Investing in the U.K. Real Estate Market

This article provides a comprehensive guide to property investment in the U.K., with tips for foreign investors looking to get into the U.K. real estate market.

Overview of the U.K. real estate market

Real estate markets vary considerably throughout the world. The U.K. property market as a whole has high average yields of about 5.31% as of May 2020, beating other key European countries and fast-becoming a hotspot for investors. This article provides a comprehensive guide to property investment in the U.K., with tips for foreign investors looking to get into the U.K. real estate market.

What are the best areas in the U.K. to invest in?

London

As the capital city of the U.K., London is a popular investment destination, due to high demand for housing and rental properties. Buy-to-let properties are a popular investment option in London, with an average rental yield of around 2.83%. Average residential property prices sit at £666,160 in London as of end-2020, significantly higher than other cities in the U.K., and with a five-year capital growth rate of 12.7%.

London has also been ranked as the top European city in the Global Cities 30 Index and as the second-best city globally for property investment. The success of London has also had a ripple effect on other cities throughout the U.K., which are connected, such as Birmingham, which is a two-hour train journey from London.

Birmingham

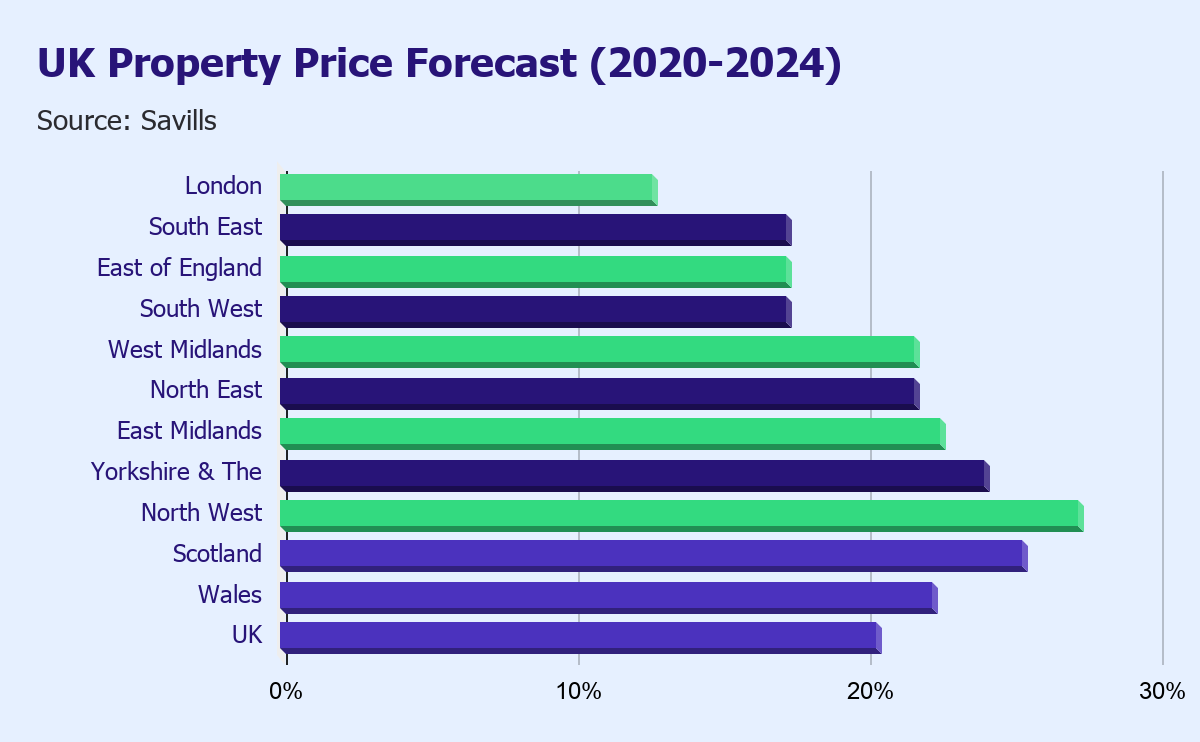

Birmingham is a great investment city, particularly for buy-to-sell investors, due to the high capital growth rates in the region. As part of the West Midlands area in the U.K., property prices in Birmingham are expected to rise by 21.7% in the next 5 years, according to Savills. This follows its history of significant capital growth, with housing prices growing by 31.67% in the past decade. This prevalence of capital growth makes Birmingham an attractive city for investors hoping to get returns through capital appreciation.

