Singapore Real Estate Stamp Duties Explained

In this article, we talk about what is stamp duty in Singapore, how to calculate them, explore in-depth BSD, SSD and ABSDs, as well as how it impacts various groups of buyers and sellers in Singapore.

Table of Contents

- What is Stamp Duty

- What is Buyer's Stamp Duty (BSD)?

- How to Calculate Buyer's Stamp Duty?

a. Example of a Pure Residential BSD

b. Example of a Part Residential and Commercial BSD - What is Additional Buyer's Stamp Duty (ABSD)?

- Additional Information on SSD

a. What is Seller’s Stamp Duty (SSD)? - Calculating ABSD and SSD

- Why Cooling Measures (SSD and ABSD) were Introduced

- History of Cooling Measures

- How will ABSD Affect Singaporeans?

a. Changes in ABSD Rates Based on Residency Status

b. Terms of Loan for Different Property Types - How will Stamp Duties Affect Foreigners or Permanent Residents?

- The Stamp Duty Loophole

- When is Stamp Duty Payable in Singapore/When to Pay Buyer Stamp Duty

- How and Where to Pay Stamp Duty Singapore

- Alternative Real Estate Investment

a. REITs

b. Overseas Properties

c. Co-Investing

What is Stamp Duty

With the Asian real estate market booming, governments at times may need to employ measures to exert control over the market to stabilise property prices so as to improve affordability. This article discusses the Singapore Government’s cooling measures on the real estate market and how it impacts various groups of buyers and sellers in Singapore. A cooling measure to regulate property market prices in Singapore would be to impose additional stamp duties.

Stamp duty is a tax on dutiable documents for immovable properties, stocks and shares in Singapore. These documents include lease or tenancy agreements for properties, transfer documents for properties and mortgages for properties. There are three different types of stamp duties in Singapore:

- Buyer's Stamp Duty (BSD)

- Additional Buyer's Stamp Duty (ABSD)

- Seller's Stamp Duty (SSD)

What is Buyer's Stamp Duty (BSD)?

Before we talk about ABSD, we have to know what buyer stamp duty (BSD) is.

Buyers have to pay buyer's stamp duty when transferring ownership of or purchasing a property in Singapore. The BSD is calculated based on the market value of the property or the documented purchase price, whichever is higher.

Sometimes, benefits are associated with the transaction and noted in the paperwork, to be given to the purchaser when the deal is completed. When these benefits come in the form of cash discounts such as cash or cheques, its value may be deducted from the purchase price when calculating the BSD.

In the case of non-cash benefits such as rental guarantees or furniture vouchers, their value cannot be deducted from the purchase price when calculating the buyers stamp duty. The benefit also has to be noted in the document to be stamped in order for it to be considered for deduction from the BSD.

Only the first document executed for a property purchase is liable for ad valorem stamp duty, while other documents relating to the same transaction are only liable for nominal duty.

How to Calculate Buyer's Stamp Duty?

