Build a diversified real estate portfolio with ease

RealVantage Investor

RealVantage Investor

RealVantage Investor

RealVantage Investor

CMS 101156

RealVantage Investor

RealVantage Investor

RealVantage Investor

RealVantage Investor

Invest in multiple properties at the click of a button

Get access to deals previously reserved for institutions

Traditionally only available to institutions with minimum sums exceeding $1 million, our goal is to make these deals accessible to everyone.

Diversify like never before

Build your own real estate portfolio through fractional ownership with deals across different sectors, countries, and strategies.

You invest, we do the rest

We do all the hard work so you don't have to. From finding and negotiating the deal, liaising with accountants, lawyers and tax advisors, to distributing your returns.

Invest in properties worldwide

Invest across geographies and asset classes

Get access to investments in office spaces, shopping malls, hotels and more in different countries

Access exclusive opportunities

Invest in core, value-add, and opportunistic real estate deals to diversify your investments across different sectors, geographies and risk classes

Track record

As of: 1 May 2025

See the breakdown for more information.

1Average net IRR is calculated as the weighted-average internal rate of return of fully realised equity deals weighted by the USD equivalent investment amount for each deal, computed net of taxes and fees.

2Average net return p.a. is calculated as the average annualised return for fully realised income deals, net of taxes and fees.

Every deal is vetted by industry experts

Deep industry expertise

All deals are assessed by experienced professionals, with an investment committee that comprises industry veterans

Very few deals make the cut

Less than 10% of the deals we analyse clear our bar before presenting for investment

We are in it together

To drive strong investor alignment we invest alongside every deal on the platform

Former Deputy Group CEO, ARA Asset Management

Past experiences:

Deputy Group CEO of ARA Asset Management, Board Member and Finance Director of Low Keng Huat, Head of Stone Forest M&A, Vice President of DBS Bank, and independent directors of various SGX-listed companies

Graduated from:

Master of Engineering (Software Engineering) with first class honours from Imperial College London

Former CEO, Sasseur REIT and Fortune REIT

Past experiences:

CEO of Sasseur REIT, Fortune REIT and ARA's flagship USD 1.3 billion Asia Dragon Fund, senior positions at GIC Real Estate, Vertex Management, and the Singapore Economic Development Board

Graduated from:

BSc (M.Eng) with first class honours from Imperial College and an MBA from INSEAD

Former Senior Director of Finance, Suntec REIT

Past experiences:

CFO at Sasseur REIT, CFO of ARA Private Funds, senior finance positions at Suntec REIT, Hewlett Packard, and Schroders

Graduated from:

Bachelor of Accountancy from Singapore University

Former CEO, Keppel Land

Supervisory Board Member, Arcadis

Past experiences:

CEO of Keppel Land, one of Singapore's largest developers, Executive Vice-Chairman of Keppel Land China, Board member of Singapore Building and Construction Authority, and Advisor to TVS Motors

Graduated from:

Bachelor of Science (summa cum laude) from University of Denver and MBA from Imperial College, University of London

