The Real Estate Cycle (And How To Find The Next Investment)

In this article, we explain the different phases of the real estate cycle and the strategies investors adopt during specific periods of the cycle.

Article was updated on 24th March 2023.

Real estate is an industry that is intertwined with the general economy, and it is a dynamic sector in which trends are constantly changing. Global occurrences such as the COVID-19 pandemic, Brexit, rising global inflation and interest rates and the U.S.-China trade war are some of the recent major trends that have impacted the real estate market.

Read also: RealVantage's COVID-19 Viewpoints and Strategies

Understanding the real estate cycle can help investors project the income and capital appreciation of a property and advise investors on the right time to make capital improvements or divestments. Investors may also apply theories of the real estate cycle to identify the correct phase at which the real estate cycle is, and adopt the appropriate investment strategy to maximise returns.

In the following parts of this article, we will explain the different phases of the real estate cycle, and the strategies investors typically adopt in specific periods of the cycle. We will also elaborate on some of the economic factors that affect the real estate cycle, and pinpoint the phase of the real estate cycle we are currently in.

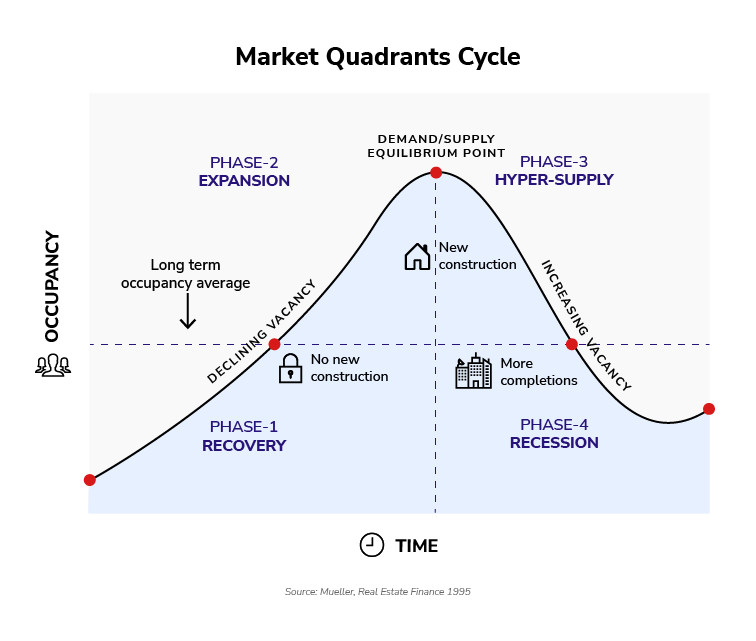

The four phases of the real estate cycle

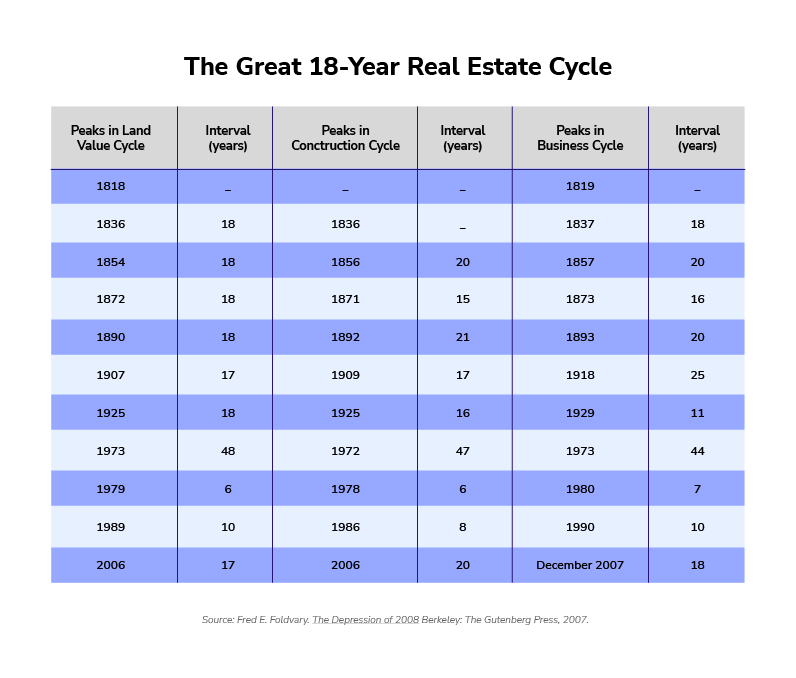

Back in 1933, Homer Hoyt, an American economist who specialises in land economics, discovered that the real estate business cycle has an average duration of 18 years. However, many modern researchers claim that real estate cycles are too unpredictable to establish an accurate time period, as there are too many variables that can affect the time horizon of the cycle. Nonetheless, a typical real estate cycle consists of four different phases, namely: recovery; expansion; hyper-supply; and recession.

