What is a Waterfall Structure?

For most real estate investments, profit is distributed using a profit-sharing structure called a ‘waterfall’. This ‘waterfall’ model outlines the preferred return or hurdle rate required and the amount of promote given to the sponsor should this threshold be exceeded.

For most real estate investments, profit is distributed using a profit-sharing structure called a ‘waterfall’. This ‘waterfall’ model outlines the preferred return or hurdle rate required and the amount of promote given to the sponsor should this threshold be exceeded. Simply put, a real estate waterfall is the profit-sharing structure that outlines the distribution of profits between investors and sponsors in a real estate deal.

What is the Waterfall Model?

Picture a waterfall in which water flows from the top pool to several levels below it. At each level, the water stops and pools together before flowing down to the next level and so forth. Now, think of the profits from a real estate investment deal as the water flowing down the waterfall. Once the top pool is filled, water flows to the next pool. Once the second pool is filled, water flows to the third pool.

The water or profits in each pool is then distributed between the sponsors and investors according to a predetermined structure. All of the profits in the top pool usually goes to the investors. Any profits or water flowing out of the top pool will be shared between the sponsors and investors. The lower the pool, the higher the percentage of profits that goes to the sponsors.

If there is enough water or profits to fill the first pool, the preferred rate of return is said to be achieved. When this is achieved, the sponsor is eligible for a share of the profits for any return exceeding this preferred rate of return.

Roles in the Waterfall Model

The two main roles in the waterfall model are the General Partners (GP) and the Limited Partners (LP). Each role may consist of multiple entities, meaning that there can be many different companies or individuals acting as LPs or GPs for the investment deal.

General Partner

The General Partner, also known as the sponsor, has control over most aspects of the investment. The sponsor is responsible for sourcing the real estate deal, negotiating the terms and price of the deal with the vendor, obtaining the property loan and managing the debt repayment. After Limited Partners invest in the deal, the General Partner continues to play an active role by managing and maintaining the property throughout the duration of the investment.

In return for assuming this responsibility, the General Partner often expects a larger proportion of the profits relative to the proportion of capital that he contributed to the investment deal. This larger share is known as a promote. While this is beneficial for the General Partner as it skews the share of returns in his favour, it also means that the General Partner’s return on investment takes on a more volatile profile. This is because the General Partners generally only receive their outsized share of the profits after the Limited Partners have received a preferred return on their capital invested in the project.

Therefore, if an investment underperforms, the General Partner stands to lose out. Conversely, if an investment is successful, the General Partner receives a disproportionate share of the profits. This will motivate them to work harder towards the success of the investment.

Limited Partner

Limited Partners refers to other investors in the real estate deal who invest alongside the General Partner. Limited Partners are otherwise passive investors who do not participate in the day-to-day operation and management of the real estate asset. The maximum amount of liabilities that Limited Partners are liable for in an investment deal is limited to their invested capital.

Key Components of the Waterfall Model

1) Promote

A promote refers to the performance fees earned by a sponsor in an investment. The promote is the additional returns the General Partner receives for achieving a return that exceeds the preferential rate of return.

2) Return Hurdle

The return hurdle represents the amount of cash distribution that has to be reached before cash can trickle down to the next tier in the waterfall. It is the minimum rate of return on an investment required by an investor. The return hurdle is determined prior to the investment and is dependent on a predetermined Internal Rate of Return (IRR).

The return hurdle is a key aspect of the waterfall model as it triggers the disproportionate distribution of profits from the investment. In a typical waterfall model, the higher the returns from an investment, the higher the sponsor’s share of returns, incentivising the sponsor to work harder towards the successful performance of the investment.

Read also: How Does Internal Rate of Return (IRR) Impact Real Estate Investors' Decision-Making Process?

The return hurdle is based on the IRR, If the investment is realised with an IRR that is below the return hurdle, the General Partner is not eligible for any promote. If the IRR exceeds the return hurdle, the General Partner is entitled to a share of the excess return. Take for an example a real estate investment with a return hurdle of 8%. If the investment only achieves an IRR of 6%, the General Partner is not entitled to any promote. But if the investment achieves a return of 10%, the General Partner is entitled to a share of the profits beyond the 8% threshold. The profits beyond the threshold may be distributed with an 80:20 split with the Limited Partners getting 80% and the General Partners 20%.

3) Preferred Return

The preferred return is the rate of return earned by Limited Partners before the General Partner can receive any share of the profits. The preferred return gives Limited Partners priority over returns compared to the General Partners. However, the preferred returns do not guarantee any returns but rather determines how any profits made are distributed. Distributions are paid out, at specified times, during the investment period.

The higher the risk, the higher the preferred return rate. After this preferred return hurdle has been reached, further profits are distributed between the parties in the investment based on the terms of the deal.

4) Lookback Provision

A common element of the typical Waterfall Model is a Lookback Provision. This provision specifies that the sponsor is required to forfeit a portion of the distribution they have already received if the investment returns fall short of the preferred rate of return. The Lookback Provision further motivates the sponsor to ensure that the real estate asset performs well to avoid having the provision take effect and reduce their returns.

