Capital Preservation in Real Estate Investments

In this article, we explain the importance of capital preservation and how to apply capital preservation strategies in real estate investments.

What is capital preservation?

Capital preservation refers to an investment strategy where its main objective is to preserve capital and avoid losses in an investment portfolio. With a capital preservation strategy, investments tend to comprise the safest short-term investment products, such as fixed deposits and bonds.

Investors using this strategy should also be wary of the impact of inflation on their investments. Low-risk investments are the preferred investment option for capital preservation investors, but they also provide correspondingly lower returns.

Investments with a rate of return lower than the inflation rate would result in a loss of capital on an inflation-adjusted basis for the investor, despite its lower risk. While this effect may not be immediately noticeable in the short term, it can significantly undermine the value of an investment over time.

What is a capital preservation fund?

Capital preservation funds help preserve investors’ capital in all types of environments, even during economic downturns. Regardless of the expected future market condition, it might be wise to invest in a few capital preservation funds to increase your exposure to investment-grade bonds. Investing in capital preservation funds helps investors to remain resilient to the various challenging economic conditions that one may face, while earning a small yield.

What is a capital preservation portfolio of investments?

A capital preservation investment portfolio seeks to provide maximum current income while ensuring the stability of the principal and preserving the capital of investors. An investor's risk tolerance plays a key role in driving the capital preservation portfolio.

Read also: Building a real estate portfolio

Why is capital preservation important?

Capital preservation may not be the most attractive part of investing in real estate, but it is one of the most important aspects when investing. Even if an investor ultimately does not earn any return from an investment, he should at least ensure that he recoups his original return and suffer zero losses.

Investors may be attracted to the cash flow returns or potential earnings that an investment offers. However, it is the capital preservation of an investment that would significantly help them remain resilient if an unexpected situation occurs. Just as Warren Buffett puts it, there are two rules to investing:

Rule #1: Never lose money

Rule #2: Never forget Rule #1

Which class of investors take on the mode of capital preservation?

Investors embarking on the preservation of capital tend to have a long investment time horizon with a low risk appetite.

Pension funds

Pension funds are pools of investment used to fund retirement and tend to follow the capital preservation strategy, since the fund’s purpose is to retain the capital as a form of retirement savings. Clients of pension funds do not require the funds to appreciate; instead, their purpose is to preserve their capital value until their retirement.

Family offices

Family offices are private companies managing wealth and investments for high-net-worth families. These family offices generally have more than $100 million of assets to manage, and the capital preservation strategy may be used to preserve their wealth for future generations.

Retirees

One class of investors who pursue capital preservation are the retirees looking to preserve their capital after they stop working, since they no longer receive an income. Younger investors may also make use of this investment strategy as one way to preserve their capital for a future real estate mortgage down payment.

Read also: What is an accredited investor?

Read also: An overview of institutional investors

How to invest for capital preservation?

When investing for capital preservation, the key thing is to assess the asset's volatility. Volatility refers to the changes in the price of a given security for a given set of returns over a given period. Investors who want to adopt a capital preservation investment strategy usually choose to invest in less volatile and less risky assets. Generally, the higher the volatility, the riskier the security.

Since investors interested in preserving their capital mainly look for investments with minimal risk and volatility, they usually prefer assets like savings accounts, government bonds, treasury bills, and inflation-adjusted accounts.

Popular asset classes to preserve capital

Some inflation-adjusted investment options available for investors using the capital preservation strategy are the Treasury Inflation-Protected Securities (TIPS) in the U.S. and Singapore Savings Bonds in Singapore.

Other popular capital preservation options include annuity products, which are primarily offered by life insurance and investment companies. Annuities are typically used by retirees who contribute to the fund earlier in the accumulation phase, and can receive regular payouts when they retire.

Lastly, a favoured asset class for capital preservation is real estate. Real estate is generally seen as a safe investment option, since property prices tend to grow with inflation.

