Quick Facts You Should Know about Stamp Duties

Most of us in Singapore would have heard of the term ‘stamp duty’. But do you know what they are, how they may affect you, and how the Singapore government uses the Additional Buyer’s Stamp Duty to prevent the property market from overheating? Read on to find out more.

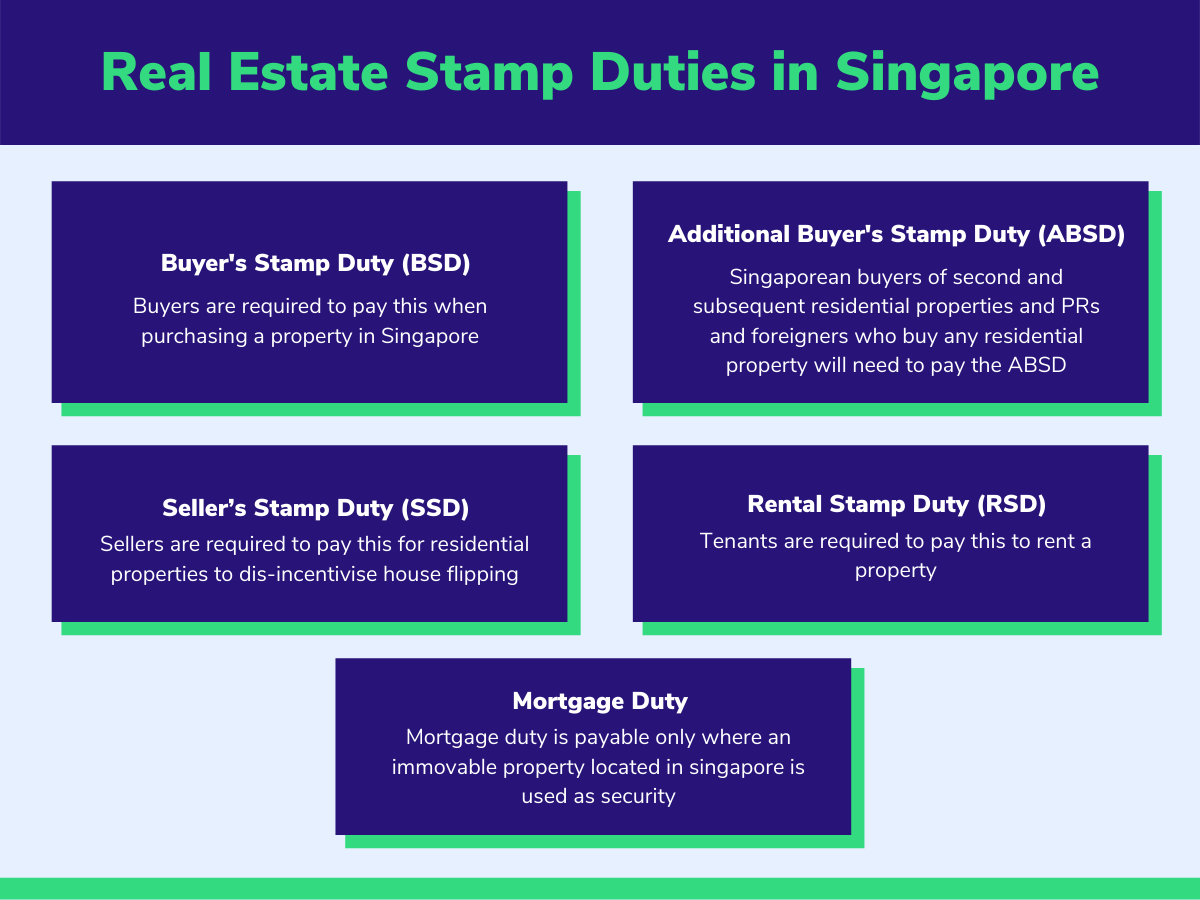

In the simplest terms, a stamp duty is a tax that the government imposes on documents relating to immovable properties or shares. And when it comes to real estate, these documents would include tenancy agreements, transfer documents, as well as mortgage documents.

As a real estate investor, it is essential that you understand the various types of real estate stamp duties in Singapore. Having good visibility of these costs associated with your properties will enable you to make well-calculated investment decisions and better plan your finances.