5) Catch-up Provision

With a Catch-up Provision, Limited Partners receive all the distributions from the investment until they have reached the preferred rate of return. Only after the Limited Partners have received the preferred rate of return will the General Partners be eligible to receive returns to “catch up” with the returns received by the Limited Partners. This “catch up” will occur until both parties have received an equal return up to the preferred rate of return.

This Catch-up Provision is sometimes used in place of the Lookback Provision and is more favourable towards the Limited Partners since they receive the distributions first and do not have to claim it back from the sponsors.

How returns are calculated in the Waterfall Model

The Internal Rate of Return (IRR) is the most frequently used measurement to determine the threshold for each tier of the waterfall model. The IRR calculates the annual compounded rate of return of an investment over the entire investment period.

In the most common waterfall model, senior lenders are first paid first; then Limited Partners receive their preferred return. After this, the returns flow down to the next layer in the waterfall, where investors receive their initial investment amount, followed by the sponsors receiving their first payment as a percentage of the profits from the deal, otherwise known as the promote.

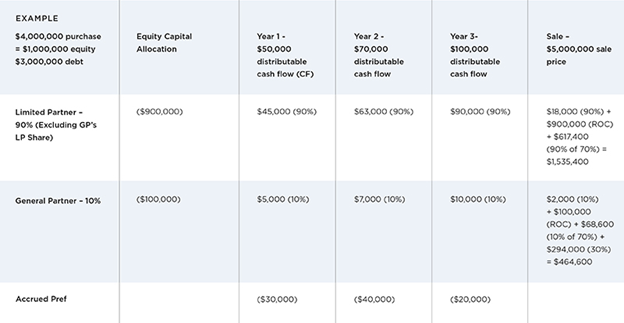

Here is an example of how returns are distributed using a waterfall model.

Given that the investment is worth $4 million, with $1 million in equity and $3 million in debt, the Limited Partner holds 90% of equity, while the General Partner holds 10%. In the example above, the preferred return is set at 8%. It is non-compoundable and the split is 70:30 in favour of the Limited Partner after the return hurdle is achieved.

During the first year, $50,000 in distributable cash flow is generated. Of this, $45,000 belongs to the Limited Partner, while the remaining $5,000 goes to the General Partner. $30,000 in unpaid preferred returns is accrued.

During the second year, $70,000 in distributable cash flow is generated. Of this, $63,000 belongs to the Limited Partner, while the remaining $7,000 goes to the General Partner. $40,000 in unpaid preferred returns is accrued. ($30,000 in the first year and $10,000 in the second year).

During the third year, $100,000 in distributable cash flow is generated. Of this, $90,000 belongs to the Limited Partner, while the remaining $10,000 goes to the General Partner. $20,000 in unpaid preferred returns is accrued. ($40,000 in the first two years and negative $20,000 in the third year).

At the end of the three-year investment period, the investment is sold for $5,000,000. After the debt has been repaid, the remaining sum of $2,000,000 is distributed based on the waterfall structure with an 8% hurdle rate.

The Limited Partners receive their capital of $900,000 and the General Partner gets back his capital of $100,000. As for the distribution of $1,000,000 in capital gains, the first $20,000 of it will be used to make up for the $20,000 shortfall in preferred returns. Since the Limited Partners contributed 90% of the capital, they will receive $18,000. The General Partner receives the remaining $2,000.

After the distribution of this $20,000, the Limited Partners and General Partners will have received the 8% preferred rate of return. The remaining capital gains of $980,000 will be split in a 70/30 manner in favour of the investors. Investors will get 70% of this $980,000 or $686,000, with the Limited Partners getting $617,400 and the General Partner $68,600. The remaining gains of $294,000 goes to the General Partner as promote.

Ultimately, the waterfall structure gives $1,535,400 to the Limited Partner for a $900,000 initial investment and $464,600 to the General Partner for a $100,000 initial investment (excluding cash flow distributions). This illustrates the outsized returns the General Partner stands to gain if he exceeds the preferred rate of return. Hence the General Partner is highly incentivised to perform.

The Two-Tier Waterfall Model

The two-tiered waterfall model is an alternative model, used in about 24% of cases. In this model, the distributable cash flow and the proceeds realised upon the divestment of the investment are split into two different waterfalls.

The two-tiered waterfall model is applied in more complex situations to align the interests of the General Partners and Limited Partners. An increase in the numbers of tiers is typically associated with greater motivation for the General Partner to deliver exceptional returns.

Do you Know?

What happens if the investment does not generate enough profits to meet the preferred return?

If an investment fails to generate sufficient returns to meet the preferred rate of return, the sponsors will not receive any promote. Therefore, sponsors are highly incentivised to ensure that the investment generates returns in excess of the preferred rate.

Does the waterfall structure apply to all investment projects offered by RealVantage?

Not all projects on offer are subjected to a waterfall structure. Some of our projects are subjected to a fixed fee (1 percent to 3 percent a year depending on the project). Others have a waterfall structure whereby RealVantage will only receive promote if the investment returns exceed the preferred rate of return. Opportunistic and value-add equity deals usually have a waterfall structure in place. Debt deals usually have fixed fees in place.

Read also: What are Real Estate Debt Funds?

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.