Understanding More about Singapore Savings Bonds (SSB)

In this article, we provide an in-depth explanation of the inner workings of Singapore Savings Bond (SSB), its historical performance and also provide other forms of investment alternatives out there.

Table of Contents

- What are Singapore Savings Bonds (SSB)

- Understanding Bonds and How They Work?

a. How do Singapore Savings Bonds Work? - Types of Bonds

a. Corporate Bonds

b. Government Bonds - Features of SSB

a. Low Risk Bond

b. Long Term Investment

c. Flexibility of Investment - Purchase and Redeem SSB

a. How to Buy Singapore Savings Bonds (SSB)?

b. How to Redeem Singapore Savings Bonds (SSB)? - Is SSB a Worthwhile Investment?

a. What is a Fixed Income Instrument?

b. Benefits of Investing in Fixed Income Instruments

c. Risk of Fixed Income Investment - Comparison SSB with Other Fixed Income Assets in Singapore

a. Let us Take a Look at SSB

b. Fixed Deposits - Conclusion

What are Singapore Savings Bonds (SSB)

Singapore savings bond, otherwise known as SSB, was introduced in 2015 with an intention of being a low risk fixed income investment for Singaporeans to invest their wealth. It is usually seen as an alternative to the bank’s fixed deposit.

SSB is a relatively easy form of investment that is open to most individuals and does not require the investor to be an accredited investor.

Understanding Bonds and How They Work?

Before we start to explore SSB, we first have to understand what a bond is and how it works. A bond is a type of fixed income security. It is a loan given by an investor to a government or a company.

In return, investors are paid interest on the money they have borrowed, to the government or company and return of the principal at maturity (end of loan term).

How Do Singapore Savings Bonds Work?

Bonds can help governments and businesses to fund projects, hire more staff and invest in opportunities or research and development (R&D). Bonds are usually seen as a safer investment alternative as compared to other forms of investments, because it ensures a scheduled interest payment and also returns on principal during maturity.

However, just like any form of investment, investing in bonds does come with its set of risks. This will be discussed in the later sections.

Read also: Understanding IRR, Cash Yield, and Equity Multiple

Types of Bonds

There are two main types of bonds found in Singapore namely corporate bonds and government bonds.

Corporate Bonds

Corporate bonds are issued by a company to investors. Usually, the company's assets will be used as collateral if the company is unable to return principal amount loaned by investors. In the US, ratings are given to corporate bonds to rank the level of risk involved; As the saying goes: With higher risk comes higher rewards. A high-risk bond, or junk bond (BBB rated bonds) will have higher interest rates but the risk of credit default is higher, and vice versa.

Corporate bonds usually carry higher interest rates than government bonds as there are greater risks involved.

An investor can get exposure to corporate bonds either through wholesale bonds or retail bonds.

- Wholesale Bonds

Wholesale bonds are corporate bonds issued by companies to investors to raise additional capital for the business, traded Over-The-Counter (OTC). These OTC trades take place directly between two parties rather than through a stock exchange, potentially with the help of a broker. These wholesale bonds are traded in higher denominations, with the minimum at S$250,000. - Retail Bonds

Retail bonds differ from wholesale bonds in that they are traded through the stock exchange, and have trading lot sizes of S$1,000 The company is required to pay the investors interest and reimburse the principal sum at a set date. Retail bonds typically have an interest rate of around 3% to 6%. The market for retail bonds is relatively small in Singapore, with around 10 different retail bonds available to investors.

Government Bonds

Governments may also issue bonds to fund projects and infrastructure, such as to build roads and schools. In a country like Singapore where governance is strong and the economy is relatively stable, the risk of credit default from the government is low, making government bonds a relatively safe investment. The returns on investment for this safer asset tend to be lower than corporate bonds.

Sign Up at RealVantageFeatures of SSB

Singapore Savings Bonds (SSB) works almost the same as the bank's fixed deposit or regular savings plan. Essentially, an investor is putting up capital for the Singapore government, of which in return, investors will receive an interest coupon on the principal investment amount.

MAS has issued a statement stating that “the government is not issuing Saving Bonds to finance its expenditure. The money raised from issuing Savings Bond cannot be spent and will be invested”. The SSB is generally seen as an instrument for investors to preserve their wealth through lower risk investments.

According to MAS, these are the key features of a SSB.

Low Risk Bond

Because this is an investment fully backed by the Singapore government, investors are assured that they will “always get the investment amount back in full with no capital loss”. The risk of credit default is low and the bond is relatively safe.

