Investing in Australian Residential Real Estate

Real estate investment remains a popular choice over other assets for investors in the Australian market.

- Why Invest in Australia?

a. Steady Demand for Properties

b. Stability

c. Friendly to Foreign Investors

d. Safer Market

e. Increasing Housing Prices - Rules and Regulations for Foreign Investors

- Buying Process

- Residential Property Types in Australia

a. New Dwellings

b. Vacant Land

c. Established Dwellings

d. Established Dwellings for Redevelopment - Markets

a. Melbourne

b. Perth

c. Adelaide

d. Brisbane

e. Sydney - Alternative Options

Real estate investment remains a popular choice over other assets for investors in the Australian market. However, a nuanced understanding of the workings of the Australian property market is required to be successful in investing in real estate.

Why Invest in Australia?

Steady Demand for Properties

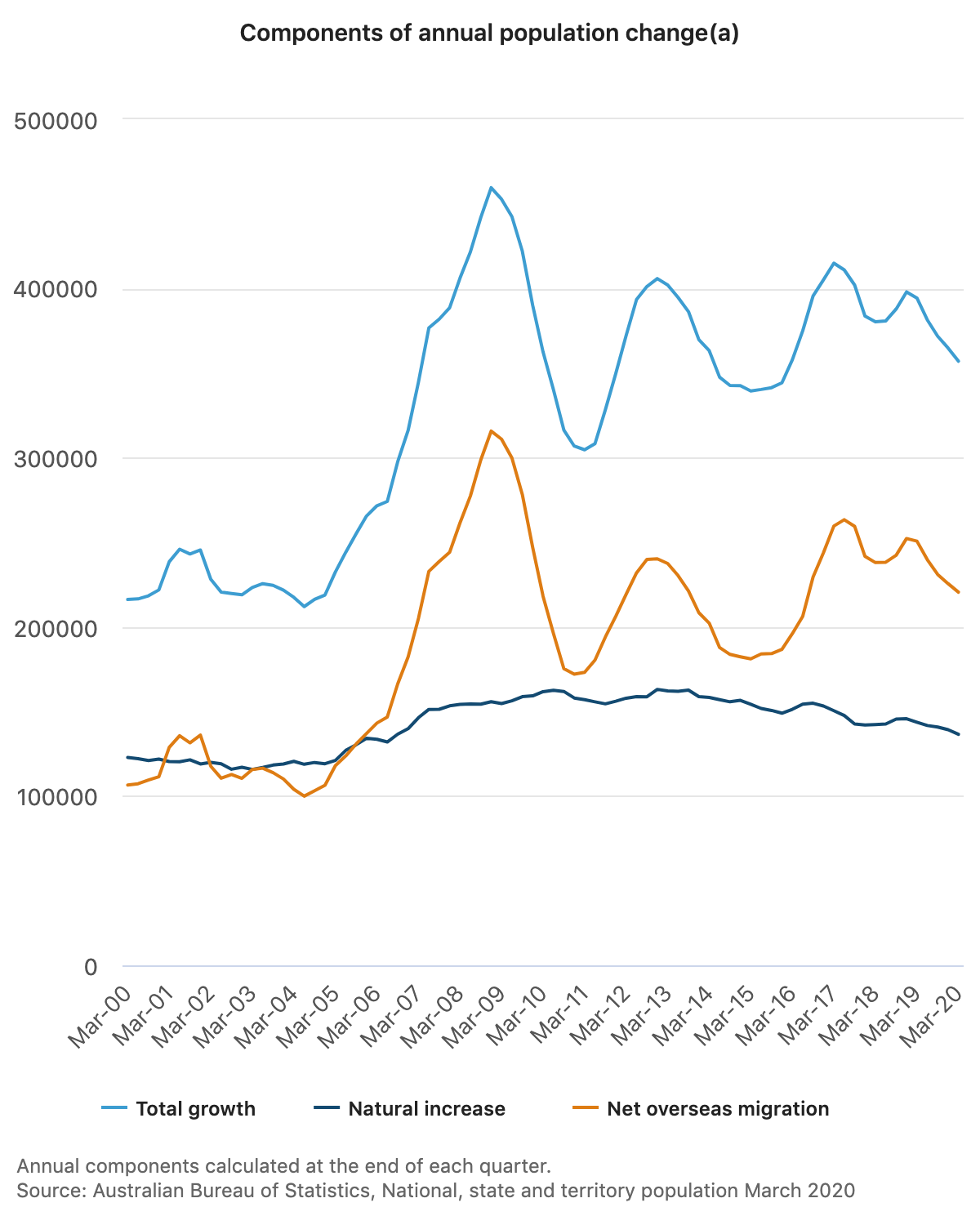

The demand for properties in Australia has been increasing steadily over the past few years, due to the increase in population size, growing at an average of 1.6% over the past 5 years. The increase in population is correlated with a steady demand for properties in Australia. This population growth is especially noticeable in major cities like Melbourne and Sydney.

