What is Dividend Yield?

In this article, we explain what dividend yield is, how to calculate it, as well as its significance in real estate investments.

Dividend yield is a measure used to calculate the amount a company pays out in dividends in a given year relative to the price of its stock.

Since the calculation of the dividend yield involves both the amount paid out in dividends per year, as well as the share price, a drop in the share price may increase the yield, while a rise in the share price would decrease the yield. As a result, investors should consider other factors besides the dividend yield when evaluating a company, as a stock that has recently fallen in value may have an unusually high dividend yield.

What is Dividend Yield in Real Estate?

Dividend yield in real estate is similarly a measure of the amount a real estate company pays out in dividends relative to the price of its stock.

Investors looking to invest in real estate can buy shares of real estate companies that hold many different classes of income-generating properties such as, student accommodations, offices, retail malls and multifamily properties. The stable and recurrent rental income stream generated from these properties are paid out to shareholders as dividends after deducting for property expenses and taxes. Hence, real estate stocks are an attractive option for investors looking for a consistent source of income.

Read also: Understanding Investment Properties

How to Calculate Dividend Yield?

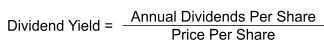

To calculate dividend yield, we divide the annual dividends per share by the price per share. The dividend yield ratio is expressed as a percentage.

The dividend yield may be manually calculated by retrieving dividend amounts from the company’s last annual report or website, or from various online sources which calculate the yields. Some dividends are paid out on a quarterly or half-yearly basis, so investors should ensure that they include the entire year’s dividend payments when calculating the dividend yield.

How to Calculate a REIT’s Dividend Yield?

A real estate investment trust (REIT) is a company that pays investors dividends generated through the rental income of the properties that it owns, operates and manages.

The process of calculating a REIT’s dividend yield is similar to any other company. The REIT’s annual distributions per share is divided by the current share price of the REIT.

Why are REITs Dividend Yields Higher than Other Companies?

REITs tend to distribute a large share of their profits in dividends and offer above-average dividend yields, and are mandated to do so in certain countries in order to be classified as a REIT. Hence their dividend yields might be disproportionately high as compared to other companies.

The link below provides a daily update of the dividend yield of all the Singapore REITs: https://sreit.fifthperson.com/

Read also: Seeking Distressed Assets – A Playbook during Tumultuous Times

Dividend Yield vs Dividend Rate vs Dividend Payout Ratio

A company’s dividend rate refers to the absolute monetary amount an investor receives as dividend for each share held in a given financial year. A dividend yield uses the dividend rate in its calculation and also factors in the share price and is expressed as a percentage rather than an absolute amount.

The dividend payout ratio calculates the total annual dividend payout as a proportion of the company’s net income generated in a given year.

The dividend payout ratio of a company depends on a number of factors. They include:

- The company’s dividend policy. Some companies choose to pay out a higher percentage of their income to attract investors who are seeking regular income. Conversely, some may choose to retain more of their profits to help finance the company’s business expansion and boost future profits.

- The nature of the industry the company is in. Some industries like banks have higher payout rates as it is a mature business generating stable cash flows while new technology companies may choose to retain most of their profits to finance growth opportunities.

- The financial performance of a company. A company with profits that grows steadily year after year will most probably have a higher distribution payout rate than a company where profits are volatile and/or stagnant over time.

Is it Better to Have a High or Low Dividend Yield?

In general, investors seeking higher-yield investments may lean towards companies with high dividend yields. However, it is important to consider other factors that may affect an investor’s returns. The choice between a high or low dividend yield depends on investors’ risk/reward spectrum appetite. Higher dividend yield stocks provide more income, but the higher yield often comes with greater risk. Lower-yielding dividend stocks may generate less income, but they are commonly offered by more stable companies with a record of consistent growth and steady payments.

It would be prudent to go through the financial and dividend history of the company and assess whether dividends have increased, decreased, or maintained over time. Investors should be forward-looking as well and analyse whether the company has the income generation potential, or sufficient cash reserves, to continue these dividend payouts in the future.

Read also: Top 8 Sources of Real Estate Investment Risk

It is also worth noting that if a company is consistently distributing a large amount of dividends, it implies that the money is not being reinvested into the company’s growth. While this might not have a major impact on companies that have huge cash reserves, investors should be wary if companies are distributing large dividends despite lacklustre business performance, or if they do not have sufficient cash reserves and are taking on additional debt just to fund or maintain high dividend payouts.

Read also: Diversifying Real Estate Investing

Why is Dividend Yield Important?

Some investors, especially retirees, may rely on dividend payments from the shares they hold as a primary source of income. For such investors, the dividend yield is essential to their financial well-being. For a company’s shareholders, the dividend yield is an important barometer of how a company is doing financially, and a company’s dividend policy also gives an indication of management’s stance on utilising cash reserves.

In some countries, Institutional investors also value dividends because prevailing tax laws reduce or eliminate the double taxation on dividends whereas capital gains made from share investment are taxed.

Even for accredited investors, positioning their portfolios to focus on growing dividends can also deliver strong long term returns regardless of the market cycle, especially as dividends have accounted for a significant portion of historical total stock market returns.

RealVantage is a real estate co-investment platform connecting investors with carefully selected properties located in different countries. Each property is chosen based on its potential for risk-adjusted returns and vetted by professionals with decades of experience in the real estate industry. RealVantage allows investors to own various types of real estate assets, including steady income-generating assets, in countries around the world.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.