Alternative Real Estate Assets and Why They Would Catch Your Eye

Niche investments in the real estate space offer unique investment potential and diversification benefits, and they should have a seat in the investment portfolio of every aspiring investor.

When it comes to real estate investing, most investors will intuitively think of traditional real estate assets, such as office, commercial, retail, residential, industrial, as well as mixed-use properties.

“What many investors may not have realised is that there is also an array of alternative real estate assets that has been riding on rapidly growing structural demand, and has been seeing growing investment potential over the years.”

What many investors may not have realised is that there is also an array of alternative real estate assets that has been riding on rapidly growing structural demand, and has been seeing growing investment potential over the years. These include medical office buildings, senior housing, student housing, data centres, as well as film studios, among other forms of non-traditional property.

For real estate investors who are keen to venture into non-traditional assets, these offer niche pockets of investment opportunity, which could potentially deliver respectable returns that are lowly correlated with the traditional real estate assets.

Let’s take a closer look at some of these alternative real estate assets.

Medical office buildings

Medical office buildings (MOBs) are specialised properties that serve the healthcare industry, and they are powered by a structural growth in demand for medical services that is relatively inelastic due to various factors – in particular, the ageing populations worldwide.

MOBs are a subset of the office real estate sector but they are specifically tailored to meet the needs of healthcare practitioners, such as doctors, dentists, and other clinicians. According to U.S.-based property investment company, Alliance, MOBs are deemed to be able to generate long-term, predictable income that is potentially “recession-proof”.

With the growing need for specialised medical services in countries due to an ageing population, as well as more advanced medical technology, demand for such real estate is likely to continue to grow and stay firm. And that probably explains why these specialised real estate assets are perceived to be “recession-proof” by some investors.

MOBs have come a long way in some countries, especially in the U.S. According to Colliers research, total investment in MOBs in the U.S. set a record of USD17.4 billion in 2021 – up from USD11.9 billion in 2020. What this implies is that this is an important alternative real estate asset investors should keep a lookout for, and not just in the U.S., but also in countries where an ageing population has been a growing phenomenon.