Who will be required to pay stamp duties?

In a real estate transaction, when a transfer of ownership or rental of a property occurs, the relevant contract will highlight the parties who are obligated to pay stamp duties. If the contract does not state this, stamp duties will have to be duly paid in accordance with the Third Schedule of the Stamp Duties Act.

In addition, stamp duties will also need to be paid in a mortgage transaction. In this case, a mortgage duty is payable on the mortgage document where the interest in immovable property or shares is transferred from the borrower to the lender as security for the repayment of a loan obtained under such an agreement.

Visit the Inland Revenue Authority of Singapore (IRAS) website to find out more about who should pay stamp duties and how to calculate stamp duties.

When are stamp duties payable?

Stamp duties must be paid within 14 days from the date of the contract, usually after the last person signs the document, if it is signed in Singapore. If the document is signed overseas, the relevant stamp duties must be paid within 30 days after the document is received in Singapore.

Be sure to pay stamp duties well in advance, as the penalty for late payment could be hefty. Late payment of stamp duties not exceeding three months will result in penalties amounting to SGD10 or an amount equal to the duty payable, whichever is greater. As for late payments exceeding three months, a penalty amounting to SGD25 or four times the duty payable, whichever is greater, will be levied.

The ABSD as a stamp duty used to rein in an over-buoyant property market

When there is a sustained increase in residential property prices relative to incomes, the government will typically step in to stabilise property prices and moderate investment demand. This is to ensure that residential properties remain affordable to the masses.

And one of the most effective ways Singapore uses to control an over-buoyant property market is the Additional Buyer’s Stamp Duty (ABSD) - a stamp duty that is levied on property buyers, on top of the Buyer’s Stamp Duty (BSD).

This was also the case for the latest round of government cooling measures that were rolled out in December 2021, which saw the upward adjustments of the ABSD.

The ABSD was first implemented in December 2011 to discourage entities, foreign individuals, and Singapore Permanent Residents from purchasing residential properties. It was also meant to deter Singaporean citizens who intend to buy more than one property from doing so. In particular, foreigner individuals buying a residential property in Singapore would be required to pay the highest rate of the tax.

This policy tool has proven to be successful in controlling fast-rising property prices, by weeding out speculative property demand. In fact, it has helped the Singapore property market avert potential housing bubbles, which could have negatively impacted the stability of the Singapore economy.

One such example would be the increase in the ABSD in 2018, as one of the cooling measures, to curb an overheating property market, specifically targeted at entities and foreign individuals.

In the 18 months after the curbs were implemented, from July 2018 to December 2019, the total number of private housing units purchased by foreigners fell by 32%, compared to the 18 months prior to this cooling measure.

Impact of ABSD on Foreigners and Permanent Residents

In general, a higher rate of the ABSD would apply to foreign individuals and Singapore Permanent Residents, when these individuals purchase a property in Singapore. The ABSD applicable to these buyers is an additional 25% of the property’s purchase price and it is payable within two weeks of closing a property deal.

However, U.S. citizens as well as citizens and permanent residents of Iceland, Liechtenstein, Norway and Switzerland, are the exceptions, and these buyers would pay the same stamp duties and ABSD rates as Singaporean citizens do.

The ABSD is, of course, only part of the entire equation. All property owners are also subject to other taxes and duties, including the BSD and standard property taxes, whether or not they are Singaporean citizens.

Choose the Smarter Way to Invest in Properties

The ABSD would add a steep premium to the price of real estate assets for most potential buyers. This makes it even less affordable than before to own a property.

But the good news is that investors looking to gain an investment exposure to real estate investments can also explore other investment vehicles, such as Real estate investment trusts or co-investments in overseas properties, including industrial and commercial properties.

One simple way to invest in overseas properties would be to do so through a co-investment platform. Through this, investors would be able to invest in and fractionally own physical properties together with other investors, with a relatively low capital outlay. They will also be able to gain investment exposure to different real estate asset types across various markets, and leverage different investment strategies and investment time horizons to attain their goals - all without the financial strain of the ABSD.

It is clear that co-investing in overseas properties is a smarter way to invest in real estate assets, and it comes with lower barriers to entry. So, take that first step now and start building your real estate investment portfolio today.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.