Australia has also emerged as a popular migration destination, with approximately 7 million out of its population of 25 million being born overseas. This migration to Australia has further increased the overall population growth, contributing to a higher demand for property in the country.

However, the COVID-19 pandemic is expected to slow birth rates, while border closures may have a significant impact on migration rates to Australia, lowering the overall growth rate of the country temporarily. Despite this, the population is still expected to increase, albeit at a slower rate than in previous years.

Stability

The Australian property market is viewed favourably by investors as one of the most consistent real estate markets worldwide. Australian residential properties generate an average 5-7% returns on an annualised basis, with market declines lasting shorter in comparison to that of other countries.

Read also: Australian Residential Market Correction Nearing an End

Friendly to Foreign Investors

While many other countries impose overly strict foreign investment regulations, foreign investors are welcome in Australia, making it an ideal investment destination for real estate investors.

Foreign investors are also allowed to invest in and own freehold properties in Australia, opening up investment options in the market. Foreign investors may also invest in Australian properties independently, without the need to buy with a citizen or as a shareholder of an Australian company. Although government approval is required for foreign investors, the process is relatively straightforward, making the investment process accessible and easy.

Legally, Australia’s legal system is based on the Commonwealth system and therefore very similar to that of other countries such as Singapore, making it familiar to foreign investors. The National Consumer Credit Protection Act also contains sound and successful consumer protection laws, which can protect investors and create a secure investment environment.

Safer Market

While other volatile property markets such as those in the United States or Hong Kong have gone through major crashes, declines of that magnitude have never been experienced in Australia. This resilience makes Australia a safe haven for investors, shielded from the volatile price drops of up to 70% seen in other countries. Based on Australia house prices from the past century, the consistent capital growth rate has caused house prices to approximately double every seven to ten years. This bodes well for investors who may see more returns on the investment within a shorter time horizon as compared to property markets in other locations, while reducing the risk and increasing the confidence of investors.

Increasing Housing Prices

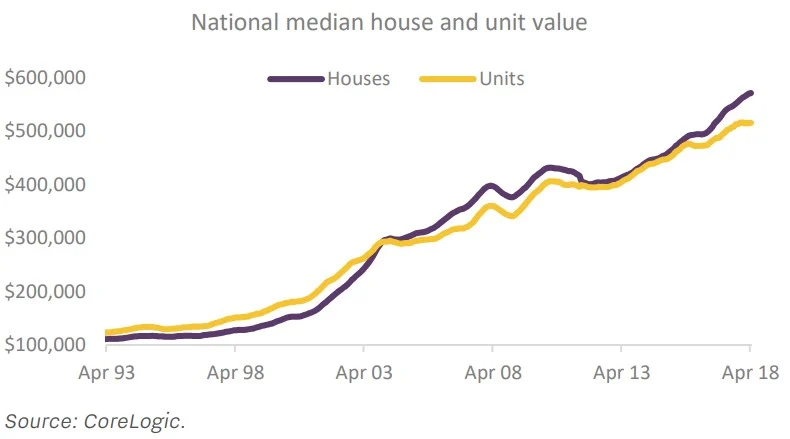

Housing Prices in Australia have grown over the past three decades, proving to be a well-performing asset and thus an excellent investment market for potential investors. With the average house prices in Australia at just A$111,524 in the 1980s, this has increased over 400% to A$549,918 in 2020. This is indicative of an average price growth of 7.25% per year, a strong growth rate which can generate a profitable return on investment, especially for long-term investors.

Rules and Regulations for Foreign Investors

When investing in a property in Australia, representation by a lawyer is required to complete all the legal procedures. The lawyer acts as legal representation for matters relating to the property. Foreign investors may have difficulty sourcing and communicating with a lawyer in Australia if they are overseas, so using an experienced investment company may be beneficial.