Senior housing

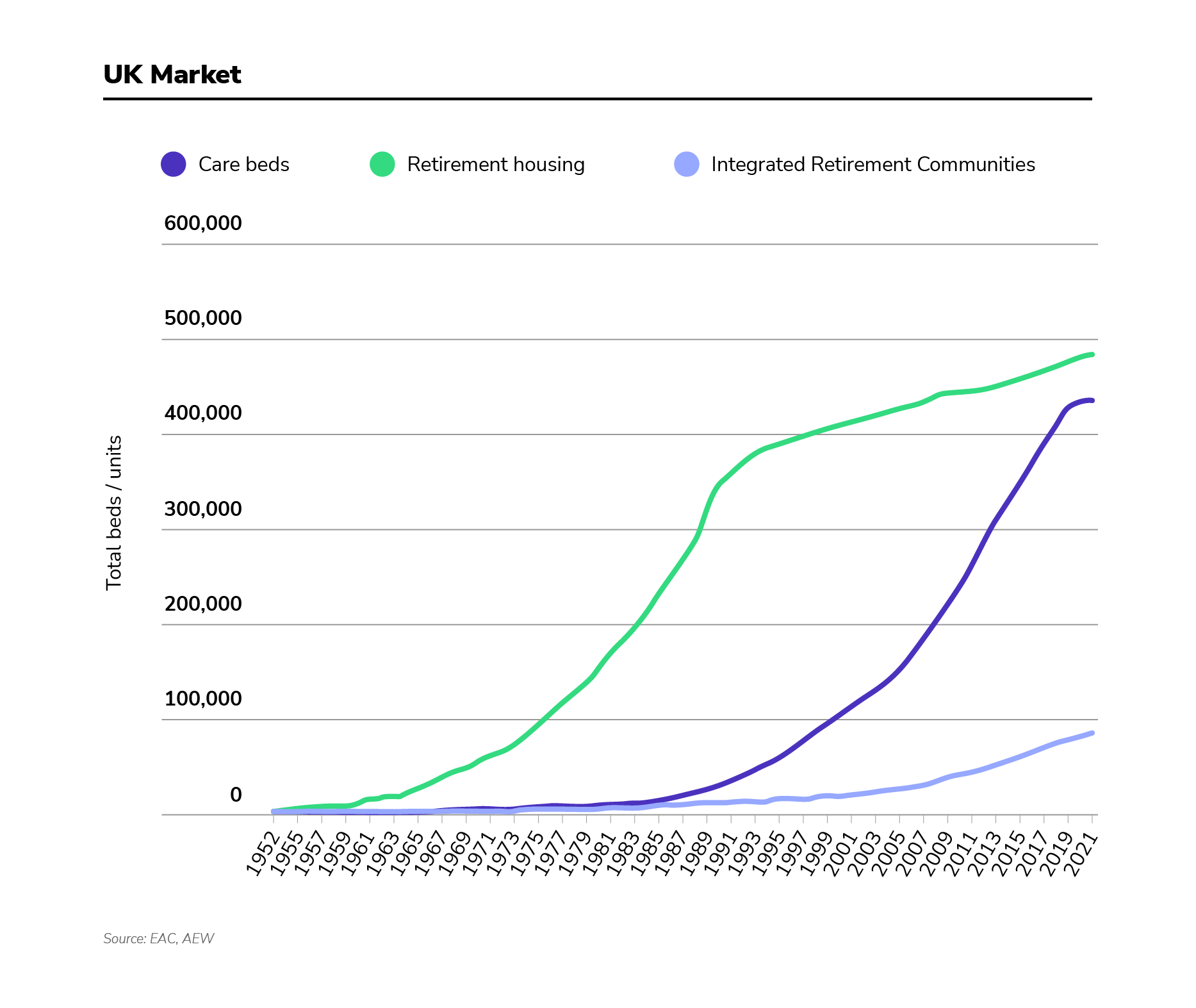

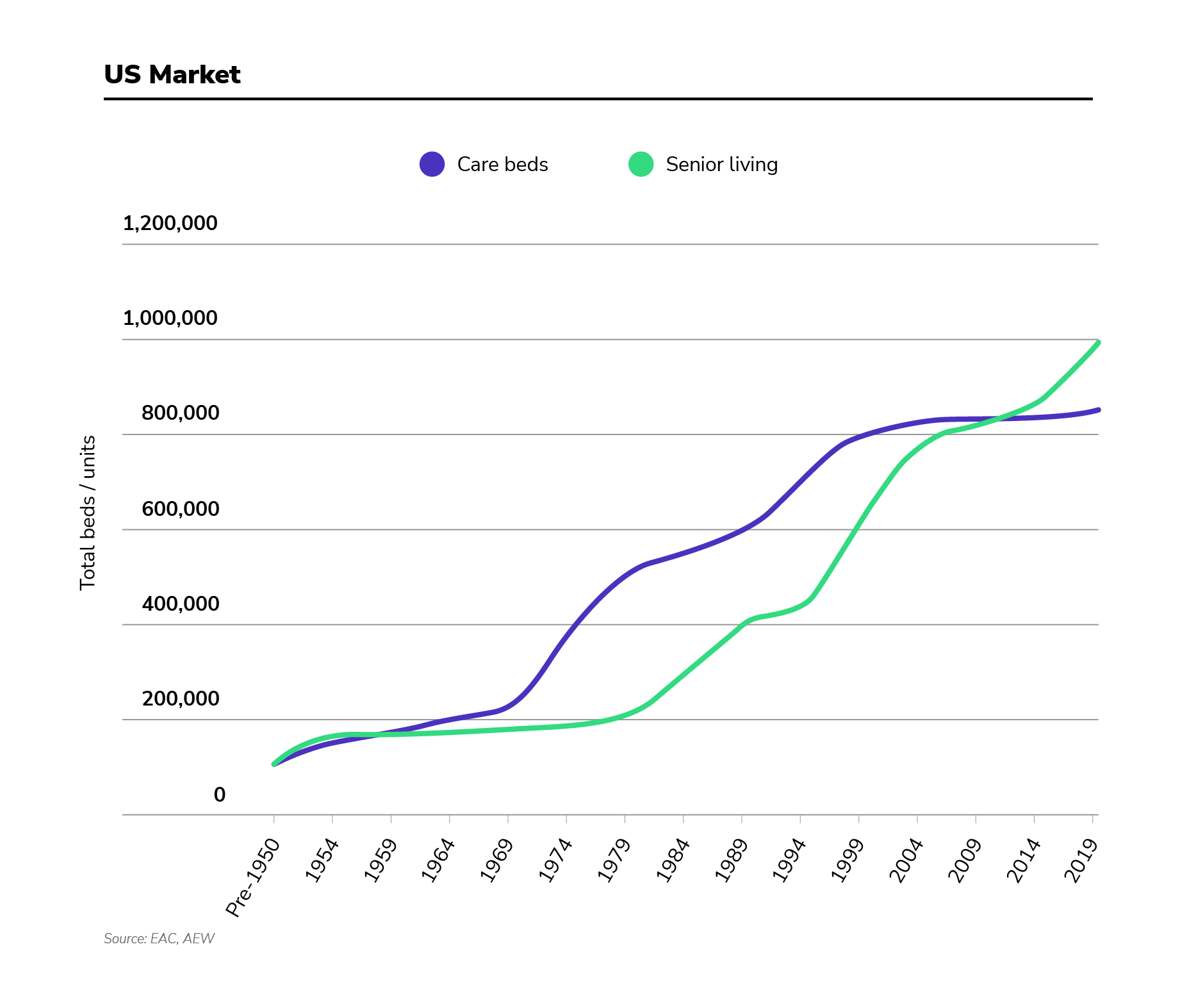

An ageing population and longer life expectancies across the world are not just driving demand for MOBs, but also that of senior housing or senior care homes. This is especially the case in the U.S., U.K., and Australia.

More than just homes, senior housing are communities designed to suit the mobility needs of seniors who are typically above 55 or 62 years old, and help them live under dedicated care and with dignity, among like-minded seniors. Many of these communities offer amenities like recreational centres or clubhouses, which come with an array of activities and services, as well as medical and nursing facilities.

While the senior housing sector is just nascent in most parts of Europe, it is a thriving market in the U.K. Just in 2021 alone, a total of GBP1.4 billion was invested in the U.K. senior housing market. The momentum has continued into 2022, with more than GBP662 million invested in the first half of this year – up 47% from the first half of 2021. It is no wonder that the demand for senior housing in the U.K. is primed for continued growth into the future, according to a recent report by Savills. Across the Atlantic, in the U.S., demand for senior living is also on the rise, and it is expected to register a compound annual growth rate (CAGR) of more than 5.2% from 2022 to 2027.

Senior housing is also catching on in Asia Pacific, with Australia, New Zealand, and Japan being the three key markets that are seeing strong demand growth. China has also been identified as an up-and-coming market of strong growth potential for these specialised real estate assets, with its fast-ageing population.

So, senior housing is indeed an investment trend that real estate investors should look out for.

Sign Up at RealVantageStudent housing

Student housing refers to student accommodations that are commonly known as “purpose-built student accommodation”, or PBSA. In countries like the U.S., U.K., and Australia, limited housing supply has led to skyrocketing living costs for many local and international students over the years. At the same time, demand for high-quality and affordable student accommodations has also contributed to the burgeoning PBSA sectors in these countries.

In the U.K., for instance, research by global real estate consultancy, Knight Frank, has shown that PBSA could be the most cost-effective solution for students looking to avoid the ongoing cost-of-living crisis, driven by inflation that has gone through the roof. This goes to say that demand for such real estate assets is likely to remain strong into the future, even if inflation tapers off at some point in time.

In Australia, the PBSA market is heavily reliant on the demand from international students, of which 79% comes from Asian students. With the return of international students from various parts of Asia, as the COVID-19 pandemic abates, this sector has renewed growth potential.

