Suntec REIT Overview

Suntec Real Estate Investment Trust (Suntec REIT) was founded in 2004 and subsequently became listed on the SGX-ST on the 9th of December in the same year.

Table of Contents

- Background

- Management of Suntec REIT

- Suntec REIT Share Price And Other Key Data (T82U.SI)

- Suntec REIT Annual Report Highlights

- Suntec REIT Key Statistics for 2021

- Current Asset Under Management (“AUM”): Countries and Assets

a. Singapore

b. Australia

c. United Kingdom - REITs vs Co-Investment Opportunities

Background

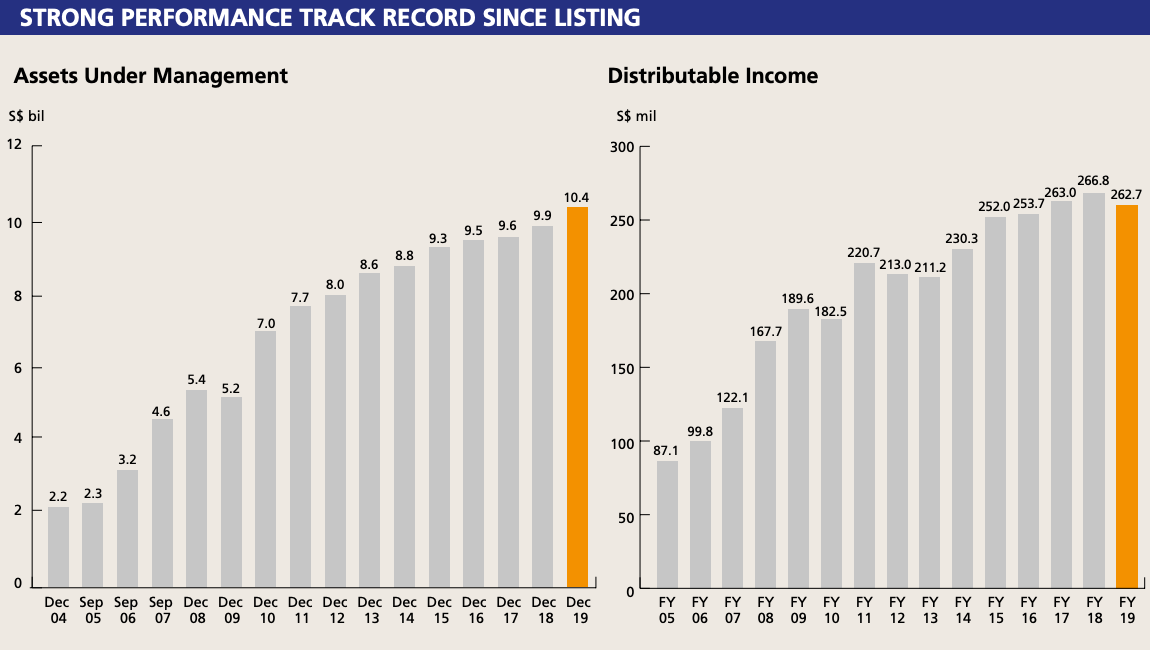

Suntec Real Estate Investment Trust (Suntec REIT) was founded in 2004 and subsequently became listed on the Singapore Exchange (SGX-ST) on the 9th of December in the same year. Suntec REIT owns income-generating properties in both office and retail sectors, making it Singapore’s first composite REIT. Suntec REIT’s property portfolio consists mainly of real estate assets in Singapore, Australia, and the United Kingdom, with Assets Under Management (AUM) of S$10.8 billion as of Q3 2020.

Management of Suntec REIT

Suntec REIT is managed by ARA Trust Management Limited, a subsidiary of ARA Asset Management Limited. ARA manages both listed and unlisted REITs, private equity funds, and credit funds across 28 countries, and operates real estate management teams across each of its markets to manage its real estate portfolio.

