Sasseur REIT Overview

Sasseur REIT is a retail Real Estate Investment Trust based in Singapore, with its portfolio of outlet malls located in China. Sasseur REIT has 4 assets across the Chinese cities of Chongqing, Bishan, Hefei and Kunming.

Table of Contents

- Background

- Sasseur REIT Share Price (CRPU.SI)

- Sasseur REIT Annual Report Highlights

a. Outlet Sales - Sasseur REIT Key Statistics (SGD)

- Current Asset Under Management (AUM)

a. Chongqing

b. Bishan

c. Hefei

d. Kunming - Right of First Refusal Properties

- Sasseur REIT Pipeline Properties

- REITs vs Co-Investments

Background

Sasseur REIT is a retail Real Estate Investment Trust based in Singapore, with its portfolio of outlet malls located in China. Sasseur REIT has 4 assets across the Chinese cities of Chongqing, Bishan, Hefei and Kunming, with a portfolio valued at RMB 8.212 billion. On 28 March 2018, Sasseur REIT became listed on the Singapore Exchange (SGX), becoming the first REIT in the outlet mall sector to be listed in Asia.

Sasseur REIT is sponsored by Sasseur Cayman Holding Limited, which operates outlet malls across China. Sasseur REIT is also managed by Sasseur Asset Management, a subsidiary of Sasseur Cayman Holding Limited.