Up in the northern hemisphere in Europe, many countries are facing a significant undersupply of PBSA stock, which resulted in strong rental growth. In fact, just in the first three quarters of 2022, EUR11.7 billion was invested in PBSA across Europe, and this represents a 130% increase over the same period in 2021. Growth in Europe’s PBSA sector will remain strong, as the young population aged 15 to 19 years old in the key European cities, primarily in southern Europe and Dublin, is also expected to rise by 302,000 by 2027.

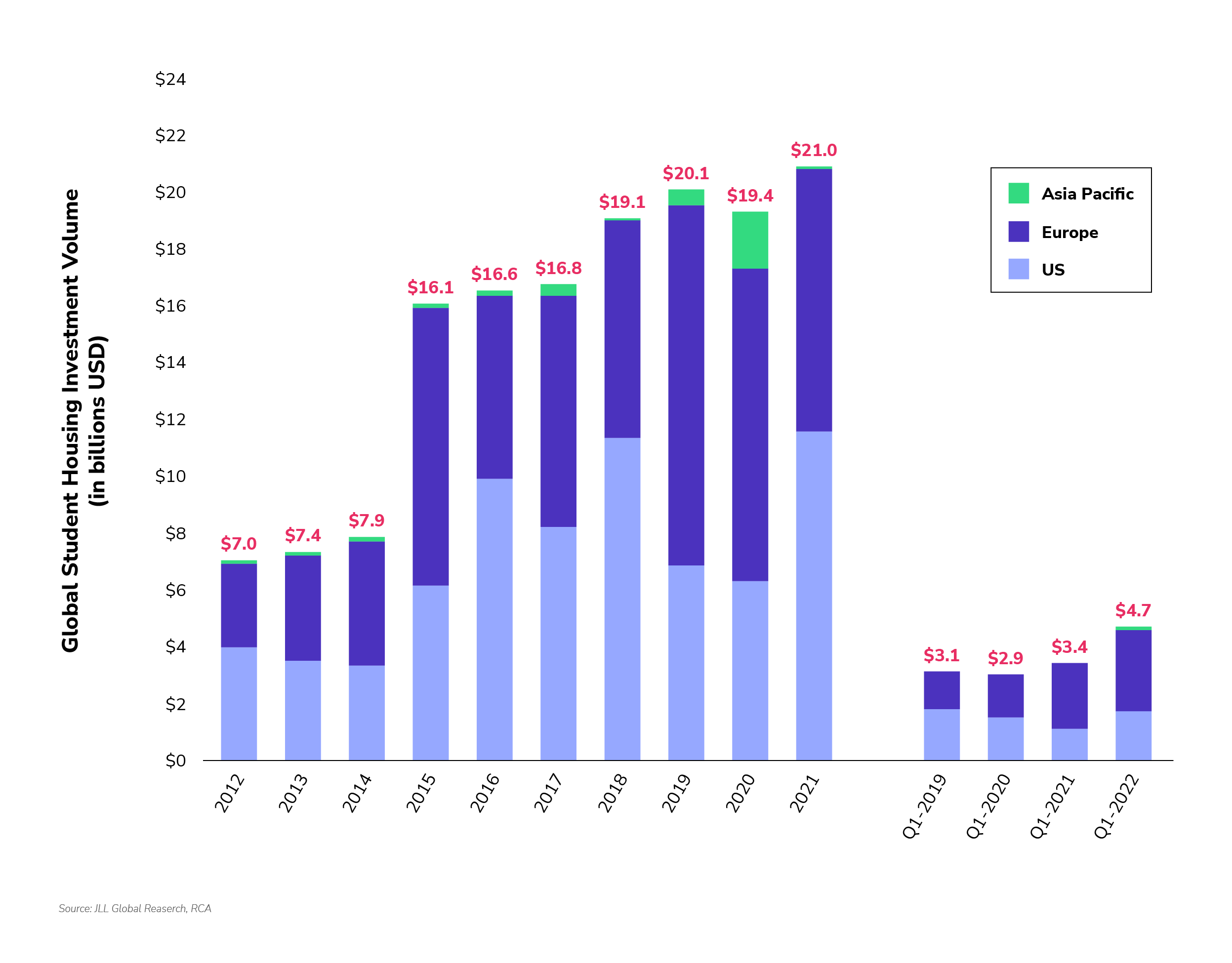

To be sure, rising demand for PBSA is a global phenomenon that spans continents, not just a few countries. And real estate investors looking to invest in alternative assets should certainly pay closer attention to this asset class. According to JLL, global student housing investment volumes rose to a record USD21 billion in 2021, as seen in the chart below, driven by major investors looking to diversify their investment exposure across various regions and submarkets.

Data centres

Over the years, demand for data centres has been driven by the growth of hyperscalers the likes of Facebook, Google, and Microsoft, which have all thrived amid the transition to cloud service. These companies provide cloud, networking, and internet services at scale, by offering organisations access to these infrastructure through an Infrastructure as a Service, or IaaS, business model.

