Guide to Investments in Singapore

This article provides an overview of some of the various investment options available for Singapore based investors, and highlight the risk and rewards of various investment instruments.

Table of Contents

- Overview of Investment Options in Singapore

- Singapore’s Financial Market Overview

- Types of Investment Instruments in Singapore

a. Real Estate Investment

b. Real Estate Investment Trusts (REITs)

c. Stocks

d. Bonds

e. Savings Plan/CPF

f. Crypto

g. Crowdfunding

h. Co-Investments - In Conclusion

Overview of Investment Options in Singapore

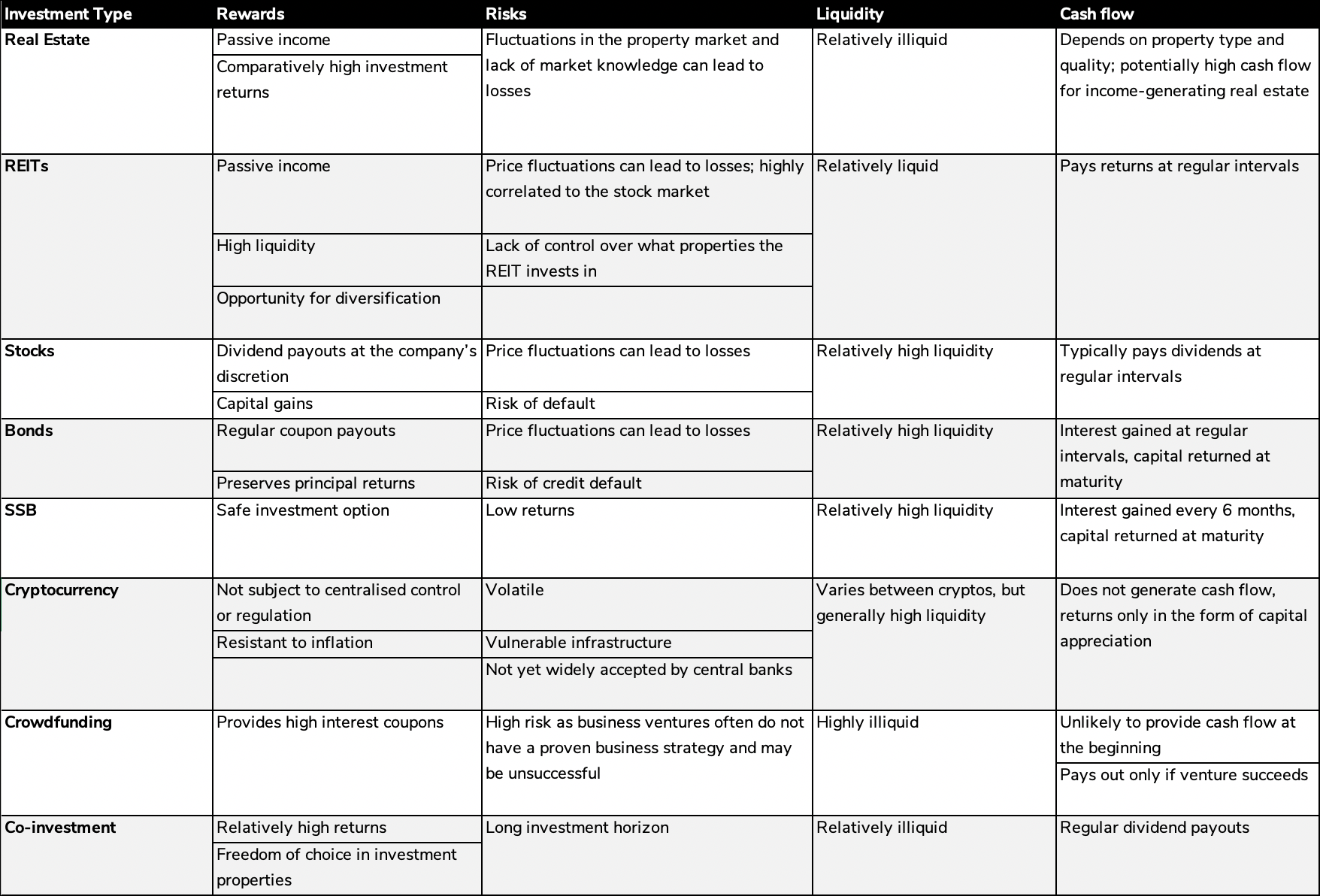

There are a myriad of financial products available for an investor to invest in, each having their own characteristics and risk-returns profiles. This article seeks to provide more information for each different type of investment product summarised in a table below.