Partnering only with the best

Realised opportunities

Vantage Point

THE SPACE

Provide

Providing tailored support to address realities of unequal life circumstances

Empower

Empowering the next generation to break out of the poverty trap

Reduce

Reducing social stratification through equal opportunities

Meet the team

in real estate transaction experience spanning Asia, Europe, and Australia

of AUM previously managed across different geographies

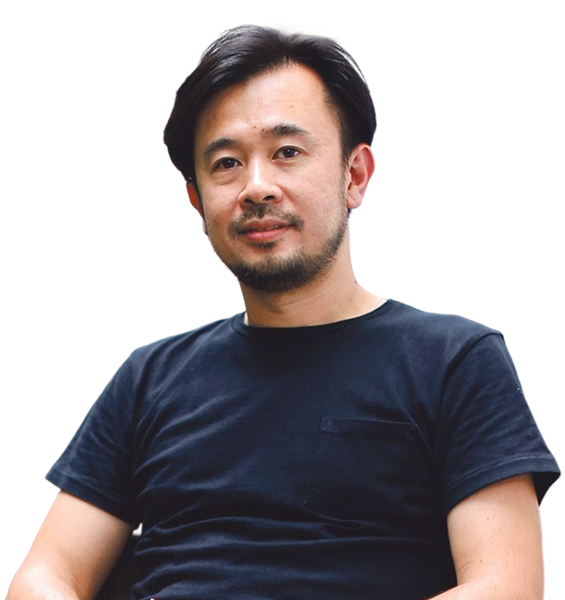

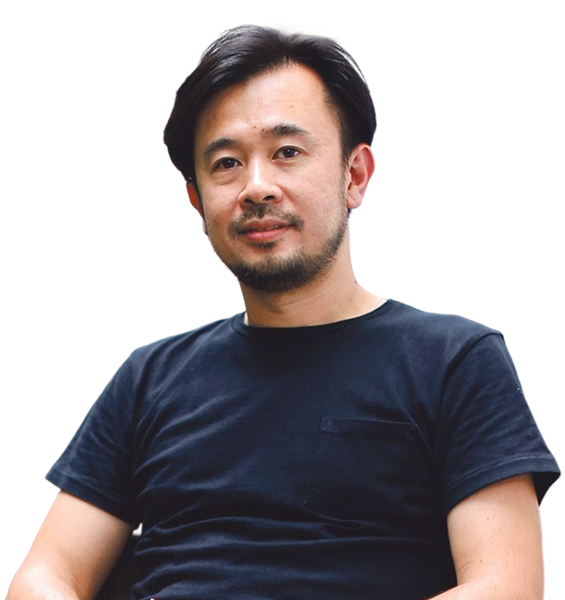

Co-founders

Past experiences:

20 years of real estate fund management experience, transacted over USD 3 billion across various geographies and sectors. Held senior positions at ARA Asset Management, Firmus Capital and Rockworth Capital Partners

Graduated from:

MPhil (Land Econ) from the University of Cambridge and BSc (Real Estate) from the National University of Singapore

Past experiences:

Chief Technology and Data Officer at Funding Societies a P2P FinTech platform. Held Quantitative Equities Trading & Portfolio Management roles at Ronin Capital (Chicago) and Barclays Global Investors (San Francisco) running a fully automated long-short market-neutral global equities book

Graduated from:

MSc from Stanford University, MComp and BSc in Computing from the National University of Singapore

Hear from our investors/sponsors

Compliance Director for a Private Bank

"I like the way they lay out the investment rationale and details of each opportunity. Very transparent compared to other financial platforms I have come across."

General Manager, Times Publishing

"Wonderful property investment platform, great diversification angle. Interesting property opportunities available. Love the fact that they can take the landlord hassles off my plate."

Senior Director (Asia Pacific) for a leading trade association

"The team's depth of experience, track record, and knowledge in cross border investments are clearly evident. Importantly for me, the rigorous and conservative analyses of deals is a key differentiation factor. Target returns are shown net of all fees and taxes, reflecting a team that is keen to over-deliver and careful not to over-promise."

Entrepreneur

"I am a seasoned property investor myself and always dive deep into the details of any potential investments I make. I was impressed that the team was able to handle all my difficult questions regarding one of the deals, which gave me confidence."

RV Portfolio Manager Pte. Ltd.

12 Kallang Avenue #03-26

Aperia, The Annex

Singapore 339511

The information about the investment opportunities and our products that are profiled on this website have not been reviewed by the MAS and is provided solely for general informational and marketing purposes only.

Nothing in this website (1) shall be considered an inducement to engage in any investment activity, or (2) is intended to be, nor be construed as, an offer to sell or a solicitation of an offer to purchase any securities or products where their offer or sale or use is not licensed, qualified or exempt from registration or permitted by the applicable law, or to any person to whom such offer or solicitation would be unlawful.

By accessing this site and any pages thereof, you agree to be bound by the Terms of Use, Platform Terms and Conditions, Disclaimer, and the potential set of risks involved highlighted under the FAQ section.

+65 8817 6239

+65 8817 6239