Liverpool

Liverpool is a popular investment city, due to its relatively lower property prices, positioning it as one of the most affordable cities for real estate investment in the U.K. The average property price in Liverpool is GBP182,913, making it an ideal choice for property investors looking for a lower-cost investment, while still being able to reap decent rental yields of about 5.48%. In addition to this, Liverpool also has strong capital growth rates, with prices rising by 15.1% since 2019, generating strong returns for real estate investors.

The large size of the city of Liverpool implies that the property market can vary depending on the postcode, so property investors should focus on the L1, L2, and L6 postcodes for their affordability.

Read also: Manchester as an Investment Destination

Read also: Overview of St Andrews (Scotland, UK) as an Investment Destination

Types of Properties to Invest in the U.K.

There are a few ways to invest in properties in the U.K. The main investment methods are through buy-to-let, buy-to-sell, and development properties, as well as REITs.

With buy-to-let properties, investors invest in a property with the intention of leasing it out to tenants. This allows the investor to benefit from returns from the property through rental income and enjoy potential capital growth through the appreciation of the property’s value. This is a lucrative investment strategy, as it allows for multiple forms of returns, making it popular among investors. For buy-to-let properties, investors typically hold the property for a longer time than buy-to-sell properties, so that the property can generate more rental revenue passively.

Buy-to-sell properties, on the other hand, mainly generate returns through increases in property value. This strategy is also known as “property flipping”, whereby an investor purchases a property typically in need of repairs or in poor condition. The investor then refurbishes the property and sells it for a higher price, generating a profit margin. This is a shorter-term investment strategy but is also risky if investors do not select a property wisely, since the investment could generate a loss, if the refurbishment costs or acquisition price is too high to generate a profit.

Another strategy is through property development, where investors take on the role of a property developer and purchase land or property with the purpose of developing it for sale. While this gives investors the most freedom in terms of planning and building to their specifications, it also requires a large degree of expertise and knowledge of property development. While newly developed properties are often sold at a large profit, the process of developing the property can take up a lot of time and effort, as well as additional capital beyond the acquisition price.

Finally, investors may also invest in U.K. properties through real estate investment trusts (REITs). REITs are companies that own, manage and operate income-generating properties. Investors in REITs indirectly invest in these properties and get returns through dividends paid out by the REITs at set times, which differ from REIT to REIT. REIT share prices also fluctuate according to market forces and investor demand. Investing this way gives investors little control over the specific properties they are investing in, and while potential returns are considered relatively low compared to other forms of property investment, it is generally viewed as a safer and lower-risk investment.

Read also: An Overview of Investing in REITs

Sign Up at RealVantagePros and cons of investing in the U.K.

As with any market, property investment in the U.K. has its pros and cons. With the U.K.’s mature economy, the country offers strong potential on investors’ returns. However, the market also comes with certain risks that investors should be aware of. As with any investment, Investors should weigh the costs and benefits, before entering the U.K. property investment market.

Pros of investing in U.K. properties

High rental returns

Rental returns are one of the most important considerations, when investing in real estate, especially for buy-to-let properties. Returns from rental properties are represented by the rental yield, which is calculated by dividing the annual rent by the value of the property. However, rental yields can vary drastically between postcodes and investors should conduct research specific to the area in which they are investing. Nevertheless, the U.K.’s rental yields of as high as 10% can be quite attractive to investors.

Read also: Understanding IRR, Cash Yield, and Equity Multiple

Read also: What is Cap Rate?

In addition, the undersupply of rental properties in the U.K., and a shift towards building higher quality, rather than a high quantity of properties is increasing competition, driving up rental rates, and generating higher returns for investors. This trend is expected to continue to increase rental returns in the U.K. property market.

Capital growth potential and increasing property prices

Capital growth is another important factor in property investment and applies to all property types. It refers to the property’s increase in value over time, through a comparison of the property’s value at the time of purchase and sale. Capital growth is part of the profit gained by property investors and typically takes a longer period of time to be realised. The U.K. has shown signs of economic recovery from the impact of the coronavirus and property price forecasts have predicted average price growth of 20.4% throughout the U.K. over the next five years, with the slowest recovery expected in London.

The slower recovery is driven by the disproportionate economic impact of the pandemic on the capital city of London, as well as increased levels of local and foreign investment in more regional areas in the U.K. Nonetheless, the U.K. as a whole can provide strong capital growth opportunities for investors.

