Real Estate Investing in a Less Certain World

The near-term global economic outlook may seem uncertain, but your real estate investment objectives shouldn’t be.

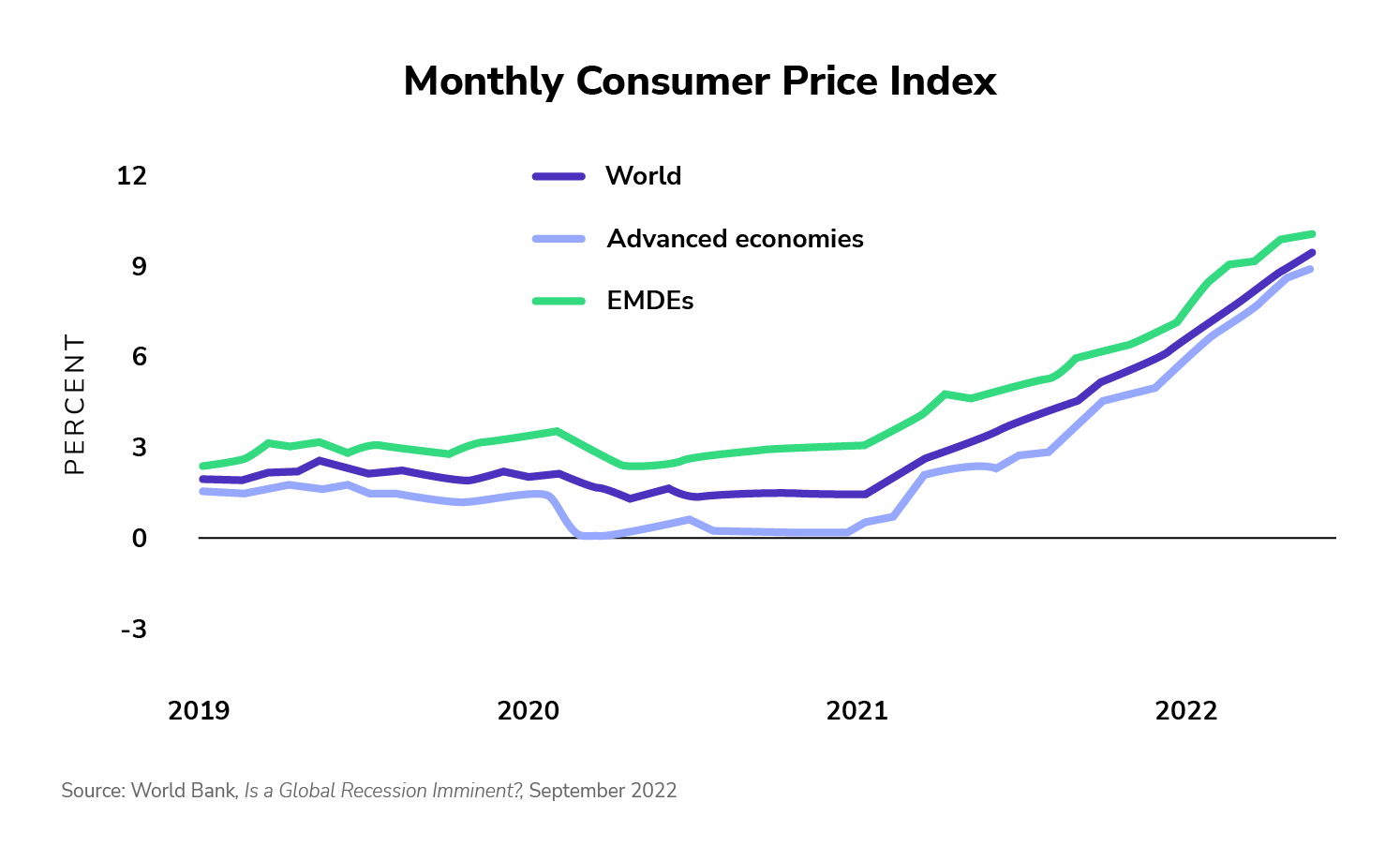

Just as the world has begun to recover from the effects of COVID-19, countries worldwide now have to grapple with an even more challenging scourge – soaring inflation.