ARA Trust Management Limited seeks to deliver consistent returns and achieve long-term capital growth for investors through proactive asset management, strategic accretive acquisitions, and prudent capital management.

Suntec REIT Share Price and Other Key Data (T82U.SI)

Suntec REIT Annual Report Highlights

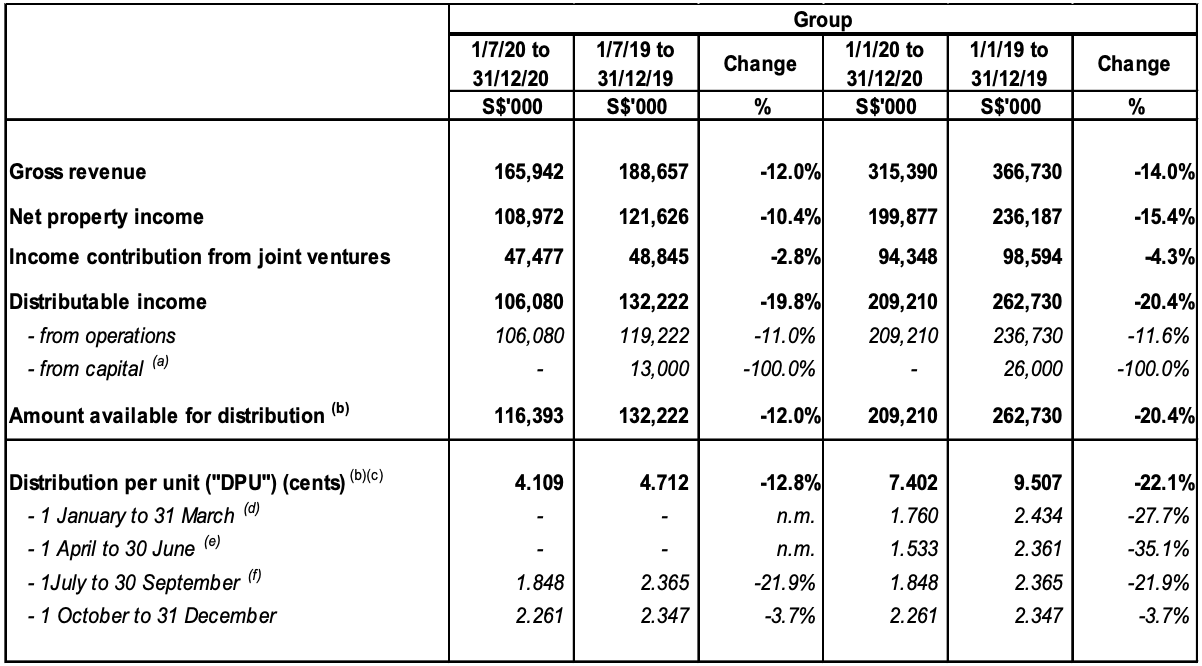

Financial Highlights for Suntec REIT’s 2020 Financial Year

| Consolidated Statement of Financial Position | 31 Dec 2020 | 31 Dec 2019 |

|---|---|---|

| Investment Properties | S$7,262.9m | S$6,879.7m |

| Interest In Joint Ventures | S$3,686.5m | S$2,956.8m |

| Total Assets | S$11,227.4m | S$10,032.4m |

| Debt at Amortised Cost | S$4,826.5m | S$3,630.2m |

| Total Liabilities | S$5,114.2m | S$3,926.2m |

