Brisbane Riding on Cyclical and Structural Tailwinds

As the curtains are drawn on a tumultuous 2020, Australia stands out as a small elite of countries that has handled both the pandemic and its economic fallouts impressively.

Table of Contents

- Australian Economy Poised to Race Ahead

a. COVID-19 Fiscal Stimulus as a % of GDP

b. Economic Growth Forecast 2021 - 2025

c. Unemployment Rate and Domestic Demand

d. Unemployment Rate Forecast - What About the China – Australia Tensions?

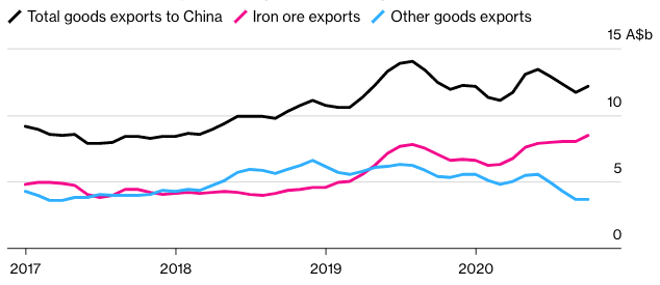

a. Australian Iron Ore Export Picking up Slack from Other Exports - Outperforming Outperformer

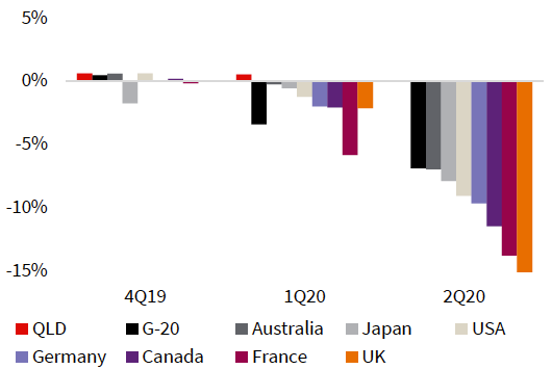

a. Quarterly GDP Growth Rate

b. 3Q 2020 Data Release - Robust Metals and Mining Prices

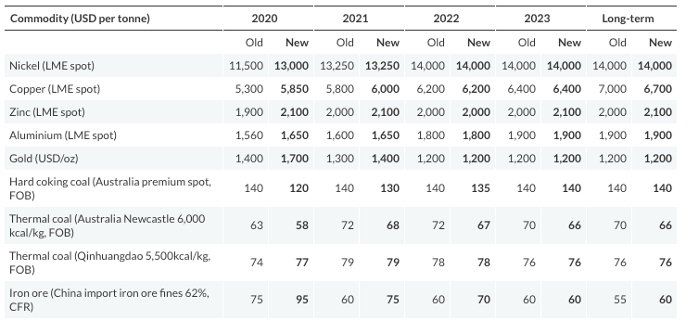

a. Metals and Mining Price Assumptions - Rebound in Tourism Contribution

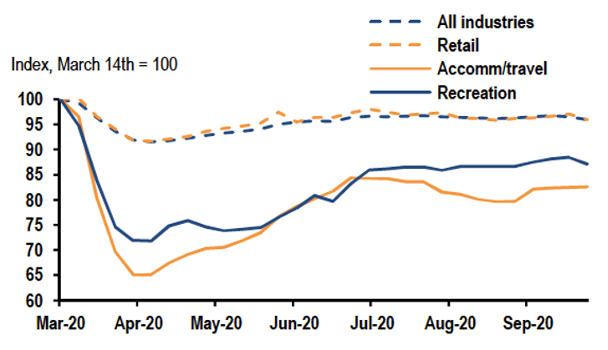

a. Industry Level Payrolls

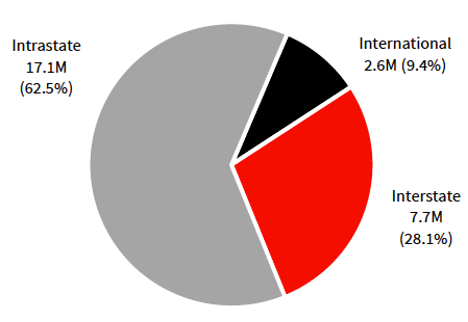

b. Queensland – Total Visitors (Millions) - Brisbane Gets Secular Growth Boost From Infrastructure