Singapore’s Financial Market Overview

Financial markets are places where people and companies come to buy and sell assets like stocks, commodities and other products. Singapore’s Financial Market is made up of primary and secondary markets.

New financial assets are sold on the primary market, which refers to the market where assets are first floated. Examples of a primary market include Initial Public Offering (IPO), where the shares of a private company are publicly sold for the first time, and tenders for government bonds are also sold in the primary market. After securities are created in the primary market, they can later be traded between investors in secondary markets.

The secondary market, for example the stock market exchange, allows investors to trade stocks and other securities among themselves. The stocks’ companies are not directly involved in trade activities in the stock market.

An example of a stock exchange in Singapore is the Singapore Exchange (SGX). The SGX contains securities from different asset classes, such as Real Estate Investment Trusts (REITs), Exchange Traded Funds (ETFs) and shares, which are traded throughout the trading hours. SGX is open for full-day trading on most days, and closes or follows half-day trading hours on various Singapore public holidays.

Auction markets or dealer markets can also be categorised as secondary markets. Auction markets, such as the New York Stock Exchange (NYSE), allow all buyers and sellers to list their bid and ask prices, with prices regulated by the natural demand from buyers and sellers.

In a dealer market, such as the Nasdaq, dealers set firm bid and ask prices for the securities they want to trade, with the difference between the buying and selling prices as their profit margin.

Read also: Understanding IRR, Cash Yield, and Equity Multiple

Read also: What is Cap Rate?

Types of Investment Instruments in Singapore

Investment instruments are used to increase an investor’s exposure to each investment asset class. These investment instruments vary in risk levels and asset types, including lower-risk investments such as bonds or higher-risk investments such as stocks.

This section explains the characteristics of a number of such investment instruments, including real estate, real estate investment trusts (REITs), stocks, bonds, Singapore Savings Bonds (SSB), exchange-traded funds (ETFs), savings plans, as well as other alternative investments.

1) Real Estate Investment

Real estate investments are gaining popularity as an investment asset class. Direct real estate investment may be in the form of rental properties, where an investment property is rented out to tenants, generating rental income as profits.

Another method is by strategically purchasing properties and selling them at a profit, either through appreciation or by “flipping” the property. Real estate investment is especially attractive as it provides value to investors who may use the property themselves or as an income source, while also having its value appreciate over time.

In Singapore, properties are seen as a starting point for investment, with many Singaporeans investing their wealth into a home as their first investment. This is linked to the small land area in Singapore (supply) compared to the growing population (demand). Depending on the location, real estate can be a good investment option for Singaporeans as it is likely to appreciate in value over time above the inflation rate.

Read also: Market Selection in Real Estate - RealVantage’s Approach

Read also: Six Critical Success Factors in Direct Real Estate Investment

However, the property market in Singapore may be quite limited and does not provide much diversification for investors. Overseas property investment can solve this issue by diversifying real estate assets across different markets and property sectors hence reducing risk.

If investors already own a primary residential property in Singapore, they will have to pay an Additional Buyer’s Stamp Duty (ABSD) on additional residential properties in Singapore. By investing in overseas properties, investors may be able to avoid this significant overhead.

In addition, overseas properties also tend to generate higher returns than properties in Singapore owing to the fact that property prices in Singapore are relatively high. This, combined with the other advantages of overseas property investment, provides investors with a better and safer source of passive income.

Read also: Important Considerations when Buying Overseas Properties | Deal Sourcing with AI

However, investors should be well-informed before making any investment decisions. They should be familiar with the risks and trends in the property markets, as well as the potential returns and drawbacks of investing in a particular property in a foreign country.

Unwise investment decisions may result in a loss rather than profit, so investors should consult with professionals to get a better idea of how to invest in a particular market and generate better risk-adjusted returns.

Read also: How Does Internal Rate of Return (IRR) Impact Real Estate Investors' Decision-Making Process?

Sign Up at RealVantage2) Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are a type of fund usually structured by real estate companies to own and operate income-producing investment properties in a portfolio. Some REITs are thematic in nature and keep focus on having their assets in a particular sector, such as healthcare, hospitality, retail, industrial or commercial, while others diversify their assets across a combination of these sectors.

Investing in REITs is considered a form of indirect investment. Investors in REITs typically do not have any responsibilities in the property management, but can trade their REITs shares through a broker or stock exchange. REITs invest in properties through capital collected from investors, and provide returns for their investors through its dividend income generated from rents from its underlying properties and /or capital gains through value appreciation.

Read also: REITs or Real Estate Co-Investments?

In Singapore, REITs are required to distribute at least 90% of their net income to investors. Some REITs in Singapore include Keppel REIT, Ascendas REIT and Ascott REIT.