Taxation laws vary between states but some may offer a rebate on stamp duty costs, saving costs for investors. In addition, the tax deductions may be possible for income-generating property investments through annual tax returns.

Buying Process

Here is a step-by-step guide to investing in an Australian residential property as a foreign investor.

Before considering Australia as an investment destination, investors should understand what buying and managing an investment property entails, guided by local government advice.

Firstly, investors have to go through the legal procedures, taxation, securing a loan and purchasing insurance for their property. This may involve establishing a team of professionals, including a lawyer, accountant, broker and buyers agent. While not all these roles are required for an investment, they would be beneficial towards a smooth investment process. Loans can be acquired in other currencies from international banks. Investors may choose to do so as it may lower capital debt and other currencies typically have a significantly lower interest rate than in Australia.

Read also: What is Debt-to-Equity (D/E) Ratio and What is it Used for?

Secondly, loan pre-approval can be the difference between securing a property investment and losing out to other buyers. By getting approval for a loan before investing in a property, an investor can get an idea for the size of their loan, and the approximate value of the properties they should be looking at. The mortgage loan application process may involve a few forms and documents. Compiling these documents and submitting them takes time, which jeopardises the investor’s chance of acquiring an ideal property, which often gets taken off the market quickly. However, investors should keep in mind that loan pre-approvals can expire, so they should act fast to retain their deposit and secure the mortgage loan.

In applying for a mortgage loan, foreign investors have a narrower range of options for lenders but Australian banks typically offer up to 80% of the value of the property as a loan. As a foreign investor, approval from the Foreign Investment Review Board (FIRB) is needed to purchase an Australian property. While the approval process is quite simple, it may take up to two weeks to receive a response. This also comes with fees relative to the value of the property. When purchasing newly-developed properties, FIRB approval for the entire property may have already been sought by property developers, meaning that foreign investors are free to invest in the property directly without having to go through the FIRB directly.

Following this, investors may begin searching for a suitable investment property. During this process, it is important to look at comparable properties to ensure that the investment property’s valuation is fair and can generate desired returns. After selecting the property, a holding deposit of around A$2000 to A$5000 may be required to be deposited into a Trust Account to reserve the property for a few weeks. This will prevent other buyers from purchasing it during that period of time. Generally, Australian properties are open to negotiations and can sell for a price up to 10% lower than the listing price.

After the desired property has been found, investors should approach a mortgage broker to seek approval for their mortgage, which may take a week. Investors should refrain from formally entering into an investment before this approval has been granted. Following approval, the investor may proceed to pay the deposit for the property, which may vary but typically hovers around 10% of the property’s price. Legal advice should be sought regarding any contracts relating to the property to reduce the risk and protect the investor.

Finally, the foreign investor may apply for FIRB approval to purchase the property. It is important to note that investors should have a clause in their contract stating that the agreement is subject to FIRB approval. Contracts are required to be signed and returned to the appropriate parties. In the case of loan contracts, a witness or identification may be required when signing the contract. Foreign investors who are not in Australia may do so at an Australian consulate or embassy. After this, the property may proceed to settlement, whereby the property developer or previous owner has been paid in full, all other fees are settled and ownership of the property has been transferred to the investor(s).

For income-generating rental properties, foreign investors may choose to engage a property manager to manage all aspects of the property. In Australia, ideal tenants usually range from 25 to 39 years old, and are working individuals living closer to the city.

Read also: Understanding Property Management

Residential Property Types in Australia

New Dwellings

New dwellings refer to residential properties that are either still under development or have been developed, zoned as residential land. In order to be classified as a new dwelling, the property must not have been occupied previously or be part of a development that was sold by the property’s developer with a maximum previous occupancy of not more than 12 months. This does not include renovated established dwellings on residential land.

New dwellings are mostly open to foreign investors without any restrictions or conditions. Foreign investors may invest in an unlimited number of new dwellings but approval from FIRB is required before each purchase. Exemptions are granted for new dwelling properties where developers have approval to sell to foreign investors, provided that the exemption covers the property purchase type.

Vacant Land

Vacant land refers to undeveloped land without any permanent structures, zoned for a variety of purposes. Such land may be set aside by an existing owner or the government to remain vacant or may be available to be developed.

