Institutional vs Retail Real Estate Investments

Learn the differences between institutional and retail real estate investing, including scale, management, returns, and access. Discover how RealVantage bridges the gap for individual investors.

Introduction

When people think of real estate investment, they might imagine buying a rental apartment or a small commercial shop. That’s retail real estate investing, which is accessible, straightforward, but often limited in scale. On the other side of the spectrum lies institutional real estate investing, which is larger, professionally managed, and traditionally reserved for big players like pension funds, REITs, and sovereign wealth funds.

Understanding the differences between these two approaches can help you choose the right investment path, or even combine both in a diversified portfolio.

What is Retail Real Estate Investing?

Retail real estate investing refers to property purchases made by individual investors (or small groups) with personal or pooled capital. Common examples include:

- Condominiums or apartments for rent

- Small office units

- Shop houses

- Standalone warehouses or industrial spaces

Characteristics of Retail Investments:

- Lower capital requirements (sometimes as low as the property down payment)

- Self-managed or managed by small property agencies

- Tenant base can range from individuals to small businesses

- More hands-on involvement in maintenance, leasing, and rent collection

What is Institutional Real Estate Investing?

Institutional investing involves large-scale, high-value properties managed by professional teams and owned by investment institutions. Common examples include:

- Grade A office towers

- Prime logistics hubs

- Large shopping malls

- Luxury hotels and resorts

Characteristics of Institutional Investments:

- High minimum investment (often millions for direct ownership)

- Professional asset management teams handle leasing, compliance, and operations

- Tenants are often multinational corporations or long-term contracts

- Typically part of a broader investment portfolio with risk management strategies

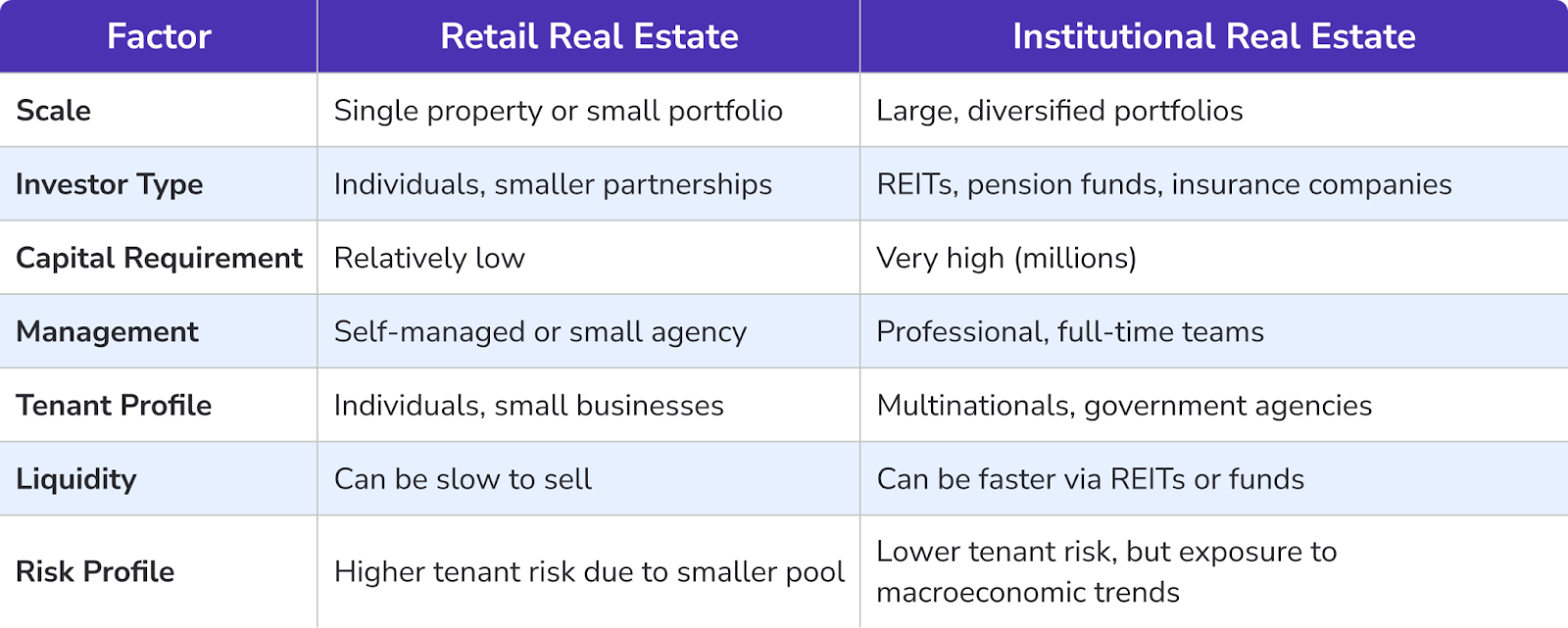

Key Differences Between Institutional and Retail Investments

Pros & Cons of Retail Real Estate

Pros:

- Lower barrier to entry

- More personal control over asset

- Familiarity with local property market

Cons:

- Requires active management

- Limited diversification (often tied to one property or location)

- Income can be inconsistent if tenant vacancies occur

Pros & Cons of Institutional Real Estate

Pros:

- Diversification across assets, markets, and tenant types

- Professional management reduces hands-on work

- Potential for more stable, long-term income streams

Cons:

- Historically limited to large-scale investors

- Complex deal structures may be harder for individuals to access directly

- Exposure to global economic trends can affect performance

How RealVantage Bridges the Gap

Traditionally, individual investors had no way to participate in institutional real estate without committing huge amounts of capital. RealVantage changes that by:

- Offering fractional ownership in institutional-grade properties

- Providing rigorous due diligence on every deal

- Giving investors access to diversified opportunities in over 20+ cities and 7 major global markets

This means everyday investors can enjoy the benefits of institutional investing without the typical barriers.

When to Choose Which?

- Retail: If you prefer tangible, hands-on property ownership and have the time to manage tenants and maintenance.

- Institutional: If you value diversification, stability, and professional management, and want exposure to global real estate.

- Hybrid: Many experienced investors blend both to balance control and diversification.

Next in the Series

📖 Read next: Key Players in Institutional Real Estate: REITs, Funds, Pension Funds, Sovereign Wealth Funds — Learn who dominates this space and how they operate.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. All investments carry risks, including the potential loss of capital. Past performance is not indicative of future results. Investors should conduct their own due diligence and seek professional advice before making investment decisions.