DollarsAndSense - Core, Value-Add & Opportunistic Investment: How Different Property Investment Strategies Determine The Ideal Properties To Invest In

Target different risk and returns with each investing strategy.

SINGAPORE, Dec. 13 2022 / DollarsAndSense / – The truth is, the investment strategies that we adopt will decide whether we will be able to realise our investment objectives over time. And when it comes to property investing, there are three real estate investment strategies we may adopt: Core; Value-Add and Opportunistic.

Here’s what these terms actually mean, and how they can guide our property investments:

Core: Investing In Lower-Risk Rental Properties

At its heart, a Core investment strategy is a buy-to-hold investment strategy. Investors purchase a high-quality property, typically in a good location and with strong transport connectivity, to generate a stable rental income with lower risk.

Being desirable properties with visible rental cash flows, this type of investment tends to provide capital value preservation for investors. By the same token, they will be sought-after properties by tenants. Besides making it easier to rent them out, investors can also expect to inject minimal capital expenditure to generate their targeted rental returns.

Depending on the demand, the owners of such properties can choose to lease them out to tenants with stronger cash flows that are likely to take up longer-term leases, which will contribute to a longer Weighted Average Lease Expiry, reducing the overall tenancy risk. Such tenants may include government agencies, institutions and blue-chip companies.

Read Also: How Avid Renters are Fuelling a Build-To-Rent Property Boom

Value-Add: Buying Properties You Can Enhance The Value Of

As its name suggests, this property investment strategy involves the acquisition of underperforming real estate and enhancement of their value. The aim is for the property to secure higher future rents, and in turn, higher future property valuations.

You would probably also be able to guess that Value-Add deals are typically riskier, as they require investors to first identify and acquire underperforming assets, which tend to be run down and may have limited cash inflow.

This could be the result of sub-par operational day-to-day maintenance and outdated renovations, translating into poor tenant mix as well as higher vacancies. Rental desirability and rental rates of such properties tend to be depressed, compared to similar properties.

Underperforming real estate may also come with structural problems resulting from years of poor maintenance. Uncovering and fixing these issues may be time-consuming and may end up in a hefty bill.

In addition, other Value-Add investment opportunities could include assets with a poor tenant mix, or assets that could be enhanced by creating additional space by either adding another floor or extending the space within.

Value-Add investing requires on-ground knowledge and expertise in property enhancement and management to turn things around. You stand to earn a better return if you are successful in unlocking the potential of your investment.

After completing the project, you may choose to keep the enhanced property for better rental returns.

If you are good at identifying Value-Add property deals, it could be wiser to divest completed projects at a higher value and reinvest your money in another Value-Add real estate investment opportunity.

Opportunistic: Acquiring Properties That Need Significant Development To Pay Off

An Opportunistic strategy is the riskiest among the three strategies. That is why the investment payoffs for deals that adopt this strategy tend to be the most attractive.

A hallmark of an Opportunistic deal is acquiring a property that does not provide significant initial cash flow and there are typically complicated flaws in the property that need to be fixed. This could be an empty building, a building that is currently being used for another purpose (that you are intending to change), or even a bare plot of land to be developed.

The “opportunity” here is that a well-managed project will deliver a lucrative payoff at the tail end of the deal. Investors participating in such real estate investments should be aware that they may not receive regular cash flow from the deal until the investment is realised through a disposition. Such investments usually also require intimate knowledge of property development and construction, as well as a professional team to turn around the assets.

Read Also: What Singapore Investors Should Look Out For When Investing In Overseas Properties

How Much Risk Do We Want To Take With Our Property Investments?

All three property investment strategies above – Core, Value-Add, and Opportunistic – carry varying levels of risk. Depending on our risk appetite and ability to participate in a real estate investment, each has its own investment merits.

Risk-averse investors may prefer a Core investment strategy. Investors adopting a Core strategy should prioritise properties that already provide strong and visible cash flows. This should be underpinned by strong tenants and long-term leases.

Due to the defensive nature of such investments, the capital value of the underlying assets would be higher. Returns also tend to be lower, ranging from 7% to 9% per annum, and primarily derived from rental income.

On the other hand, property investments – represented by Value-Add and Opportunistic deals – are riskier.

Value-Add deals require investors to be able to identify and turn around underperforming properties. This endeavour will typically be supported by limited cash flow from the investment property, and the challenge would be to complete the asset enhancement initiatives to increase rents, and eventually, the property’s value.

For Value-Add deals, the key is to enhance rental from the property and consequently increase its capital value. Given the added risk of the renovations, returns from such investments should commensurate with the relevant risks and range between 10% to 15% per annum. In addition, total returns would be derived from a combination of income and capital appreciation.

Opportunistic deals require investors to stomach investment risks with almost no cash flow throughout the investment period. The payoff only comes at the tail-end of the deal, when we have developed it to the point that it is ready to be sold off.

Planning risk, construction risk, and disposal risk are some of the key risks involved in such investments. Returns should therefore commensurate with the additional risks assumed by investors, and ideally be 17% or higher.

Investing With Real Estate Co-Investment Platform – RealVantage

While all three property investment strategies may be deployed by individual investors, there are merits to investing via a fractional property co-investment platform like RealVantage.