Foreign investors are generally allowed to invest in vacant land for the development of residential properties, with certain conditions. Typically, the land has to be developed into residential property within four years of the date of FIRB approval. After development is completed, owners are required to submit evidence of development completion within 30 days.

Established Dwellings

Established dwellings are existing residential properties on residentially-zoned land that are no longer considered new dwellings. However, there are specific rules for what properties are considered as established dwellings. Commercial residential properties in the hospitality sector such as hotels or motels are not categorised as established dwellings. The classification of student accommodation and retirement or aged care facilities may also differ, so investors should look further into this before exploring these properties as potential investments.

Foreign investors are restricted from purchasing established dwellings if they do not reside in Australia - whether the property is intended as a secondary residence or for rental purposes. Exemptions may apply if the foreign investor operates an Australian business and intends to purchase a residential property to house employees based in Australia. However, many eligibility factors still apply in this scenario.

Established Dwellings for Redevelopment

Established dwellings for redevelopment refer to existing properties that are not newly developed and are intended to be reconstructed. Foreign investors are usually permitted to purchase such properties, subject to FIRB approval and specific conditions. The existing established dwelling may not be rented out prior to being redeveloped. The redevelopment process should also increase the housing stock in Australia. This means that purchasing a property to redevelop it into another single unit property is not allowed for foreign investors.

In addition, similar to the guidelines for vacant land developments, foreign investors purchasing established dwellings for redevelopment are required to complete redevelopment within four years from the date of FIRB approval and submit evidence of completion within 30 days thereafter.

Sign Up at RealVantageMarkets

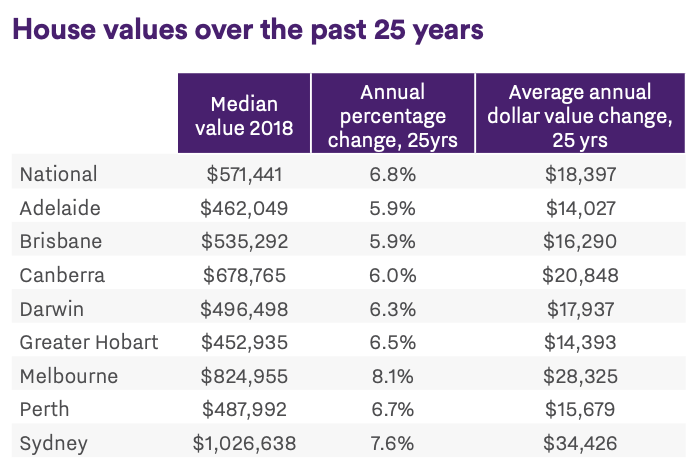

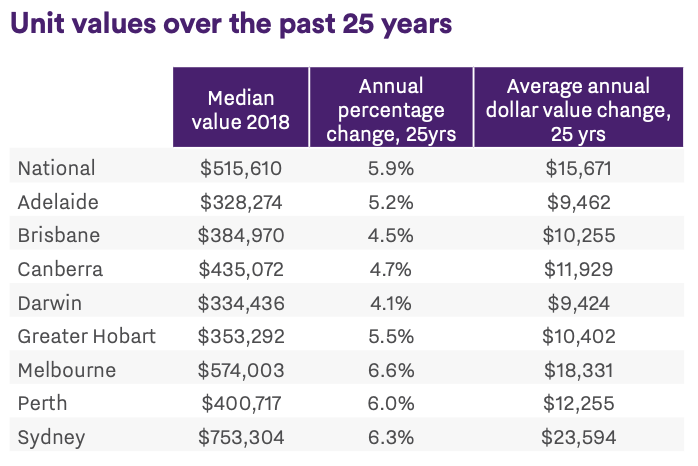

While the Australian residential property market as a whole may be an attractive option for foreign investors, there are different features within each key city in Australia that positions it differently for real estate investments. Housing prices can vary significantly between these cities, ranging from an average of A$462,049 in Adelaide to A$1,026,638 in Sydney, with the average national house value at A$571,441.

Unit prices, while slightly lower, follow a similar pattern as the house values, with the lowest average unit value in Adelaide at A$328,274 and a high of A$753,304 in Sydney, with a national average of A$515,610.

There is also an increasing number of independent youth within these cities, who are likely to form a large proportion of the housing demand in the years to come.

