Institutional Investors Look to Maintain or Increase Allocation to Real Estate

The world economy faces numerous headwinds and the economic outlook appears murky. Institutional investors look to maintain or increase RE allocations

The world economy faces numerous headwinds and the economic outlook appears murky. High inflation is set to remain for some time, central banks continue with their tightening cycles, and governments are stretching their budgets further to insulate against unprecedented energy prices. Amid the convoluted global environment, real estate prices had adjusted in some markets in 2022 and this repricing is likely to continue into early 2023. There is still a significant amount of capital sitting on the sidelines waiting to capture the right opportunities.

Read also: What is Market Value?

A recent Real Estate Investment Intentions Survey revealed that Institutional investors worldwide look set to maintain their allocations to real estate this year, with the Asia Pacific cohort even planning to raise its percentage. Investors overall are targeting a 10.4 percent allocation to real estate, a share marginally higher than the current 10.2 percent level. The top investment destinations were identified to be Sydney, Melbourne, and Tokyo.

Read also: Investing in Australian Residential Real Estate

What caught our eyes this month?

APAC investors boost allocations to real estate: ANREV

Mingtiandi – Institutional investors worldwide look set to maintain their allocations to real estate this year, with the Asia Pacific cohort even planning to raise its percentage, according to data compiled by a group of non-profits serving the property investor community. The poll revealed that APAC investors are upping their real estate allocations from the current 6.3 percent to a target of 8.3 percent.

Is the real estate market slowing down? What to expect in 2023 - by the numbers

Forbes – With persistent rate hikes from the Fed, there are widespread fears that the economy will enter a recession. The rate hikes and overall economic uncertainty have brought mortgage demand down. Existing home sales dropped for the 9th straight month (by 5.9% in October) as potential home buyers struggle with affordability.

Global real estate outlook 2023

JLL – Real estate pricing adjusted considerably in some markets in 2022 and this repricing is likely to continue into early 2023. The volatility of debt costs will ease, the current phase of price discovery will pass, and more certainty will enter the market as underwriting becomes clearer and the appetite for risk returns. The period of repricing is likely to see some winners and losers, but forced sellers are expected to be limited.

House prices continue to drop, but pace of declines eases

The Urban Developer – Sydney house prices have recorded a steep annual fall, but fresh data shows the rate of house price decline nationally is finally easing. Australia-wide, Domain Group’s house price report revealed the median house prices across the nation’s capital cities have declined 0.7 per cent—or six times slower—from the previous September quarter.

4 bright spots for investors in 2023

JLL – Investors are increasingly cautious as growth slows, with the focus shifting to real estate sectors most likely to weather any bumps in the economy. Real estate investment volumes in Asia are forecast to shrink up to 10% in 2023, according to JLL’s Asia Pacific Outlook 2023. However, any disruptions to the economy are expected to be short-lived as participants begin thinking beyond this period to take advantage of opportunities that lie ahead.

Vantage Point is a curated cache of the latest trends in real estate investing repurposed from media outlets and websites around the globe. Each article is a succinct wrap-up of key news points for an easy read. Outbound links, embedded in each editorial, are attributed to original external sources. RealVantage makes no warranties or representations regarding the accuracy, completeness or veracity of the information or data contained in such external sources. Editorials under the Vantage Point vertical do not reflect the views of RealVantage, in part, or in its entirety.

About RealVantage

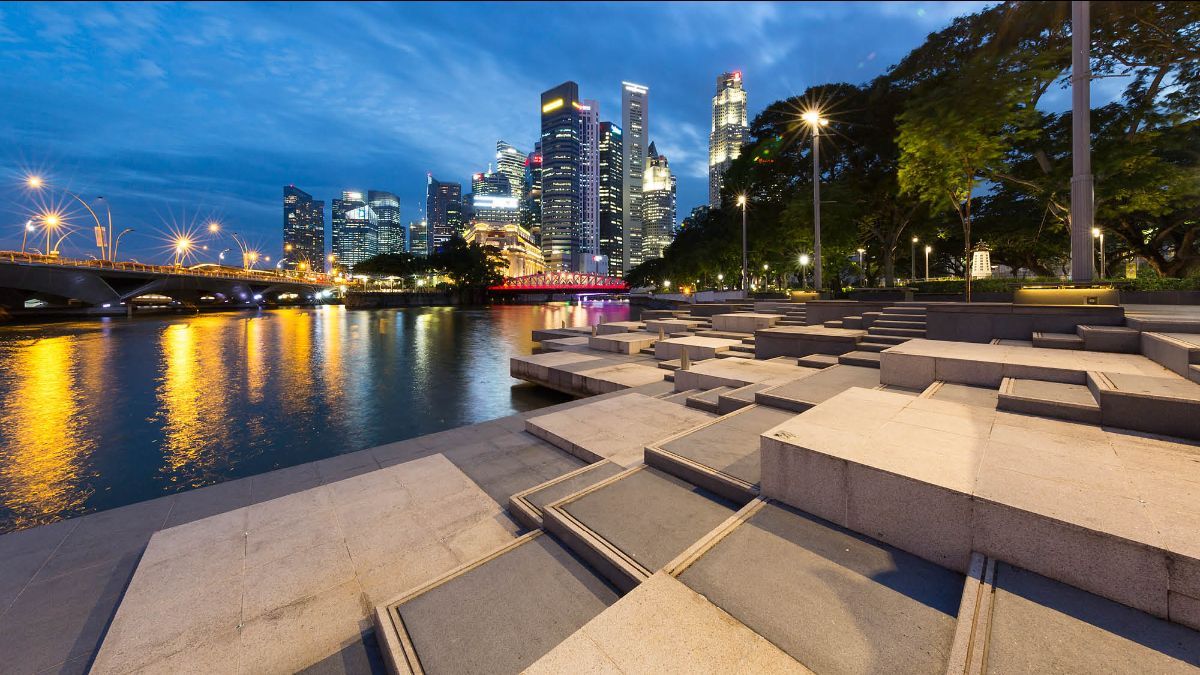

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.