What is Loan-to-Cost (LTC) Ratio?

The LTC ratio is used to determine the amount or percentage of a loan that the lender will issue for project financing, on the basis of the construction costs.

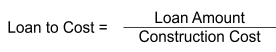

LTC Formula

The Loan-to-Cost (LTC) Ratio is calculated by dividing the loan amount by the construction cost to compare the financing amount with the cost of a property, and this is expressed as a percentage.

What does the Loan-to-Cost ratio tell you?

The LTC ratio is used to determine the amount or percentage of a loan that the lender will issue for real estate project financing, on the basis of the construction costs. Following the completion of construction, the project will be revalued.

The higher the LTC ratio, the higher the risk of the loan for the lender. As such, most lenders have set LTC ratio limits for the amount they are willing to lend to finance a real estate project, and most lenders have this capped at 80% of the total project cost. There are some exceptions, however, where higher LTC financing comes with a higher interest rate to make up for the increased risk to the lender.

However, the LTC ratio is just one factor used by lenders to evaluate the issuance of a loan, including the value and location of the project, as well as the loan and credit history of the potential borrower.

Read also: Understanding IRR, Cash Yield, and Equity Multiple

Example on how to use the LTC ratio

Example of a $200,000 project with an 80% LTC ratio.

| Total Construction Cost | $200,000 |

|---|---|

| Loan from lender | $160,000 |

| LTC ratio | $160,000 / $200,000 = 80% |

In the example above, the LTC ratio is used to calculate the loan amount for a $200,000 real estate project. With a hard construction cost of $200,000, an 80% LTC ratio comes to a loan amount of $160,000, providing the borrower with debt capital for the project. This debt capital injection serves to motivate the borrower to bring the project to completion.

Read also: Knowing Your Capital Stack

What is the maximum LTC?

Lenders usually set a maximum loan amount based on the LTC ratio, as well as a maximum dollar amount. For example, a lender may set a maximum LTC of 80% or $200,000, whichever is lower. In this case, if a buyer hits the $200,000, while still remaining below the 80% maximum LTC, they are required to make up the rest of the cost and invest more of their own money.

Sign Up at RealVantageWhat is Loan-to-Value (LTV) Ratio?

The Loan-to-Value (LTV) ratio is the loan amount given to the borrower on the back of the valuation of a real estate asset. A higher LTV ratio represents a higher risk to the lender.

The difference between the Loan-to-Cost and Loan-to-Value ratios

The LTV ratio is related to the LTC ratio, but it uses the total value of the project as its denominator, rather than its cost.

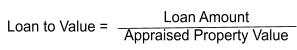

The LTV ratio is calculated using the following formula:

To give an example, if the Appraised Property Value is $400,000, and the total loan given is $320,000, the LTV would be calculated as $320,000 / $400,000, resulting in a ratio of 80%.

Read also: How Does Internal Rate of Return (IRR) Impact Real Estate Investors' Decision-Making Process?

When do you use the LTC and LTV ratios?

The LTC ratio measures the debt against the overall cost of the project, whereas the LTV ratio expresses the debt against the fair market value of the property. In both instances, with all other factors being equal, a higher value is an indication of greater risk since the borrower holds less equity in the investment proportionally.

Overall, the LTC ratio is more appropriate when assessing a project which requires more construction, such as a value-add (house flipping) property or a ground-up development, which both come with more required construction costs. On the other hand, the LTV ratio is more suitable for evaluating a stabilised real estate asset or a property investment that adopts a Core investing strategy.

Read also: The Real Estate Risk/Reward Spectrum & Investment Strategies

Read also: Real Estate Co-Investment – The New Alternative

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.