Read also: Market Selection in Real Estate - RealVantage’s Approach

Melbourne

Melbourne is a large and sprawling city of 4.936 million, consisting of several suburbs, with each suburb holding a unique investment environment for potential buyers. The city provides a strong median gross yield, with a high of 2.8% in the suburb of Kensington. Rents vary significantly, with an unusually high median weekly rental rate at A$1,050 in the suburb of East Melbourne.

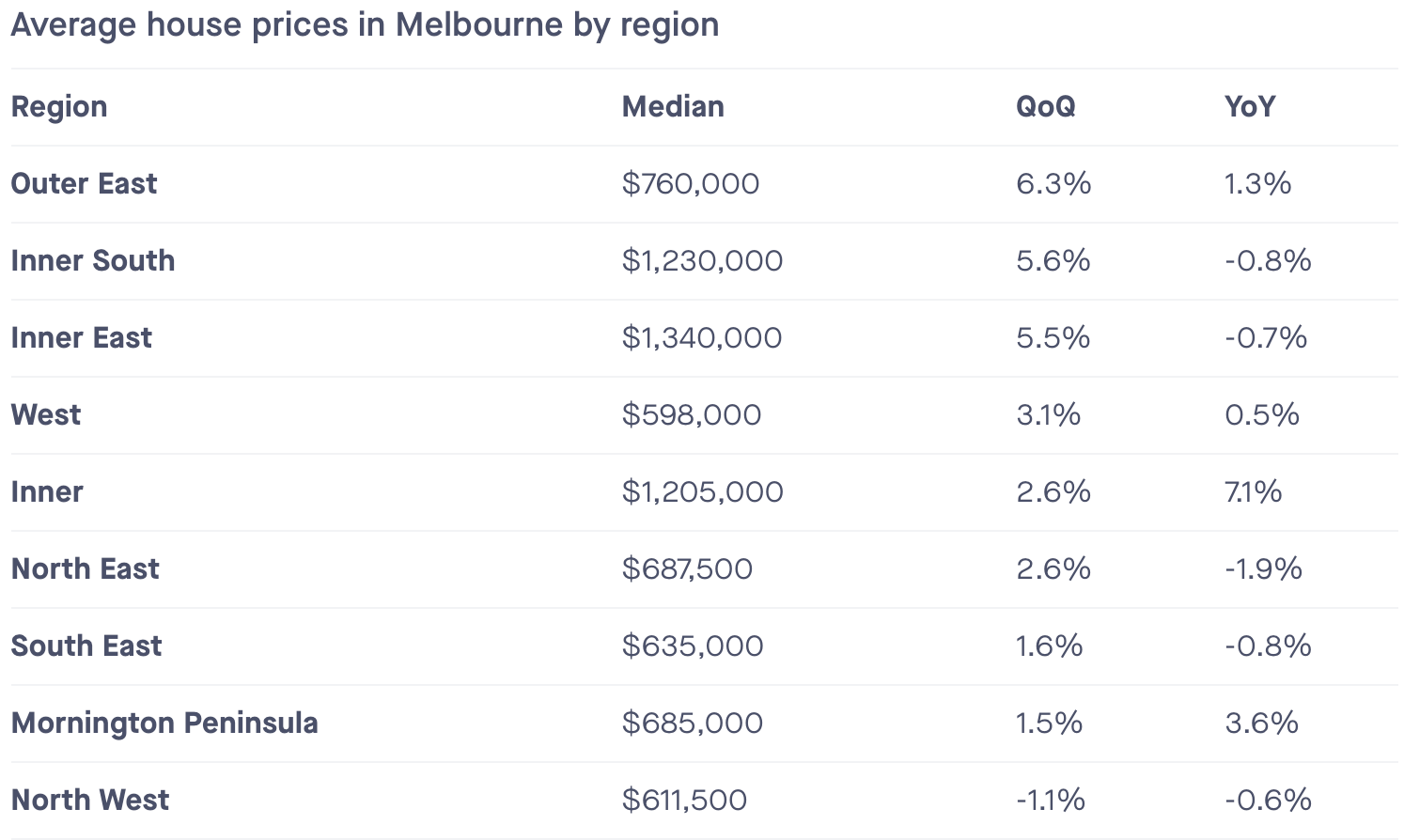

The average house price in Melbourne sits above the national average at A$798,000 based on the past year of house sales. However, housing prices differ significantly depending on the suburb, with inner suburbs closer to the CBD having higher housing prices. This can be seen through the average house prices in each region, with the highest at A$1,340,000 in the Inner Eastern suburbs and the lowest at A$598,000 in the Western suburbs. This is impacted by a few different factors. Most importantly, the location of the property and its proximity to the Melbourne CBD is correlated with the property price. Melbourne is a highly sought after location for foreign investors, which also plays a role in driving up the high property prices.