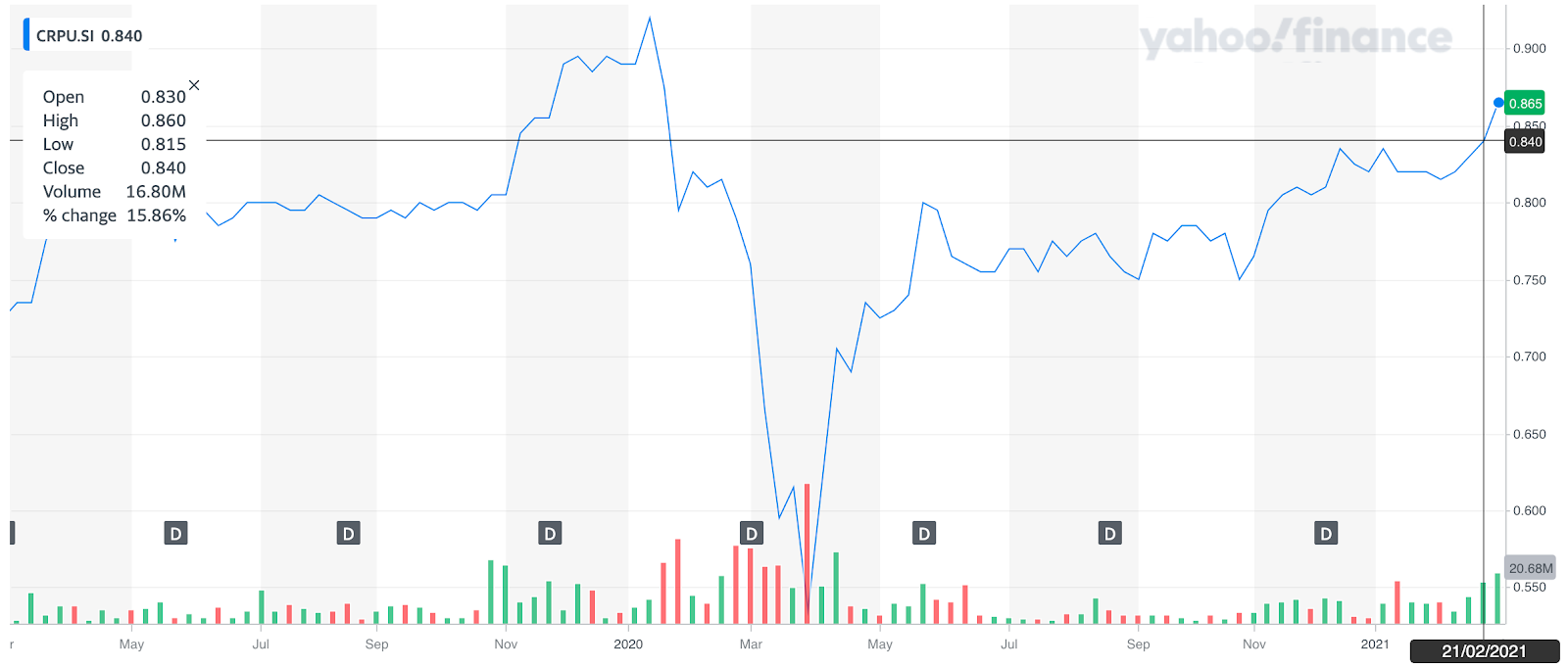

Sasseur REIT Share Price (CRPU.SI)

Sasseur REIT Annual Report Highlights

(as of Sasseur REIT 2019 Annual Report)

Outlet Sales

| Property | Projection (RMB millions) | Actual (RMB millions) |

|---|---|---|

| Total Outlet Sales | 4,711.3 | 4,826.0 |

| Chongqing | 2,206.3 | 2,342.5 |

| Hefei | 1,175.8 | 1,140.4 |

| Kunming | 901.5 | 884.1 |

| Bishan | 427.7 | 459.1 |

| Report Highlights | |

|---|---|

| EMA Rental Income | RMB 617.6 million |

| Distributable Income | S$77.9 million |

| DIstribution Per Unit | S$0.06533 |

| Annualised DIstribution Yield | 8.2% |

| Portfolio Valuation | S$1.6 billion |

| Net Asset Value Per Unit | S$0.8920 |

Sasseur REIT Key Statistics (SGD)

| Key Statistics | |

|---|---|

| Book Value Per Share | 0.91 |

| Price to Book Ratio | 0.95 |

| Market Cap Value/M | 1040 |

| Shares Outstanding/M | 1210 |

| Occupancy Rate | 0.935 |

| WALE (by NLA) | 3.0 |

| Weighted Average Debt Maturity | 2.6 |

| Beta (5Yr Monthly) | 0.93 |

Current Asset Under Management (AUM)

Sasseur REIT has assets across China, with large outlets across the cities of Chongqing, Bishan, Hefei and Kunming. As of the most recent valuation on 31 December 2020, Sasseur REIT’s portfolio has an overall occupancy rate of 93.5%, bringing in S$115.8 million in annual rental income. The current AUM is valued at RMB8.212 billion as of end 2019.

Chongqing

Sasseur’s first outlet mall commenced operations in August 2008 in Chongqing. The Sasseur (Chongqing) Outlets is strategically located in northeast Chongqing, just 10km away from Chongqing Jiangbei International Airport and 20km from the retail central in Jiefangbei.

The retail mall is home to many large international retailers such as Gucci, Hugo Boss, Armani, Michael Kors and Coach, drawing in high-spending retailers seeking international brands.

The Sasseur (Chongqing) Outlets has a total net lettable area of 50,855 metres square with a 100% occupancy rate at 389 tenants as of end 2020. The property is valued at RMB 2,973 million as of end 2019.

Bishan

Sasseur (Bishan) Outlets is an outlet mall with a soft launch in January 2014, and zones rolled out progressively through 2016. The mall is located within 3km of the downtown Bishan district and situated next to the Jinjian Mountain, a popular tourist destination.

Sasseur (Bishan) Outlets is made up of 3 zones, with a total net lettable area of 47,308 metres square. The property has an occupancy rate of 81.4% with 194 tenants as of end 2020, putting its total valuation at RMB 824 million as of end 2019.

Hefei

Sasseur (Hefei) Outlets first commenced operations in May 2016, featuring entertainment and luxury brand options for visitors. Located in the High-Tech Industrial Development Zone of Hefei, it is located along major urban roads providing high foot traffic.

Sasseur (Hefei) Outlets has a total net lettable area of 144,583 metres square, at a 94.9% occupancy rate with 345 tenants as of end 2020. This puts Sasseur (Hefei) Outlets at a valuation of RMB 2,795 million as of end 2019.

Kunming

Sasseur (Kunming) Outlets was the most recent addition to Sasseur REIT’s portfolio, having commenced operations in December 2016. The property contains a variety of stores across the retail, healthcare, entertainment and cultural sectors.