Read also: Implications of COVID-19 Aftermath on Real Estate Sectors

Strong demand for properties

The strong demand for properties in the U.K. is largely driven by residential undersupply; this means that the number of people looking for rental properties has exceeded the number of rental properties available in the market.

There has also been a shift in lifestyle choices, with many individuals re-evaluating their living arrangements and shifting towards long-term renting in more central areas. Core regional U.K. cities are also increasing in popularity amongst renters, as they are relatively affordable, and this has been driving up rental demand.

The demand for rental properties in the U.K. is largely made up of a younger demographic of students, driven by the strong educational credentials of the U.K., and young adults who have yet to get into homeownership. Properties in close proximity to highly sought-after institutions often enjoy strong rental demand.

Read also: Purpose-Built Student Accommodation (“PBSA”) as an Asset Class

Reduced Stamp Duty Land Tax

The U.K. government has temporarily reduced Stamp Duty Land Tax (SDLT) until 31 March 2021 to boost a weakening property market. The reduced SDLT applies to residential properties, with a 3% increase for additional properties, providing good value for investors.

Regeneration

With such steep property prices in London, investors have been turning towards alternative regional cities. Major cities in regional areas of the U.K., such as Birmingham and Manchester, are undertaking major regeneration and development projects which improve connectivity and amenities.These projects add value to the properties in these cities by making these cities more attractive to potential residents or businesses, increasing the demand for real estate in the area.

Shift towards renting

In the U.K., the millennial generation is shifting towards renting, rather than owning homes, with close to 40% of individuals in the U.K. privately renting their homes at age 30. For investors, this signals a change in mindset that is beneficial for buy-to-let investors, with the higher rental demand reducing the investment risk and securing returns for investors.

Low interest rates

The interest rates in the U.K. are at a historical low of 0.1%, cut from 0.75% in March 2020 by the Bank of England. This low-interest rate environment allows lenders to provide low property mortgage rates to lenders and investors. It is also a good time for investors to remortgage their existing properties at lower rates to get better value out of their property investments.