Phase 1: Recovery

The recovery phase is the first stage of the real estate cycle after a recession. Low occupancy rates, tepid demand for housing, declining numbers of development projects, and stagnant rental growth are some common indicators in this phase. The recovery phase can be tricky and difficult to identify, as most people still feel the impact of the previous phase (that is, recession), and hence have a pessimistic outlook.

However, many sophisticated investors consider this phase to be the prime time to purchase properties.

Strategies to adopt in this phase

Even though the economy may be recovering from a recession, many property owners are still experiencing financial hardship and hence may sell their real estate assets at a bargain. When this happens, investors may acquire these bargain-priced properties from distressed sellers and hold onto them in anticipation of capital appreciation, once the recovery phase ends and the expansionary phase kicks in.

Read also: Seeking Distressed Assets – A Playbook during Tumultuous Times

In addition, investors may also invest in properties that require improvements by adopting a value-add strategy. Both the distressed strategy and the value-add strategy can be risky, as rental demand in this phase tends to be weak. However, these strategies can potentially be very profitable, especially when market rents rise and accelerates once the economy shifts to the expansion phase. Timing the market and having sufficient liquidity are the keys to success in this phase.

Phase 2: Expansion

After the recovery phase, the real estate market will undergo an expansionary phase. In this phase, demand for properties and spaces will increase, occupancy rates will be on the rise, and rental prices will surge; job growth will be steady and there will be more new property developments. Investment activity will soar as people regain their confidence in the economy.

Investors who have invested in discounted properties during the recovery phase may reap their ‘harvest’ by selling their properties, as prices and rents will reach a peak in this phase, where demand and supply for real estate are in equilibrium.

Strategies to adopt in this phase

With economic sentiment rising but with the economy still not at full employment yet, interest rates will likely be at reasonable levels with financing conditions being accommodative. Many real estate developers and investors will be able to secure low-cost financing, and will choose to develop new properties or redevelop existing properties, as the strong leasing or buying momentum can help investors reach their desired returns. The expansion phase is also a good time to acquire value-add investment properties because the perceived risk is lower in this phase.

Phase 3: Hyper-supply

The hyper-supply phase starts when the supply of real estate in the market exceeds demand. New developments and redevelopments during the expansion phase have caused an oversupply in the market, and prices of real estate start to decline as supply overwhelms demand.

Although rental rates might remain high because of strong economic factors, vacancy rates will start to rise. The increase in the number of new developments will begin to slow down as market inventory is high. The hyper-supply phase typically lasts for a long time, and will occur before the economy enters the recession phase.

Strategies to adopt in this phase

In the hyper-supply phase, investors should put a great deal of thought on their financial position, as the economy begins to enter a recession. Investors who do not have sufficient cash to get through the recession should consider liquidating their holdings to avoid a decline in property value in the next phase. On the other hand, for investors who hold properties that have strong tenants and long-term leases, the best course of action during this phase would likely be to stay put and ride out the upcoming downturn.

Phase 4: Recession

The recession phase can be painful for property investors. In this phase, the supply of properties overshadows demand, and real estate prices fall dramatically. Most property owners will suffer from high vacancy rates and lower rents, and rental income will plummet.

The economic downtown will also cause unemployment rates to rise and tenants may demand rent concessions or reductions to stay. The number of new construction projects will plunge and investment activity will slump. The real estate cycle will ultimately reach the lowest point in this phase before any sign of recovery starts to emerge.

Strategies to adopt in this phase

Real estate investors should keep a lookout for signs of recovery in this phase, rather than to feel emotional about the state of the economy. Recessions provide opportunities for investors with liquidity to acquire properties at deep discounts. Bank-owned or foreclosed real estate are great targets that opportunistic investors can consider purchasing during the recession phase.

However, investors should keep in mind that this phase is regarded as a high-risk period, due to the lack of market liquidity and demand, and that investors will likely have to wait for an extensive and indeterminate period of time, before property prices hit a peak again.

Read also: The Real Estate Risk/Reward Spectrum & Investment Strategies

Sign Up at RealVantageReal estate cycles have been tracked from as far back as the 1800s, with research showing that the U.S. real estate market typically follows a similar pattern over 18-year cycles, and this has proven to be true over the last 200 years.

However, the above sample size is small, from a statistical perspective. Applying the theory of real estate cycles to the actual real estate market is a lot harder, hence trying to time the market is extremely difficult. Ultimately, it is less about timing the market perfectly, but more about being as well-informed as possible.

How does the economy affect the real estate cycle?