Just in 2021 alone, total investment in data centre infrastructure worldwide more than doubled from USD24.4 billion in 2020 to USD53.8 billion. Outlook on the sector remains sanguine, as the global data centre market is projected to achieve a value of USD517.17 billion in just 10 years, with a 10.5% CAGR from 2021 to 2030.

Data centre investment has been mainly targeted in the United States and Europe so far, but the demand from the Asia Pacific region is expected to see strong future growth. This is especially so for China, which can be attributed to the rise of Chinese hyperscalers, including Alibaba, Tencent, and ByteDance.

Singapore is also a major data centre hub in Asia Pacific. In fact, it is the second-largest data centre hub in the region, after Tokyo, according to a June 2022 Colliers report, citing Singapore’s Ministry of Trade data. This growth trend is expected to continue on the back of increasing digitalisation and technological adoption by businesses and organisations, coupled with the tight supply of data centres.

However, the challenge for data centre owners is to be able to balance their operations with environmental, social and governance requirements to lower their energy consumption and carbon emissions. While these asset owners endeavour to achieve that, this sector is likely to continue growing on the back of increasing demand from hyperscalers over the long term, and investors should not miss out on the investment opportunities within.

Film studios

Yes, you read it right! You can actually invest in film studios. Not a widely known trend, growing demand for content and video production has led to the increase in demand for film production facilities – known as “soundstages” within the industry – in New York City.

