What is Loan-To-Value (LTV) Ratio?

In this article, we find out what is Loan-To-Value (LTV) Ratio, the LTV formula, and is a higher or lower LTV is better?

Table of Contents

- Understanding the Loan-to-Value (LTV) Ratio

- LTV Formula

- Example of a LTV Calculation

- Is a Higher or Lower LTV better?

- Combined Loan-to-Value (CLTV) Ratio

- CLTV Formula

- LTV vs CLTV

- Limitations of LTV

Understanding the Loan-to-Value (LTV) Ratio

The Loan-To-Value (LTV) Ratio is the proportion of loan amount given to the borrower, relative to the value of the asset. It is a tool used to assess the lending risk that financial institutions and other lenders have to take when underwriting a mortgage. A higher LTV ratio represents a higher risk to the lender, since it makes recovery of the principal loan amount in the event of a default more difficult.

The LTV ratio is an important criterion when underwriting a mortgage to buy a home, refinance a current mortgage, or borrow against accumulated equity within a property. Additionally, in countries such as the US, the LTV ratio is used to determine whether mortgage insurance is required when approving a home mortgage.

Read also: Understanding IRR, Cash Yield, and Equity Multiple

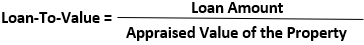

LTV Formula

The LTV ratio is calculated by dividing the loan amount outstanding by the property's latest appraised value, expressed as a percentage.

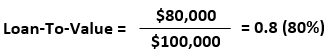

Example of a LTV Calculation

Suppose a property's appraised value is $100,000, and had an outstanding loan of $80,000, this implies a LTV ratio of 80%, calculated as follows:

Similarly, if the loan amount was $75,000, the LTV ratio would be 75% (i.e. 75,000/100,000).

Is a Higher or Lower LTV better?

The LTV ratio could affect the eligibility for securing a mortgage, the interest rate charged, and whether additional costs, such as mortgage insurance is required.

A higher interest rate is usually set for loans that are deemed riskier to lenders, and loans with high LTVs are typically associated with higher interest rates. For example, if a borrower requests a loan close to or equal to the property's value (which is considered a high LTV ratio), this is considered to be a higher risk to the lender, and the lenders is more likely to impose a higher risk premium on that mortgage, affecting the chances of approval and interest rate negatively. Higher LTVs can at times be seen in residential mortgages protected by private mortgage insurance, as this provides a second layer of protection for the lender. However, it is less common in commercial mortgages, which results in lenders issuing commercial loans relying solely on the property as security.

Lenders usually support a lower LTV ratio as in the event of a default, the lender would more likely be able to recover the principal loan amount from a foreclosure and sale. Borrowers have a better chance of negotiating more favourable loan terms, such as the interest rate, with lenders when the requested LTV is lower.

Read also: Knowing Your Capital Stack

Sign Up at RealVantage

Combined Loan-to-Value (CLTV) Ratio

The Combined Loan-To-Value (CLTV) Ratio is the ratio of a property’s overall mortgage debt load expressed as a percentage of the property value. Commercial and residential mortgage lenders use CLTV to assess the risk of default when a borrower takes up more than one mortgage on a single property.

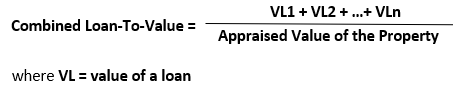

CLTV Formula

The CLTV ratio is calculated by dividing the sum of all loans taken out on the property by the property's appraised value, expressed as a percentage.

LTV vs CLTV

The Loan-to-Value (LTV) ratio of a mortgage is the ratio of a single mortgage loan to the property's value, while the Combined Loan-To-Value (CLTV) is the ratio of the sum of all loans taken out on the property to the property's value.

The CLTV accounts for any additional loans that a property buyer takes on a property. It includes any second mortgages or mezzanine loans, home equity loans, or home equity lines of credit (HELOC).

For example, assuming a borrower took up a primary mortgage of $250,000 for the purchase of a property worth $500,000. Later on, he took up a second loan of $100,000. In this case, the LTV = 50% ($250,000/ $500,000), while the CLTV = 70% ($250,000 + $100,000/ $500,000); a higher ratio.

The CLTV ratio is typically used by secondary mortgage lenders to assess the riskiness of providing an additional loan on a property, as in the event of default, they would rank behind the senior or primary lender for any claims on the property.

The LTV ratio only considers the primary mortgage, disregarding other obligations such as any other mortgages taken on top of the first. Therefore, the CLTV is a more inclusive form of calculation when determining a borrower's total debt exposure on a single property.

Read also: How Does Internal Rate of Return (IRR) Impact Real Estate Investors' Decision-Making Process?

Limitations of LTV

While the LTV ratio is somewhat useful in determining how likely the principal loan amount can be recovered in the event of default or foreclosure, the LTV ratio should be used in conjunction with other metrics and tools such as the Interest Cover Ratio (ICR), borrowers credit score, and property valuation report when analysing a potential loan. This is because the LTV ratio does not provide information on the borrower’s income or creditworthiness, nor the property’s rent or saleability, all of which are important considerations when assessing lending risk.

Read also: What is Loan-To-Cost (LTC) Ratio?

Read Also: What is Debt-to-Equity (D/E) Ratio and What is it Used for?

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.