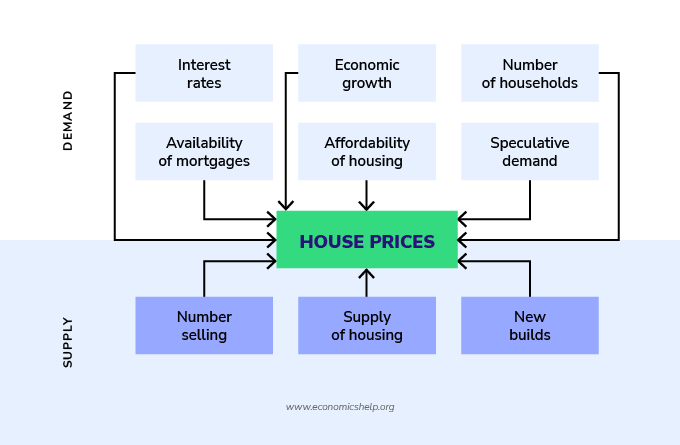

The real estate sector is, to a large extent, influenced by the state of the economy, and GDP growth, unemployment rate, interest rate, and consumer confidence, are some of the economic factors that greatly affect the real estate industry.

State of the economy

One factor that drives demand for real estate is the income of the general public. When the economy is booming, home prices will rise in accordance with rising wages. People can afford to spend more money on housing, and this boosts the demand for properties. Conversely, in a recession, falling wages mean that people will have less purchasing power. As a result, demand for housing weakens, causing real estate prices to tumble.

Unemployment

Unemployment will affect people’s ability to purchase real estate, as it decreases their ability to apply for mortgages and afford mortgage payments.

Interest rate

Interest rates play a major role in determining the demand for real estate. High-interest rates discourage buyers from buying as the higher financing cost reduces the returns from real estate investment. A low-interest rate environment, on the other hand, will attract more buyers and cause an uplift in investment activities in the housing market.

Consumer confidence

Consumer confidence is a measure of consumers’ optimism about the current and future state of the economy. It will affect expectations of property market performance and will directly impact risk appetite for real estate investment. When consumer confidence is low, consumers are worried about their future financial well-being and may be less likely to commit to buying real estate; conversely, when consumer confidence is high, the consumer is sanguine about their future financial well-being and is more likely to commit to buying real estate.

What stage of the real estate cycle are we in 2023?

The COVID-19 pandemic has led the global economy to go into the largest recession since the Great Depression. However, the discovery of vaccines to fight Covid-19, and large monetary and fiscal stimulus being injected into the economy means that the recession while steep was rather short-lived. Most developed economies have reached or exceeded their pre-pandemic levels of economic activity. The problems that global economies face now is not one of deficient demand but one of elevated levels of inflation and monetary tightening by central banks.

With policy rates continuing to rise globally to get inflation back to target and to keep inflation expectations anchored, the fear is that central bankers will raise rates to a level that will tip many economies into recession.

A recession will dampen demand for real estate space and investment. Rents will soften and capital values will be negatively affected as net property income falls and as higher cap rates and discount rates are being applied to real estate valuations.

While we wait and see if a recession does indeed materialise, landlords benefit during periods of high inflation as rents get pushed up during inflationary periods. In some commercial leasing contracts, there is a rent escalation clause that allows for annual rent adjustments to be at the higher of a prespecified rate or the level of consumer price inflation. Rent escalation clauses are very common in the Australian commercial real estate sector.

Currently, we are still at the expansion phase of the property cycle. Despite inflation being high, most developed economies are still registering positive growth and many have unemployment rates that are at their lowest levels in decades.

In the meantime, supply has become extremely tight due to work interruptions caused by safe distancing measures during Covid-19. Rentals of residential properties have risen sharply in response to the arrival of expatriates and foreign students as borders reopen.

So, is it a good time to invest in real estate in 2023?

Current property market condition makes it hard for individuals to invest in, residential real estate in Singapore. Not only have mortgage rates increased to over 4 percent, but the government has also increased the buyer stamp duty rates for residential properties valued at over $1.5 million. In addition, property tax for residential properties with annual values of over $30,000 are set to increase this year and next.

These developments along with the possibility of a global recession due to aggressive interest rate hikes by central banks all over the world has darken the prospects of the Singapore residential real estate sector. As such housing sales have slowed.