The main benefit is that we can start our property investment journey with as little as $5,000 or $25,000 per investment. This is a far cry from the several hundreds of thousands of dollars in down payments that we have to fork out, if we were to buy a single property on our own. The other advantage is that we get to diversify our property investments, rather than concentrate our investment risks on a single property.

Cutting up our property investments into smaller ticket sizes with a reputable platform, such as RealVantage, also enables us to diversify our property investments by different strategies: Core, Value-Add and Opportunistic.

In the first place, as retail investors, we may not have the confidence, expertise, or time to manage our own property investments. Often, we may be found lacking in all three aspects. RealVantage solves this with its highly experienced co-founders, who started the co-investment platform because they observed this very gap.

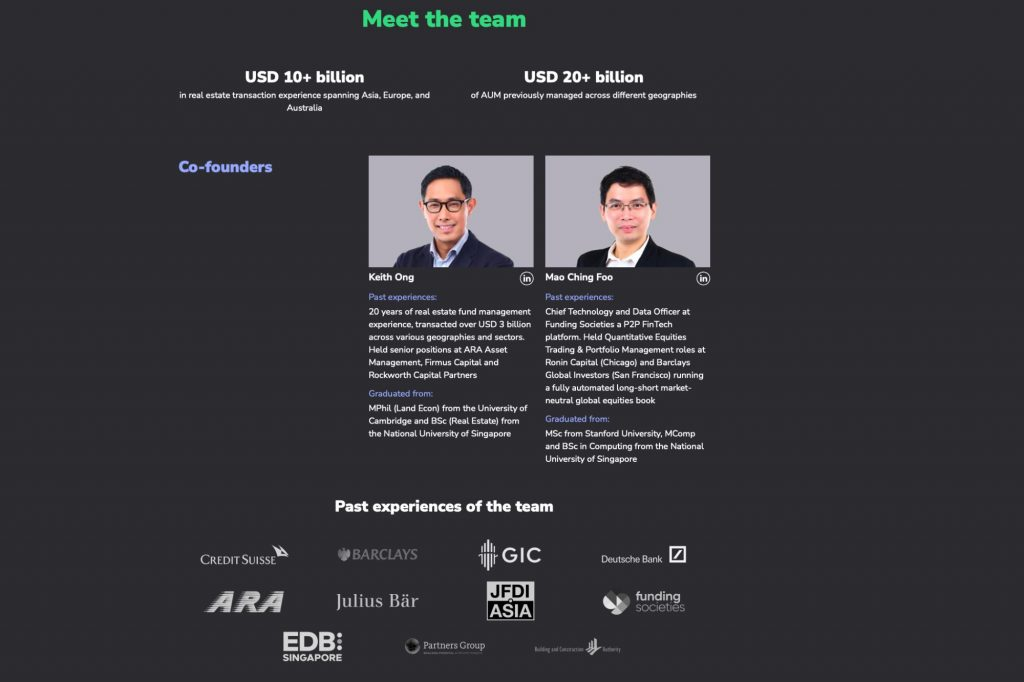

Co-founders Keith Ong and Mao Ching Foo have decades of experience in real estate, real estate investment portfolio management, and technology. They are further supported by a team that has diverse professional experience across some of the biggest names in the real estate and finance industry. Collectively, the team has experience transacting more than USD10 billion in real estate investments and managing more than USD20 billion in assets under management.

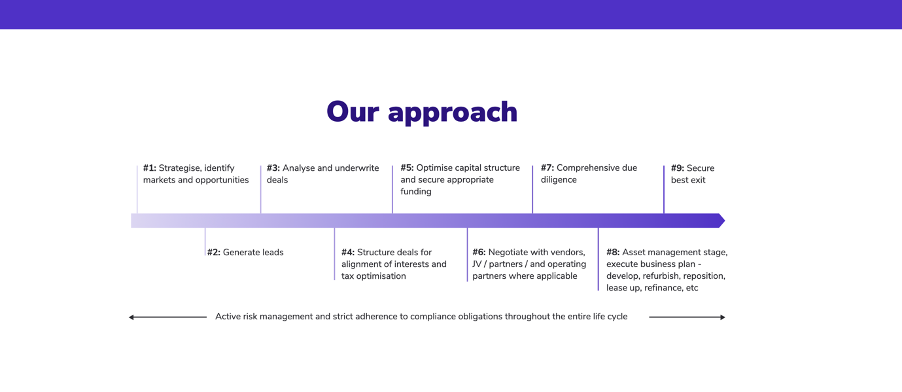

The advantage of investing through RealVantage is that they have the expertise to identify good investment properties across the different types of risk we are able to tolerate. In fact, the team’s expertise spans wider – being able to analyse and underwrite the deals, optimise property tax and capital structures, source for funding options, negotiate with vendors, execute due diligence on investors’ behalf, and secure the best possible exit for investors.

Furthermore, all its property investment deals made available on the platform are vetted by an Investment Committee, which is made up of industry professionals with vast industry experience.

Another big differentiating factor for RealVantage is that they invest alongside investors on every deal that they bring to the table. This means that the interests of investors are always aligned with those of RealVantage.

Check out the latest property investment deals now on RealVantage.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.