Australian Economy Poised to Race Ahead

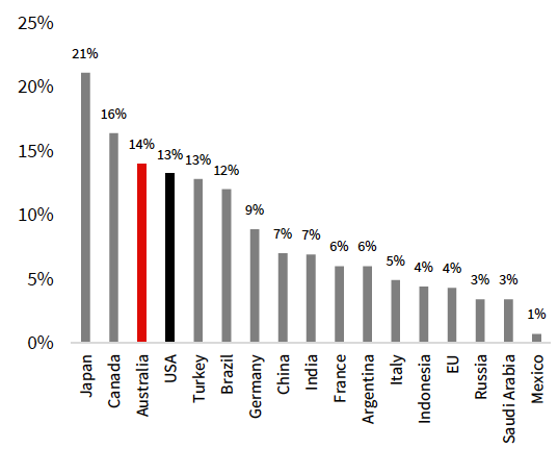

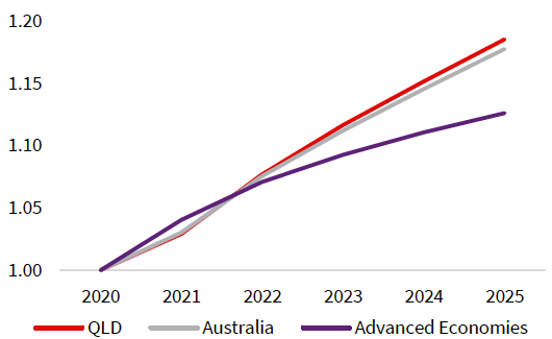

As the curtains are drawn on a tumultuous 2020, Australia stands out as a small elite of countries that has handled both the pandemic and its economic fallouts impressively. The confluence of firm leadership, nation-state capability, social cohesion and public culture ushered Australia into the post-pandemic cycle faster than many other envious countries. An earlier emergence from containment measures, in addition to the speed and scale (Figure 1) of the government’s fiscal response have laid the foundation for economic outperformance going forward. Forecasts from Oxford Economics place Australia on a firmer recovery trajectory over the next five years (Figure 2).