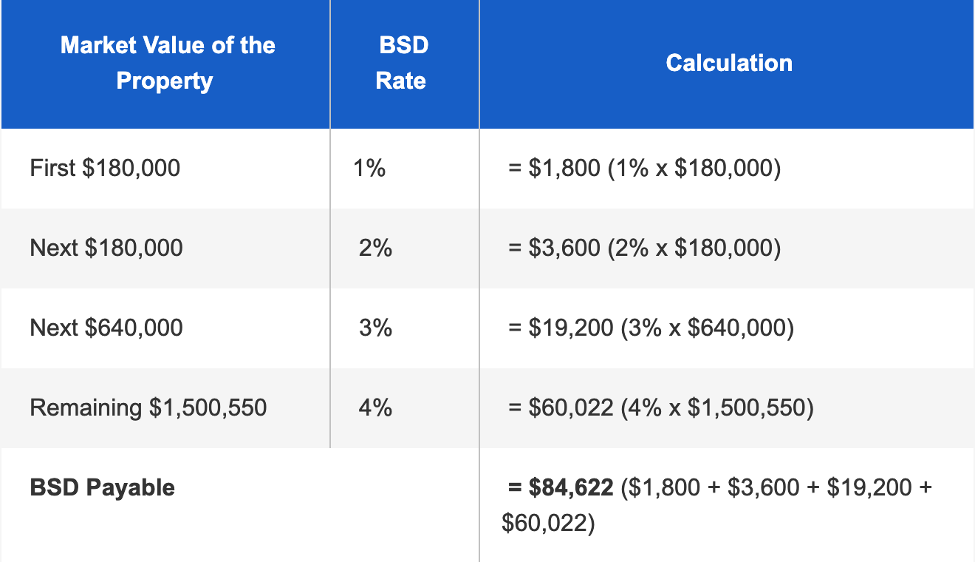

Example of a Pure Residential BSD

This example shows the BSD on a condominium unit purchased for $2,500,550 on 30th March 2018.

A 1% BSD rate is applied to the first S$180,000, amounting to a S$1,800 stamp duty. A 2% BSD rate is applied to the next S$180,000, which is S$3,600. A 3% BSD rate is applied to the next S$640,000, which is a S$19,200 fee. Finally, a 4% BSD rate is imposed on the remaining S$1,500,550, which is S$60,022. This adds up to a total BSD of S$84,622.

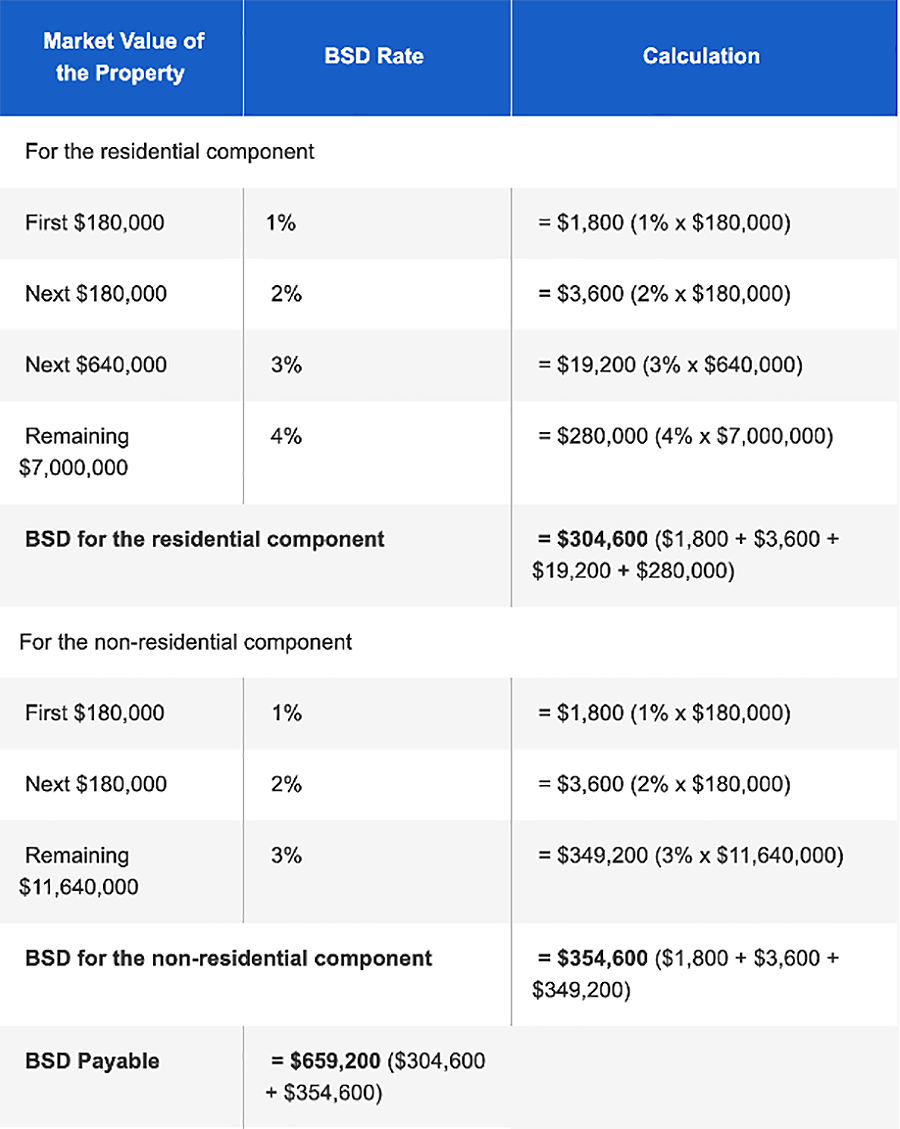

Example of a Part Residential and Commercial BSD

This example shows the BSD on a vacant land zoned as “Commercial and Residential” purchased for $20,000,000 on 1st March 2018, assuming that the residential component is valued at $8,000,000, while the commercial component is valued at $12,000,000.