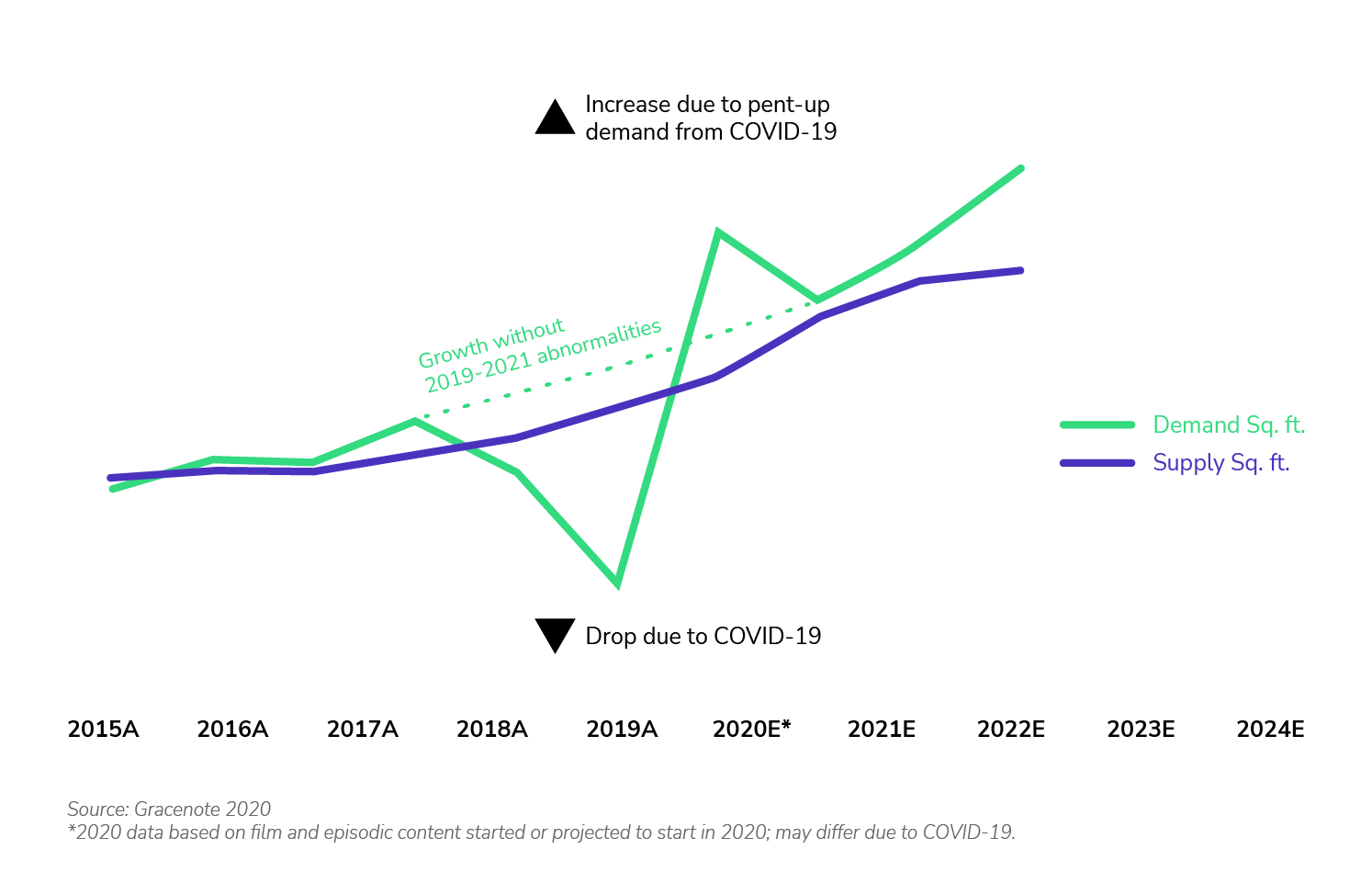

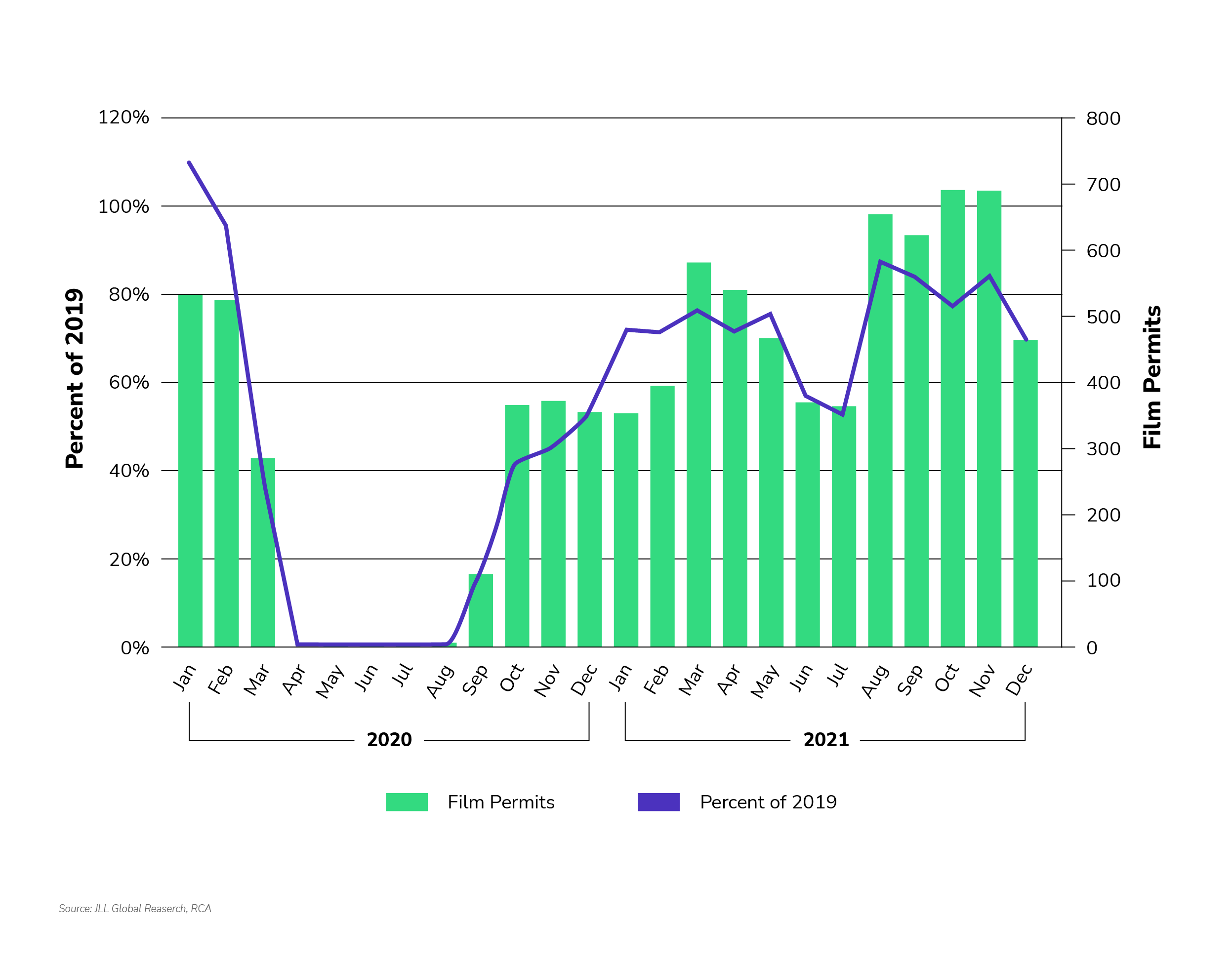

New York City is home to dozens of institutional players in broadcast media, including major programme producers, cable companies, and international news organisations. The city’s film industry has now returned to close to pre-COVID-19 levels (see chart below), and this bodes well for the demand for soundstages. In addition, demand for soundstages has also been supercharged by broadcast television, streaming video-on-demand, and advertising video, as well as the increase in spend on original content in recent years, says a Deloitte report.

According to another report by CBRE, demand for production space is also expected to outpace supply by approximately 19% of the expected square footage, as consumers watch more content and new streaming media players invest in original content. So, real estate investors may want to take a closer look at this niche alternative real estate asset type, in order to harness the pockets of opportunity it offers.

Niche investments are not without risks

While most real estate investors would usually focus on investing in traditional real estate assets, we believe that the unique growth potential of alternative real estate assets should not be ignored. Apart from niche investment opportunities, these assets also provide diversification benefits for investors who are keen to build a diversified real estate investment portfolio, as they are typically not highly correlated with traditional real estate assets.

“Apart from niche investment opportunities, these assets also provide diversification benefits for investors who are keen to build a diversified real estate investment portfolio, as they are typically not highly correlated with traditional real estate assets.”

However, it is important to be cognisant of the risks associated with such investments. Firstly, the market depth of these investment assets may be limited, so there might not be a ready pool of buyers during when investors dispose of such assets. Secondly, given the unique nature of such assets, it may be challenging to find good operators like agents, property managers, as well as builders to manage and maintain them at economical prices. Thirdly, given the niche demand for such assets, traditional lenders might not be open to finance these properties or might provide less favourable financing terms, such as lower Loan-to-Value Ratios or higher interest rate margins.

At the end of the day, it is still imperative for investors to conduct their due diligence to assess the risks and rewards of such investment properties before investing, and identify assets that can be readapted for other uses, in the event demand patterns take a turn for the unexpected.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.