Keppel REIT is a REIT based in Asia, with approximately S$8 billion in properties throughout the Asia Pacific region, including cities such as Singapore, Sydney, Melbourne, Brisbane, Perth and Seoul. Keppel REIT is a diversified REIT, with real estate, infrastructure and data centre properties across their markets.

Read also: Keppel REIT Overview

Ascendas REIT has properties in key countries such as Singapore, Australia, the United Kingdom and the United States. This forms its S$12.8 billion portfolio with over 200 properties across the office, logistics, data centre, retail and factory sectors.

Read also: Ascendas REIT Overview

Ascott REIT has properties across 15 countries in North America, Europe and the Asia Pacific region, with an overall portfolio of S$7.4 billion. Ascott REIT’s portfolio is concentrated in serviced residences, income-generating properties and hospitality real estate.

Read also: Ascott REIT Overview

3) Stocks

A stock also known as a share is a security that gives investors partial ownership of the company. Investors in stocks are known as stockholders or shareholders and are entitled to the assets and profits of the company they hold stocks for, proportional to the percentage of stocks they own, paid out as dividends. Stocks may be traded publicly through the Singapore Exchange (SGX).

Investors can gain profits from stocks using two different strategies.

- Dividend Income

Dividend income refers to the payout that stockholders receive from the company’s corporate earnings, and may be distributed one to a few times a year, depending on the dividend policy of the individual company. - Capital Gain

Investors can also make profits by selling shares at a higher price than when they bought it, with the difference between these prices known as their capital gain. The capital gain typically forms a large proportion of the profits from stockholders.

There are a few different types of stocks: blue chip stocks, value stocks and exchange-traded funds, each utilising different strategies to yield returns.

- Blue Chip Stocks

Blue chip stocks are shares of large companies which are typically well-established, profitable, well-known and financially sound.

These companies have usually been around for a number of years with a reliable revenue and income flow, with a market capitalisation in the billions of dollars, and are leaders within their markets. These factors make blue chip stocks relatively low in risk, while providing a source of passive income, stability and diversification, making it one of the most popular stocks to invest in.

Most blue chip stocks pay out regular dividends to stockholders, which may increase over the years.

In Singapore, some examples of blue chip stocks include DBS, CapitaLand and SingTel. Blue chip companies are also usually part of the Straits Times Index (STI), an index which displays the trends of the 30 largest companies on the SGX. - Value Stocks

Value stocks are shares of a company that are traded at a lower price than its fundamental value.

For examples, companies that might have stable business models but due to a negative event, usually temporary, could be priced lower and seen as a bargain for investors. Other examples of value stocks include relatively small capitalised (small-cap) companies with shorter track records yet promising products.

As a result of this, value stocks typically hold more risk but bigger upsize potential and have to be held for a longer investment horizon to yield positive capital gains, although most value stocks also pay dividends to stockholders on a regular basis. - Exchange-Traded Funds (ETFs)

ETFs are funds which are traded through the stock exchange and consist of a selection of different assets, depending on the index used by the ETF. Purchases of ETFs may be favourable to investors due to its convenience, since it may be more time consuming or more expensive to purchase these stocks individually.

For example, the STI ETF invests in and tracks the stocks listed in the STI, which are the top 30 listed blue chip stocks. As a result, only the strongest stocks are invested in, allowing positive returns on low-risk stocks, making it an incredibly popular choice for passive investors.

Opening A CDP Account & Choose A Brokerage

An important step to take for an investor to begin their investment journey is to open a Central Depository (CDP) account. A CDP account refers to a Direct Securities Account handled by the SGX, which gives investors clearing, settlement and depository services on a single platform for all investments in the Singapore stock market. The CDP account secures all stocks and bonds purchased through the Singapore stock exchange.

There are a few criteria individuals are required to meet in order to open a CDP account. Firstly, the individual must be above 18 years old and have a bank account with either Citibank, DBS or POSB, HSBC, Maybank, OCBC, Standard Chartered Bank or UOB. Then, individuals should fill up the CDP application form online and provide the supporting documents required. This includes identification documents, financial statements and tax information. The full list of supporting documents can be found here.

Alternatively, a CDP account can also be opened through retail brokers that are supported by the SGX. When opening a brokerage account, investors should consider the minimum fees charged by each brokerage including the trading fees, relative to the investment amount.

Read also: What is an Accredited Investor?

4) Bonds

Bonds are used by entities such as corporations or governments, as a form of financing. Investors invest in these bonds, providing a kind of loan for the entities’ operations. This forms a public debt market, where corporations borrow large sums of money from many individual investors rather than through a financial institution.

