What is Inflation and What Causes it?

Inflation quantifies the rate at which a currency’s value declines, resulting in an increase in the prices of goods and services in a particular economy.

Table of Contents

- How to Calculate Inflation Rate

- How does Inflation Affect Interest Rates

- Inflation - Is it a Boon or Bane for the Country

- What Happens if Inflation is too High

- Hyperinflation in an Economy

- Does Inflation Benefit Anyone?

- Using Investments as a Safeguard Against Inflation

Inflation quantifies the rate at which a currency’s value declines, resulting in an increase in prices of goods and services in a particular economy. Inflation is also reflected in the decline in purchasing power of a particular currency as time passes. Inflation serves to determine the impact of the changes in price of a range of goods and services and this is represented as a single value.

When a currency drops in value, prices within that economy rise and the currency can now purchase fewer goods and services, meaning that there is a reduction in purchasing power. This increases the cost of living in the economy, slowing the overall economic growth. Therefore, from an economist’s standpoint, when a nation’s growth in monetary supply exceeds the rate of economic growth or demand, sustained inflation occurs.

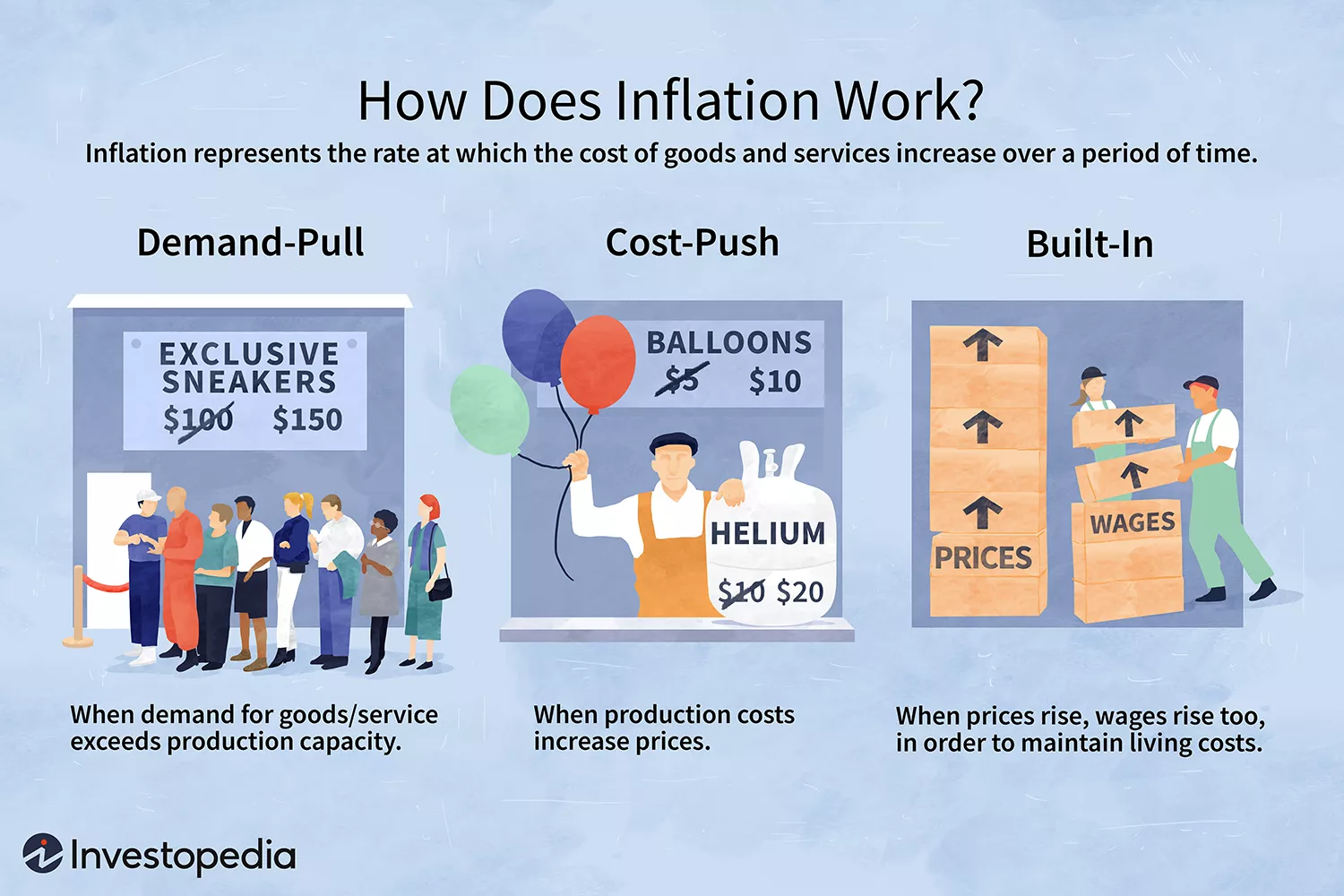

Although inflation is generally attributed to an increase in the supply of money, whereby purchasing power is decreased, this can play out through three different types of mechanisms - the demand-pull effect, the cost-push effect or built-in inflation.

