What is Debt-to-Equity (D/E) Ratio and What is it Used For?

In this article, we explain what is debt-to-equity ratio, or D/E ratio, how it is calculated and what it is used for. We also delve deeper into what is a good D/E ratio, a D/E swap and limitations of the D/E ratio.

The debt-to-equity ratio, or D/E ratio, represents a company’s financial leverage and measures how much a company is leveraged through debt, relative to its shareholders’ equity. The D/E ratio is a metric commonly used to measure the extent to which a company is leveraged through external versus internal financing.

The D/E ratio is a type of gearing ratio, comprising a group of financial ratios, which compares a company’s equity to its borrowed funds or liabilities. The D/E ratio is also known as the company’s gearing or leverage.

Read also: Understanding IRR, Cash Yield, and Equity Multiple

How do you calculate debt-to-equity (D/E) ratio?

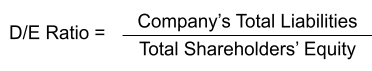

The D/E ratio is obtained by dividing the sum of the company’s debt by its total shareholders’ equity. The definition of debt may include other liabilities such as accounts payable, as these are amounts owed to other parties, similar to debt. The formula is as follows:

For example, a company has USD2 million in assets and USD1 million in debt. To obtain the company’s equity figure, USD1 million is subtracted from the USD2 million in assets, as this figure includes assets funded by both debt and equity. This gives an equity figure of USD1 million and a D/E ratio of 1.0, which is derived by dividing the total debt of USD1 million by the equity figure of USD1 million.

Read also: What is Loan-To-Cost (LTC) Ratio?

What is debt-to-equity (D/E) ratio used for?

The D/E ratio is typically used in corporate finance to estimate the extent to which a company is taking on debt to leverage its assets.

However, the D/E ratio may sometimes be applied to personal finance, where it is known as personal debt-to-equity ratio. The personal D/E ratio is calculated by dividing an individual’s total personal liabilities by his personal equity. The personal equity figure is obtained by subtracting liabilities from total personal assets. Similar to the D/E ratio for companies, the personal D/E ratio can also assess personal financial risk through existing leverage.

Read also: Understanding Investment Properties

What is a good debt-to-equity (D/E) ratio?

While the definition of a good D/E ratio varies by industry, geography, company size and other factors, in general, a D/E ratio of between 0 and 1.0 is considered healthy whilst a D/E ratio of above 2.0 is deemed high.

For example, the banking industry typically tends to operate with a higher proportion of debt relative to equity. Therefore, a D/E ratio of more than 1.0 is common, indicating that the company’s total liabilities exceed its total shareholder equity. However, this may not necessarily mean that the company is struggling to meet its financial obligations.

In the technology industry, whose operations are typically not capital-intensive, the normal range for a D/E ratio is lower, averaging around 0.5. This means that the company’s total liabilities amounts to half of its total shareholder equity. In such an industry where a low D/E ratio is the norm, the benchmark for what is considered a high D/E ratio is correspondingly lower.

A debt-to-equity ratio may also be negative if a company has negative shareholder equity, where its liabilities are more than its assets. Thus a company with a high D/E ratio is perceived as risky, as it could be an early indicator that the company is approaching a potential bankruptcy.

Read Also: How Does Internal Rate of Return (IRR) Impact Real Estate Investors' Decision-Making Process?

Long-term debt-to-equity (D/E) ratio

The long-term D/E ratio measures the proportion of a company’s long-term debt relative to its shareholders’ equity. Long-term debt is commonly defined as debt that is due to be repaid after 12 months or more.

The long-term D/E ratio is not as commonly used as the D/E ratio, as it does not provide a comprehensive view of all the liabilities a company is due to pay. It tends to be used in conjunction with the D/E ratio to obtain a view on how much a company’s liabilities are long-term, as opposed to such liabilities being due within a year.

Debt to equity swap

In a debt to equity swap, a company’s debt is offset in exchange for equity in the company. This allows the company to write off debts owed to lenders and is typically carried out in the event of a company’s imminent bankruptcy, or if it is unable to meet its debt repayments.

The net result of a debt to equity swap is a lower D/E ratio since the total amount of liabilities outstanding has decreased, with a corresponding increase in the amount of shareholder’s equity.

Limitations to the debt-to-equity (D/E) ratio

Firstly, the D/E ratio cannot be used as a benchmark across all industries and companies, as the level at which the D/E ratio could be perceived as low or high varies across industries, geographies and also dependent on other factors.

Secondly, the term debt is often loosely used. Thus, analysts might be subjective in their interpretation and judgment, resulting in possible variations on how they classify different assets as either debt or equity. Preferred stock for example may be categorised by some as equity, while a preferred dividend may be perceived by others as debt, due to its value and limited liquidation rights. Such varying treatments and computation of D/E ratios can significantly impact companies such as real estate investment trusts (REITs), which tend to hold more preferred stocks with a higher amount of debt used as leverage, as part of their business model.

Companies can also influence their D/E ratio by controlling what is classified as debt or equity in their financial statements. This affects the credibility of the D/E ratio as a measure of a company’s financial leverage. Thus, investors should always use the D/E ratio in conjunction with other metrics and analysis to derive a holistic view of a company’s financial health and performance.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.