| Unitholders’ Funds | S$5,829.7 | S$5,977.1m |

| Net Asset Value Per Unit | S$2.055 | S$2.126 |

| Aggregate Leverage Ratio | 44.3% | 37.7% |

Suntec REIT Key Statistics for 2021

| Book Value Per Share | S$2.09 |

|---|---|

| Price to Book Ratio | 0.72 |

| Market Cap Value | S$4,250m |

| Shares Outstanding | 2,820m |

| Occupancy Rate | 98.7% (Office) 99.1% (Retail) |

| WALE (by NLA) | 3.94 |

| Weighted Average Debt Maturity (years) | 3.1 |

| Beta (5 Yr Monthly) | 0.77 |

Current Asset Under Management ("AUM") Countries and Assets

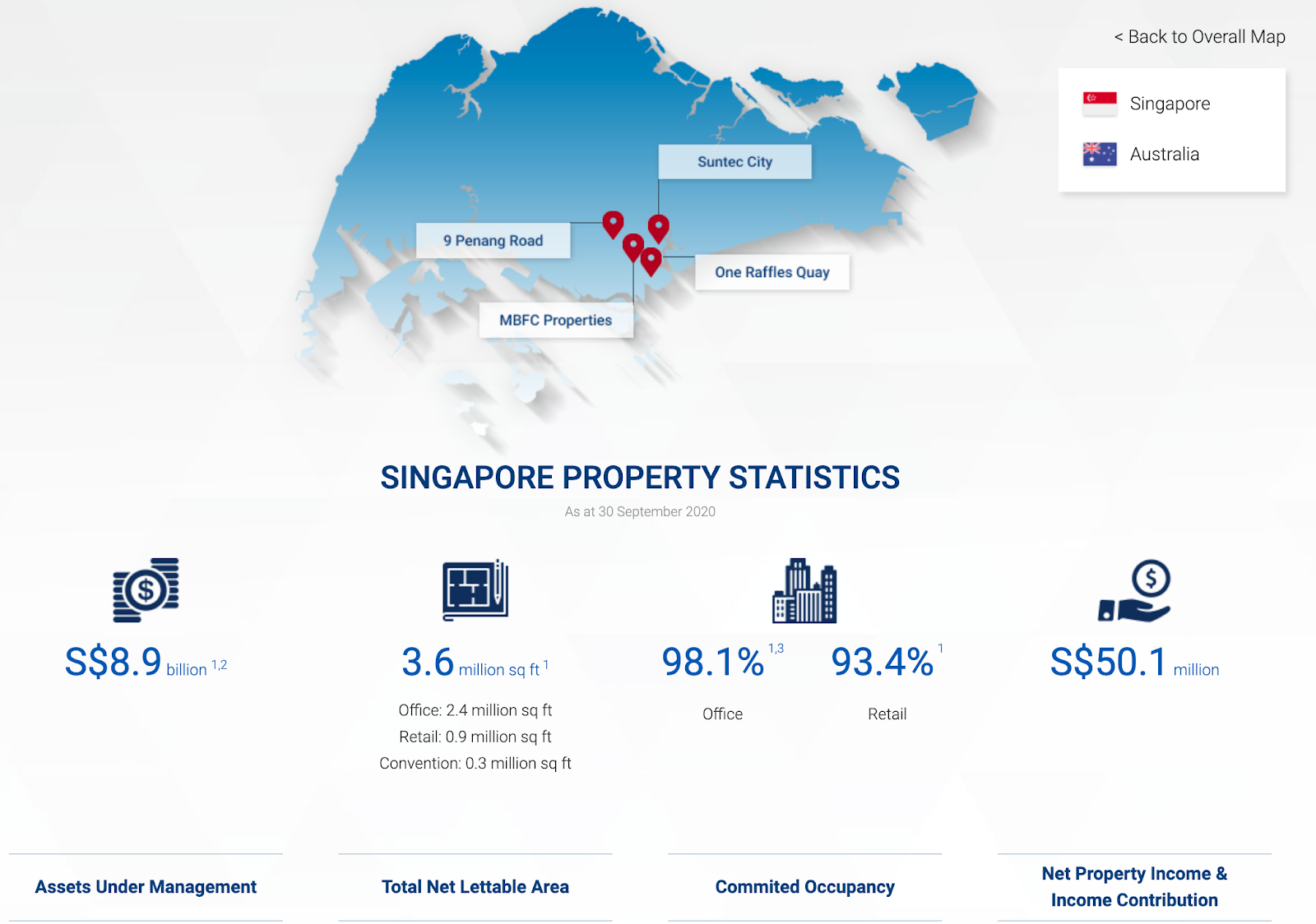

Singapore

Location: 3, 5, 6, 7, 8 and 9 Temasek Boulevard, 1 Raffles Boulevard, Singapore

Description: Suntec City is a composite office and retail property located in the Central Business District (CBD) of Singapore.

