Key Considerations in Multifamily Real Estate Investment

Multifamily property investment is a great way for first-time real estate investors to dip their toes into the rental property market.

Multifamily property is a popular form of investment for real estate investors, and rental demand for such assets continues to be strong. This has resulted in strong rentals and occupancy rates, outperforming other property sectors. . This is especially notable in mature and well-established multifamily markets, such as the U.S. and Japan, where demand in the multifamily market has increased and is expected to continue growing.

Multifamily properties are an asset class that many people are familiar with, especially those who have previously rented out an accommodation or purchased a home. Similar to any residential property, a multifamily unit also comes with a functional kitchen, bathrooms and a mixture of living spaces and bedrooms.

To many experienced investors, multifamily real estate is the most basic type of commercial real estate. It is much less complicated and less tedious to invest in, compared to other commercial properties, such as office buildings and hotels. A multifamily property investment is also a great way for first-time real estate investors to dip their toes into the rental property market.

What is a multifamily property?

A multifamily property is commonly known as a multi-dwelling unit, or MDU. It is a residential building with multiple separate housing units or several buildings in one complex. Multifamily real estate accommodates multiple tenants; each having their own housing unit. Rental leases for this type of property typically run on a monthly or annual basis.

There are several different forms of multifamily property in the market; each having its own set of unique features and amenities. In the following parts of this article, we will discuss the different types of multifamily real estate:

- Duplexes: A duplex is a two-floor building with two separate housing units. The building will have one front door and a foyer in which both units will have to share. However, each unit will still have its own entrance.

- Triplexes and Fourplexes: Similar to a duplex, a triplex and fourplex are buildings with three or four separate housing units.

- Townhouses: Townhouses are quite common in the outskirts of the city. This type of house shares one or two walls with other units, while having their own private entrance. Typically, they are connected to one another in a row and are usually two or three storeys high.

- Semi-detached houses: A semi-detached house is like a townhouse but it shares a common wall with the house adjacent to it.

- Condominiums and Apartments: Condominiums and apartments are commonly found in the city area, where land prices are high. These types of housing have at least five separate units and amenities such as a swimming pool, gardens, playground, and parking spaces. A condominium is a building or complex of buildings containing several individually owned units, whereas an apartment building or complex is wholly owned by one owner.