Perth

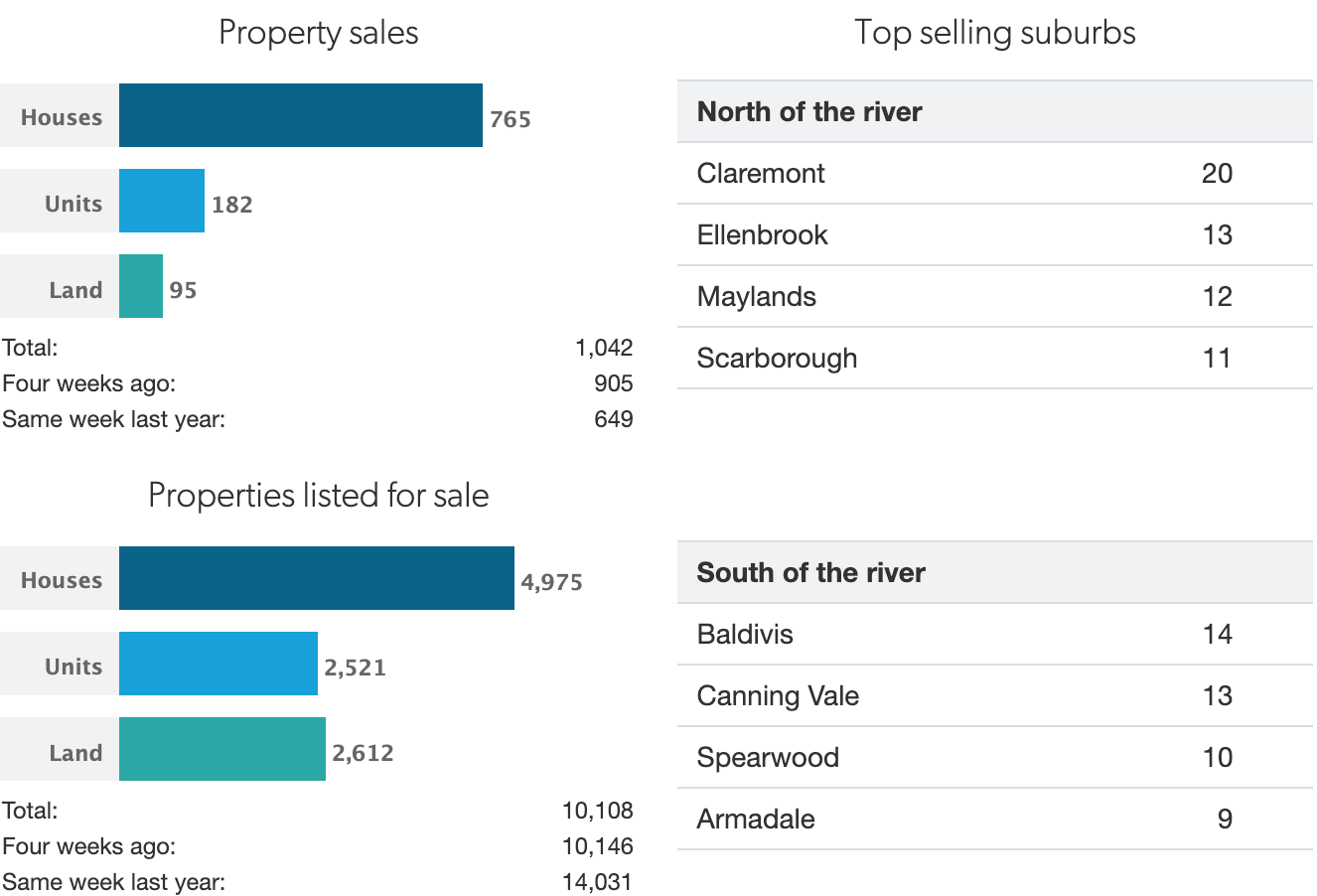

The housing market in Perth is relatively small compared to other cities like Melbourne and Sydney, with a population of just 1.985 million, but property sales have been performing well nonetheless. The city of Perth is separated by the Swan River, with the top selling suburb of Claremont located North of the river. Southern suburbs also enjoyed a fair number of house sales, with the highest number of house sales in the Southern suburbs in Baldivis.