Long Term Investment

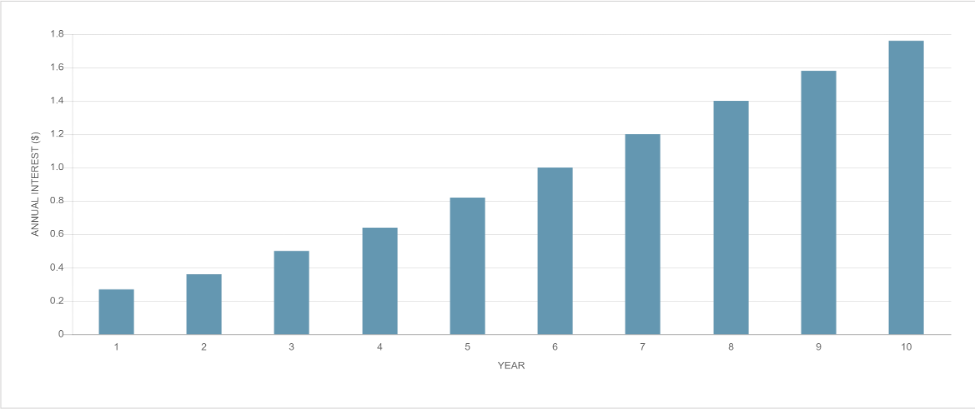

The maturity term for SSB is 10 years, which is a pretty long investment plan. The interest rate increases over time, which means the longer an investor invests in the issued SSB, the higher returns one will receive on the investment.

Flexibility of Investment

SSB allows investors to exit their investments at any time period without penalty. Hence, investors do not have to plan for an investment time frame with SSB. This is in contrast to most regular deposit savings plans in banks where there is a penalty for early withdrawal on your deposit.

Purchase and Redeem SSB

A SSB is issued on the first working day of every month. Since 2015, it is projected that this investment alternative will be sustainable for at least five years. Only individuals with CDP accounts are allowed to purchase SSB, which means to say the minimum age for this savings plan is 18 years old and corporations are not allowed to purchase savings bonds.

How to Buy Singapore Savings Bonds (SSB)?

SSB can be bought through DBS, POSB, UOB, OCBC ATM or through internet -banking. The mode of payment can be in cash or SRS (supplementary retirement savings).

You must have an individual CDP account before investing. The minimum investment amount is $500, and subsequent investment must be in the multiples of $500.

Unlike a typical bond, SSB cannot be traded over the counter through the Singapore stock exchange. All transaction, purchasing and redeeming, must only be done through the above listed banks.

How to Redeem Singapore Savings Bonds (SSB)?

There are two possibilities when redeeming a SSB.

Firstly, when the SSB reaches maturity (after 10 years), the banks will automatically return the principal amount and also the final interest rate payment.

Secondly, if you decide to redeem your principal capital before maturity, you will have to submit a request to the bank. There is a $2 transaction fee and you are expected to receive your principal investment and outstanding interest payment within a month.

Is SSB a Worthwhile Investment?

In order to answer this question, we would have to look at other forms of investment with a similar structure to SSB. Since SSB falls under the category of a fixed income instrument, we will analyse the characteristics of a fixed income investment, and subsequently compare SSB to other forms of fixed income investments found in Singapore.

What is a Fixed Income Instrument?

Fixed income is a broad financial term used to represent securities which repay investors a dividend or fixed interest based on the principal amount they have invested. There is a maturity date, where the scheduled dividend payout stops, and the principal is returned to the investors in cash or in equities such as stocks (convertible bonds).

Benefits of Investing in Fixed Income Instruments

- Capital Preservation and Diversification

Usually fixed income is seen as a very low risk form of investment as an investor is guaranteed a fixed return - either monthly or quarterly. In addition, the investor is able to choose the time frame on his/her investment.

Fixed income serves as a great diversification from the equities market. Stock markets are very prone to market fluctuations, economic downturn and geopolitical issues, ultimately rendering the return on investment for equities to be unpredictable.

In fixed income investments, an investor loans capital to a company. The company is then liable to repay the principal amount of the loan with interest.

On the other hand, equities allow investors to invest in a company, in exchange for a portion of the company’s shares. There is no obligation for the company to repay a fixed percentage on the capital invested over a certain period and there is no predetermined time frame on the ROI. - Income Generating Asset

There is a scheduled dividend payout on the investment at regular intervals, and hence a fixed income asset can be a steady income source. Usually, a fixed income asset is great for a retirement portfolio, as the maturity date can be selected, which is when the principal investment amount can be collected, along with regular payouts for monthly expenses.

Read also: An Overview of Institutional Investors

Sign Up at RealVantageRisk of Fixed Income Investment

Despite fixed income being coined as a “safe investment”, there are risks associated with it.

