-known examples of pension funds include the Central Provident Fund (CPF) in Singapore, Government Pension Fund of Norway, and the California State Teachers Retirement System.

Read also: Understanding IRR, Cash Yield, and Equity Multiple

Sign Up at RealVantageImpact of institutional investors

Market maker

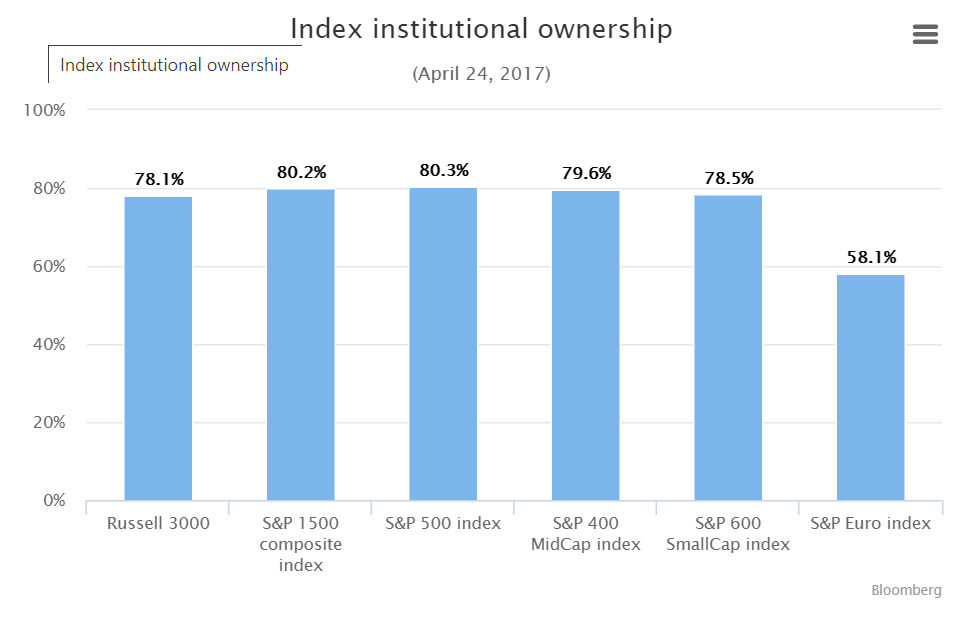

Institutional investors have significant clout in the financial market and are able to exert a large influence over the price dynamics of certain securities. They also own large portions of publicly listed companies. According to a study conducted by Harvard Business Review, institutional investors own around 80% of all stocks in the S&P 500 index. In addition, financial institutions, such as Blackrock, Vanguard, and State Street are the three largest owners of most DOW 30 companies.

Institutional investors are crucial to financial markets as they provide capital to businesses and create liquidity for the financial securities they trade in. They also help to enhance market efficiency by improving management accountability and price discovery.

Corporate governance

Besides economic contributions, institutional investors also play an active role in improving corporate governance practices. According to a research paper written by Stephen Bainbridge, a Professor of Business Law at UCLA, institutional investors have greater incentives to develop expertise in tracking and monitoring their investments, due to large monetary commitments when compared to retail investors. This practice has encouraged firms to adhere to the principles of good corporate governance for their operations.

In addition, institutional investors that hold a large portion of shares have more power to hold the management of companies accountable for actions that undermine shareholders’ interests and welfare. With a large portion of shares and voting rights in the company, institutional investors are able to make constructive adjustments in the board’s composition when a company's performance falls by the wayside.

In other words, institutional investors provide not only funds but also practical recommendations, networks, and support, which can be valuable to the companies that they invest in.

Read also: Doing Right by Our Investors

Advantages of institutional investors

1) Lower fees

In most cases, institutional investors tend to trade on high-volume shares and only engage in large transactions; these refer to block trades of 10,000 shares or more with a significant amount of capital. Because of their large size and purchasing power, this enables them to negotiate for better fees for each transaction and better terms on their investments. Institutional investors may also not be charged for fees such as marketing or distribution expenses.

2) Access to securities

Institutional investors are able to gain access to exclusive investment opportunities. These transactions may require a large amount of capital, for example: commercial real estate, currencies, and futures contracts, which retail investors typically do not have access to.

Other transactions such as IPOs, forwards, and swaps are restricted to institutional investors because of the complexity and high-risk nature of the deals. Institutional investors are deemed to have the knowledge, experience, and ability to guard themselves against the risks. In the U.S., institutional investors are entitled to buy private placements under Rule 506 of Regulation D as Accredited Investors. However, individual or retail investors may also gain access to exclusive investment opportunities through co-investing, for example, individual investors may invest in institutional real estate opportunities through real estate co-investing.

3) Resources and professional guidance

Managers who manage institutional funds are generally experienced investment specialists. These experienced managers are less prone to emotions, such as greed and fear, when investing, as compared to retail investors. Emotions are one of the top reasons retail investors lose money. Moreover, institutional investors are also better equipped with various analytical tools and technology, allowing them to make more accurate financial analysis when reviewing their investment options.

Conclusion

In summary, institutional investors are large organisations that typically invest money on behalf of a pool of investors. There are many different types of institutional investors in the market, which differ in terms of the amount of control, the level of risk tolerance, the level of liquidity, as well as the participation in their investments.

Institutional investors are vital to the capital markets. They exert a great influence and have a considerable impact on all asset classes and markets, and are also known to improve corporate governance and information transparency in the corporate world.

Since institutional investors often take part in large transactions, they may enjoy preferential treatment and lower transaction fees when purchasing securities in the primary financial markets. As a result, they may be able to achieve better returns for their investments, compared to the retail investors.

Read also: REITs or Real Estate Co-Investments?

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.