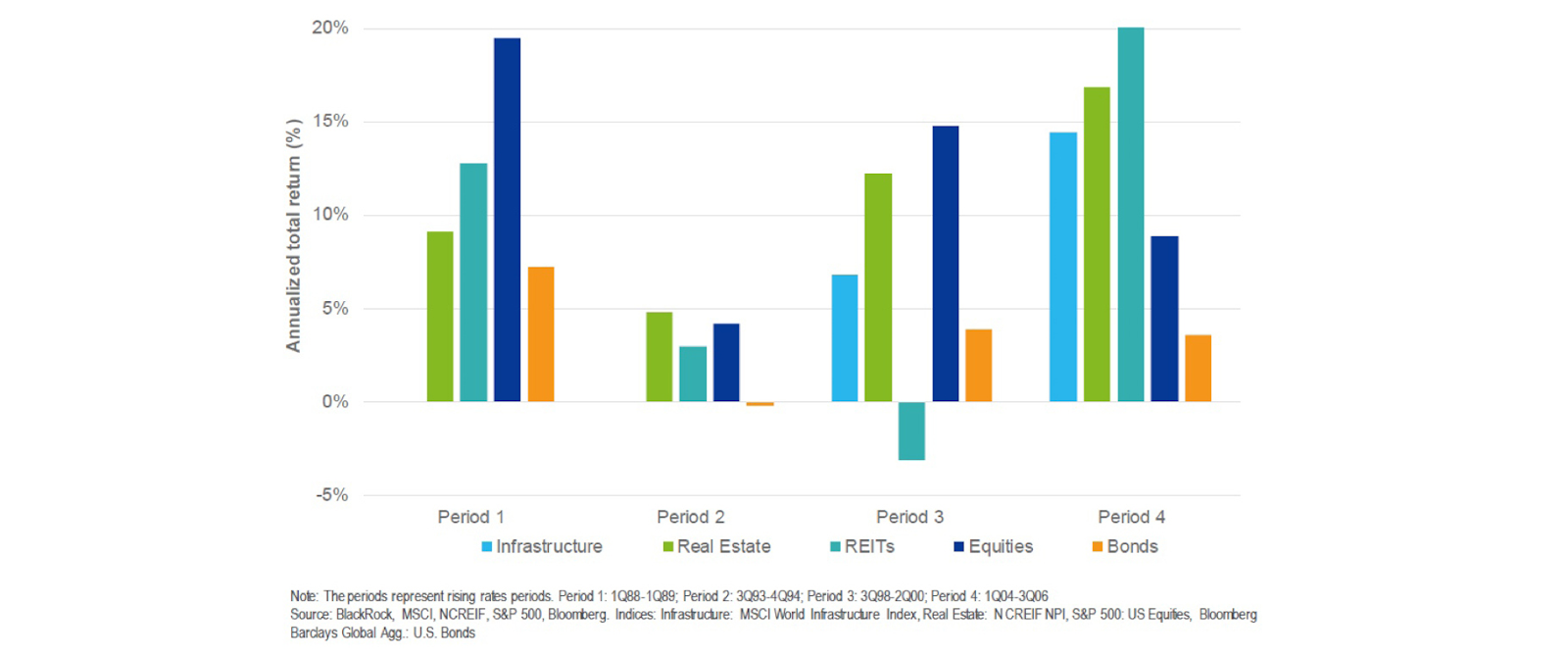

Real estate as an asset class provides returns that are less prone to fluctuations than other investments like equities and bonds.

What are alternative capital preservation investments?

Apart from the above-mentioned capital preservation investments, wealthier investors may also seek alternative investments to protect themselves against losses. These include fine art, rare coins, and gold.

1. Fine art

There will always be someone who is interested in and appreciates the value of fine art. This makes it a good investment, since those who know its worth rarely bargain with the seller.

2. Rare coins

Historically-significant items which are very limited in supply are in high demand. Therefore, the scarcity and exclusiveness of rare coins make them a precious asset that helps to preserve capital and allows the investor to profit based on the basis of high demand and limited supply.

3. Gold

Gold is a good capital preservation investment as it can preserve considerable value, even when currencies depreciate.