- Credit Risk

There are credit risks associated with the loan of funds. When investing in a fixed income, there is a risk that the bond issuer will not be able to repay the loan. This means that the lender may not receive the principal of the loan at maturity, resulting in a net loss. - Inflation Risk

As some interest rates given by the bond issuer tend to be on the lower end (especially AAA rated bonds), there is a chance that the inflation rate is greater than interest rates. This would result in having inflation adjusted returns being net negative. - Interest Rate Risk

There is an inverse relationship between interest rate and the value of your fixed income. When the interest rate increases, the value of your bond decreases. When bonds are first released for sale on the market, they are sold at a lower interest rate for investors. However, when newly issued bonds are put on the market with higher interest rates for the same principal, the higher interest rates provide more attractive returns for investors at the same principal. As a result, older bonds with lower interest rates become less desirable, and have to be traded at a lower price to appeal to investors and offset their lower interest rates. The risk of this happening is referred to as an interest rate risk. - Liquidation Risk

In an investment, when an investor opts to exit the investment by selling the asset - this is termed as liquidating the investment. Not all assets / investments can be easily liquidated. All asset classes have varying degrees of liquidation risks, and this refers to various occasions when investors are may be unable to liquidate or sell off the investment.

Read also: The Real Estate Risk/Reward Spectrum & Investment Strategies

Comparison SSB with Other Fixed Income Assets in Singapore

Now that we have a good understanding of fixed income and its associated risks and benefits, we now look to comparing SSB with other forms of fixed income.

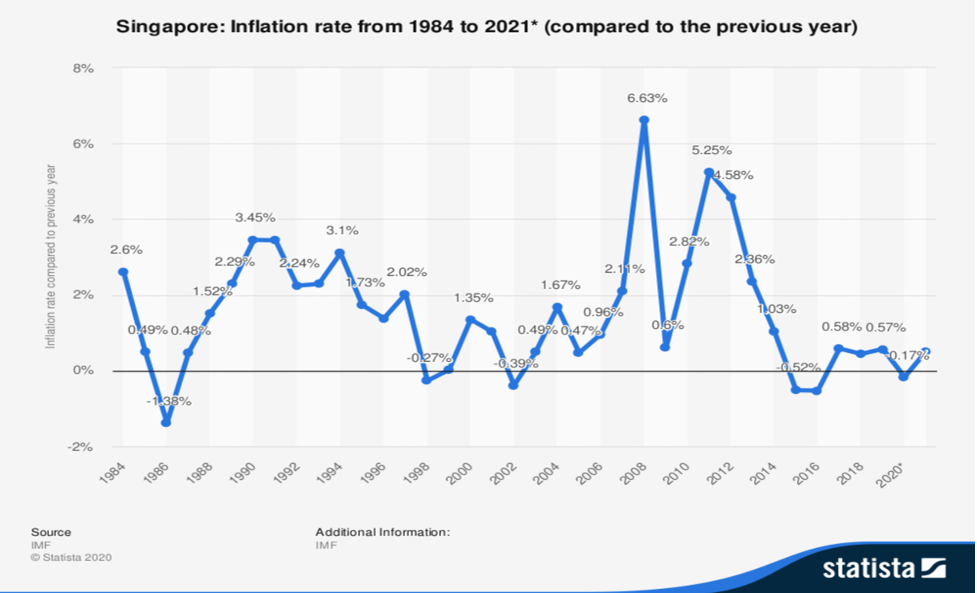

Any investment should at least generate positive inflation-adjusted returns. Shown below is a chart of the inflation rate in Singapore.

| Inflation on rate % | 2.6 | -1.38 | 1.52 | 3.5 | 2.24 | 3.1 | 1.38 | -0.27 | 1.35 | -0.39 |

|---|---|---|---|---|---|---|---|---|---|---|

| Year | 1984 | 1986 | 1988 | 1990 | 1992 | 1994 | 1996 | 1998 | 2000 | 2020 |

| Inflation on rate % | 1.67 | 0.96 | 6.63 | 2.82 | 4.58 | 1.03 | -0.53 | 0.44 | -0.17 |

|---|---|---|---|---|---|---|---|---|---|

| Year | 2004 | 2006 | 2008 | 2010 | 2012 | 2014 | 2016 | 2018 | 2020 |

As seen above, after 2015 to 2020, the inflation rate has been very low - about -0.5 to 0.6 % which is good, as the purchasing power of the Singapore Dollar does not decrease by a lot.

