What is Compound Annual Growth Rate (CAGR)?

The Compound Annual Growth Rate, or CAGR, is the calculated rate of return required for an investment to increase from its initial value to the value at the end of the investment period.

Table of Contents

The Compound Annual Growth Rate, or CAGR, is the calculated rate of return required for an investment to increase from its initial value to the value at the end of the investment period. The CAGR calculation assumes that all profits generated through the investment are reinvested throughout the investment period at the CAGR.

The CAGR may be used to track performance or to project annual returns for investments. It is commonly used by investors to determine the annual growth rate of investments where cash flows are volatile and non-uniform.

The CAGR provides a relatively accurate measure of the return of an investment, while taking into account fluctuations in its value over time. In essence, while the CAGR depicts the growth rate of an investment assuming reinvested returns, this is not a true rate of return, but rather a reflection of the average return rate over time.

Read also: Understanding IRR, Cash Yield, and Equity Multiple

Read also: How Does Internal Rate of Return (IRR) Impact Real Estate Investors' Decision-Making Process?

Formula and Calculation of CAGR

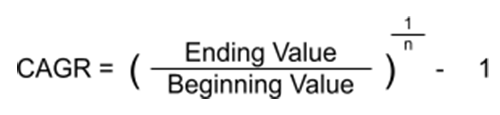

The Compound Annual Growth Rate (CAGR) is calculated using the following formula:

The ending value of the investment is first divided by its initial value. The result is then put to the power of ‘1 divided by the investment period in years’. 1 is then subtracted from the result to derive the CAGR.

Example of How to Use CAGR

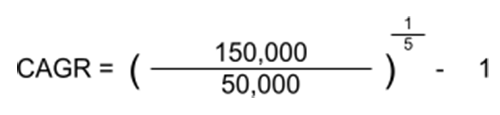

An example of the CAGR being applied is if an investor purchased 100 shares of a company’s stock in 2015 at the share price of $500 per share. This amounts to a total initial investment of $50,000.

If the share price is $1,500 after 5 years, the investment will be worth $150,000 in total. Based on these figures, the CAGR can be calculated as follows.

This works out to a CAGR of approximately 24.57%, reflecting the rate of return of the investment based on the change in the investment value, assuming that the returns received throughout the 5 years are reinvested each year.

Read also: What is Dividend Yield?

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.