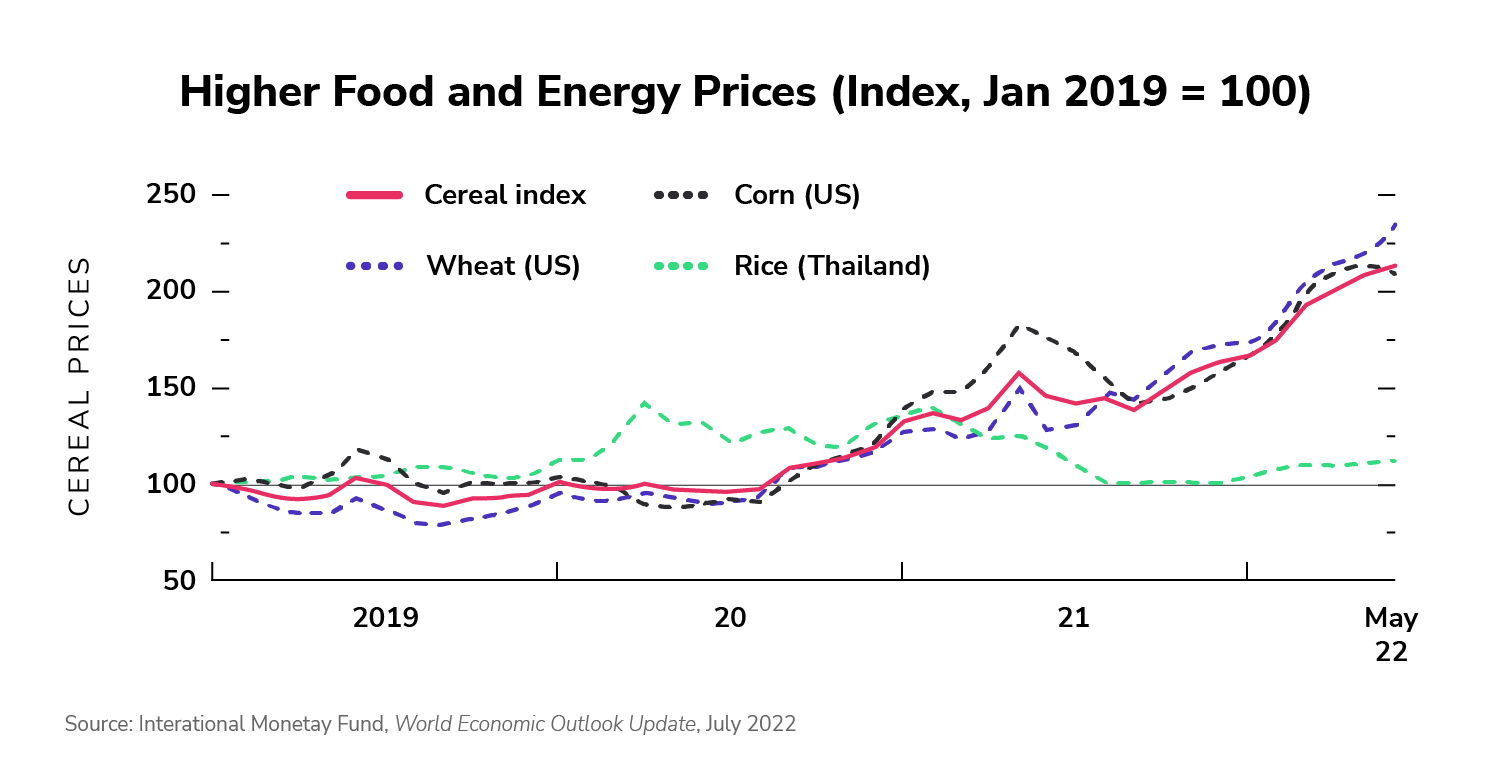

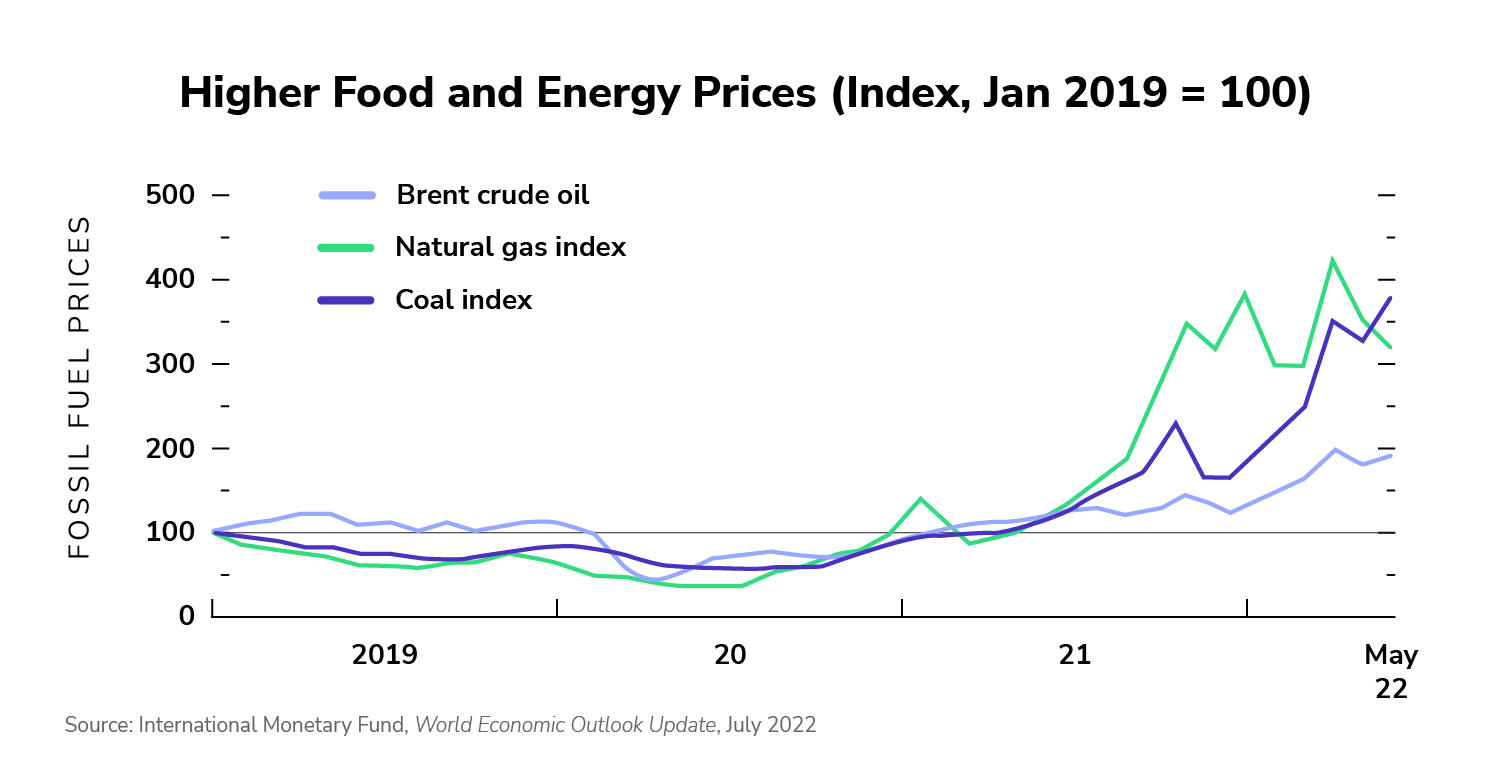

This time round, geopolitical factors have been the key culprits of high inflation, as the Russia-Ukraine war that broke out since February has disrupted energy, raw material and food supplies, sending prices of all things to stratospheric levels. And the impact of the supply chain disruption has also contributed significantly to rising prices.

Rates rise as prices fly

Central banks around the world have been anxiously trying to snuff out the flames of inflation by tightening monetary policy throughout the year, for fear that they will become a raging inferno.

Among the key real estate markets that we monitor, the Federal Reserve has already hiked interest rates five times so far this year, bringing the Fed funds target rate to a 14-year high range of 3.00% to 3.25% in September – and it looks like more hikes are on the cards. In a similar fashion, the Bank of England has also raised interest rates seven times in a row since December last year to a 14-year high of 2.25% in September. Meanwhile, the Reserve Bank of Australia has also hiked rates in September for a fifth month running to a seven-year high of 2.35%.

Rate hikes are a bitter medicine to swallow, especially when they could derail a brittle economic recovery that most nations are now in. Too much of this bitter prescription could possibly stunt business and economic growth, which is likely to have a domino effect on exports, investments, employment, and consumer spending, among others.