Increasing population

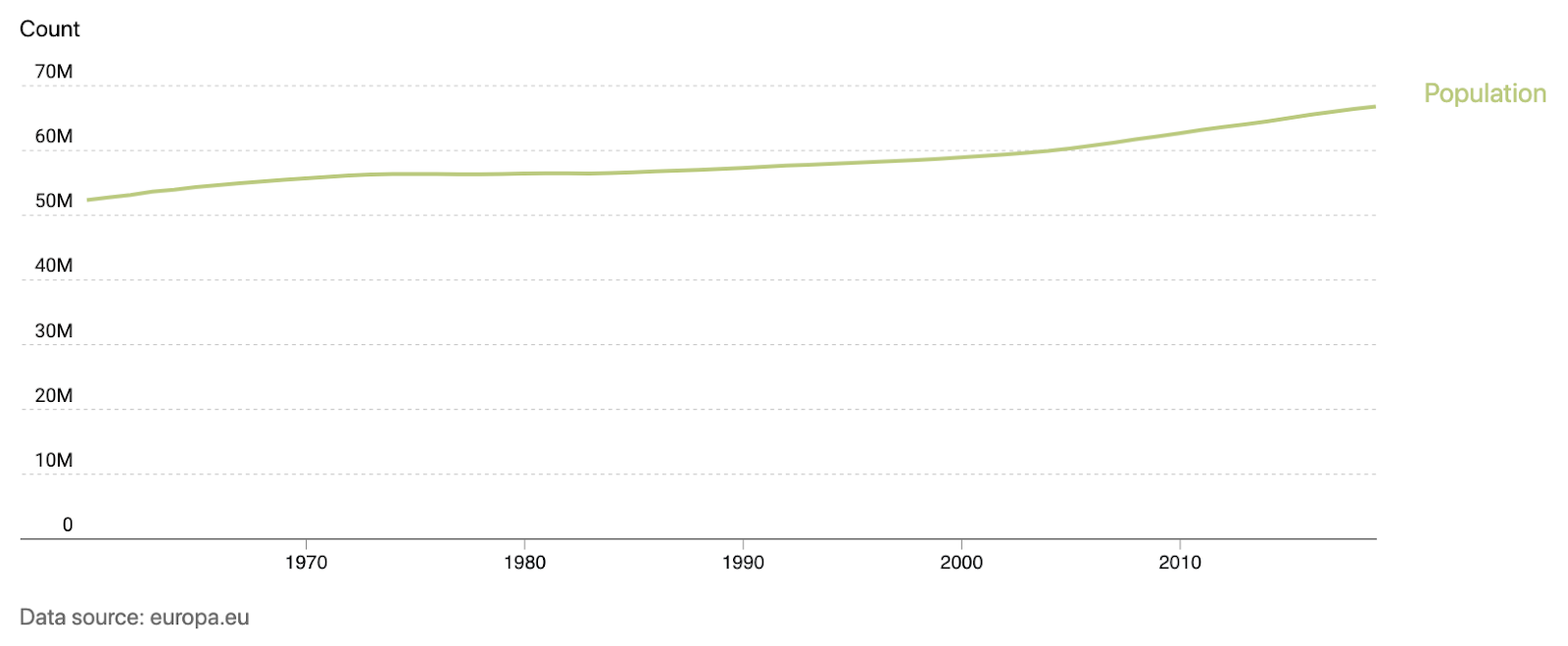

The U.K. has a population of around 66 million, increasing at a rate of approximately 0.65% per year, with the population expected to reach 74 million by 2040. In addition, there is a demographic shift towards an ageing population, of which 1.13 million of over-50s are renting. While young professionals still make up a majority of renters in the U.K., the increasing number of older renters indicates a wider range of renters in the U.K. This provides new opportunities for real estate investors to capture different demographics with their properties.

High foreign direct investment

The U.K. boasts high levels of Foreign Direct Investment (FDI), with GBP1.6 trillion in FDI in 2019, ranking it as the second-highest country for FDI in 2019, the only time it has not occupied the top spot since 1997. This reinforces the popularity of the U.K. as a global investment haven for real estate investors.

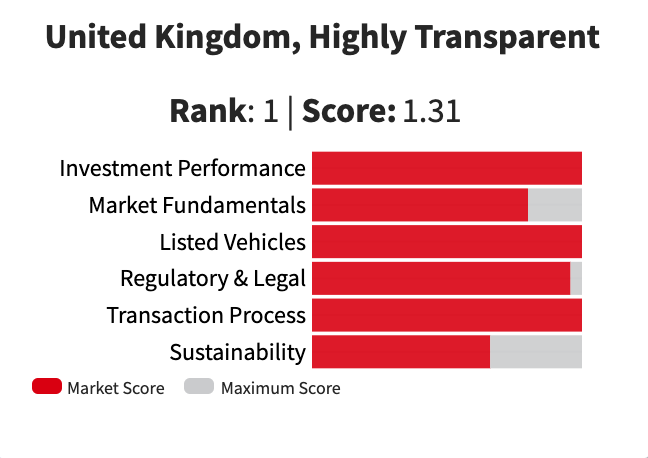

Transparency

The U.K. is at the top of The Global Real Estate Transparency Index 2020, meaning that investors have unparalleled access to information on performance regulations and the market of their investments. This information is key to any real estate investment, as it gives investors the means to make informed decisions for successful investments.

Read also: Six Critical Success Factors in Direct Property Investment

Cons of investing in U.K. properties

Taxes

When acquiring real estate in the U.K., investors are required to pay stamp duties on top of the cost of the property. As of 1 April 2021, the SDLT applies for properties valued above GBP125,000 for residential properties and GBP150,000 for non-residential land or properties. These taxes can add up to a significant premium for investing in properties in the U.K.

The following stamp duty rates apply for all residential properties in the U.K.:

| Property or lease premium or transfer value | SDLT rate |

|---|---|

| Up to £125,000 | 0% |

| The next £125,000 (the portion from £125,001 to £250,000) | 2% |

| The next £675,000 (the portion from £250,001 to £925,000) | 5% |

| The next £575,000 (the portion from £925,001 to £1.5 million) | 10% |

| The remaining amount (the portion above £1.5 million) | 12% |

Capital Gains Tax (CGT) also applies for properties sold at a profit in the U.K. and it is applied based on the difference between the sale and acquisition prices. This can have an impact on buy-to-sell investors looking to flip properties for a profit. CGT is calculated as a percentage of the profits made and applies in the event of a sale, trade, or transfer of ownership of the property.

There are also additional taxes for buy-to-let properties, which began in 2017, when the U.K. government began phasing out mortgage interest tax relief. Starting from the 2020/2021 tax year, landlords are only allowed to offset 20% of their mortgage interest payments through their tax returns. This means that landlords have higher tax costs, and have to pay taxes even when no profits are being made.

