Importance & Benefits of Institutional Real Estate Investing

Learn why institutional real estate investing matters and the key benefits it offers, from portfolio diversification to stable income streams, and how RealVantage makes it accessible.

Introduction

Institutional real estate investing isn’t just for billion-dollar funds, it’s a cornerstone of wealth creation, economic stability, and urban development. For decades, it has been the preferred choice of pension funds, sovereign wealth funds, and large institutions seeking stable returns and long-term growth.

Today, platforms like RealVantage are opening doors for individual investors to enjoy the same benefits once reserved for the financial elite. But why is institutional real estate so important, and what makes it worth considering?

Why Institutional Real Estate Matters

Institutional real estate plays a unique role in the investment landscape:

- Economic Impact

- Funds large-scale projects that drive job creation, infrastructure improvements, and urban regeneration.

- Stabilises property markets through long-term holding strategies, reducing short-term speculation.

- Scale and Influence

- Institutions own some of the world’s most valuable assets, from prime office towers to massive logistics hubs, influencing rental rates, market valuations, and investment trends.

- Resilience in Market Cycles

- While no investment is immune to downturns, institutional-grade assets tend to withstand economic volatility better than smaller, less diversified holdings.

Key Benefits of Institutional Real Estate Investing

1. Portfolio Diversification

- Real estate behaves differently from stocks and bonds, helping reduce overall portfolio volatility.

- Exposure across asset types (office, retail, industrial, residential) and geographies adds stability.

2. Stable, Predictable Income

- Long-term leases with creditworthy tenants can provide consistent cash flow.

- Rental escalations tied to inflation protect income over time.

3. Professional Management

- Experienced asset managers handle leasing, maintenance, compliance, and capital improvements.

- Reduces the burden and complexity for investors, especially across multiple jurisdictions.

4. Access to Prime Assets

- Institutional investors often secure assets in top-tier locations that are difficult for individuals to acquire directly.

- These properties often have better tenant demand, occupancy rates, and long-term appreciation potential.

5. Potential Inflation Hedge

- Real estate values and rents often rise with inflation, helping preserve purchasing power.

- Certain leases are explicitly linked to inflation indexes.

6. Global Opportunities

- Institutional investing enables exposure to real estate markets beyond one’s home country.

- This can capture growth in emerging markets or stability in mature economies.

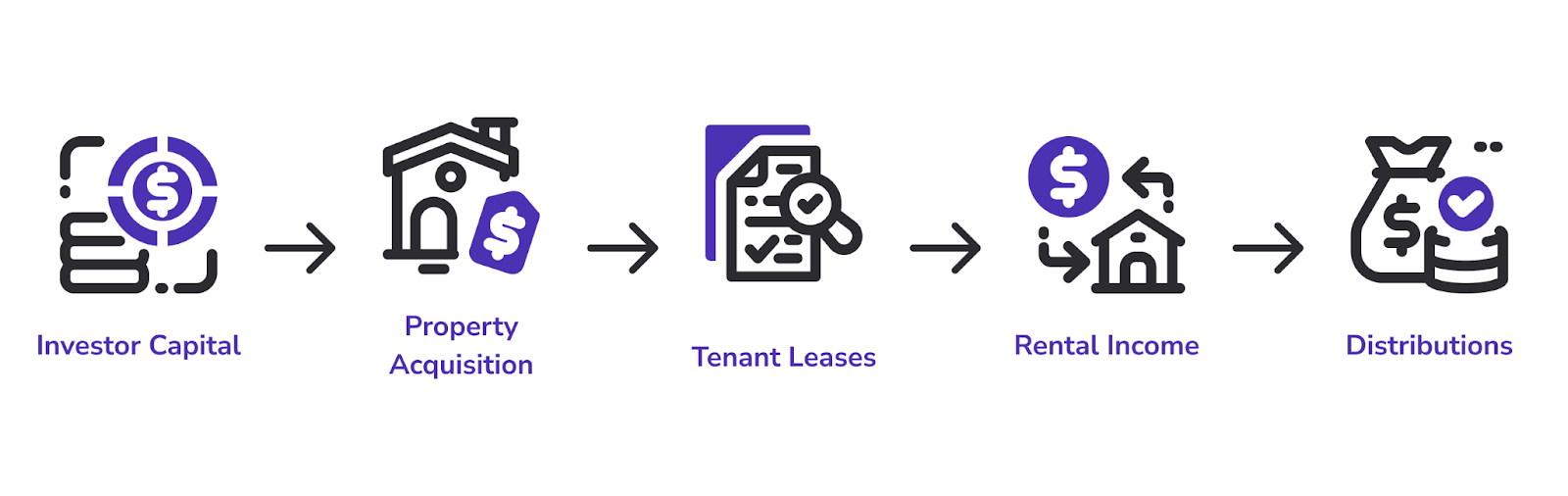

How RealVantage Makes It Accessible

Historically, accessing these benefits required multi-million-dollar commitments and industry connections. RealVantage removes these barriers by:

- Offering fractional ownership of institutional-grade deals.

- Conducting rigorous due diligence to identify quality opportunities.

- Providing transparent reporting and investor updates.

This means individual investors can now enjoy the same advantages as large institutions, without the traditional hurdles.

Next in the Series

📖 Read next: Risks Overview in Institutional Real Estate Investing — Understanding the potential challenges and how to manage them effectively.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. All investments carry risks, including the potential loss of capital. Past performance is not indicative of future results. Investors should conduct their own due diligence and seek professional advice before making investment decisions.