Parkway Life REIT Overview

Parkway Life REIT is one of Asia’s largest listed healthcare REITs, it invests in real estate and real estate-related assets that are primarily used for healthcare-related purposes.

Table of Contents

- Background

- Management of Parkway Life REIT

- Parkway Life REIT Share Price and Financial Summary (C2PU.SI)

- Parkway Life REIT Financial Highlights

a. Significant Highlight in 2020 - Parkway Life REIT Portfolio Highlights

a. Parkway Life REIT Top 10 Tenants - Parkway Life REIT Portfolio Diversification

a. Singapore

b. Japan

c. Malaysia - Performance of Parkway Life REIT in Pandemic

- Risk Related to Individual REIT

a. Geographical Expansion/Competitors

b. Interest Rate and Foreign Exchange

c. Credit Default by Tenants - REITs vs Co-investment Opportunities

Background

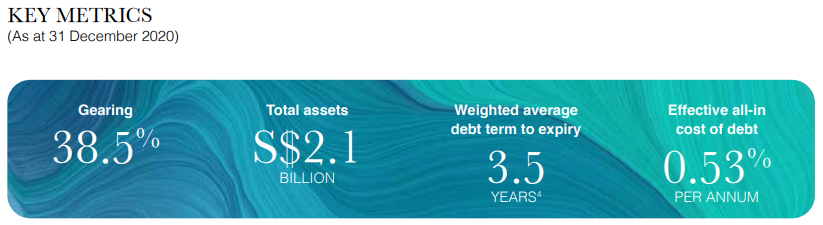

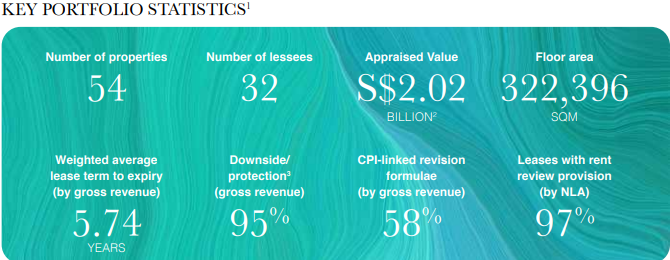

Parkway Life REIT is one of Asia’s largest listed healthcare REITs, it invests in real estate and real estate-related assets that are primarily used for healthcare and healthcare-related purposes. As at 31 December 2020, Parkway Life REIT owns a portfolio of 54 properties with a total approximate value of S$2.02 billion. It owns several private hospitals in Singapore such as Mount Elizabeth Hospital, Gleneagles Hospital and Parkway East Hospital. On top of that, it has 50 assets located in Japan including 1 pharmaceutical distributing and manufacturing facility and 49 nursing facility properties. It also owns strata-titled units in MOB Specialist Clinics in Kuala Lumpur, Malaysia. Parkway Life REIT has been listed in the Singapore Stock Exchange since August 2007.

Management of Parkway Life REIT

Parkway Life REIT is managed by Parkway Trust Management Limited. With a mission to deliver regular and stable distribution and achieve long-term growth for their Unitholders. Parkway Life REIT has a vision to become a leading healthcare REIT and the Partner of Choice for healthcare expansion.

Parkway Life REIT Share Price and Financial Summary (C2PU.SI)

Parkway Life REIT is currently trading at S$4.390 as of 14 June 2021.

Parkway Life REIT Financial Highlights

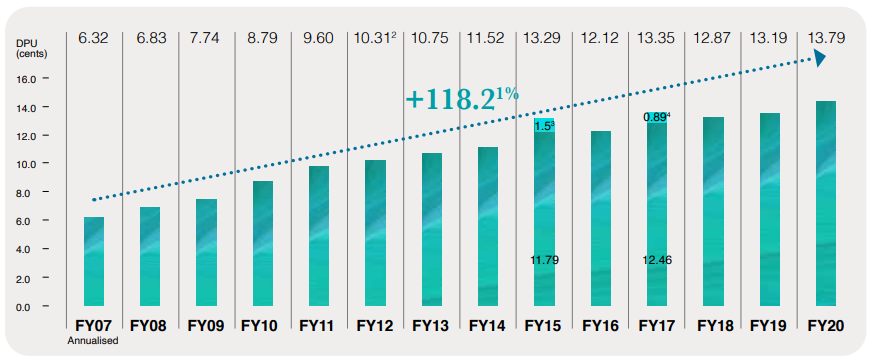

Parkway Life REIT maintains a healthy and resilient balance sheet by tapping into attractive opportunities, creating great value for their shareholders. PLife REIT recorded a full year Distribution per Unit (DPU) of 13.79 Singapore cents, as DPU increased by 4.5% in FY2020 and registered a 118.2% growth since listing in 2007.