Suntec City is valued at S$5.6 billion as of 30th September 2020, and made up of 1.3 million square feet of office space, 0.9 million square feet of retail space, and 0.3 million square feet of convention space. The property has a high occupancy rate of 97.0% in their retail space and 93.3% in their office space, generating up to S$30.2 million annually.

Location: 1 Raffles Quay, Singapore

Description: One Raffles Quay is a landmark commercial development located between Marina Bay and Raffles Place, in the heart of the Singapore CBD. The property is made up of two office towers - the 50-storey North Tower and the 29-storey South Tower. One Raffles Quay is a 99-year leasehold property, expiring in 2100.

One Raffles Quay is valued at S$1.3 billion as of 30th September 2020. It’s total net lettable area of 0.4 million square feet has a committed occupancy rate of 98.4%, generating S$6.9 million annually. The property was purchased at S$941.5 million and Suntec REIT currently holds a 33.3% ownership stake of the property, shared with Hongkong Land and Keppel REIT.

Read also: Keppel REIT Overview

Marina Bay Financial Centre (MBFC) Properties

Location: 8 Marina Boulevard, Singapore

Description: MBFC Properties is a large office property, with a small proportion of retail space, located at the heart of Marina Bay in Singapore. The property was purchased at S$1.5 billion and Suntec REIT holds a 33.3% ownership stake of the property, shared with Hongkong Land and Keppel REIT.

MBFC Properties is valued at S$1.7 billion as of 30th September 2020, with 0.5 million square feet of office space and 0.03 million square feet of retail space generating S$13 million in net income contribution each year. Because of the large companies occupying the office space, the office space has a 100% occupancy rate, with a slightly lower retail occupancy rate of 97.4%.

Location: 9 Penang Road, Singapore

Description: 9 Penang Road is a newly developed Grade A commercial property located near Orchard Road, consisting of eight floors of office space and one storey of retail space, spread across its two ten-storey towers.

The property was purchased at S$245.1 million as a 99-year freehold property, of which Suntec REIT has a 30% ownership share, shared with Haiyi Holdings and SingHaiYi Group. The property is valued at S$276 million as of 30th September 2020, with a total net lettable area of 0.2 million square feet and a 98.2% occupancy rate.