The same calculation as above is used for the residential component, with a 1% BSD rate for the first $180,000, 2% BSD for the next $180,000, 3% BSD for the next $640,000 and finally a 4% BSD for the remaining $7,000,000. This amounts to a total of $304,600 in BSD for the $8,000,000 residential component of the property.

Moving on, the BSD is calculated separately for the commercial component of the property. A 1% BSD is charged for the $180,000, which is $1,800, a 2% BSD is charged for the next $180,000, amounting to $3,600, while 3% is being charged to $11,640,000, which amounts to $349,200. This is a total of $354,600 in BSD for the non-residential component of the property.

In total, for a $20,000,000 residential and commercially zoned land, with the residential component valued at $8,000,000 and commercial component valued at $12,000,000, the total BSD payable is $659,200.

Read also: Guide to Investments in Singapore

Sign Up at RealVantageWhat is Additional Buyer’s Stamp Duty (ABSD)?

Additional buyer’s stamp duty (ABSD) is applicable when purchasing residential properties, and the rate varies based on the buyer. The ABSD is affected by a number of different characteristics, including whether the buyer is an entity or an individual, the buyer’s residency status, and the number of properties already owned. When acquisitions are made jointly between parties falling in different buyer categories, the higher ABSD rate is applied for the property.

Additional buyer stamp duty is a tax that is levied on top of Buyer's stamp duty (a tax that property buyers have to pay when they buy a property), and only applies to the following:

- For Singaporeans, ABSD will be levied on the second property purchased, and all subsequent property purchases.

- For Permanent Residents, ABSD will be levied on all purchases, with the first purchase at a lower rate.

- For entities, ABSD will be levied on all purchases at a similar rate, including the first purchase.

If you’re a Singaporean citizen, additional buyer's stamp duty applies to you only when you buy more than one property. Also, note that an HDB flat will still count as your first property under the ABSD framework.

Additional Information on SSD

What is Seller’s Stamp Duty (SSD)?

SSD is a duty payable for all residential property or residentially zoned land purchased after the introduction of the SSD on 20th February 2010, and sold or transferred within the holding period. As of 11th March 2017, the holding period where SSD is imposed is 3 years, with a 12% SSD if sold in the first year, 8% in the second year and 4% in the third year, after which the SSD is no longer applicable.

The SSD was introduced to disincentivise house flipping, which may inflate property demand and prices, creating a housing bubble. The SSD also applies in other situations not involving a purchase, where ownership is transferred, such as a property transfer following a divorce in accordance with the Stamp Duties (Matrimonial Proceedings) Remission Rules, from an inheritance, or a HDB transfer within a family in accordance with the Stamp Duties (Transfer of HDB Flat Within Family) Remission Rule.

HDB flat owners selling their flats after the Minimum Occupation Period (MOP) of 5 years are also exempted from paying SSD.

Calculating ABSD and SSD

Stamp duties can be calculated using IRAS’ stamp duty calculator or other alternative calculators.

Why Cooling Measures (SSD and ABSD) were Introduced

ASBD was first introduced in December 2011 as a “cooling measure” to discourage foreigners and entities from purchasing residential properties, especially multiple properties. In other words, it was introduced to discourage demand for residential properties in order to make housing affordable for Singaporeans. The rates were increased further in January 2013, along with the introduction of new buyer profiles that would be liable for ABSD.

Then in July 2018, both the BSD and ABSD increased again, and additional cooling measures like the Total Debt Servicing Ratio (TDSR) and Seller’s Stamp Duty (SSD) saw the volume of property transactions drop rather significantly.

Firstly, the ABSD nudges property prices downwards by cooling down the high property demand. The ABSD is increased to slow the price increase, avoiding the formation of property price bubbles, which can negatively impact the Singapore economy.

