Understanding IRR, Cash Yield, and Equity Multiple

These are three commonly used metrics to calculate the real estate investment returns. Find out their differences and determine which to use to evaluate your investments!

For real estate investors, syndicators and others involved in the field, investment terminology can appear to be an alphabet soup of mysterious acronyms. There are three in particular that are related to the return on real estate investments, and each has its own unique meaning and purpose. They are Cash Yield (also known as the Cash-on-Cash Return), Internal Rate of Return, and Equity Multiple. Read on to learn their differences and how they could help you when exploring real estate investments.

Internal Rate Return

One of the most common metrics used to gauge investment performance is the Internal Rate of Return (IRR). This is one of the first performance indicators you are likely to encounter when browsing real estate opportunities. The IRR is defined as the discount rate at which the net present value of a set of cash flows (i.e., the initial investment, expressed negatively, and the returns, expressed positively) equals zero.

In simpler terms, IRR is the annual rate of growth on your capital that a real estate investment opportunity is expected to generate over its life. Keys to understanding IRR analysis is realising that timing plays an important role. Both the duration of the investment period and the timing of cash distributions paid to investors have a substantial influence on the IRR value.

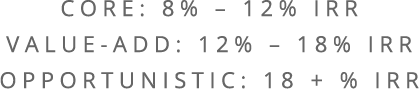

Typically, the higher the projected IRR of an investment opportunity, the higher the level of risk involved. Real estate investment can be classified into different risk classes based on their projected IRR. Though there is no concrete definition for the IRR values associated with each risk class, investment analyst associate IRR values with the following risk classes.

Read also: What is Compound Annual Growth Rate (CAGR)?

Cash Yield

Cash Yield is the simplest way to evaluate the performance of a real estate investment. It utilises a formula to calculate the return on investment by taking the property’s or investment opportunity annual net cash flow and dividing it by the investment’s downpayment; this is expressed as a percentage.

The Cash Yield is a useful metric for investors to compare the returns of different investment opportunities, as it allows them to evaluate the annual cash flow generated by an investment relative to the amount of cash invested.

Suppose that you bought a property and your net cash flow was $5,000, and the cash invested in your property was $50,000. In that example, your Cash Yield would be 10% ($5,000/$50,000). The down payment would usually be the net property investment, which is the property’s cost minus the amount you borrowed. One important detail to keep in mind is that Cash Yield does not include the property’s appreciation or any principal debt payments. Appreciation is only taken into consideration when it is realised after the property is sold. It also does not include principal debt payments.

Equity Multiple

The equity multiple is defined as the total cash distributions received from an investment, divided by the total equity invested. Here is the equity multiple formula:

For example, if the total equity invested in a project was $1,000,000 and all cash distributions received from the project totalled $2,500,000, then the equity multiple would be $2,500,000 / $1,000,000, or 2.50 times. Unlike the IRR measure, the time value of money is not taken into account.

So, what does the equity multiple indicate? An equity multiple that is less than 1.0 times indicates that you are receiving in return less cash than you invested. An equity multiple greater than 1.0 times, on the other hand, means that you are receiving more cash than the amount that you have invested. In our example above, an equity multiple of 2.50 times simply means that for every $1 invested in the project, an investor is expected to get back $2.50, including the initial $1 investment.

It is possible for an investment to have a high IRR but a lower Equity Multiple if the timing and amount of cash flows are such that the investor receives a high return in the early years of the investment but a lower return in the later years. Similarly, an investment can have a high Equity Multiple but a lower IRR if the cash flows are spread out over a longer period of time.

At RealVantage, we disclose to our investors the projected IRR, Equity Multiple and Cash Yield (if applicable) of each investment opportunity that we market. These performance metrics gives the investor a better picture of the expected returns. All three levels of performance must be viewed in totality to enable the investor to decide if it suits their risk appetite and investment goals.

Read also: What is Loan-To-Cost (LTC) Ratio?

Read also: What is Debt-to-Equity (D/E) Ratio and What is it Used for?

For more insights:

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.