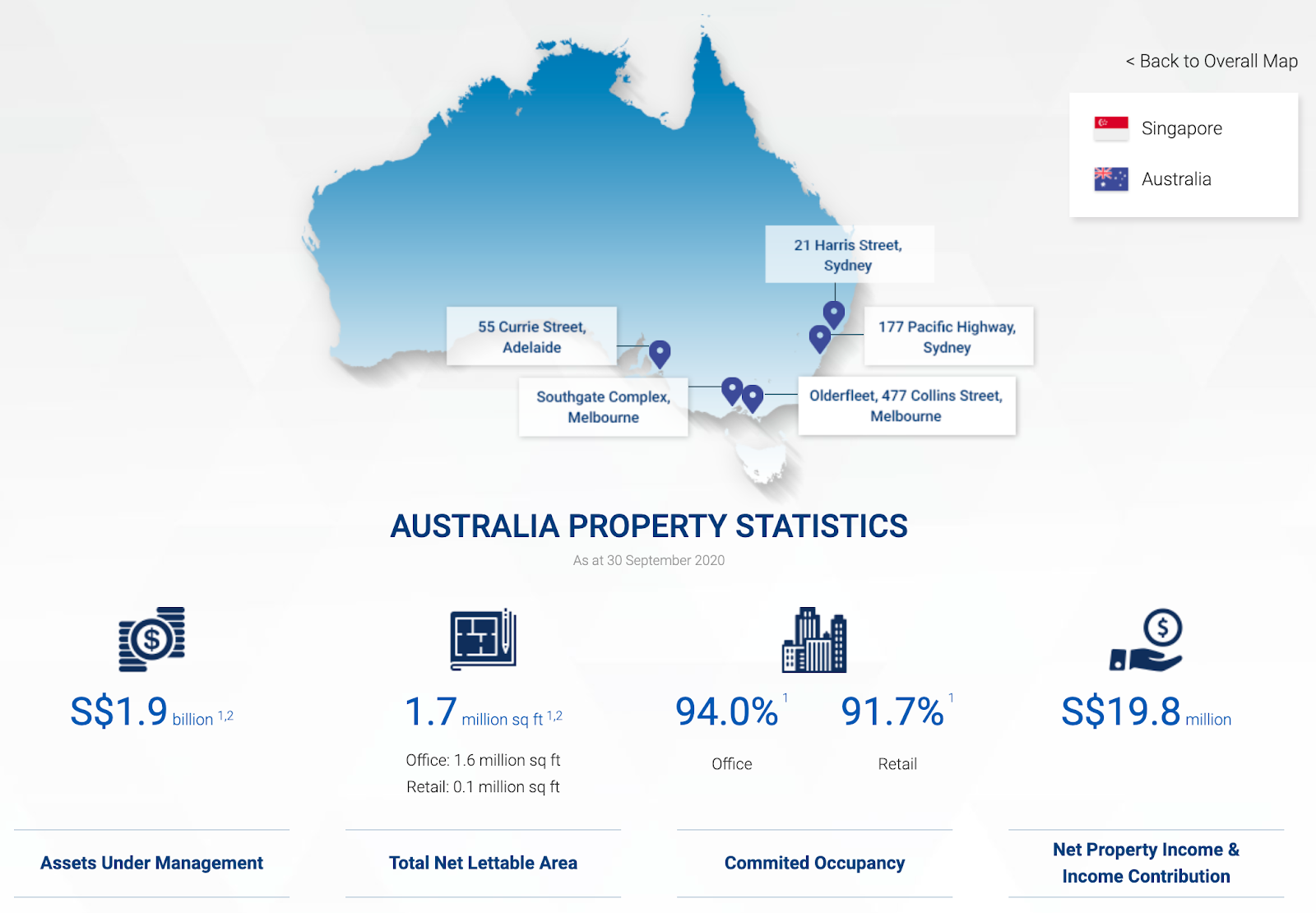

Sign Up at RealVantageAustralia

Read also: Investing in Australian Residential Real Estate

Location: 177 Pacific Highway, North Sydney, NSW 2060, Australia

Description: 177 Pacific Highway is a Grade A commercial property located in Sydney’s CBD. It is a freehold property wholly owned by Suntec REIT, purchased at S$457.5 million. The 31-storey building has a total net lettable area of 0.4 million square feet with a 100% occupancy rate. The property generates S$8.8 million in net property income annually and is valued at S$621.5 million, as of 30th September 2020.

Location: 21 Harris Street, Pymont NSW 2009, Australia

Description: 21 Harris Street is a Grade A office property located 2 kilometres from Sydney’s CBD. The newly developed 9-storey building has a total net lettable area of 0.2 million square feet, which has a committed occupancy rate of 68.7%.

The property was purchased at S$257.4 million as a freehold property, in which Suntec REIT has a 100% ownership interest, and is worth S$302.4 million as of 30th September 2020. The property generates an annual net property income of S$2.3 million.