Read also: Real estate co-investment – the new alternative

Capital preservation through real estate

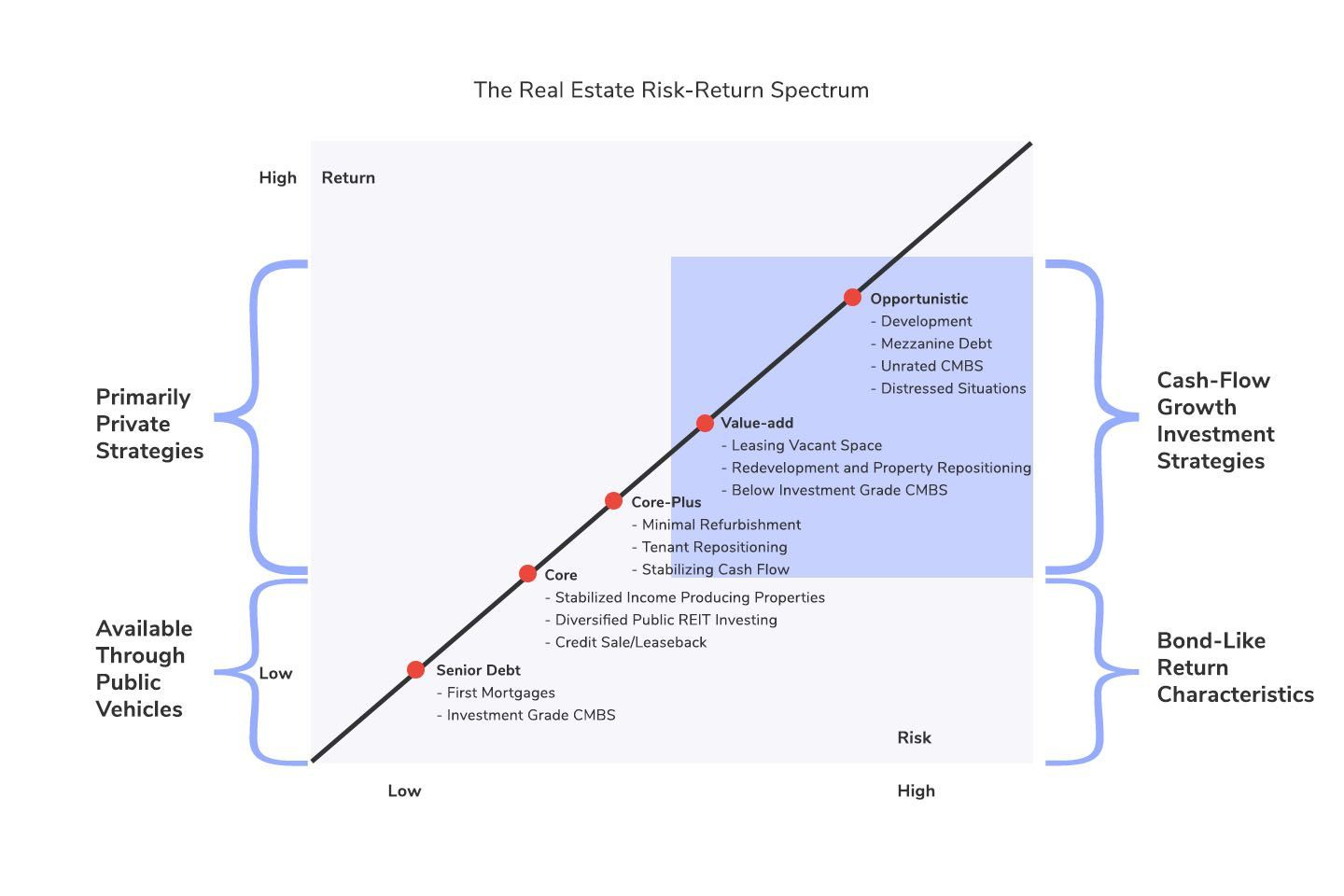

It would be prudent for investors who follow a capital preservation strategy to consider investing in real estate. Real estate investments may be diversified by geographical locations, asset types, as well as investment strategies, which may range from core and core-plus to value-add and opportunistic.

Investors adopting a capital preservation strategy tend to gravitate towards investing in core real estate properties, which are stable income-generating properties. These investment properties are the least risky, relative to properties employ a value-add or opportunistic strategy.

The risk associated with core real estate investment can also be further reduced with a diversified investment portfolio by investing across different geographical markets or in different property types, such as residential or commercial properties.

Why is real estate good for capital preservation?

Real estate is considered one of the ideal investment vehicles to grow wealth. Real estate assets, such as office buildings, are not volatile, given that the primary determinants of the value of the buildings are their quality, location, and the stability of their tenancies. Therefore, to investors whose main concern is the preservation of capital, investing in real estate assets is considered relatively safer than investing in stocks.

Read also: The real estate risk/reward spectrum and investment strategies

RealVantage is a co-investment platform that allows investors to co-invest directly in properties around the world. The carefully curated selection of properties serves to maximise returns for investors, while limiting risk at each level of the real estate risk-reward spectrum. The Core strategy opportunities presented on the platform provide a good option for investors seeking capital preservation.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.