Historical performance

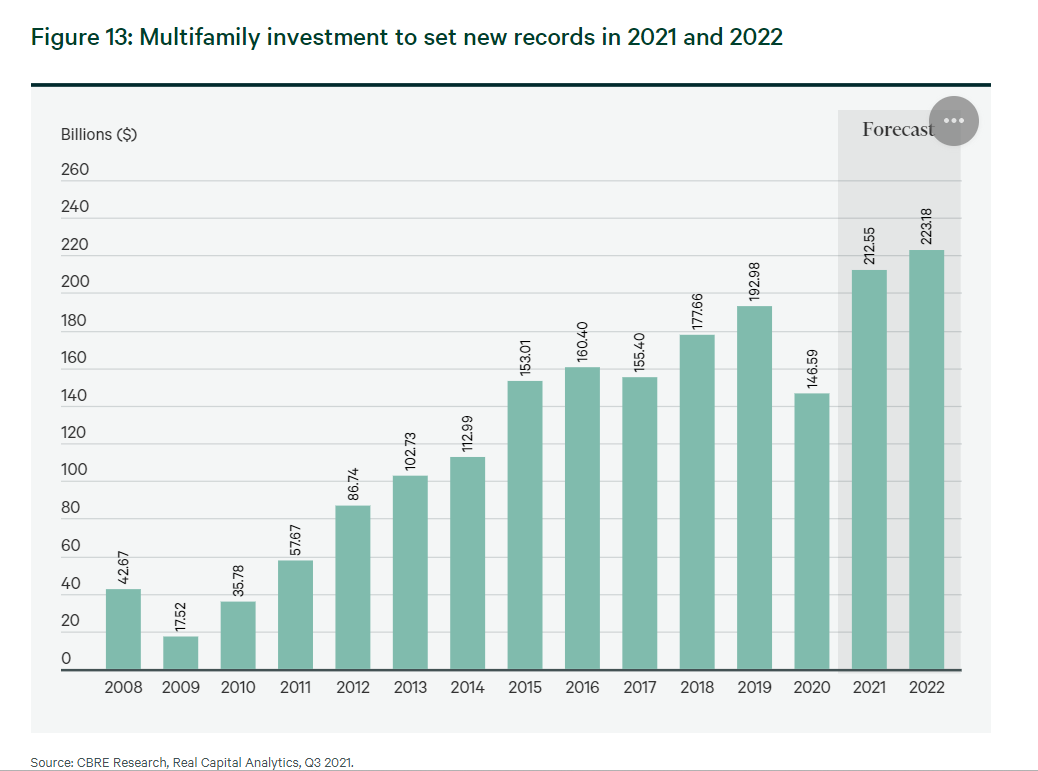

According to CBRE, a prominent real estate services firm, multifamily real estate was the first sector to recover from the 2008 recession and it has outperformed many other real estate asset classes since. A research study conducted by the firm has found that the investment demand for U.S. multifamily properties had grown exponentially from approximately USD 17.5 billion in 2009 to USD 193 billion in 2019. After a slowdown in 2019, investment demand is forecast to exceed USD200 billion annually in 2021 and 2022.

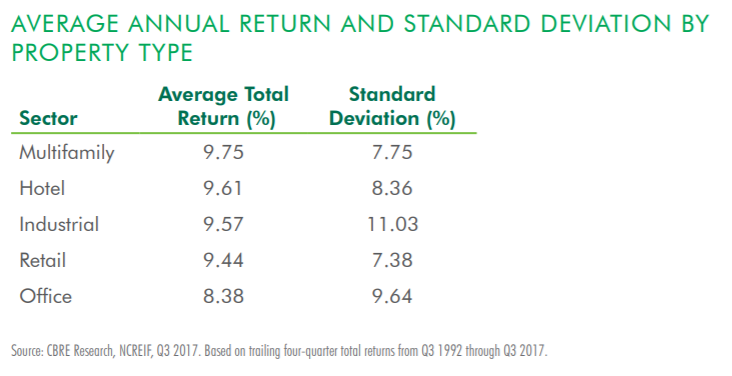

Multifamily investments have also proven to deliver stable and solid returns for investors. CBRE has pointed out that over the past 25 years, multifamily investment has had the highest average returns, compared to other commercial real estate asset classes. Furthermore, total returns in the multifamily sector are more stable compared with other sectors as can be seen from the sector having the lowest total return standard deviation.

Multifamily real estate is well-known for its low-risk characteristic and is considered a ‘defensive investment’ by many investors. This is due to the fact that the demand for housing is relatively inelastic. During economic downturns, there could be a loss of jobs, economic duress and strain, where people may be forced to sell their homes and occupy rental properties instead.

Further, there is always a need for a residential property for families to stay in and multifamily real estate makes a good renters’ choice. It is common for real estate investors who wish to add resilience and diversification to their portfolio to consider investing in multifamily real estate investment. Multifamily properties tend to be more resilient against economic cycles, since everyone needs a place to live, even when a declining economy may reduce occupier demand for other types of commercial space.

The higher average total return on investment of 9.75% and a comparatively lower standard deviation of 7.75% for multifamily real estate, as indicated above, is more evident that multifamily properties are a more attractive risk-adjusted return option.

Sign Up at RealVantageWhy invest in multifamily property?

Strong rental demand from the millennials

Median home prices have increased gradually since the global financial crisis of 2008. As a result, homeownership has become out of reach for many young adults. According to the U.S. Census Bureau, the national rate of homeownership is 64% in 2019, marking a decrease from 2012 to 2013 when the rate hovered at around 65%. Meanwhile, only 11% of younger millennials and 29% of older millennials in 2019 owned their homes; most prefer to rent or live with friends or family.

With unaffordable home prices, millennials are now opting to rent rather than to purchase homes. Furthermore, millennials also appreciate the flexibility to change residences anytime, as they place the advantages of geographic mobility over the benefits of owning a property.

Urban renaissance becomes a positive driver for multifamily property demand

Over the years, many cities in the U.S. have developed into bustling and picturesque metropolises. The lively urban atmosphere and convenient lifestyle have not only enticed young adults, but also the older generation, especially the baby boomers (aged 52 to 70).