With the Demand-Pull Effect, an increase in the supply of money in the economy boosts the demand for goods and services, which in turn exceeds the supply at that point in time. This creates a gap in the demand and supply of goods and services, causing the price of goods and services to increase, thereby lowering the purchasing power of the currency resulting in inflation.

With the Cost-Push Effect, an increase in the production inputs drive up production costs. These higher production costs are then passed on to the consumers in the form of higher prices which results in inflation.

With Built-in inflation, the expectation of a steady increase in the prices of goods and services results in an increase in the demand for higher wages to keep up with the expected rise in living costs. This increase in wages further drives up the prices of goods and services, perpetuating the cycle of inflation.

How to Calculate Inflation Rate

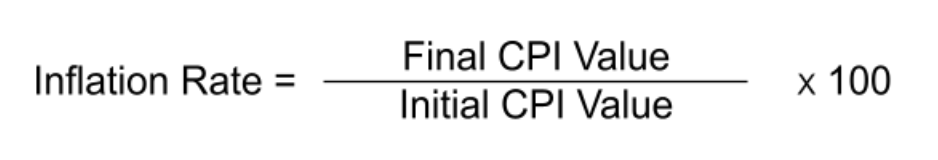

The inflation rate is calculated as a percentage, based on the Consumer Price Index (CPI), Wholesale Price Index (WPI) or the Producer Price Index (PPI).

The inflation rate can be calculated by dividing the Final CPI Index Value by the Initial CPI Value, multiplied by 100 to get a value as a percentage.

The Consumer Price Index (CPI) is a measure of the weighted average of the prices of a selection of essential goods and services such as food, transport and medical costs. The CPI calculates the changes in their standard retail price and weights them based on their relative significance in the basket of essential goods and services. Because the goods and services used for the CPI are considered as basic essentials, it is a relatively accurate measure of the cost of living in a particular economy.

How does Inflation Affect Interest Rates

Interest rates are the rates at which a lender charges for lending money to a borrower, which is typically determined by the government at a national level. The government may attempt to regulate the inflation rate by adjusting benchmark interest rates.

Inflation rates tend to have an inverse relationship with interest rates. For example, when interest rates are low, borrowing tends to increase which results in greater consumer purchasing power. This both speeds up economic growth and increases inflation.

Inflation - Is it a Boon or Bane for the Country

An inflation rate that is too high or too low tends to have negative effects on the economy. As such, a low to moderate inflation rate or around 2% is considered good. Higher inflation can encourage spending in the short term since consumers may be more willing to spend before prices rise further which results in the growth of the economy overall.

What Happens if Inflation is too High

A high inflation rate can harm consumers’ monetary savings since their purchasing power is reduced. However, borrowers would benefit from high inflation since the inflation-adjusted value of their existing debts would diminish as time goes on.

Hyperinflation in an Economy

Hyperinflation occurs when inflation increases rapidly in an economy. This means that prices of general items are increasing uncontrollably and excessively, usually characterised by a 50% or more increase in consumer prices per month.

A recent example of hyperinflation is the Venezuelan economy whereby prices of goods were up by 65.7% in November 2020 and the annual inflation rate was as high as 4,087%. Hyperinflation causes the country’s currency to be worthless. Hyperinflation is less commonly observed in developed countries.

Does Inflation Benefit Anyone?

Although inflation is generally bad news for consumers as it decreases their purchasing power, inflation is good news to others like businesses and investors. Businesses can gain higher revenue due to increased consumer prices. However, inflation is also a double-edged sword. When the prices of raw materials, such as oil and energy, increase yet businesses are unable to increase their prices to cover the higher production costs, their profit margin would decrease.

Investors who are in possession of assets that gain value during inflation would benefit from inflation as well.

Using Investments as a Safeguard Against Inflation

There are a few investments that investors look to as a safeguard against inflation. An example would be real estate. The value of the property increases along with the increase in inflation. Landlords can also increase the rental rate resulting in a higher income.

Read also: Real Estate Co-investment ‒ The New Alternative

RealVantage is a co-investment platform that allows investors to co-invest alongside other investors. This can effectively lower the initial investment required for various types of real estate deals, reducing capital risk. RealVantage is run by experienced industry experts who have access to quality real estate deals, providing investors with strong risk-adjusted returns. Investors are able to leverage on the team’s in-depth knowledge of the industry and hassle-free asset management services for real estate investments.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.