Is Hong Kong’s Real Estate Market a Total Write-Off?

Will 2023 see Hong Kong regain its shine as a thriving property market it once was? Read on for more insights.

Triggered in part by waves of incendiary protests and political crackdowns from mid-2019 to mid-2020, Hong Kong has been caught in a perfect storm of political instability and economic uncertainty over the last four years or so. This has roiled the jurisdiction’s stock market, business confidence, and real estate industry, which have been in a moribund state since.

COVID-19 only muddied the waters further, as Hongkongers found themselves in extremely stringent lockdowns and rounds after rounds of mass testing under what was christened the “zero-COVID” policy, which was aligned with mainland China’s approach to managing the pandemic.

This confluence of factors has led to an exodus of Hong Kong residents, which saw its population fall from 7.52 million to 7.29 million, from end-2019 to mid-2022. Just in 2021, 113,200 residents left Hong Kong, and this marked a decline in population of 1.6%. And in the first 18 months after the Hong Kong SAR government opened a special visa scheme in January 2021, known as the British Nationals (Overseas) visa, more than 130,000 Hongkongers have moved to the U.K.

With so much happening in Hong Kong, some may naturally be concerned about whether it will be able to retain its status as a global financial hub and a global air travel hub? And some real estate investors may also be wondering if Hong Kong’s property market will see a turnaround in its fortunes anytime soon.

Despite the concerns, we are cautiously optimistic that Hong Kong’s real estate market will embark on a path of recovery starting from this year. And here’s why:

Reopening of borders as travel restrictions ease

8 January 2023 marked a momentous day where mainland China and Hong Kong ended its “zero-COVID” policy, which lasted for nearly three years. And this also marked the reopening of China’s borders to inbound travellers, including those from Hong Kong, as travel restrictions were eased.

“Hong Kong’s reopening of its borders to mainland China is likely to provide a new lease of life for its tourism and retail industries, as well as its business activity, and set it on a path to regain its status as a global financial hub and a global air travel hub.”

In our opinion, this is likely to provide a new lease of life for Hong Kong’s tourism and retail industries, as well as its business activity, and set it on a path to regain its status as a global financial hub and a global air travel hub.

Tourism is big business in Hong Kong, especially when it comes to visitors from mainland China. Before COVID-19 struck, 78% of the 65 million visitors to Hong Kong in 2018 hailed from mainland China. And in 2019, 36% of the 154 million Chinese outbound travellers made Hong Kong their travel destination. With the reopening of travel borders to mainland China, the tourism industry, which used to provide jobs for around 257,000 people and contributed to 4.5% of Hong Kong’s GDP, is likely to receive a shot in the arm. Business activity, as a corollary, will also increase – and so will jobs.