Strict loan criteria

The Bank of England’s interest rate remains low at 0.1%, allowing investors to obtain mortgage loans with low interest rates. However, financial institutions have been tightening their lending criteria on new loans. This means that investors’ should be aware that Loan-to-Value ratios on loans may be lower, or that properties need to be performing well enough to cover more than just the mortgage payment, before getting approved for a loan.

Step-by-step: investing in properties in the U.K.

1) Explore areas in the U.K. for investment

Different cities and areas in the U.K. can come with different risks and returns for investors. Before investing in U.K. properties, an investor should conduct sufficient research to select the area they want to invest in. Foreign investors may conduct research online, without having to visit the U.K.

We have highlighted a few cities above which could provide good returns for investors.

Read also: Manchester as an Investment Destination

Read also: Overview of St Andrews (Scotland, UK) as an Investment Destination

2) Research the property market

After identifying the key investment cities, investors should then find out more about the property market and the property trends in the region. Investors can make use of information online and consult with experts within the region to ensure that they are well-informed before entering into an investment. This is an important step regardless of the type of investment.

Buy-to-let investors should understand the type of tenants looking for rental properties in the area and seek properties accordingly. Buy-to-sell investors on the other hand should research which properties are in high demand and where the highest capital returns can be gained. In addition, alternative property classes, such as industrial and commercial office properties, can also be attractive investments.

3) Source deals

After securing financing for the investment, the investor should proceed to explore good deals in their target market. In the U.K., off-plan properties are properties in the pre-construction stage, generally priced at below market value with discounted prices to attract investors. This can be a good way for first-time investors to enter the U.K. market and source a deal.

4) Secure financing for the investment

As with any other property investment, the investor requires a significant amount of funds to acquire a property in the U.K. However, there are a number of financing options available to investors. Foreign investors may face higher barriers when securing mortgages from financial institutions in the U.K. Some institutions may enforce stricter requirements, such as a higher minimum deposit.

In addition, mortgages for certain property types, including mortgages for off-plan properties and buy-to-let properties, may require deposits of up to 25% to 40% of the total mortgage value.

Given the large amount of information and knowledge of the U.K. property market required for investors, many choose to engage property investment firms or seek alternative ways of investing in U.K. real estate. RealVantage goes through the step-by-step process outlined above on behalf of investors, and opens up co-investment opportunities in the U.K. and around the world.

Frequently asked questions

Should I still invest in U.K. properties given the uncertain economic climate?

With the uncertainty in the property market in 2020, many investors have been re-evaluating the U.K. property market to determine whether they should still invest in U.K. real estate. Despite the general economic uncertainty, U.K. properties are a relatively stable asset and a few factors, including high rental yield, increasing demand for rental properties, and capital growth, have driven the popularity of U.K. property investment. U.K. residential prices are also projected to increase significantly throughout the country in the next few years, providing potential lucrative returns for investors.

How do I maximise my profits from investing in U.K. properties?

The most important step for an investor to maximise their profits in the U.K. is to have an in-depth understanding of the market and strategise wisely. Different strategies may work better for different property types and different locations, so investors should conduct thorough research in each market and look at the performance of similar properties in the area to determine if an investment is likely to be profitable.

How has COVID-19 impacted the U.K. property market?

The main impact of COVID-19 comes from lockdowns imposed in the U.K., which has slowed property investment activity. However, a recovery is well underway, with residential property prices rising at record rates and property investment remaining a strong option. This is in part due to the stamp duty holiday introduced as a measure to encourage real estate activity and support an economic recovery.

The overall property market in the U.K. has shown its resilience in the face of the COVID-19 pandemic, despite the uncertainty faced by other investment options.

Read also: Implications of COVID-19 Aftermath on Real Estate Sectors

Read also: An Analysis of COVID-19’s Impact on Office Real Estate Demand

Which cities can generate the best returns for investors?

In terms of rental yield, Manchester is expected to generate the highest growth in rental prices of approximately 16.5% in the next five years, followed by Liverpool at 14.8%. This is a positive sign for buy-to-let investors, who are likely to see a significant increase in rental yields in the near future.

Generally, top-performing southern cities in the U.K., such as Bristol, Brighton, and London, do not provide high rental yields for investors due to the high property prices in the area. Northern cities, along with cities in the Midlands and Scotland, generally outperform Southern cities in both rental price growth and property price growth.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.