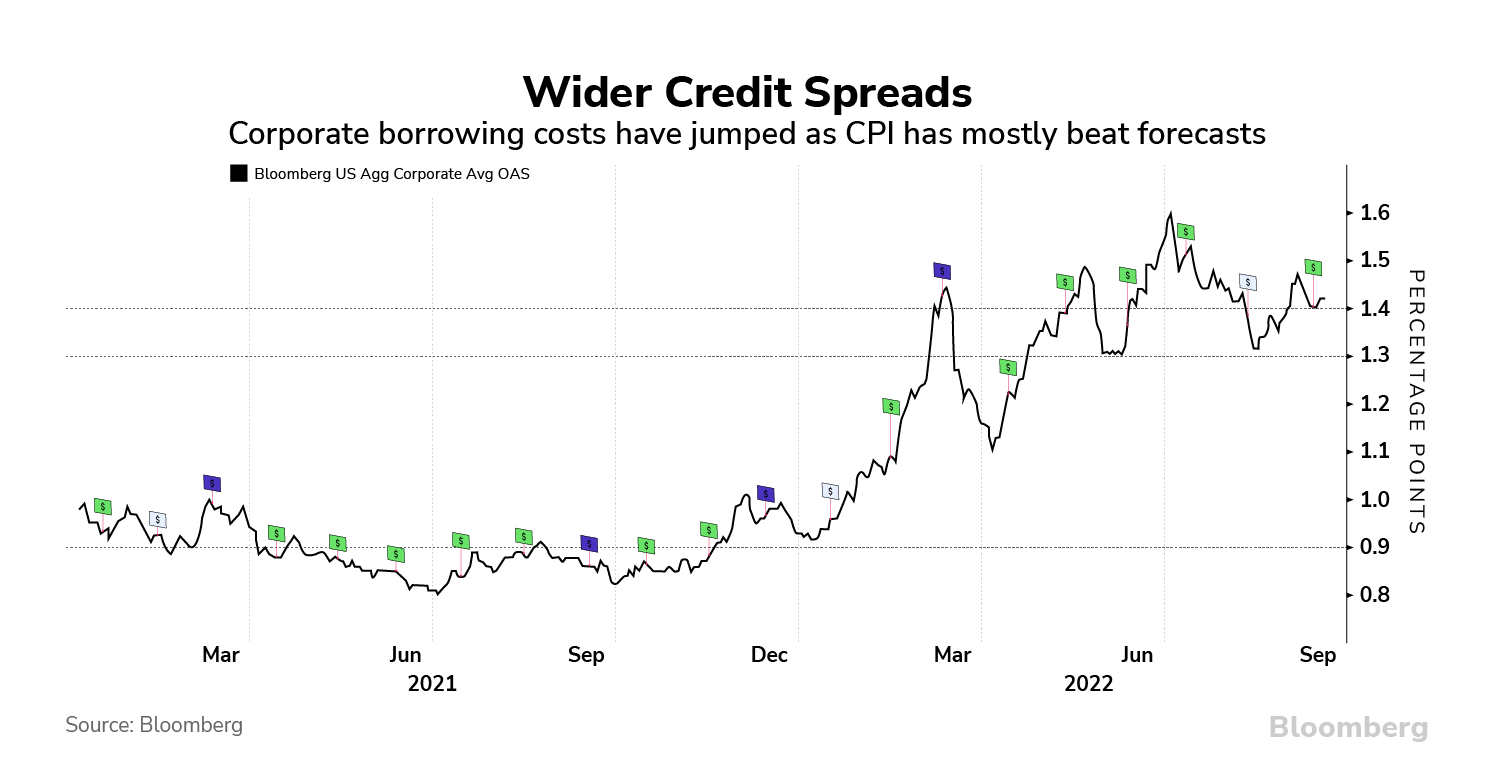

It probably isn’t surprising that this has stoked a frisson of market jitters, which have led stocks to whipsaw wildly and retreat since the start of the year. Bonds were not spared either. Credit spreads have jumped about 70% over the past year, due to rising inflation, and that has pushed up borrowing costs for businesses in the U.S. Globally, bond markets have also fallen into a bear market, as indicated by the Bloomberg Global Aggregate Total Return Index of government and investment-grade corporate bonds, which has declined more than 20% below its 2021 peak as at early September this year.

Year-to-date Performance of Key Global Stock Markets

Source: Google Finance, as at 22 September 2022

Economic growth to lose speed

Scroll through the online news pages and it is not hard to notice that “recession” is one of the most oft-mentioned words in the last few months.

With monetary policies tightening to temper inflation, many experts are forecasting an economic downturn that is likely to result in a global recession. The International Monetary Fund (IMF), for one, expects that global GDP growth will fall to about 3.2% and 2.9% in 2022 and 2023, respectively. Echoing a somewhat similar view, the World Bank (WB) is expecting a global recession in 2023, and it predicts global GDP growth to slow to 2.8% and 2.3% in 2022 and 2023, respectively.