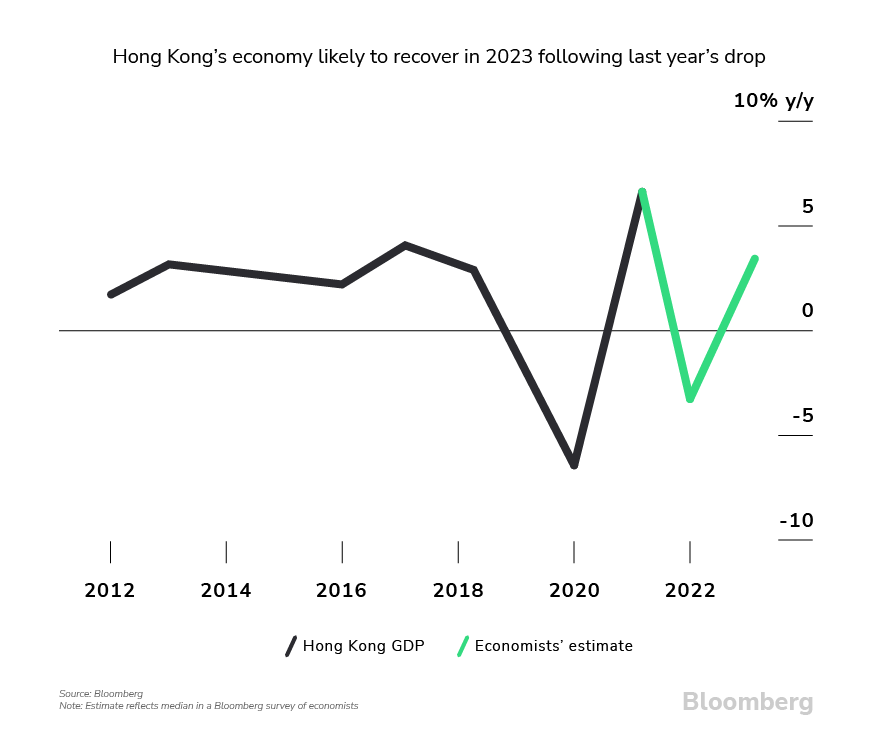

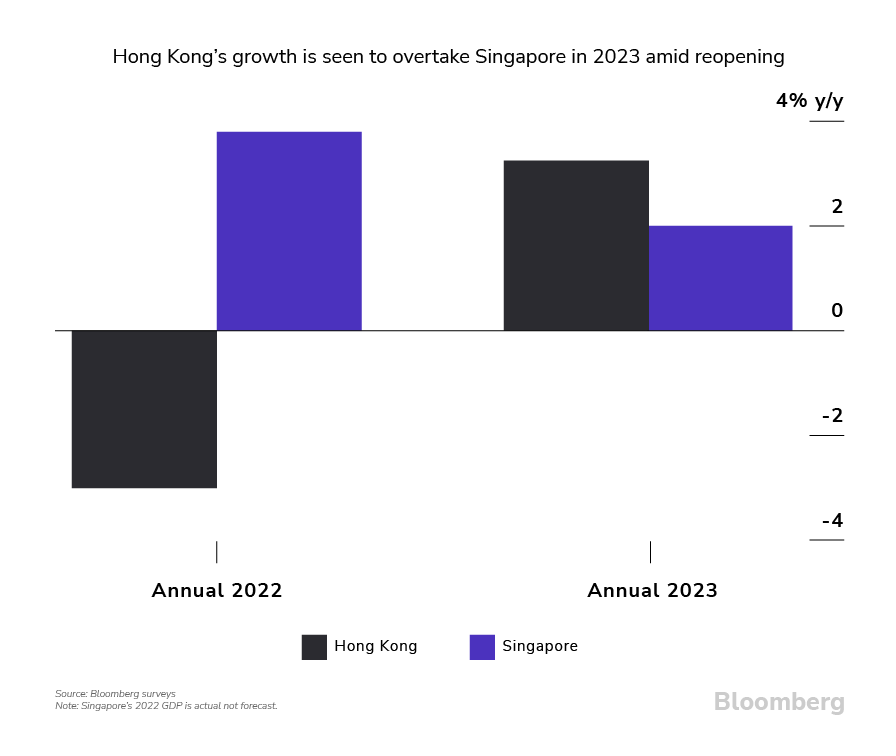

We are not the only ones who are optimistic about Hong Kong’s reopening. In a recently released Bloomberg survey report, economists are fast upgrading their forecasts for Hong Kong’s economic growth, following China’s much-anticipated move to reopen its borders. According to these economists, Hong Kong’s economy may even grow at a faster pace than Singapore’s at 3.3% this year, propped up by the government’s fiscal support and other measures. If this materialises, it will be the first time since 2008 that Hong Kong’s economic growth surpasses that of Singapore’s.

These are likely to fuel a growing demand for commercial properties, including residential and office real estate in Hong Kong, and especially retail.

In a recent Bloomberg Intelligence report, Hong Kong’s home sales are forecasted to surge by as much as 50%, with the reopening of its borders with mainland China and as interest rates in the territory are expected to peak this year.

Sign Up at RealVantageExodus of Hong Kong residents appears to be slowing down

A stable population is one important factor that contributes to stable demand for real estate in a market. An October 2022 survey by the Chinese University of Hong Kong conducted on 705 respondents aged 18 and above showed that significantly fewer Hongkongers are inclined to emigrate overseas (28.8%) if they had the chance to do so, compared to 42.0% from the same survey conducted a year ago.

The stabilising of the waves of emigration that started in 2019 is likely to be a positive for stable real estate demand, especially when coupled with the reopening of China’s travel borders.

U.S. interest rates to peak and Hong Kong’s should follow suit

Hong Kong’s interest rates follow U.S. interest rates closely as the Hong Kong dollar is pegged to the U.S. dollar. And with the U.S. Federal Reserve expected to hike its policy rate just once more this year to between 5% and 5.25% and start cutting next year, interest rates in Hong Kong should progressively stabilise in 2023, and may move lower in 2024.

A recent report from Bloomberg Intelligence also supports this view, predicting that Hong Kong’s lending benchmark – HSBC Holdings’ primate rate – is expected to peak at 7% this year on expectations that the Federal Reserve is almost done with interest rate hikes.

“With interest rates expected to peak in Hong Kong, investors are likely to see an alleviation of mortgage financing pressures, which could lift property demand and boost net operating income for owners of rented properties.”

When this happens, investors are likely to see an alleviation of mortgage financing pressures, which could lift property demand and boost net operating income for owners of rented properties.

Hong Kong’s real estate market to progressively recover in 2023

Experts from Citi, Morgan Stanley, and Colliers also share our cautious optimism about Hong Kong’s real estate market.

In a recent Citi research report, it was asserted that Hong Kong’s residential property prices will bottom in Q12023 after falling 5%, and rise 5% towards the end of the year – what Citi dubs a “U-shaped recovery”. Meanwhile, Morgan Stanley sees Hong Kong’s home prices bottoming out in Q22023 and expects a rise of 5% by the end of 2023. In the office real estate space, Colliers sees the demand for offices rising in 2023 and expects rents for Grade A offices to rise moderately by 3% year-on-year.

Time to take a look at Hong Kong’s real estate

With things starting to look up for Hong Kong’s real estate market, even while property prices may still see some softening in the near term, investors may be able to find attractively priced real estate deals in 2023 to partake in as they anticipate a market recovery.

But as with any real estate deal, investors should scrutinise the deal specifics, even if macroeconomic conditions were to turn favourable. And as always, it pays to be mindful of risks, such as a looming global recession, while the pursuit of enticing returns continues.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.