Significant Highlight in 2020

In Q1 2020, Parkway Life REIT announced a gross revenue increase of 5.2% year-on-year to S29.9 million. Pushing total distributable income by 1.4% to S$20.1 million. A 3.32 Singapore cent distribution per unit was declared during the period. In Q2 2020, DPU was raised to 3.36 cents for that period, supported by strong Q2 results as revenue increased to S$30.3 million.

Parkway Life REIT achieved a huge milestone by being included in the FTSE EPRA NAREIT Global Developed Index. This serves as a huge endorsement to PLife REIT’s commitment in achieving long-term growth and value. With the inclusion, it helps to create better awareness for PLife REITs and enhances trading liquidity and visibility to investors and index funds across the globe.

Parkway Life REIT has acquired a nursing home in the Greater Tokyo Region in Japan for S$21.2million, which is approximately 4.6% below market value. This asset is expected to yield a return of net 6.4%. On top of that, a non-core asset in Japan has been divested for S$37.1million, achieving a 12% premium over its purchase price.

Parkway Life REIT Portfolio Highlights

Parkway Life REIT recognises the importance of building a strong landlord-lessee relationship and working with credible operators. A huge part of its success stems from the close partnership that has been fostered between the landlord and lessee. The Group actively engages in active asset management and works closely with lessees to see if there are any asset enhancement opportunities to maximize portfolio performance.

Parkway Life REIT Top 10 Tenants

| S/N | Tenant | % |

|---|---|---|

| 1 | Parkway Hospitals Singapore Pte. Ltd. | 57.4% |

| 2 | K.K Sawayaka Club | 8.2% |

| 3 | K.K Habitation | 5.5% |

| 4 | K.K Asset | 2.9% |

| 5 | Miyako Enterprise Co., Ltd. | 2.5% |

| 6 | Riei Co., Ltd | 2.1% |

| 7 | Japan Amenity Life Association | 2.0% |

| 8 | Green Life Higashi Nihon | 1.4% |

| 9 | Abbott Diagnostics Medical Co. Ltd. | 1.4% |

| 10 | K.K Taijyu | 1.4% |

Parkway Life REIT Portfolio Diversification

The REIT has a mix asset class of 57.5% in Hospitals and Medical Centres, 41.1% in Nursing Homes and 1.4% in Pharmaceutical Product Distributing and Manufacturing Facility.

Singapore

57.4% of Parkway Life REIT assets are located in Singapore, with three strategically located world-class private hospitals amounting to S$1.21 billion. Parkway Hospitals Singapore Pte Ltd. has a long-term master lease with the Group, with a 15 + 15 years agreement contracted in August 2007. Parkway Hospitals has also committed to a 100% occupancy to the property.

Through an exclusive Triple Net Lease Arrangement, PLife REIT does not incur property tax, property insurance and property operating expenses. This arrangement also helps to minimize the exposure to rising operating expenses.

Japan

42.5% of REIT assets are located in Japan, with fifty premium quality healthcare properties with S$799.7 million. Parkway Life REIT is able to attain a favourable lease structure with lessees, these terms include a long-term master lease structure with a weighted average lease expiry of 11.29 years, an “up-only” rent review clause for most of the properties and a 100% occupancy commitment by the lessees.

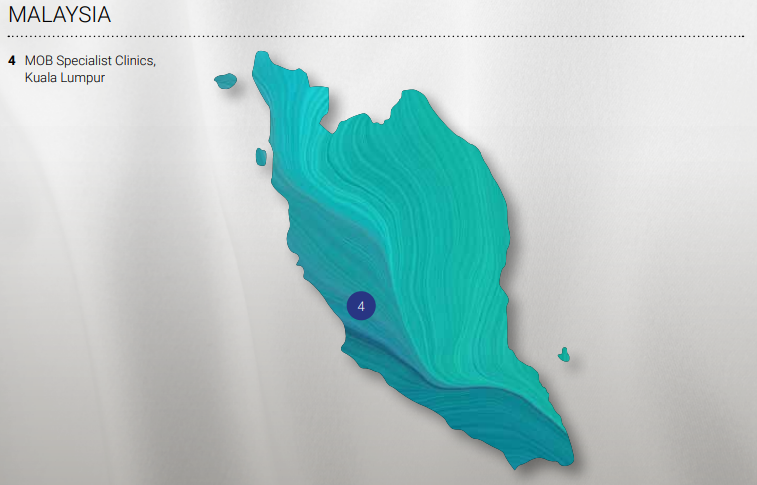

Malaysia

Only 0.1% of REIT assets are located in Malaysia, these assets are strata-titled properties located at MOB specialist clinics in Kuala Lumpur, with a value of S$6.2 million. MOB specialist clinics are especially well known in Kuala Lumpur for providing high-quality medical services. The building is leased to reputable tenants such as Gleneagles Hospital, Excel Event Networks and KL Stroke & Neuro Clinic. PLife REIT owns 23.1% of this freehold medical centre.