In Singapore, these bonds include Singapore Government Securities, and Singapore Corporate and Retail Bonds.

Bonds are known as fixed income instruments. This means that investors in bonds are paid a fixed amount of coupon every so often throughout the length of their bond, and are paid the principal of the bond at maturity, when the length of the bond ends, making it a safer investment option with more certain returns for investors. Bonds can be traded publicly or privately, and range in prices, depending on the general economic conditions, the issuer and the time until maturity.

These bonds may be bought directly from the corporations or from previous bondholders. While bonds may be a profitable form of investment, they also hold some risk due to their low rate of return, and the fact that the bond issuers can default.

- Singapore Savings Bonds (SSB)

Singapore Savings Bonds (SSBs) were introduced in 2015 with the purpose of providing a low-risk investment option for Singaporean investors. It is usually sought as an alternative to the banks’ fixed term deposit.

Investors can purchase a SSB at a minimum of S$500, earning an increasing amount of interest each year. The interest rate starts low, with the Year 1 interest rate for the most recent bond at 0.27%, reaching 1.64% in Year 10, at maturity. However, despite the low interest rate, this is a safer investment option, being fully backed by the Singapore Government and having no loss regardless of the interest rates.

SSBs may be purchased through Singapore banks (DBS/POSB, OCBC or UOB) using their respective ATMs or internet banking services, in increments of S$500. This is only available to individual investors who are above 18 years of age and have a CDP account.

5) Savings Plan/CPF

The Central Provident Fund (CPF) is a fund required for all Singaporeans and Permanent Residents, with the main purpose of allowing them to accumulate savings for retirement. Monthly contributions are made to these CPF accounts from both employees and employers. There are four types of CPF accounts:

- Ordinary Account (OA)

The OA is used for housing, investment and insurance purposes, with an interest rate of up to 3.5% per annum. - Special Account (SA)

The SA is used for old age and investment in financial products related to retirement, with an interest rate of up to 5% per annum. - Medisave Account (MA)

The MA is used for hospitalisation expenses and for approved medical insurance, with an interest rate of up to 5% per annum. - Retirement Account (RA)

The RA is created after the account holder’s 55th birthday, used for retirement purposes, with an interest rate of up to 5% per annum.

However, there is also a CPF Investment Scheme (CPFIS), which allows account holders to invest their savings from their OA and SA in a wide variety of investment options to gain higher returns. In order to use the funds in these accounts for investment, individuals are required to have at least $20,000 in their OA or $40,000 in their SA.

6) Crypto

Cryptocurrency is a virtual or digital currency that may be used as a form of payment online. However, it is still not widely adopted and may therefore be limited in how it can be used. Cryptocurrencies are usually built on decentralised networks using blockchain technology, secured by cryptography.

This means that fraudulent transactions such as counterfeit cryptocurrency or double-spending is close to impossible. In addition, since there is no central authority issuing this cryptocurrency, governments have little control over them, for better or worse. Cryptocurrency is often commended for its transparency, mobility and resistance to economic inflation, but is frowned upon for its volatility, infrastructural vulnerabilities and the lack of regulation leading to its use in illegal activities.

One example of a cryptocurrency is Bitcoin, which was the first cryptocurrency and still remains as the most valuable and most popular form of cryptocurrency today.

7) Crowdfunding

Crowdfunding is an alternative form of investment allowing investors to invest in small and medium-sized enterprises (SMEs), funding these entrepreneurs based on their pitches and business ideas or proven products and services.

Crowdfunding platforms allow these SMEs to gain access to public capital and fund their ventures, without the high administrative costs associated with traditional funding. In return, investors receive a high interest coupon, along with capital repayment at a specified date.

8) Co-Investments

Co-investment is a type of investment structure made up by a pool of investors to supplement various investment opportunities.

In the context of real estate co-investing, each investor contributes a relatively small amount of capital to finance together a real estate acquisition, which in turn gives them a percentage of co-ownership in the property. The real estate co-investment platform is responsible for the sourcing, upkeep and management of the property as well as the investors’ fund.

This way, investors can own part of a property and gain returns through rental income in the case of income-generating real estate assets, or through capital appreciation when the group of investors exit the investment and the property is sold.

Read also: REITs or Real Estate Co-Investments?

In Conclusion

RealVantage is a real estate co-investment platform which provides potential investors with the opportunity to co-invest in global real estate deals. All opportunities are fully vetted by experienced real estate investors and details about the property and the investment is provided to all potential investors.

This gives investors the choice to invest in properties they like and have full control over where their investment capital goes, as well as the chance to see how these properties are performing whilst receiving returns periodically.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.