Sasseur (Kunming) Outlets is located in Taiping New City within a transportation hub, making it well connected to many highways, including Gaohai Highway, the Northwest Highway and the Kun’an Highway.

Sasseur (Kunming) Outlets has a total net lettable area of 70,067 metres square. Its 261 tenants form a 95.8% occupancy rate as of end 2020, and it is valued at RMB 1,620 million as of end 2019.

Right of First Refusal Properties

Right of First Refusal (ROFR) Properties are properties owned and operated by the Sponsor, Sasseur Group, in which Sasseur REIT has first priority to purchase the properties should the Sponsor choose to sell them.

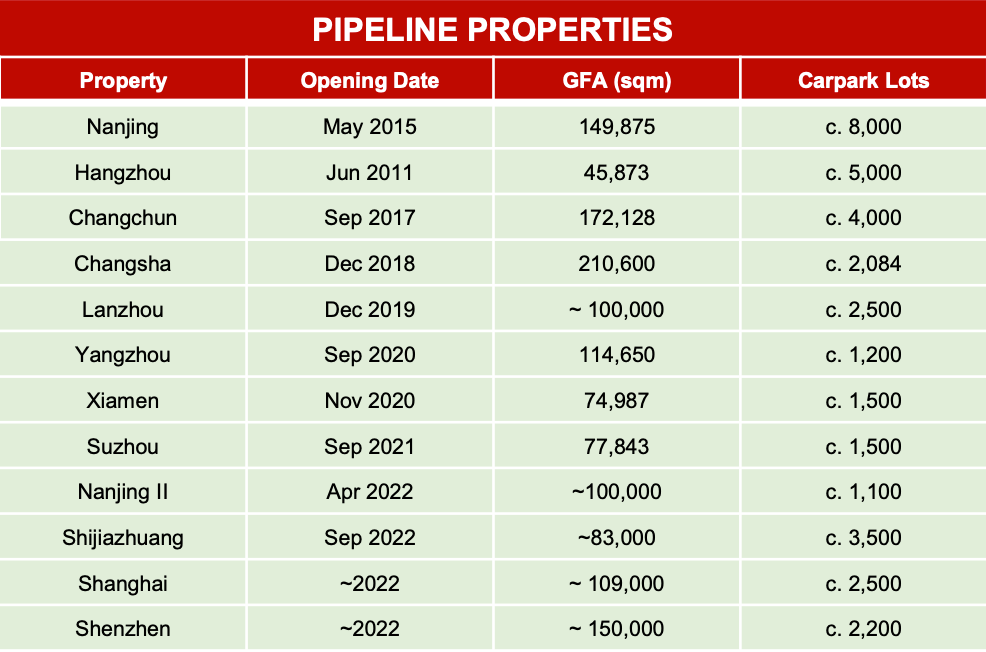

Sasseur REIT Pipeline Properties

Sasseur REIT has several pipeline properties, which are currently operated by their Sponsor, Sasseur Group, and owned by external third-party entities. These properties will become Sasseur REIT’s Right of First Refusal (ROFR) Properties if acquired by the Sponsor. These pipeline properties form the pool of potential properties for future acquisition by Sasseur REIT.

REITs vs Co-Investments

While REITs are a fantastic instrument for investors to gain exposure to the real estate sector, it is not without limitations.

While the United States has the most advanced and deepest REIT market in the world, real estate co-investment has grown by leaps and bounds since the JOBS Act of 2012 paved the way for this alternative investment channel. US investors have since realised the value offered by co-investments, alongside the traditional REITs market.

With that in mind, RealVantage has embarked on the mission to offer investors similar benefits that their US counterparts have been enjoying for the past decade. As US investors have shown, there is room and purpose for both investment modes to co-exist within an investor’s strategy.

Read also: Real Estate Co-Investment – The New Alternative

For interested readers and potential investors hoping to understand more about the options available to them, the following article comparing REITs to real estate co-investments should prove to be useful: REITs or Real Estate Co-Investments?

Read also: What is an Accredited Investor?

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.