Performance of Parkway Life REIT in Pandemic

Given the nature of health care assets, the REIT has been resilient throughout the pandemic. Despite these challenging conditions, Parkway Life REIT’s unit price hit a record high due to the inclusion of REIT in the FTSE EPRA NAREIT Global Developed Index. The REIT continued to maintain a market capitalization of above S$2.0 billion alongside delivering strong growth and earnings in FY2020, where its DPU hit a record high of 13.79 cents from 13.19 cents in FY2019. Overall, the outstanding performance of DPU is led by acquisition, rental growth and financing cost savings. With a resilient balance sheet and prudence capital management measures, PLife REIT is expected to maintain its strong financial position in 2020.

Risk Related to Individual REIT

Geographical Expansion/Competitors

With Geographical expansion, Parkway Life REIT may be exposed to risks associated with local real estate market conditions such as demand for healthcare assets in the region, changes in local regulations and capital valuation of properties. Being in different markets, there will be increased competition for attractive investment opportunities from other real estate investors and other funds that are alike to Parkway Life REIT.

The group plans to mitigate such risk by:

- Diversifying into new markets

- Identify new opportunities and platforms by working closely with sponsors

- Close surveillance on asset class concentration

- Focus more on mature markets like Singapore, UK, Australia, Japan and Europe

- Scrutinise established quantitative and qualitative investment criteria

- Monitor, evaluate and assess pitfalls caused by black swan events

Interest Rate and Foreign Exchange

Foreign exchange risk is imminent when assets are located in various countries. However, the Manager has exercised prudent financial risk management to manage such risks to maintain a stable distribution and steady net asset value of PLife REIT. The Manager utilises financial instruments such as interest rate swaps, interest rate caps and fixed-rate cross-currency swaps to hedge against market fluctuations. To hedge the net foreign income from Japan, the Group has entered into foreign currency forward contracts. Parkway Life REIT has a policy to hedge at least 50% (up to 100%) of all financial risks. As at 31 December 2020, around 87% of the interest rate risk is hedged and the forward contract placed will be valid till 2Q 2025.

Credit Default by Tenants

The Group has put in place procedures such as periodic reviews to assess the creditworthiness of the lessees to safeguard its cash flow stability and assess the likelihood of potential rent default. Overseas revenue is additionally secured by a three to six month’s security deposit for Japanese properties and some lessees were required to pay additional deposit security should the occupancy rate fall below a certain threshold. Throughout the pandemic recession,the Group has worked closely with the tenants to ensure prompt rental payment and has set aside relief assistance for the tenants if they require it. As of 31 December 2020, 70% of the deposit has been deployed.

REITs vs Co-investment Opportunities

Both REITs and co-investment platforms allow investors with limited capital to invest in real estate properties for a return. REIT is a real estate investment trust that owns a portfolio of income-producing properties. Investors who invest in REITs then own a small share of each property that is in the portfolio, it is a way to diversify your portfolio with little effort. REIT is a very popular investment vehicle in Singapore because of its tax transparency that allows 90% of the income produced by the REIT company to be distributed to the unitholders.

On the other hand, real estate co-investment is a pooling of capital from individual investors for the purpose of investing in a real estate project. The ownership of the asset is proportional to the contributed investment capital of each co-investors, relative to the overall purchase price of the asset. Usually, the asset is acquired through a single-purpose vehicle and someone is designated to make key decisions and steer the investment.

Read also: REITs or Real Estate Co-Investments?

RealVantage is a real estate co-investment platform that aims to provide investors with access to international property investments through co-investment. RealVantage has a team of experts who perform due diligence on potential real estate opportunities before these opportunities are introduced to investors on our co-investment platform. RealVantage caters to different real estate investment strategies such as development, value-add, or core opportunities, and different risk structures, such as providing debt or equity.

Read also: An Overview of Investing in REITs in Singapore

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.