Figure 1: COVID-19 Fiscal Stimulus as a % of GDP

Figure 2: Economic Growth Forecast 2021 - 2025

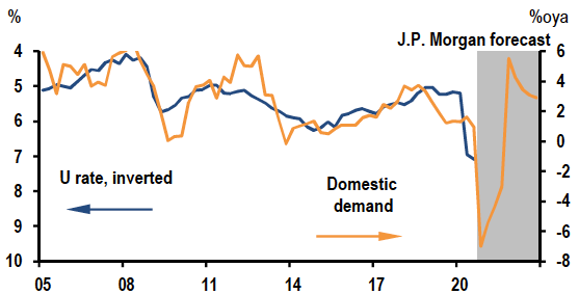

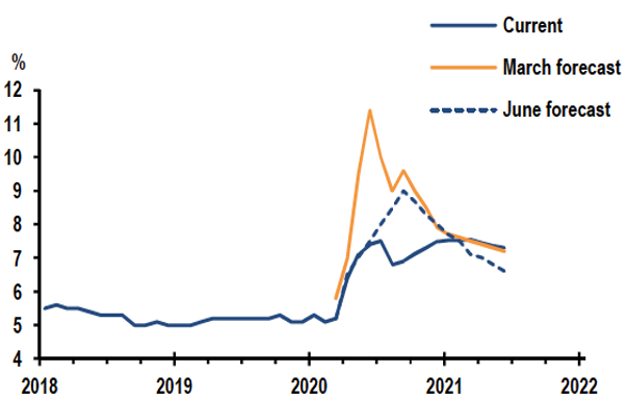

It is important to note that more than just being an economic barometer, people feel the pulse of the economy through the jobs market rather than GDP. On this front, the labour market has proven to be much more resilient than historical data would suggest (Figure 3). Where unemployment rate (inverted) used to track domestic demand closely, the government’s aggressive policy response – a cocktail of unprecedented fiscal spending and record-low interest rates – proved effective in stemming the shedding of jobs. This prompted the RBA (Royal Bank of Australia) and J.P. Morgan (Figure 4) to significantly revise their unemployment rate forecasts to reflect a markedly shallower peak. Hearteningly, latest 3Q data showed gross operating surplus or business profits rose again, up 3.9% to be a staggering 18.2% higher than a year ago.

Read also: Investing in Australian Residential Real Estate

Figure 3: Unemployment Rate and Domestic Demand

Figure 4: Unemployment Rate Forecast

What About the China – Australia Tensions?

Just this past week, Nomura joined the chorus to upgrade Australia’s growth forecast. Yet all this growing optimism stands seemingly in contrast to tension that continues to seethe between Australia and China, its largest export destination. With China levelling trade barriers at an increasing range of Australian exports – beef, barley, seafood, wine etc. – the improved forecasts by economists appear counter-intuitive.

As Figure 5 shows, the overall health of Australian exports has been buoyed by China’s addiction to iron ore. To date, the total value of exports impacted by China’s restrictions accounts for just 0.3% of Australia’s GDP. Where exports of other goods to China have fallen off, iron ore exports have plugged the gap. Importantly, China’s V-shaped recovery riding on huge infrastructural projects and the inelasticity of global iron ore supply mean they will remain dependent on Australian iron ore. For the foreseeable future, Australia is expected to continue running a healthy, albeit uneven, trade surplus – explaining at least in part, Canberra’s defiance against their largest trade partner.