Research conducted by Inman, a leader in real estate information, has shown that the number of renter households aged 60 and above rose 43% in the past decade, with the prevailing housing choice for urban living in most U.S. cities being multifamily rental. The availability of for-sale multifamily units is rather limited. As downsizing from a larger house to a multifamily rental is an increasingly popular option for this older group of people, demand for these properties is expected to continue rising over the next decade.

Preferential mortgage market

Investors of multifamily properties enjoy a preferential mortgage market rate and can enjoy higher leverage compared to other forms of property investment. . In fact, mortgage loans for commercial multifamily properties are typically priced at lower interest rates and have better loan terms, compared to other types of commercial real estate investments. According to a study from Real Capital Analytics, the typical mortgage rate for multifamily property is 4.25%, while that of the overall commercial real estate sector is at 4.5%. In addition, multifamily properties also have higher loan-to-value ratios (67% on average) than other commercial real estate sectors (which averaged at 59%). This is reflective of the sector’s relatively lower risk profile,

Tax incentives

Multifamily investments also enjoy favourable tax treatment at the entity level. When a multifamily property is acquired, the owner can take advantage of capital expenditure depreciation afforded to commercial property to lower his income tax bill.

A multifamily asset can be depreciated over a 27.5-year period, as opposed to 39 years for other types of commercial real estate property. This means that investors are able to receive the benefit of accelerated depreciation from direct investment in multifamily projects. In addition, the interest expense for commercial mortgage loans is also tax-deductible.

Short-term lease allows for immediate adaptation to market conditions

The majority of multifamily properties run on monthly or annual rental leases, whereas other types of real estate, such as office and retail properties, run on leases of 5 years or more. This gives multifamily assets a huge advantage because it permits its owner to adjust rent based on market conditions. These short-term leases offer multifamily property investors the flexibility to quickly increase rent when market demand rises to capture higher rental returns. However, this has its downside in tough economic times, as shorter lease tenures also result in a quicker decline in rental prices.

Multifamily properties require intensive management efforts

At the end of the day, multifamily properties are large real estate assets that house multiple groups of tenants. This means that owners will be dealing with many individual leases and tenants simultaneously.

Clearly, every unit in the property is going to induce more management responsibilities to the landlord. Every single tenant will also have different repair and maintenance needs, different ways to pay their bills, and will request different furniture and hardware, so on and so forth. These make it difficult for investors of multifamily properties to oversee their assets.

Costly to invest

One of the negative sides of investing in a multifamily property is that it requires a considerably large amount of capital outlay. In fact, this is one of the largest barriers to entry for most investors. Banks often require a downpayment of at least 20% on such investments, which can become costly given that the price of multifamily properties in more expensive cities may exceed a million dollars.

Besides the heavy initial investment, there are also fees related to renovation, property insurance, legal taxes, repairs, and maintenance works, among others. So, investors must take note of all the upfront fees associated with acquiring a multifamily asset as it can amount to a considerable sum of money.

Fierce competition in the market

Given the benefits of this real estate option, multifamily property deals are highly competitive. This fierce competition in the multifamily property sector means that, like most other sectors, first-time buyers who wish to invest in a multifamily property will find themselves having a hard time locating the ‘ideal’ deals. On the other hand, experienced investors are often able to pay cash, as they are experts in negotiating terms that are more attractive to sellers.

In conclusion

In all, any type of real estate investment carries its own set of benefits and risks.

Multifamily properties can be immensely profitable and they can offer investors consistent streams of passive income. The financial security and tax advantages that come along with investing in such assets are irresistible. However, they require a large outlay and can be hard to manage.

It is also important for investors of these properties to be aware of how to mitigate their investment risks. RealVantage is a co-investment platform that allows investors to co-invest in multifamily properties alongside other investors, at a lower initial investment sum, reducing the capital risk of investors.

Additionally, the co-investment platform is run by experienced industry experts who have access to multiple potential multifamily property deals in the U.S. Investors are able to leverage the experts’ in-depth knowledge of the industry to make well-informed investment decisions.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.