Secondly, the higher ABSD imposed on foreign buyers and corporate entities serves to create an ownership bias, ensuring that most properties in Singapore are owned by Singaporeans.

Finally, a large surge in en-bloc purchases from foreign developers led to the en-bloc fever of 2017. These mass purchases artificially injected a large sum of cash into the Singapore property market, which could have resulted in inflated housing prices. As a response, the government increased the ABSD for property developers in order to halt these land purchases.

In the 18 months after the imposition of the curbs (July 2018 to December 2019), the total number of private housing units purchased by foreigners dropped 32% as compared to the 18 months prior to the cooling measures.

Sign Up at RealVantageHistory of Cooling Measures

However, this was not the first time cooling measures have been implemented to combat inflation in home prices. Property prices have experienced drastic increases in recent years, prompting the Monetary Authority of Singapore (MAS) to impose cooling measures to avoid the formation of a property bubble, whereby inflated property demand and limited supply drive up prices. This is an undesirable situation as it can take a long time to reduce the inflated prices, so the MAS implements cooling measures to reduce the demand for properties in Singapore, allowing property prices to stabilise or decrease over time. However, not all the cooling measures will apply for first-time home buyers, as some target those purchasing their second residential properties, land developers or corporate entities.

Here is a complete list of cooling measures implemented in Singapore and the people affected by them.

| Date | Cooling Measure | |

|---|---|---|

| 2009 | September |

|

| 2010 | February |

|

| August |

|

|

| 2011 | January |

|

| December |

|

|

| 2012 | October |

◦ 60% for buyers with no outstanding housing loans |

| 2013 | January |

‣ Mortgage Servicing Ratio (MSR) for housing loans capped at 30% of the borrower’s gross monthly income ‣ Cap on MSR lowered from 40% to 35% for loans from HDB ◦ HDB flat owners who are PRs not allowed to sublet their entire flat ◦ PRs who own a HDB flat must sell it within 6 months of purchasing a private residential property in Singapore capped at 160 square metres ◦ New dual-key EC units only to be sold to multi-generational families ◦ EC developers from GLS programmes only allowed to launch unit sales 15 months after site is awarded or after the foundation works are completed, whichever is earlier ◦ Private roof terraces and enclosed spaces counted as part of the Gross Floor Area and subject to charges sold within a 3 year holding period |

| June |

|

|

| August |

|

|

| December |

|

|

| 2017 | March |

◦ 8% for second year sales ◦ 4% for third year sales |

| 2018 | February |

|

| July |

|

How will ABSD Affect Singaporeans?

In response to forecasts of a housing bubble forming, the most recent cooling measures in July 2018 were implemented to counter this, with a 5% increase in ABSD for Singaporeans and PRs, and a 10% increase for corporate entities. A non-remittable ABSD of 5% was implemented for purchases of residential properties for development by property developers. In addition the LTV limit was also reduced by 5%, from 80% to 75%. While this might have had the intended effect of cooling property demands in the long run, it caused a surge in property purchases before the cut-off time, with record sales of over 1,000 units in 4 hours.

Read also: Six Critical Success Factors in Direct Property Investment

Changes in ABSD Rates Based on Residency Status

| Date | ABSD Rates on or Before 5 Jul 2018 |

ABSD Rates on or After 6 Jul 2018 |

|---|---|---|

| SC 1st Residential Property | 0% | 0% (no change) |

| SC 2nd Residential Property | 7% | 12% |

| SC 3rd Residential Property | 10% | 15% |

| SPR 1st Residential Property | 5% | 5% (no change) |

| SPR 2nd Residential Property | 10% | 15% |

| Foreigner | 15% | 20% |

Terms of Loan for Different Property Types

| Subject Property | HDB Flat | Private Properties |

Private Properties |

Private Properties |

|---|---|---|---|---|

| No. of Home Loan | No Outstanding Loan |

No Outstanding Loan |

1 Other Home Loan |

2 Other Home Loan |

| Max Tenure (Years) | 25 | 30 | 30 | 30 |

| Loan-to_value | 75% | 75% | 45% | 35% |

| Minimum Cash | 5% | 5% | 25% | 25% |

How will Stamp Duties Affect Foreigners or Permanent Residents?