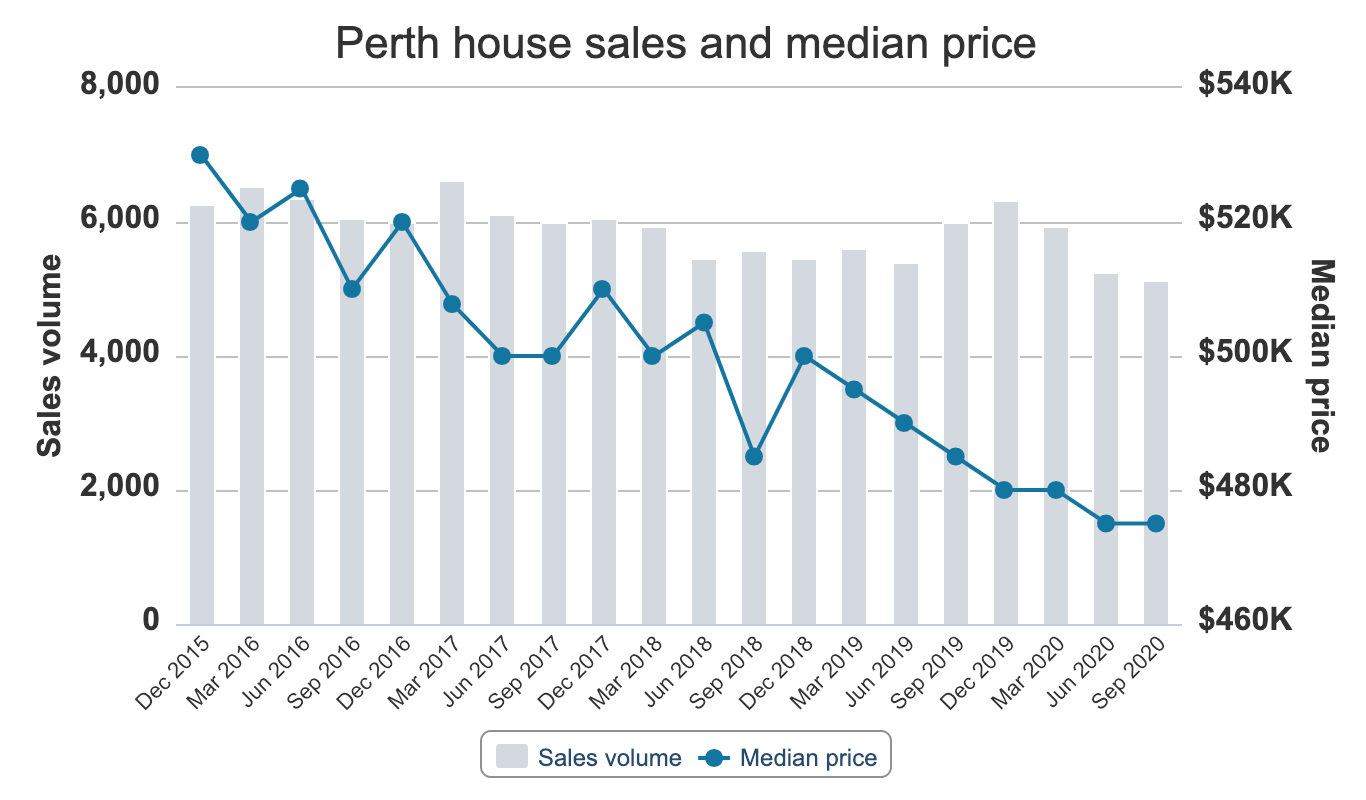

The median rent is highest in East Perth, with a weekly median rent of A$580, with a median gross yield of 3.4%. However, the median price of properties in Perth has seen a downward trend, sitting at a quarterly median of A$475,000 as of September 2020.