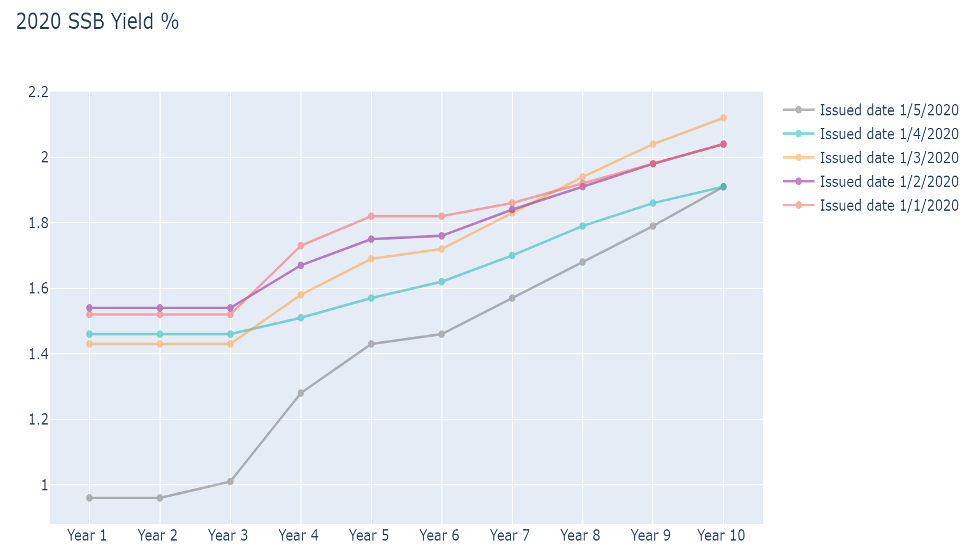

Let us Take a Look at SSB

| Issued Date | 1/1/2020 | 1/2/2020 | 1/3/2020 | 1/4/2020 | 1/5/2020 |

|---|---|---|---|---|---|

| Year 1 | 1.52 | 1.54 | 1.43 | 1.46 | 0.96 |

| Year 2 | 1.52 | 1.54 | 1.43 | 1.46 | 0.96 |

| Year 3 | 1.52 | 1.54 | 1.43 | 1.46 | 1.01 |

| Year 4 | 1.73 | 1.67 | 1.58 | 1.51 | 1.28 |

| Year 5 | 1.82 | 1.75 | 1.69 | 1.57 | 1.43 |

| Year 6 | 1.82 | 1.76 | 1.72 | 1.62 | 1.46 |

| Year 7 | 1.86 | 1.84 | 1.83 | 1.70 | 1.57 |

| Year 8 | 1.92 | 1.91 | 1.94 | 1.79 | 1.68 |

| Year 9 | 1.98 | 1.98 | 2.04 | 1.86 | 1.79 |

| Year 10 | 2.04 | 2.04 | 2.12 | 1.91 | 1.91 |

The table provides an indication of SSBs issued at different times, and their respective yearly interest rates over 10 years after purchase. The latest issued SSB on 1st May 2020, with the bond code GX20010T, offers the record lowest interest rate to date at 0.96%. Usually, a SSB will return around 2% interest rate by maturity.

Fixed Deposits

| Bank | Interest Rate (per Annum) % | Minimum Deposit $ | Tenure |

|---|---|---|---|

| ICBC | 1.25 | 500 | 12 Month |

| OCBC | 1.75 | 5000 | 48 Month |

| UOB | 1.65 | 5000 | 36 Month |

| DBS | 1.15 | 1000 | 18 Month |

| Maybank | 2.05 | 1000 | 36 Month |

| CIMB Bank | 1 | 1000 | 24 Month |

For Fixed Deposit instruments, banks typically require a higher minimum quantum as compared to investing into a SSB. The Fixed Deposit interest rates are generally higher than SSB, but the tenures are also longer. Most banks have 12 to 36 months tenure, which means that an investor is not allowed to exit the investment for that period of time without penalties. On the other hand, liquidating an SSB investment can be done at any time without penalty.

Conclusion

While SSBs and bonds have a role to play in any investors portfolio in Singapore, there is also another asset class, real estate, which could potentially serve fixed income investors well.

In particular, investors investing into a good core real estate asset type typically have a steady income stream and may also experience a small capital appreciation from holding the asset through a longer period of time.

A core real estate investment is backed by the physical asset - investments into the real estate are typically secured against the physical assets underlying that investment.

Co-investment is a type of real estate investment that allows investors to own part of a real estate asset, without having the responsibility of managing or sourcing the property. Co-investors enjoy rental income and positive returns from the property, while enabling investors to invest in real estate in smaller quantums and in different markets to better diversify their assets.

Read also: REITs or Real Estate Co-Investments?

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.