Higher food and energy prices (Index, Jan 2019 = 100)

Source: International Monetary Fund, World Economic Outlook Update, July 2022

Monthly Consumer Price Index

Source: Word Bank, Is a Global Recession Imminent?, September 2022

These predictions are not unfounded, as massive rate hikes will almost certainly put a dent in business growth and investments, which is largely a corollary of a slowdown in consumer demand from potentially higher unemployment and lower incomes.

Headwinds in real estate

Higher inflation has historically led to higher property prices, which should have been good news to real estate investors. But currently, prices are rising so fast and furiously that central banks around the world have had to start hiking interest rates hawkishly to tame inflation.

The upshot of higher interest rates on real estate is obvious – a surge in cost of borrowing in the form of higher property loan rates and mortgage rates, which will in turn slow down property demand and deflate asset prices.

Residential property sales, for one, have been hit hard as the buyer-seller price gap has been widening. Home sales in the U.S. dropped for a seventh straight month in August; U.K. house prices have started to fall and are expected to decrease 7% in the next two years; while Australia’s home prices are expected to decline an average of 6.5% this year and a further 9.0% next year.

Other real estate sectors would probably not be unscathed from the rising cost of borrowing too.

Four real estate investment trends you can ride on

"We believe that what real estate investors should really focus on are investment growth trends that are likely to flourish in the next five to 10 years, or even beyond, despite the near-term economic headwinds."

While the near future looks disconcerting, the long-term prospects for real estate do not.

We believe that what real estate investors should really focus on are investment growth trends that are likely to flourish in the next five to 10 years, or even beyond, despite the near-term economic headwinds.

In our view, these growth trends would be: senior living residences; build-to-rent properties; real estate assets compliant with environmental, social and governance (ESG) standards; as well as data centres.

Senior living residences

Across the globe, an ageing population is an issue many governments are trying hard to tackle. According to the World Health Organisation, between 2015 and 2050, the proportion of the world's population more than 60 years old will nearly double from 12% to 22%, and life expectancy, which now stands at 73.4 years, has also been increasing steadily over the years.

Against this backdrop, the need for assisted living real estate and retirement villages naturally comes to the forefront. And this structurally-driven demand for senior living real estate is likely to be inelastic and should grow strongly across many countries, in the years to come. So, it is a defensive real estate investment theme that should not be ignored.

Build-to-rent properties

Escalating home prices and the millennials’ demand for more affordable co-living housing options have created a burgeoning market for build-to-rent (BTR) properties in many countries, over the years. This is especially evident in the U.S. and U.K.

In the U.S, for instance, BTR property developments are primed for explosive growth this year and attract some USD40 billion from investors in the 18 months leading up to September 2023. In the U.K, the number of BTR properties have experienced an exponential growth over the last decade; and in the first-half of this year alone, around GBP2.5 billion were invested in these properties in the U.K. These are a testament to the huge future potential of this investment trend in the long run.

And as home ownership becomes less affordable in these countries and economic growth slows, more people are turning to renting rather than buying homes. This has led to a market that benefits the landlords.

Real estate assets compliant with ESG standards

ESG-compliant properties are not only energy- and water-efficient but are likely to attract and retain tenants. According to CBRE research, green buildings are also more likely to command higher rents and capital values.

This, being a long-term growth trend, is expected to see a steadily growing demand for such properties. And it also goes to say that investors should look to capitalise on investment opportunities bearing this attribute, should they come their way.

Data centres

Rising enterprise demand for cloud infrastructure services as a result of the increased adoption of a hybrid work model around the world, as well as the increasing adoption of 5G technologies and Internet of Things, have been and will continue to spur demand for data centres globally.

In fact, in the first-half of this year, mergers and acquisitions deals for data centres exceeded USD24 billion and capital is expected to continue to flow into this sector through private equity and real estate investments. For sure, investors should not overlook the long-term investment potential of this real estate sector.

Real estate has always emerged stronger across crises

Without a doubt, rate hikes and a looming global recession have cast a pall on investment sentiment and may dampen real estate investments in the short term. But history has shown that real estate has always stood the test of economic cycles and crises to emerge stronger, and appreciate in capital value, while generating more stable returns than other risk assets.

"History has shown that real estate has always stood the test of economic cycles and crises to emerge stronger, and appreciate in capital value, while generating more stable returns than other risk assets."

In any real estate market cycle, there would surely be investment opportunities that investors could capitalise on. But it would be critical to focus on long-term secular growth trends, if you want to become a truly successful real estate investor over time. And these uncertain times are also the very times you should put your ability to stay focused to the real test.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.