Adelaide

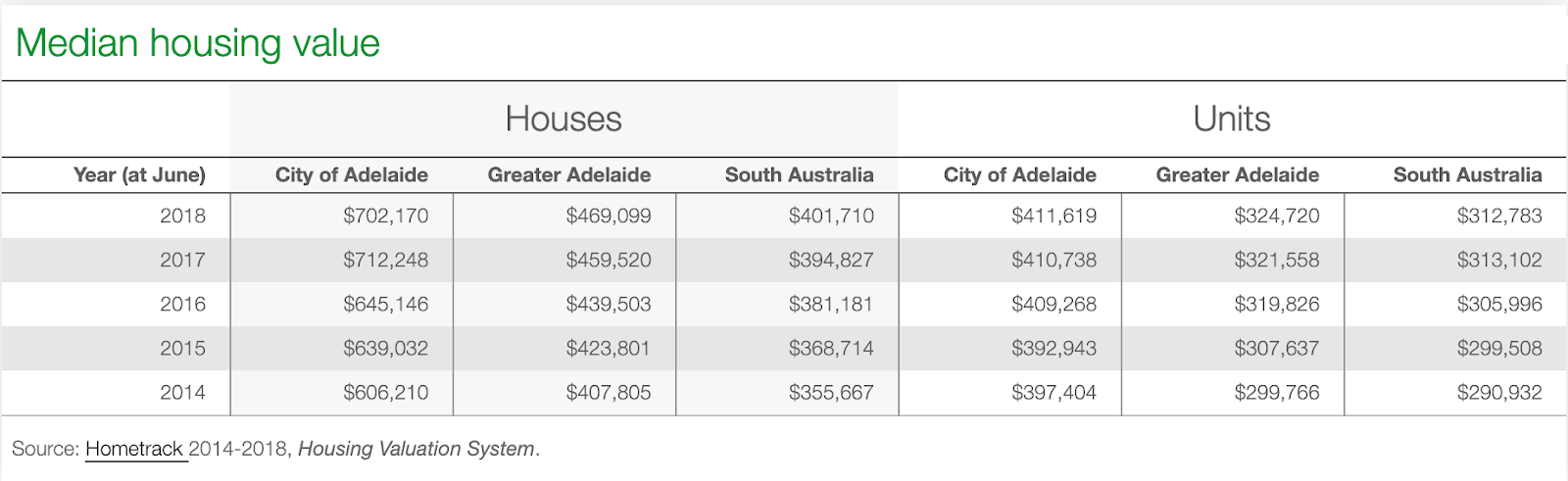

The city of Adelaide is home to just 1.306 million people, with a median house price of A$483,750 over the past 12 months. Following similar trends in other Australian cities, properties in suburbs closer to the city and CBD area have a significantly higher median price than those outside. This is seen in the median housing value data for regions in Adelaide, with central house prices almost 50% higher than those in the Greater Adelaide area.

Brisbane

Brisbane has a population of 2.28 million, fuelling a pronounced demand for housing in the city. This is supported by its high indicative gross rental yield of 4.6%, the highest among the major cities in Australia. New or near-new housing units have weekly rents between A$450 and A$620, much higher than rental rates of established dwellings, proving to be a positive factor for foreign investors.

Read also: Macro Overview of Brisbane

Read also: Brisbane Riding on Cyclical and Structural Tailwinds

Sydney

The city of Sydney is the largest in Australia, with a population of 5.23 million. Correspondingly, Sydney has seen the highest number of house sales in the past year, with the median sale price being the highest in Australia at A$1,200,000 over the past 12 months. The suburb of Millers Point has the highest median weekly rent of A$945, with a high median gross yield of 44.7%, driven by the low median sale price of A$110,000 over the past year.

Alternative Options

Due to the number of requirements and steps in the process of investing in Australian properties, foreign investors often invest through third-party companies. An alternative way to gain exposure into real estate is via co-investment. Co-investment platforms allow foreign investors to invest directly in Australian properties, without the hassle of going through the entire investment process on their own. With the right selection of a co-investment platform, investors can capitalise on the benefits of cross-border property investments while reducing the challenges that traditionally hindered it.

Read also: Selection of Real Estate Co-Investment Platforms (Best Practices & Risk Management)

RealVantage is a co-investment platform that sources and invests in properties throughout key Australian cities. Each property is vetted through by a team of real estate professionals. For properties that are put up on the platform, an investment memorandum is put up detailing the investment strategy, time horizon, expected returns, fees structure and more. This provides transparency between the platform and its investors allowing them to make wise investment decisions with the objective put up by seasoned professionals. Find out more about co-investment options at RealVantage.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.