Foreign buyers and Singapore PRs are charged steeper stamp duties through a higher rate of ABSD when purchasing property in Singapore. This ABSD is an additional 25% of the property’s purchase price and is payable within two weeks after closing a deal on the property.

Exceptions are made for US citizens, as well as citizens or PRs of Switzerland, Liechtenstein, Norway or Iceland. Buyers who meet this residency criteria are charged the same ABSD rates as Singaporeans.

Apart from the ABSD, all property owners are charged the same taxes and duties, including the BSD and standard property taxes, regardless of whether or not they are a Singaporean.

The Stamp Duty Loophole

Until 2017, there was a loophole in Singapore’s stamp duty system. Property purchased by Property Holding Entities (PHEs), where at least 50% of their assets are made up of residential properties in Singapore, was not subject to stamp duties. Individuals who wanted to purchase a property would purchase it through these PHEs, then purchase shares in the company to gain ownership of the property, without having to pay stamp duties.

This loophole has since been addressed through the Stamp Duties (Amendment) Bill, which introduced the Additional Conveyance Duty (ACD). This ACD applies for indirect property transactions, where shares sold in PHEs are subject to an ACD equivalent to the BSD and ABSD, on top of the existing share duty for purchasing shares.

When is Stamp Duty Payable in Singapore/ When to Pay Buyer Stamp Duty?

Stamp duty should be paid for a document before it is signed. However, no penalty will be issued if the stamp duty is paid off within 14 days of the document being signed in Singapore, or within 30 days of the document being received after being signed overseas.

Late payment for stamp duties will result in additional penalties amounting to the greater of S$10 or the amount equivalent to the duty payable for late payments of up to 3 months. For late payments exceeding 3 months, a penalty amounting to the greater of S$25 or four times the payable duty amount will be charged.

This amount can be significant, so it is important to pay the stamp duty well before the deadline to avoid these additional charges.

How and Where to Pay Stamp Duty Singapore?

In Singapore, the stamp duty can be settled online. Individuals may use eNETS to pay the stamp duty, or through a cheque if the amount exceeds their eNETS limit. Payment via eNETS requires an existing bank account with UOB, OCBC, DBS/POSB, Citibank or Standard Chartered Bank. Payments using NETS can be made through online banking services or through AXS kiosks or websites, provided that the amount does not exceed the limits of each service.

Alternatively, registered users may also pay through GIRO or cheque if the document allows it. Individuals may also proceed to a service bureau or the e-terminals at IRAS Surf Centre to pay their stamp duties.

Alternative Real Estate Investment

The ABSD adds a steep premium for potential buyers. It may therefore be justifiable for investors to look into alternative real estate investment options to gain exposure to real estate without the additional overheads discussed above.

REITs

Real estate investment trusts (REITs) are companies that finance, own and operate income-generating properties. Investors may invest capital in REITs and get returns through dividends paid out to shareholders. Investors in REITs are not liable for ABSD since they are not directly purchasing a property, but can still enjoy the returns of investing in real estate.

Read also: An Overview of Investing in REITs

Overseas Properties

Overseas properties can be a good addition to an investors' portfolio as it provides international diversification, reducing risk. Overseas properties also allow for higher returns, compared to the low yield of 2% to 3% for properties in Singapore. Investors may also invest in overseas properties without having to pay any ABSD, since it is only applicable for residential properties in Singapore.

Read also: Important Considerations when Buying Overseas Properties

Co-Investing

Co-investing is an alternative investment option allowing investors to invest in properties with a relatively small amount of capital. Co-investment platforms provide investors with different investment options which use carefully selected investment strategies to provide returns for investors. These platforms pool funds from a number of investors and purchase real estate assets, giving each co-investor partial ownership of the property. Investors get returns through revenue generated from these properties distributed at specific intervals and through capital gain when the property is sold at the end of the fixed investment period. These investments are also not subject to ABSD.

Read also: Real Estate Co-Investment – The New Alternative

RealVantage is a co-investment platform allowing investors to browse real estate investment opportunities and invest in the properties they want to invest in. All opportunities on RealVantage are selected and vetted by experts in the industry, ensuring that investors are given ideal options for their investments. RealVantage also has the responsibility of sourcing, vetting and managing these properties throughout the investment period, giving investors a hassle-free investment experience.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.