Read also: Market Selection in Real Estate - RealVantage’s Approach

Figure 5: Australian Iron Ore Export Picking up Slack from Other Exports

Outperforming Outperformer

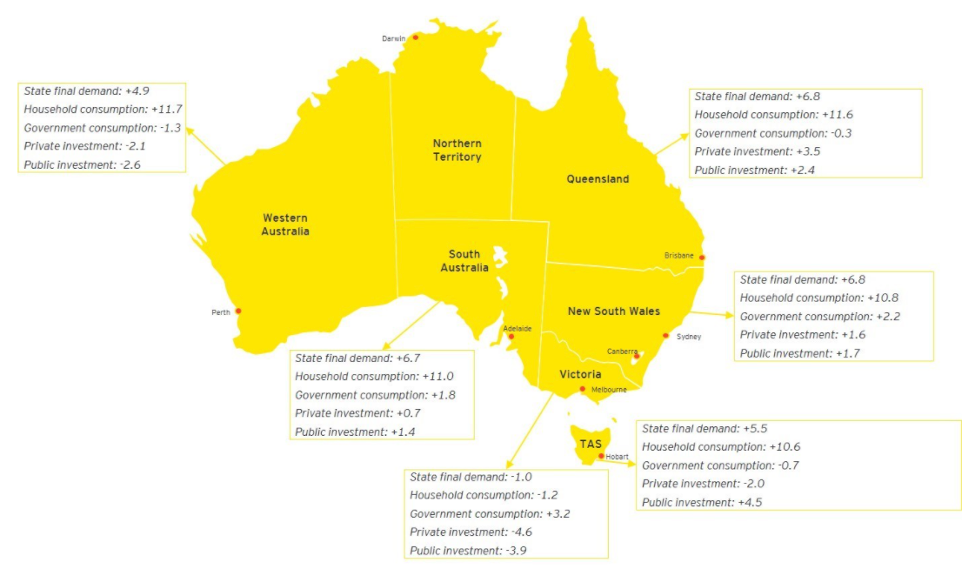

The investment case for Brisbane starts with it being the capital city of Queensland. While COVID-19 has roiled economies globally and growth has deteriorated sharply, Queensland has arguably escaped relatively unscathed, thanks to its resilient economic structure (Figure 6). While we do not expect clear blue skies ahead, especially within the near term, Queensland has a much smaller hole to dig itself out of, metaphorically speaking. We anticipate the revival of the state’s vital signs to stage an earlier rebound once impact from the cyclical economic drivers transmit through. Already, recent release of 3Q data shows the state coming off the blocks ahead of other Australian states except New South Wales (Figure 7).

Figure 6: Quarterly GDP Growth Rate

Figure 7: 3Q 2020 Data Release

Looking ahead, we see a convergence of cyclical and structural factors that will drive the recovery trajectory of Queensland and Brisbane further.

Robust Metals and Mining Prices

As the capital city of a mining state, Brisbane benefits from:

- Queensland’s modern, diversified economy of which industries that have proven resilient through the pandemic – mining, healthcare, public services, logistics – constitute a significant portion.

- Entering the recovery phase, we think robust metals and mining prices will give a boost to resource-rich Queensland. On the back of favourable demand-supply dynamics ahead, Fitch Ratings revised metal prices upwards recently (Figure 8).

Figure 8: Metals and Mining Price Assumptions

Rebound in Tourism Contribution

Unsurprisingly, tourism has been amongst the most adversely impacted sector through the pandemic. This has been a uniform theme globally and Australia is no different, as can be seen from the drop off in payroll (Figure 9). Where Queensland stands out, is the state’s huge proportion of domestic visitors, accounting for 90.6% of total visitors (Figure 10). We expect national border restrictions to be amongst the last measures to be lifted and a meaningful proportion of the c.AUD 50 billion (in 2019) usually consumed offshore on international trips to be redeployed domestically. With its relatively less reliance on international tourism, Queensland is well-positioned to receive a significant boost where households substitute domestic holidays for international travel.

Figure 9: Industry Level Payrolls

Figure 10: Queensland – Total Visitors (Millions)

Read also: Implications of COVID-19 Aftermath on Real Estate Sectors

Read also: RealVantage's COVID-19 Viewpoints and Strategies

Brisbane Gets Secular Growth Boost From Infrastructure

Even during normal times without a pandemic, the development of economic enabling infrastructure has demonstrated time and again to be a huge boon for local growth. In the post-pandemic era, we believe such economic dividends would be more impactful than before. On this note, the Queensland Government’s Economic Recovery Plan – built on the foundation of a AUD 51.8 billion infrastructure program – provides a strong starting point.

Of the entire infrastructural ticket size, around 40% of all funded work in the pipeline is focused in South-East Queensland with Brisbane expected to see the highest levels of work over the next few years. This is a highly credible infrastructure and development pipeline with funding for 99% of these projects already in place.

Australia’s third largest city held the official launch of the AUD 1.1 billion second runway at the Brisbane International Airport in July this year, signalling a vote of confidence in Queensland’s future even as passenger services were almost completely absent due to COVID-19 restrictions. Looking ahead, Brisbane’s skyline is shaping up to look very different in a span of a few years.

A spate of major, multi-billion developments including the game-changing cross river rail, Brisbane Metro project, Queen’s Wharf lifestyle and entertainment precinct, major waterfront development at Eagle Street Pier, Griffith University’s vertical campus at Roma Street Station, 17,000-seat entertainment venue pegged for Brisbane Live arena etc. are expected to dramatically transform the areas in and around Brisbane’s CBD. More than just a short-term economic stimulus, these mega-developments add to Brisbane’s value-proposition for businesses and will sharpen the city’s competitiveness over a much longer horizon.

Read also: Marcro Overview of Brisbane

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.