Location: 40 and 60 City Road, 3 Southbank Avenue, Southbank, Melbourne, VIC 3006, Australia

Description: Southgate Complex is an integrated development property located along the Yarra River in Melbourne.

It consists of two Grade A office towers, the 25-storey HWT Centre and the 30-storey IBM Tower, as well as a 3-storey retail area and a 1,026 lot car park. The 0.35 million square feet of office space has a 100% occupancy rate, while the 0.05 million square feet of retail space has a 91.7% occupancy rate.

Suntec REIT purchased a 50% ownership interest in the freehold property for S$299.8 million. Southgate Complex is worth S$391.5 million as of the latest valuation on 31st December 2019, and makes an annual net income contribution of S$2.7 million.

Olderfleet, 477 Collins Street

Location: 477 Collins Street, Melbourne, VIC 3000, Australia

Description: Olderfleet is a 39-storey premium-grade office building located in the Melbourne CBD with key transportation connections to the rest of the city, with development completed in July 2020.

Suntec REIT purchased a 50% ownership stake in the freehold property in 2017 for A$414.2 million, with Mirvac holding the other half of the ownership. The property is valued at S$420.8 million as of 30th September 2020. The 0.3 million square feet of office space has a 97.2% occupancy rate, producing S$3.0 million in net property income annually.

Location: 55 Currie Street, Adelaide, SA 5000, Australia

Description: 55 Currie Street is a 12-storey Grade A office property in Adelaide’s CBD, just 5 minutes from Adelaide railway station. 55 Currie Street is made up of 0.3 million square feet of office space, which has a 91.7% committed occupancy rate, generating S$3.0 million in net property income annually.

Suntec REIT purchased the freehold property in 2019 at a purchase price of S$138.9 million. They currently hold 100% ownership of the property, which is valued at S$145.8 million as of 30th September 2020.

United Kingdom

Location: Nova Estate, Buckingham Palace Road and Bressenden Place, London SW1

Description: Nova Properties is an office and retail property located in London’s West End, near important landmarks such as Buckingham Palace and Westminster Abbey. The property is made up of two Grade A office buildings with ancillary retail spaces within.

Nova Properties’ 0.3 million square feet of combined retail and office space has a 100% committed occupancy rate. First purchased at £430.6 million, the asset is a long leasehold property, with its lease expiring in 3062. Nova Properties is valued at S$776.1 million as of 30th September 2020, with Suntec REIT holding 50% ownership of the property, making this their first property investment in the UK, and Landsec holding the other 50%.

Read also: Investing in the UK Real Estate Market

REITs vs Co-Investment Opportunities

REITs and co-investment platforms provide opportunities for investors to invest in real estate properties previously less accessible to individual investors. Both REITs and co-investments can provide returns in the form of dividends, paid out at specified times throughout the investment, and also through capital appreciation.

Read Also: REITs or Real Estate Co-Investments?

However, REITs are a form of indirect investment since these investors invest in the REIT rather than directly in the property. As a result, they have little control over which properties their investments are going towards in a REIT. Investors are also open to stock market risk and stock price fluctuations, as REITs are typically accessed through public stock exchanges.

Read Also: An Overview of Investing in REITs

With a co-investment platform, investors are given the opportunity to invest in real estate assets of various sizes by pooling their funds with other investors, such as through a co-investment platform. Each investor selects which individual properties to invest in and has full flexibility on constructing their real estate portfolio through the co-investment platform. Co-investment platforms also allow for different strategies such as development, value-add, or core opportunities, and also for different risk structures, such as providing debt or equity.

Read Also: Real Estate Co-Investment – The New Alternative

RealVantage is a real estate co-investment platform which seeks to provide investors with access to international property investments through co-investments. With RealVantage, investors are able to leverage on the team’s expert knowledge of the market. Investors may invest directly in a thoroughly vetted selection of real estate opportunities, and enjoy hassle-free asset management services.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.