Holding up the Property Market

In the corporate space, trends are leaning toward shorter office leases as employers are cautious about committing to long-term decisions.

Only a couple of months after emerging from lockdowns, the number of COVID-19 cases worldwide still continue to climb. Governments had acknowledged that the economy could not survive a prolonged lockdown, thus changing their approach from 'restrict and contain' to 'loosen and manage'.

This has transpired into nations taking extraordinary measures to prop up the economy such as the £3.8bn stamp duty giveaway in the UK, which interestingly enough, has set off a mini property boom. In the corporate space, trends are leaning toward shorter office leases as employers are cautious about committing to long-term decisions.

Read also: RealVantage's COVID-19 Viewpoints and Strategies

Read also: An Analysis of COVID-19’s Impact on Office Real Estate Demand

What caught our eyes this week?

'Stamp Duty Cut' Fuels a Surge of Interest in London Commuter Belt

The Guardian – The £3.8bn stamp duty giveaway unveiled by chancellor Rishi Sunak last week has already sparked a mini property boom in the southern England commuter belt, according to the UK’s biggest property website, Rightmove. The data indicates that most of this benefit will flow to Conservative-voting areas in the outer orbit of London.

Read also: Singapore Real Estate Stamp Duties Explained

Read also: Investing in the UK Real Estate Market

Industrial Sector Remains Positive Despite the Pandemic

The Urban Developer – The industrial sector is the only property market to make it into positive territory as COVID-19 affects sentiment across the board. The latest results from the ANZ Property Council survey, which tracks changes in property market sentiment, shows a modest improvement across all sectors for the September quarter.

Read also: Implications of COVID-19 Aftermath on Real Estate Sectors

Office Leases are Getting Shorter

JLL – In Hong Kong, an average office lease lasts three years whereas in the United Kingdom, it lasts six years. In the U.S., lease term fell 15% in the first five months of 2020 to seven years — and this is likely to fall farther.

The trend toward shorter leases is riding an accelerated trajectory as office users exercise caution and avoid making long-term decisions in the age of COVID-19, says Ben Munn, Global Flex Space Lead, JLL.

Read also: Ins and Outs of Office Real Estate

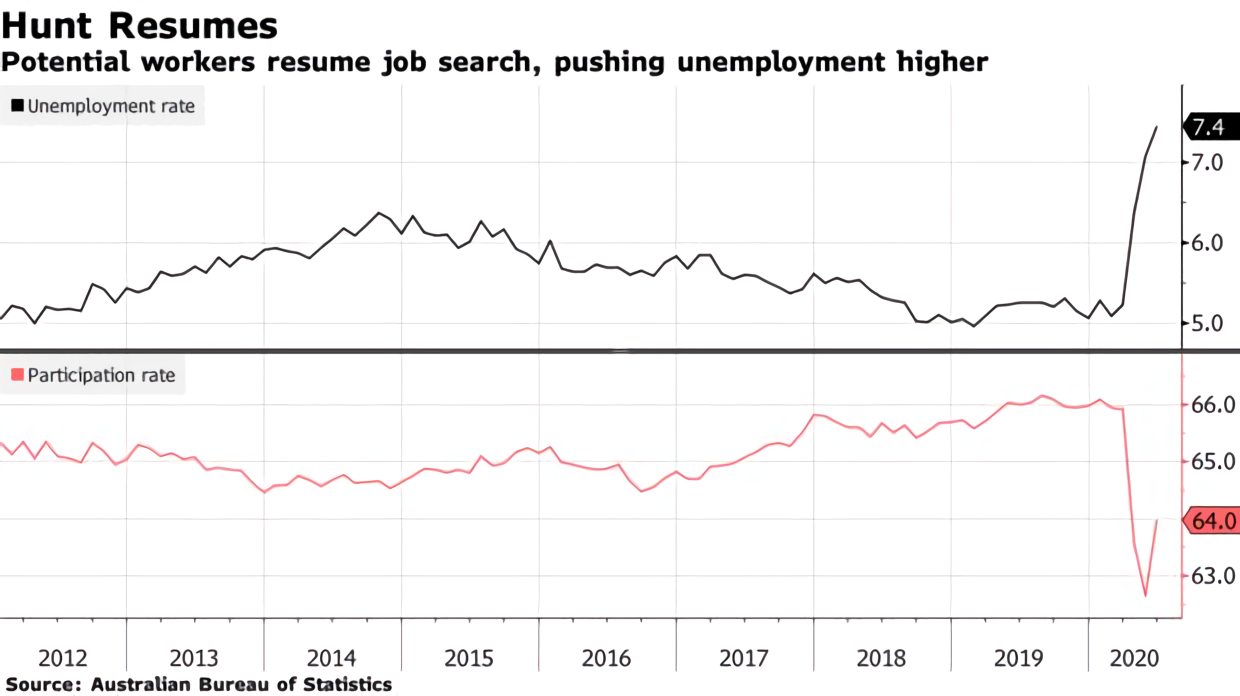

Australia Posts Record Monthly Hiring Gain and Job Hunt Resumes

Bloomberg – Australia posted its largest monthly jobs gain on record in June as the economy reopened from its COVID-19 lockdown. This comes on the back of a surge in people seeking work which had previously triggered a jump in the unemployment rate.

Employers added 210,800 roles, more than double the current estimates, after May’s job losses were revised higher to 264,100.

Read also: Australia Property Investment

Real Estate Transparency is Harder to Achieve than Ever but Some Asian Markets Have Notable Improvements

JLL – Transparency in commercial real estate markets has improved at its slowest pace in nearly a decade, at a time of rising expectations for higher standards in investment performance, market fundamentals, governance and regulatory aspects, to name but a few.

Despite this, around 70% of the countries analysed in a bi-annual study and global ranking from JLL and LaSalle Investment Management showed progress in creating more transparent markets in particular with notable gains for Asian countries such as India, Thailand and Vietnam.

Read also: Important Considerations when Buying Overseas Properties

Vantage Point is a curated cache of the latest trends in real estate investing repurposed from media outlets and websites around the globe. Each article is a succinct wrap-up of key news points for an easy read. Outbound links, embedded in each editorial, are attributed to original external sources. RealVantage makes no warranties or representations regarding the accuracy, completeness or veracity of the information or data contained in such external sources. Editorials under the Vantage Point vertical do not reflect the views of RealVantage, in part, or in its entirety.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.