Understanding the Singapore property market cycle

The Singapore property market is unique in that Singapore is a land scarce country. Singapore’s increasing population continuously drives demand, while the supply of housing is constrained by the amount of land that is made available for housing. Singapore is also viewed as a safe haven for real estate investment by wealthy foreigners, and buyers are confident that prices will grow steadily in the long term. The Singapore government has put in place various policies to regulate the property market, such as stamp duties on the buying and selling of properties in Singapore to ensure that the market doesn’t overheat

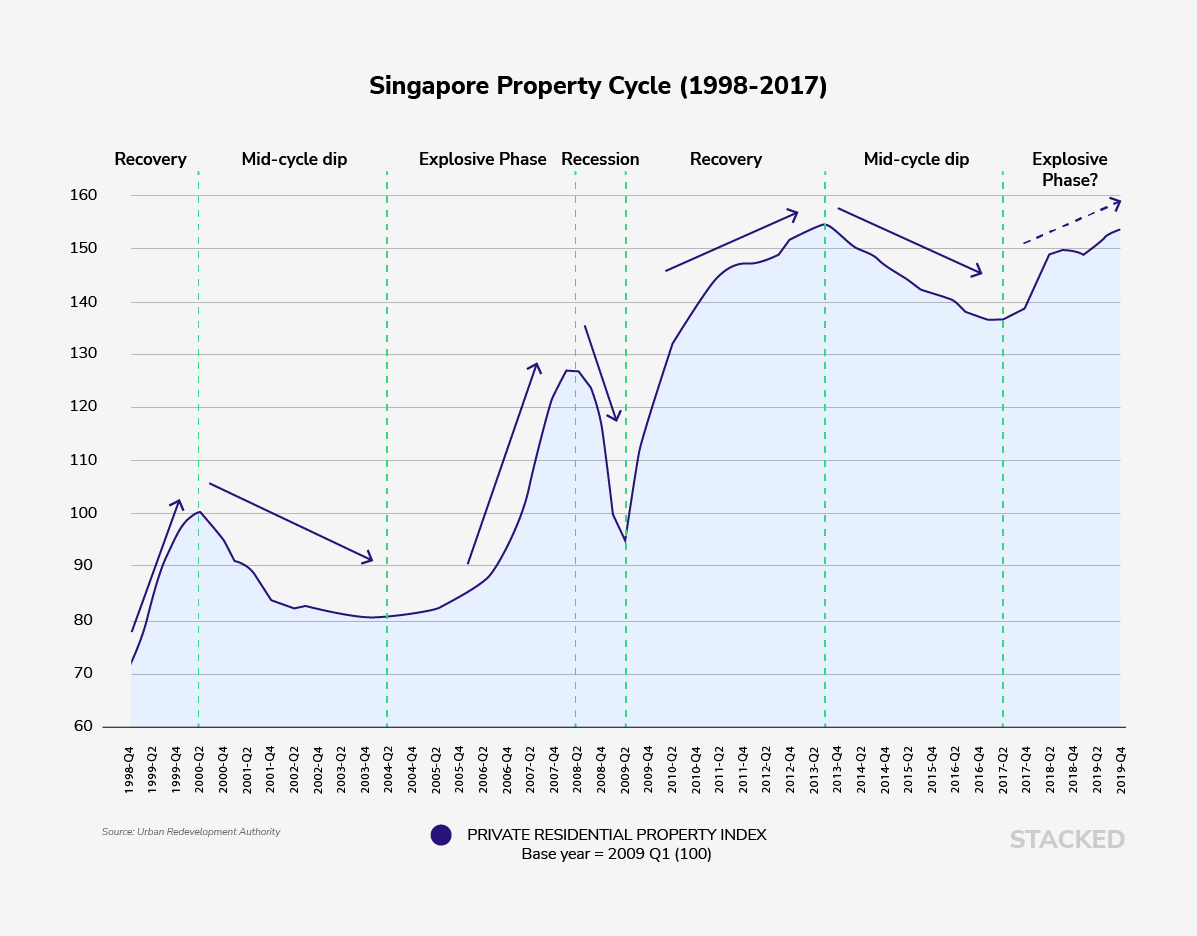

It can be seen from the graph above that the long-term trajectory for residential real estate capital values in Singapore is up. However, there are real estate cycles at play which means that the upward trajectory is a bumpy one.

In conclusion

Investors should have a view on the current state of the economy, and the current position and phase of the real estate cycle. Different phases of the cycle imply a different level of demand and supply for real estate, hence affecting prices and returns. By following the various investment strategies tailored to different phases, it is possible to invest successfully across the cycle.

At the moment, the outlook for the residential real estate sector in Singapore is a mixed bag. While the wages of Singaporeans are rising strongly and unemployment is low and the supply of housing is tight, darker clouds are emerging with elevated levels of inflation resulting in higher mortgage rates which will negatively impact housing affordability. A recession may be on the horizon should inflation stay stubbornly high and central bankers raise interest rates to extremely high levels to keep inflation in check. In addition, the government has raised taxes associated with the transaction and ownership of residential properties.

If you are uncomfortable with the outlook for the residential real estate sector in Singapore, you may look to invest your money in other sectors and in other countries. This is where RealVantage comes in. We offer retail investors the opportunity to invest across different real estate sectors and countries with varying degrees of risk to suit your appetite from as low as S$25,000. Sign up to learn about the real estate investment opportunities we offer.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.